cryptocurrencies

Nicholas Merten of DataDash predicts a ‘cold winter’ for the crypto market

Episode four of Cointelegraph’s Crypto Trading Secrets podcast features an interview with Nicholas Merten, who shared his opinions on the crypto bear market and more. Podcast Own this piece of history Collect this article as an NFT Nicholas Merten, a crypto trader and the creator of the DataDash YouTube channel, joined Cointelegraph’s Crypto Trading Secrets podcast for an interview with host Benjamin Pirus, discussing a number of topics, including his opinions on the state of the crypto market. “I think that right now, we’ve been going through what can only be seen as a period of consolidation,” he said when asked about his thoughts on the price of Bitcoin (BTC) as of Jan. 9, the date of the interview. Bitcoin largely traded sideways for part of November and most of December. January, howe...

EU lawmakers vote for more restrictive capital requirements on banks holding crypto

Banks could be required to hold a “risk-weighted exposure amount” of up to 1,250% of capital based on exposure to crypto if the full parliament passes the measures. News Own this piece of history Collect this article as an NFT The Economic and Monetary Affairs Committee of the European Parliament has voted for measures requiring banks holding cryptocurrencies to set aside a punitive amount of capital. In a Jan. 24 notice, the European Parliament announced the committee had voted overwhelmingly in favor of amendments to its Capital Requirements Regulation and Capital Requirements Directive applying to banks holding crypto. According to a draft law, banks would be required to hold a “risk-weighted exposure amount” of up to 1,250% of capital based on exposure to crypto. On Tuesday 24/01 @EP_E...

DeFi should complement TradFi, not attack it: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Following FTX’s demise, the DeFi space is up for a complete remodel as crypto users demand better security and compliance practices. SushiSwap’s roadmap for the coming year includes the development of a decentralized exchange (DEX) aggregator, a decentralized incubator and “several stealth projects.” All these projects combined can grow its market share 10x, said the CEO. The co-founder and CEO of Ava Labs spoke with Cointelegraph at the World Economic Forum in Davos, Switzerland, on the future of DeFi and traditional finance (TradFi) and said DeFi should complement TradFi, not attack it. Another DeFi report sugge...

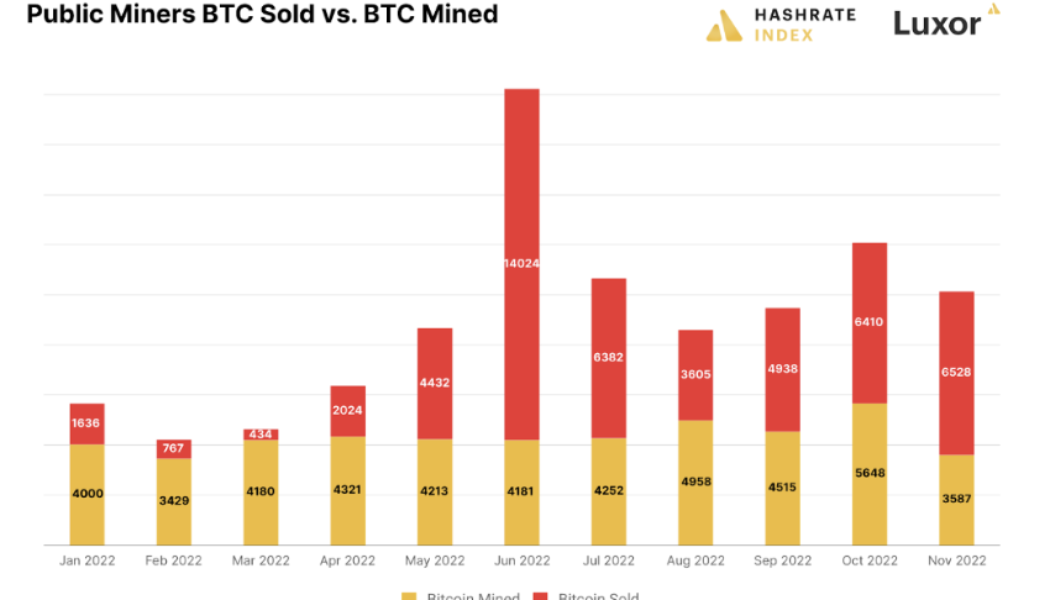

Bitcoin price rally provides much needed relief for BTC miners

Bitcoin mining powers network transactions and BTC price. During the 2021 bull run, some mining operations raised funds against their Bitcoin ASICs and BTC reserves. Miners also preordered ASICs at a hefty premium and some raised funds by conducting IPOs. As the crypto market turned bearish and liquidity seized within the sector, miners found themselves in a bad situation and those who were unable to meet their debt obligations were forced to sell the BTC reserves near the market bottom or declare bankruptcy Notable Bitcoin mining bankruptcies in 2022 came from Core Scientific, filing for bankruptcy, but BTC’s early 2023 performance is beginning to suggest that the largest portion of capitulation has passed. Despite the strength of the current bear market, a few miners were able to i...

FTX-linked Moonstone bank to exit the crypto space

Moonstone Bank, a rural Washington state bank that received an estimated $11.5 million investment from FTX’s sister company, Alameda Research, says that it will be exiting the crypto space and returning to its “original mission” as a community bank. In a Jan. 18 statement, the bank said that the change in strategy comes as a result of “recent events in the crypto assets industry and the changing regulatory environment surrounding crypto asset businesses.” As part of the bank’s initiative to “return to its roots,” it said that it will no longer use the name Moonstone Bank and will be rebranding and re-adopting the Farmington State Bank name, known in the local community for 135 years. According to the bank, the change is estimated to take effect in the coming weeks and loca...

Binance tightens rules on NFT listings

According to a Jan. 19 announcement by Binance, the cryptocurrency exchange has tightened its rules for nonfungible tokens, or NFT, listings. Starting Feb. 02, 2023, all NFTs listed on Binance before Oct. 2, 2022, and have an average daily trading volume lower than $1,000 between Nov. 1, 2022, and Jan. 31, 2023, will be delisted. In addition, after Jan. 21, 2023, NFT artists can only mint up to five digital collectibles per day. Binance NFT requires sellers to complete know-your-customer (KYC) verification and have at least two followers before listing on its platform. In addition to the revised rules, Binance said it would forthwith “periodically review” NFT listings that do not “meet its standards” and recommend them for delisting. “Users can repo...

FinCEN lists Binance among the top Bitcoin counterparties of Bitzlato

The United States Financial Crimes Enforcement Network (FinCEN), a bureau of the Treasury Department, has argued that Binance is linked to the illegal cryptocurrency platform Bitzlato. In an order published on Jan. 18, FinCEN stated that Binance cryptocurrency exchange was among the “top three receiving counterparties” of Bitzlato in terms of Bitcoin (BTC) transactions. According to the authority, Binance was among the biggest counterparties that received Bitcoin from Bitzlato between May 2018 and September 2022. Other such counterparties included Russia-connected darknet market Hydra and the alleged Russia-based Ponzi scheme known as “TheFiniko,” FinCEN noted. On the other hand, FinCEN did not mention Binance as the top three sending counterparties in the order. According to the document,...

Bitcoin crowd sentiment hit multi-month high as BTC price touches $21K

Bitcoin (BTC) price climbed to a four-month high above $21,000 in the third week of January, relishing trader’s hope. The market has seen the most substantial investor optimism since July due to the January BTC price rebound. According to data shared by crypto analytic firm Santiment, the trading crowd sentiment has touched its highest in six months and second highest bullish sentiment in the past 14 months. The data indicates that traders are treating Bitcoin’s price rebound as a signal of a possible bigger breakout in the near future. The term “crowd/investor sentiment” describes how investors generally feel about a specific asset or financial market. It refers to the mood or tenor of a market, or the psychology of its participants, as expressed by activity and changes ...

Deal Box launches $125M blockchain and Web 3 venture fund

According to a press release published on Jan. 18, U.S.-based capital markets advisory and token offering platform Deal Box has launched a new $125 million venture capital arm dedicated to blockchain and Web 3.0 startups. The fund, dubbed Deal Box Ventures, will invest in companies categorized in the emerging growth, real estate, fintech, funtech, and social impact fields. Commenting on today’s development, Thomas Carter, founder and chairman of Deal Box, said: “Deal Box Ventures is an important milestone in our journey to invest in the most promising and disruptive blockchain startups, providing them with the tools and funding ecosystem they need to be successful by simplifying and reimagining traditional financing models.” As part of initial Web 3.0 investments, D...

Masa Finance launches soulbound Web3 identity protocol for Ethereum

Masa Finance has launched the first soulbound identity protocol for the Ethereum mainnet, according to a Jan. 17 press release shared with Cointelegraph. The protocol will allow for standardized soulbound tokens to be minted on Ethereum for Know Your Customer verification, credit scores and other use cases. Soulbound tokens are tokens that cannot be transferred from one wallet to another. The concept was popularized via a blog post from Vitalik Buterin, who argued that these tokens could be used to signify governance rights for decentralized finance (DeFi) protocols or to prove that a person has attended an event. Speaking to Cointelegraph, Masa Finance founders Brendan Playford and Calanthia Mei argued that soulbound tokens will expand opportunities for DeFi users to build credit and get ...

CoinFLEX attempts to hose down backlash over proposed new 3AC project

Amid mounting criticism on social media, crypto investment firm CoinFLEX has attempted to clarify its plans to build a new crypto exchange with Three Arrows Capital (3AC). A leaked pitch deck on Jan. 16 revealed it was collaborating with the now-bankrupt hedge fund to build a proposed crypto exchange called “GTX” — which would focus on the trading of claims against bankrupt firms. In a blog post published shortly after, CoinFLEX went on to “clarify misconceptions about the leaked materials concerning the proposed ‘GTX’ Exchange.” Firstly, CoinFLEX said it won’t actually be using the “GTX” name as detailed in the pitch deck, noting that it only serves as a placeholder name for now. Some members of the community had ...

Binance to let institutions store crypto with cold custody

Amid the centralized cryptocurrency exchanges (CEX) crisis, crypto exchange Binance is moving to improve its institutional trading services with cold-custody opportunities. On Jan. 16, Binance announced the official launch of Binance Mirror, an off-exchange settlement solution that enables institutional investors to invest and trade using cold custody. The newly launched Mirror service is based on Binance Custody, a regulated institutional digital asset custodian, and involves mirroring cold-storage assets through 1:1 collateral held on a Binance account. Binance emphasized that the new solution enables more security, allowing traders to access the exchange ecosystem without having to post collateral directly on the platform, stating: “Their assets remain secure in their seg...