cryptocurrencies

Navigating the World of Crypto: Tips for Avoiding Scams

Despite the belief of many crypto enthusiasts that centralized exchanges (CEXs) are safer, history has often shown them to be rather vulnerable to attacks. Because these exchanges centralize the storage of users’ assets, they can be attractive targets for cybercriminals. If an exchange’s security measures are inadequate or successfully compromised, user assets may be stolen or lost. Another risk of centralized exchanges is the potential for fraud or mismanagement by their operators. Since CEXs may have a single point of control, they may be more susceptible to insider fraud or other forms of misconduct — which can lead to the loss of funds or other negative consequences for users. Over the last year, with the collapse of major centralized cryptocurrency platforms like FTX and Celsius, more...

Bitcoin price rally over $21K prompts analysts to explore where BTC price might go next

After Bitcoin (BTC) hit a yearly high of $21,095 on Jan. 13, where is it headed next? Bitcoin is currently witnessing an uptick in bullish momentum after the positively perceived Consumer Price Index (CPI) report was followed by a strong rally across the crypto market. The recent rally in Bitcoin is creating increased volume levels and higher social engagement on whether the price is in a breakout of fakeout mode. Is the Bitcoin bear market over? While the market is still technically in a bear market compared to last week, investor sentiment is improving. According to the Fear and Greed Index, a crypto-specific metric that measures sentiment using five weighted sources, investors’ feelings about the market hit a monthly high. Bitcoin Fear and Greed index. Source: alternative.me Bitco...

Alameda Research liquidators lost $72K during fund consolidation attempt

The liquidators of Alameda Research continue to encounter obstacles in their efforts to recover funds for creditors. Crypto analytics firm Arkham disclosed on Twitter that the liquidators lost $72,000 worth of digital assets on the decentralized finance (DeFi) lending platform Aave while trying to consolidate funds into a single multisignature wallet. The liquidators were attempting to close a borrow position on Aave but instead removed extra collateral used for the position, putting the assets at risk of liquidation. Arkham reported that over nine days, the loan was liquidated twice for a total of 4.05 Wrapped Bitcoin (WBTC), which creditors will now not be able to recoup. This resulted in the liquidation of around 4 WBTC, $72K at current prices. When positions are forcibly closed on...

Winklevoss slams SEC charges against Gemini as ‘super lame… manufactured parking ticket’

Tyler Winklevoss, the co-founder of cryptocurrency exchange Gemini, has hit out at the regulator charging the exchange over issuing unregistered securities, calling the allegations “super lame” and a “manufactured parking ticket.” In a series of tweets on Jan. 12, Winklevoss shared his disappointment over the charges from the Securities and Exchange Commission (SEC) regarding Gemini’s “Earn” program, claiming the regulator was “optimizing for political points.” He called the SEC’s action “totally counterproductive” and said Gemini had been discussing the Earn program with the regulator “for more than 17 months.” 2/ As a matter of background, the Earn program was regulated by the @NYDFS and we’ve been in discussions with the SEC about the Earn program for more than 17 months. Th...

Ava Labs partners with AWS to offer one-click node deployment

Ava Labs, the developer of the Avalanche network (AVAX), has partnered with Amazon Web Services (AWS) to implement new features intended to make running a node easier, according to a Jan. 11 blog post from Ava Labs. The new features include one-click node deployment through the AWS Marketplace, AWS GovCloud integration for decentralized app (DApp) developers concerned about compliance, and the ability to create Avalanche subnets with just a few clicks. It’s official! @Amazon #ChoseAvalanche to bring scalable blockchain solutions to enterprises and governments #AWS fully supports Avalanche’s infrastructure and dApp ecosystem, including one-click node deployment, offering the best tooling for these high compliance use cases. pic.twitter.com/syInSrU9XD — Avalanche (@avalancheavax) January 11,...

Crypto exchange Zipmex probed by Thai SEC amid buyout

The cryptocurrency exchange Zipmex is the focus of a new probe by the Securities and Exchange Commission (SEC) of Thailand for a breach of local rules. A Bloomberg report revealed that local authorities are looking into activities that they believe may violate business rules for digital asset service providers. This includes its offerings of certain digital asset products. According to the Thai SEC, Zipmex has until Jan. 12 to clarify whether it has been functioning as a “digital asset fund manager without permission” in Thailand. If true, the firm would have needed to obtain a permit before conducting business in the country. Cast your vote now! Zipmex is currently in the process of being acquired by V Ventures, a subsidiary of Thoresen Thai Agencies PCL, for around $100 million.&nb...

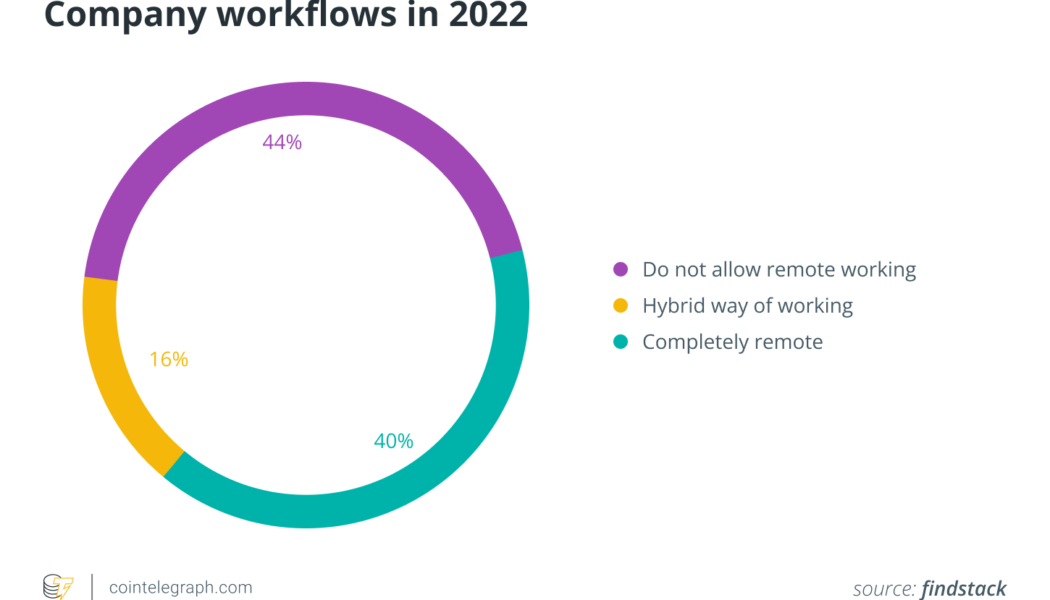

Remote work could redefine the global workforce for good

As the global economy continues to reel from the devastation caused by the COVID-19 pandemic, there is increasing data suggesting that more and more people are now favoring a remote work-based lifestyle. In this regard, a survey sample of working United States citizens shows that Millennial and Generation Z workers prefer joining a remote workforce and decentralized autonomous organizations (DAOs) as opposed to going to an office. As part of the study, more than 1,100 U.S. citizens were asked to provide their preferences regarding remote work and the emergence of DAOs in recent years. Using research pertaining to DAOs published by the Harvard Law School, the survey showed how DAOs have seen their coffers grow from a respectable $400 million to a whopping $16 billion over the course of 2021...

Manta Network conducts record-breaking trusted setup ceremony, 4,000+ contribute

Manta Network recently completed the largest trusted setup ceremony ever, with over 4,000 people participating, according to a press release provided to Cointelegraph. The setup was done in order to help create MantaPay, an app that intends to allow for private payments between individuals. 8/ 2022 also saw the launch of the world’s largest trusted setup on Polkadot by @MantaNetwork, spanning 177 countries with over 13,000 participants and counting. This technology is essential for building a better, more secure web that keeps sensitive information private. — Polkadot (@Polkadot) December 31, 2022 According to the company, MantaPay will run on the Polkadot parachain Manta Network and on the Kusama parachain Calamari. It will use zero-knowledge proofs to ensure that only the sender and reci...

Huobi net outflows crossed over 60M within the past 24 hours: Report

Cryptocurrency exchange Huobi has seen over $94.2 million dollars in net outflows within the past week. Within the past 24 hours alone, approximately $60 million has flowed out of the exchange, according to crypto analytics company Nansen. In the past 24 hours, Huobi has seen a significant increase in net outflows $60.9M* of the $94.2M* net outflow in the past week occurred in the past day alone *Contains Ethereum, Avalanche, BNB Chain, Fantom, & Polygon flows pic.twitter.com/JV1Tg13QMY — Nansen (@nansen_ai) January 6, 2023 Nansen also reported that a significant portion of withdrawals were in Tether (USDT), USD Coin (USDC), and Ether (ETH), from wallets with high balances. The significant increase in outflows from the exchange was allegedly triggered by rumors circulating on Twi...

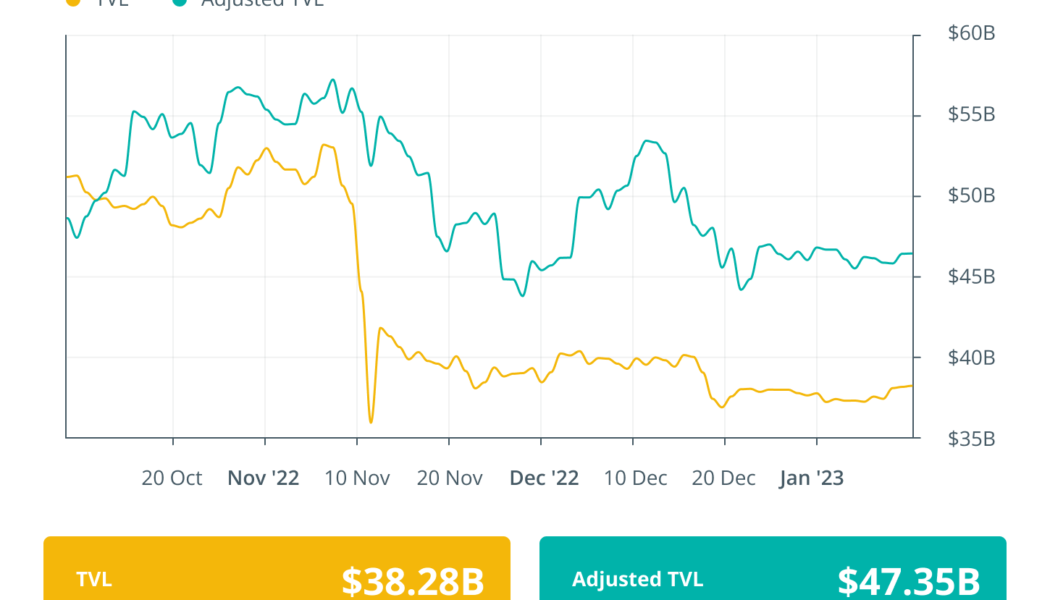

December DeFi exploits were the lowest in 2022: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The end of 2022 saw the least value of stolen funds from DeFi, with $62 million worth of exploits in December. While the figure might seem a relief given the multiple bridge hacks and hundreds of millions of dollars stolen this year, cybersecurity experts have warned that the ecosystem would see no decrease in exploits, flash loans or exit scams in 2023. Lido protocol overtook MakerDAO to have the highest total value locked (TVL) in the DeFi ecosystem. In other news, Mango Markets hacker Avraham Eisenberg was detained pending trial. The start of the new year saw a GMX whale hacked for $3.5 million worth of GMX tok...

Macroeconomic data points toward intensifying pain for crypto investors in 2023

Undoubtedly, 2022 was one of the worst years for Bitcoin (BTC) buyers, primarily because the asset’s price dropped by 65%. While there were some explicit reasons for the drop, such as the LUNA-UST crash in May and the FTX implosion in November, the most important reason was the U.S. Federal Reserve policy of tapering and raising interest rates. Bitcoin’s price had dropped 50% from its peak to lows of $33,100 before the LUNA-UST crash, thanks to the Fed rate hikes. The first significant drop in Bitcoin’s price was due to growing market uncertainty around potential rate hike rumors in November 2021. By January 2022, the stock market had already started showing cracks due to the increasing pressure of imminent tapering, which also negatively impacted crypto prices. BTC/USD daily price chart. ...

Wyre imposes up to a 90% withdrawal limit for all users

Crypto payment platform Wyre modified its withdrawal policy to limit users from cashing out up to 90% of their assets just days after two former employees allegedly hinted the possibility of a shutdown. On Jan. 7, 2023, Wyre imposed a withdrawal limit on its platform, citing “the best interest of our community.” Following the policy modification, Wyre users can withdraw up to 90% of their crypto funds as the company explores strategic options to circumvent the prolonged bear market. We are modifying our withdrawal policy. While customers will continue to be able to withdraw their funds, at this time, we are limiting withdrawals to no more than 90% of the funds currently in each customer account, subject to current daily limits. — Wyre (@sendwyre) January 7, 2023 In addition, the company ap...