cryptocurrencies

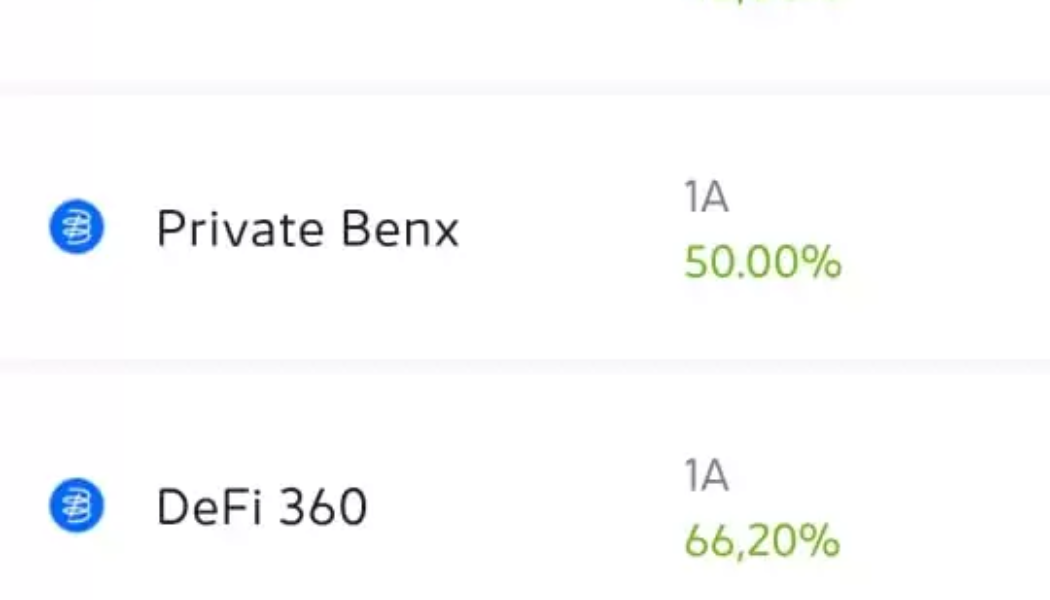

BlueBenx fires employees, halts funds withdrawal citing $32M hack

BlueBenx, a Brazilian crypto lending platform, reportedly blocked all of its 22,000 users from withdrawing their funds following an alleged hack that drained $32 million (or 160 million Brazilian real). While no details about the hack were made available, the company allegedly laid off most of its employees. BlueBenx joins the growing list of crypto companies that failed to deliver on their promise of exorbitant yield returns this crypto winter. The Brazilian crypto lender promised up to 66% returns for users investing in cryptocurrencies via various in-house earning avenues. A report from the local news board Portal do Bitcoin highlighted that BlueBenx halted all forms of withdrawals after falling victim to an “extremely aggressive” hack. According to BlueBenx’s lawyer, Assuramaya Kuthumi...

The Merge: Top 5 misconceptions about the anticipated Ethereum upgrade

The excitement around Ethereum’s (ETH) upcoming upgrade, The Merge, which involves the merger of two blockchains — Mainnet Ethereum and Beacon Chain — has unknowingly spurred rumors across the community. Termed the most significant upgrade in the history of Ethereum, The Merge does indeed mark the end of proof-of-work (PoW) for the Ethereum blockchain. However, here are five misconceptions that stand out among the rest. Misconception 1: Ethereum gas fees will reduce after The Merge Ethereum’s impending upgrade will reduce Ethereum’s infamous gas fees (transaction fees) is one of the biggest misconceptions circulating among investors. While reduced gas fees tops every investor’s wishlist, The Merge is a change of consensus mechanism that will transition the Ethereum blockchain from PoW to p...

Curve Finance resolves site exploits, directs users to revoke recent contracts: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. This past week, cross-bridge protocols became the center of DeFi discussions as a new report showed RenBridge was used to launder $540 million in stolen funds. Curve Finance, on the other hand, resolved its site exploit and directed users to revoke any recent contracts. Interlay, a London-based blockchain firm, launched a Bitcoin (BTC)-based cross-chain bridge on Polkadot named interBTC (iBTC), DeFi platform Oasis.app says that sanctioned addresses will no longer be able to access the application. The majority of the top-100 DeFi tokens saw a new surge in bullish momentum along with the rest of the market, with se...

Mailchimp bans crypto content creators without prior notice

The email marketing platform Mailchimp appears to have suspended its services to crypto content creators. Platforms associated with crypto news, content or related services started to have issues logging into accounts, followed by notices of service interruptions that began surfacing this week. Crypto-associated accounts such as the Edge wallet, a provider of self-custody crypto holding services, and Messari, a crypto research company, were among some of the affected. Early this morning, Sam Richards, at the Ethereum Foundation Tweeted that the Ethereum Foundation Ecosystem Support Program is likewise facing suspension. Add @Ethereum Foundation’s @EF_ESP to the list of customers @Mailchimp has rugged. Anyone have good recommendations for email subscription services with solid A...

Tornado Cash DAO goes down without explanation following vote on treasury funds

The Tornado Cash DAO went offline after many social media users reported the community discussing ways to challenge sanctions recently imposed by the United States Treasury Department’s Office of Foreign Asset Control. At the time of publication, the Tornado Cash DAO was offline reportedly following a discussion in which community members voted unanimously to add its governance layer as a signatory to its treasury’s multisig wallet, which manages a reported $21.6 million. It’s unclear what was responsible for the decentralized autonomous organization (DAO) going dark, but it followed a series of actions taken by different authorities and private entities in the wake of U.S. sanctions announced against the controversial mixer on Monday. In the last four days, Circle froze more than 75,000 U...

Brazilian payment app PicPay launches crypto exchange with Paxos

Major Brazilian payment application PicPay is moving into cryptocurrencies by integrating a crypto exchange service allowing users to buy Bitcoin (BTC) and Ether (ETH). The firm officially announced on Wednesday that PicPay clients can now buy, sell and store two major cryptocurrencies, BTC or ETH, directly on its app. PicPay pointed out that its choice was due to the real use cases provided by these digital assets, including security and many other benefits. The firm stated: “Blockchain technology, which is behind coins like Bitcoin and Ethereum, is already used in the real estate sector, the insurance industry and even the art market, through non-fungible tokens.” The new crypto feature is enabled through a partnership with the major crypto company Paxos and allows customers to use Paxos...

UNCTAD takes aim at crypto in developing world in a series of critical policy briefs

The United Nations Conference on Trade and Development (UNCTAD) released a policy brief Wednesday on cryptocurrency. It is the third brief in a row the agency has dedicated to crypto, and together they represent a detailed assessment of the risks crypto presents for developing economies and options for resolving those risks. UNCTAD Policy Brief No. 102, dated July but newly released, argues that although cryptocurrency can facilitate remittances and encourage financial inclusion, it can also undermine domestic resource mobilization in developing economies by enabling tax evasion by hiding the ownership of financial flows and directing them out of the country. The authors of the brief state, “Cryptocurrencies share all the characteristics of traditional tax havens – the pseudonymity of acco...

DeFi platform Oasis to block wallet addresses deemed at-risk

According to a new community Discord post on Thursday, decentralized finance platform Oasis.app says that sanctioned addresses will no longer be able to access the application. As a result of the change to the terms of service, wallets flagged as high risk are prohibited from using Oasis.app to manage positions or withdraw funds. Instead, such category of users must interact directly with the relevant underlying protocol where funds are stored or find another service. In explaining the decision, Oasis.app team member Gabriel said: “We’ve recently needed to update the Terms of Service of the Oasis.app front-end to comply with the relevant laws and regulations. In line with the latest regulations, Oasis.app has an updated Terms of Service. Any sanctioned addresses will no longer ...

Mark Cuban faces class action lawsuit for promoting Voyager crypto products

Mark Cuban, the billionaire entrepreneur who has been quite active in the crypto ecosystem for the past year, is facing a class-action lawsuit over his promotions of the bankrupt crypto brokerage firm Voyager Digital. The Moskowitz Law Firm filed a civil suit in the United States District Court in Southern Florida against Cuban for promoting Voyager’s unregulated crypto products. The lawsuit demanded a jury hearing for the case. The lawsuit alleged Cuban also misrepresented the firm on numerous occasions, making dubious claims of it being cheaper than competitors and offering “commission-free” trading services. Cuban, along with Voyager Digital CEO Stephen Ehrlich, leveraged their years of experience to lure inexperienced customers into investing their life savings in what they called...

Anonymous user sends ETH from Tornado Cash to prominent figures following sanctions

On Tuesday, one day after the U.S. Treasury sanctioned cryptocurrency mixer Tornado Cash for its alleged role in cryptocurrency money laundering operations, intervals of 0.1 Ether (ETH) transactions began materializing from the smart contract to prominent figures such as Coinbase CEO Brian Armstrong and American television host Jimmy Fallon. It is not possible to trace the source of the transactions per Tornado Cash design, and as a result, either one individual or multiple individuals or entities could be involved in the operation. Notable individuals/companies who just received funds from a government-sanctioned entity: – Jimmy Fallon– Shaquille O’Neal– PUMA– Randi Zuckerberg– Logan Paul– Brian Armstrong– Steve Aoki– Uk...

Circle plans to only support Ethereum PoS chain after Merge is complete

On Tuesday, Circle, the issuer of the USD Coin (USDC) stablecoin, pledged its full support for the transition of Ethereum to a proof-of-stake, or PoS, blockchain after the much-anticipated Merge upgrade. The firm views the Merge as an important milestone in the scaling of the Ethereum ecosystem, writing: “USDC has become a core building block for Ethereum DeFi innovation. It has facilitated the adoption of L2 solutions and helped broaden the set of use cases that today rely on Ethereum’s vast suite of capabilities. We understand the responsibility we have for the Ethereum ecosystem and businesses, developers and end users that depend on USDC, and we intend to do the right thing.” Currently, USDC is both the largest dollar-backed stablecoin issued on Ethereum and the largest ERC-20 asset ov...

Is your SOL safe? What we know about the Solana hack | Find out now on The Market Report

On this week’s episode of “The Market Report,” Cointelegraph’s resident experts discuss the latest updates concerning the recent Solana (SOL) hack. To kick things off, we broke down the latest news in the markets this week: Bitcoin realized price bands form key resistance as bulls lose $24K, significant whale activity between $22,000 and $24,800 adds to the complexity of the current spot market setup. Bitcoin (BTC) consolidated lower on Aug. 9 after familiar resistance preserved a multi-month trading range. When will we finally break out of this price range and make the move towards $30K? Institutions flocking to Ethereum for 7 straight weeks as Merge nears: Report, “Greater clarity” around the Merge has driven institutional inflows into Ethereum products, according to a CoinShares report....