cryptocurrencies

A sharp drop in TVL and DApp use preceded Avalanche’s (AVAX) 16% correction

After an impressive 73% rally between July 13 and Aug. 13, Avalanche (AVAX) has faced a 16% rejection from the $30.30 resistance level. Some analysts will try to pin the correction as a “technical adjustment,” but the network’s deposits and decentralized applications reflect worsening conditions. Avalanche (AVAX) index, USD. Source: TradingView To date, Avalanche remains 83% below its November 2021 all-time high at $148. More data than technical analysis can be analyzed to explain the 16% price drop, so let’s take a look at the network’s use in terms of deposits and users. The decentralized application (DApp) platform is still a top-15 contender with a $7.2 billion market capitalization. Meanwhile, Solana (SOL), another proof-of-work (PoW) layer-1 platform, holds a $14.2 billio...

Chinese mining giant Canaan doubles profits despite the blanket crypto ban

Major Chinese cryptocurrency miner manufacturer Canaan appears to have no issues with the local ban on crypto, as the company’s overall performance has continued to grow in 2022. Canaan officially announced its financial results for the second quarter of 2022 on Thursday, reporting a 117% increase in gross profit from the same period of 2021. According to the firm, the Q2 profits amounted to 930 million renminbi (RMB), or nearly $139 million. The company’s Q2 net income was 608 million RMB, or $91 million, or a 149% increase from 425 million RMB in the same period last year. Canaan noted that foreign currency translation adjustment in Q2 was an income compared to previous losses due to the U.S. dollar appreciation against RMB during Q2. Despite posting significant profits, Canaan has ...

Coinbase would rather shut down staking than enable on-chain censorship — Brian Armstrong

In light of the recent ban on crypto mixing tool Tornado Cash and the subsequent arrest of the Tornado Cash developer, there has been a growing debate over whether crypto services providers would choose decentralization or censorship as form of compliance. The question has become more prominent as Ethereum is moving from its current proof-of-work (PoW) blockchain to a proof-of-stake (PoS) mining consensus. With the transition less than a month away, a user pointed out that more than 66% of validators on the Beacon Chain (Ethereum PoS chain) will adhere to the United States Department of the Treasury’s Office of Foreign Assets Control (OFAC) regulations. Start with the big, current one. Currently it looks like over 66% of the beacon chain validators will adhere to OFAC regulatio...

South African Reserve Bank encourages friendly behavior with crypto

The Prudential Authority of the Reserve Bank of South Africa sent out guidelines to its subsidiaries in an effort to prevent illicit activities, encouraging banks not to cut all ties with cryptocurrency. It suggested that such an act could cause greater risk in the long run. The official notice was signed by Prudential Authority CEO Fundi Tshazibana. In the past, certain South African banks had cut ties with crypto asset service providers (CASPs) — as they are called in the document — due to unclear regulations or a high-risk factor. However, the notice highlights that risk assessment doesn’t mean dropping crypto entirely: “Risk assessment does not necessarily imply that institutions should seek to avoid risk entirely (also referred to as de-risking), for example, through wholesale t...

European Central Bank addresses guidance on licensing of digital assets

The European Central Bank, or ECB, laid the foundation for the criteria it would be considering when harmonizing the licensing requirements for crypto in Europe. In a Wednesday statement, the ECB’s banking supervision division said it would be taking steps to regulate digital assets as “national frameworks governing crypto-assets diverge quite extensively” and given the seemingly differing approaches to harmonization following the passage of the Markets in Crypto-Assets (MiCA) regulation and the Basel Committee on Banking Supervision issuing guidelines for banks’ exposure to crypto. The ECB said it would apply criteria from the Capital Requirements Directive — in effect since 2013 — to assess licensing requests for crypto-related activities and services. Specifically, the central bank will...

Senator asks FDIC about allegations it discourages bank relations with crypto companies

Pennsylvania Senator Pat Toomey, ranking member of the United States Senate Banking Committee, has sent a letter to Federal Deposit Insurance Corporation (FDIC) director and acting chairman Martin Gruenberg informing him of allegations made by a whistleblower concerning FDIC activities. The senator suspects the FDIC “may be improperly taking action to deter banks from doing business with lawful cryptocurrency-related (crypto-related) companies.” Toomey wrote that there is corroboration of whistleblower allegations that “personnel in the FDIC’s Washington, D.C. headquarters are urging FDIC regional offices to send letters to multiple banks requesting that they refrain from expanding relationships with crypto-related companies, without providing any legal basis for sending such letters...

Ethereum Foundation clarifies that the upcoming Merge upgrade will not reduce gas fees

According to a new clarification by the Ethereum Foundation on Wednesday, the network’s upcoming proof-of-stake transitory upgrade — dubbed the “Merge,” — will not reduce gas fees. Regarding this, the Ethereum Foundation wrote: “Gas fees are a product of network demand relative to the network’s capacity. The Merge deprecates the use of proof-of-work, transitioning to proof-of-stake for consensus, but does not significantly change any parameters that directly influence network capacity or throughput.” The Merge, which seeks to join the existing execution layer of the Ethereum mainnet with its new proof-of-stake consensus layer, the Beacon Chain, will eliminate the need for energy-intensive mining. It is expected to land within the third or final qua...

Bank of China unveils new e-CNY smart contract test program for school education

According to local news outlet Sohu.com, on Tuesday, the state-owned Bank of China announced a new program to bridge primary school education with smart contracts. In a combined partnership with local education and financial authorities, parents residing in the city of Chengdu, located in China’s Sichuan province, will be able to enroll their children in after-school or extracurricular lessons using the digital yuan central bank digital currency, or e-CNY. Under the pilot test, parents start by paying a deposit to a private educational entity for a series of lessons. Afterward, a smart contract binds each lesson on a pro-rata basis to the deposit. This way, should their children miss a lesson, the e-CNY payment is automatically credited back to their account via smart contract. ...

Bank of China unveils new e-CNY smart contract test program for school education

According to local news outlet Sohu.com, on Tuesday, the state-owned Bank of China announced a new program to bridge primary school education with smart contracts. In a combined partnership with local education and financial authorities, parents residing in the city of Chengdu, located in China’s Sichuan province, will be able to enroll their children in after-school or extracurricular lessons using the digital yuan central bank digital currency, or e-CNY. Under the pilot test, parents start by paying a deposit to a private educational entity for a series of lessons. Afterward, a smart contract binds each lesson on a pro-rata basis to the deposit. This way, should their children miss a lesson, the e-CNY payment is automatically credited back to their account via smart contract. ...

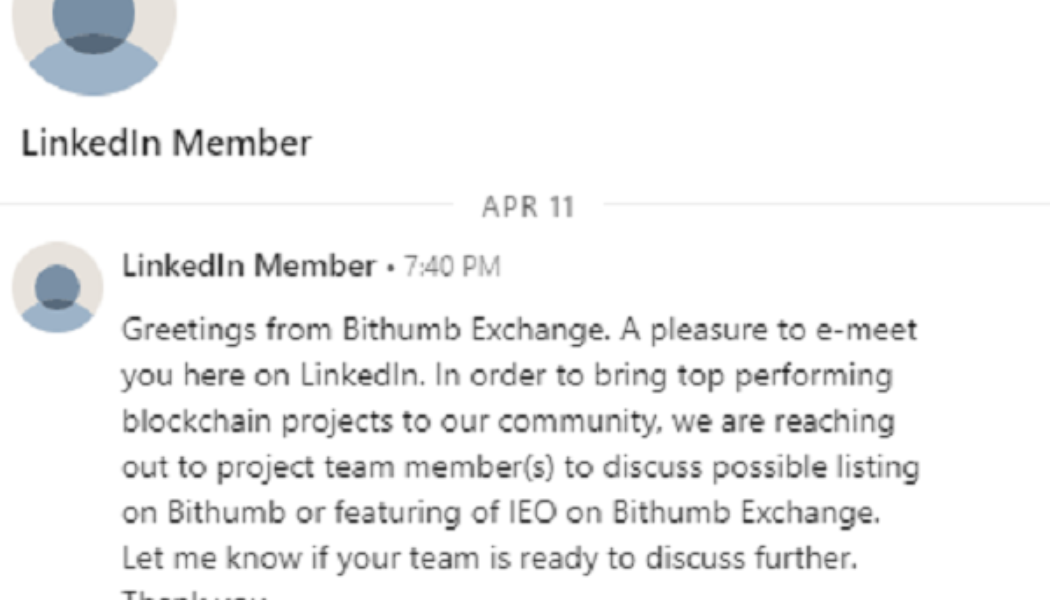

Only 50 or so profiles out of 7,000 Binance employees on LinkedIn are real, says CZ

According to a Sunday Twitter post by Binance CEO Changpeng Zhao, also known as CZ, only about 50 out of 7,000 users claiming to be employees of the world’s largest cryptocurrency exchange on Linkedin are real. The crypto executive lamented the lack of a real-ID authentication system on Linkedin, saying: “I wished LinkedIn had a feature to let the company verify people. So, many “hey, I am responsible for listing” scammers on LinkedIn. Be careful.” The LinkedIn crypto scam typically begins as an unsolicited request from an apparent crypto exchange executive to project stakeholders regarding a potential token listing. Profiles are cleverly crafted to show years of experience in the industry, along with, multiple connections, sometimes up to 500-plus, to derive ...

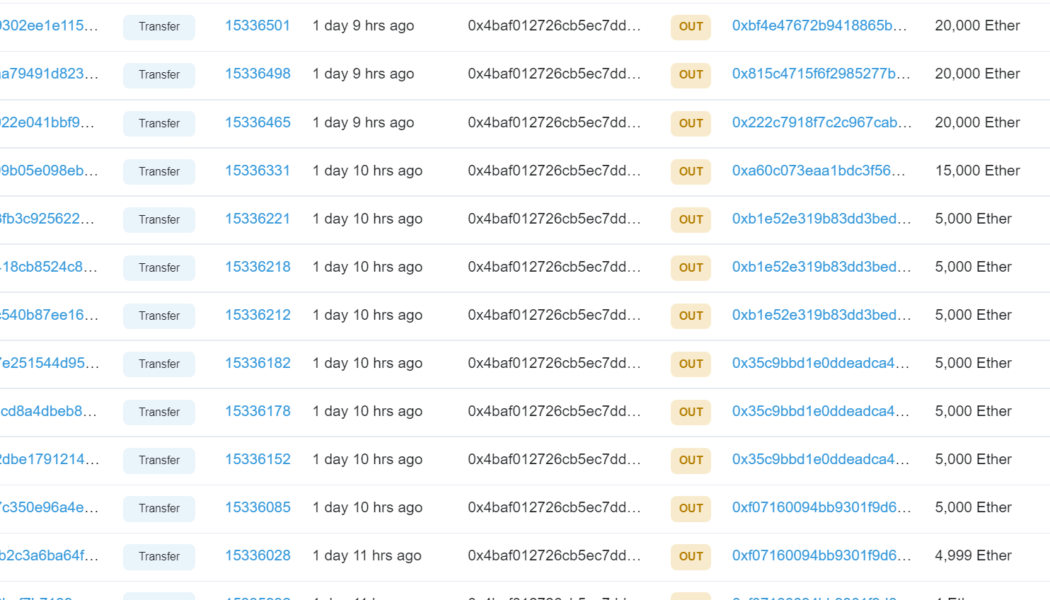

Ethereum ICO-era whale address transfer 145,000 ETH weeks before the Merge

An Ethereum (ETH) whale wallet that participated in the Genesis Initial Coin Offering (ICO) and obtained about 150,000 ETH in 2014 was activated again on Aug. 14 after three years of dormancy. The whale address transferred 145,000 ETH to multiple wallets as Ether price surged to a new 3-month high of over $2,000. The transfers were made in a batch of 5,000 ETH per transaction and a few transfers of over 10,000 ETH. The total value of the transferred ETH is over $280 million, and the wallet address currently has a balance of 0.107 ETH. Ethereum ICO era wallet transactions Source: Etherscan The 145,000 ETH transfer was only the second instance after the ICO when the whale wallet was activated, the first coming in July 2019 when the wallet sent out 5,000 ETH to Bitfinex3 exchange ...

Zipmex gets 3 month protection in Singapore amid halted withdrawals

Cryptocurrency exchange Zipmex has gotten a chance to sort out liquidity issues as a court in Singapore has granted the firm with more than three months of creditor protection. Singapore’s High Court has ruled to give each of the five Zipmex entities a moratorium until Dec. 2, 2022 to come up with a restructuring plan, Bloomberg reported on Monday. The action aims to protect Zipmex from potential creditor lawsuits during the moratorium period after the exchange abruptly halted crypto withdrawals on its platform in mid-July. The cryptocurrency has since resumed partial withdrawals from Zipmex’s trade wallet but is yet to resume all withdrawals. Zipmex sought creditor protection for a period of six months subsequently after halting withdrawals, filing five moratorium applications on July 27....