cryptocurrencies

SEC listing 9 tokens as securities in insider trading case ‘could have broad implications’ — CFTC

Caroline Pham, one of five commissioners with the United States Commodity Futures Trading Commission, or CFTC, has expressed concerns about the possible implications of a case the U.S. Securities and Exchange Commission, or SEC, brought against a former product manager at Coinbase. In a Thursday statement, Pham said the SEC complaint against former Coinbase product manager Ishan Wahi, his brother Nikhil Wahi and associate Sameer Ramani “could have broad implications” beyond the case, given its labeling nine tokens as “crypto asset securities” falling under regulatory body’s purview. The complaint alleged that the Wahis and Ramani engaged in insider trading by using confidential information Ishan obtained from Coinbase with regard to which tokens would be listed on the exchange, in ord...

Hardware wallet industry to outstrip crypto exchanges: Report

The crypto hardware wallet industry could be growing at a faster pace than cryptocurrency exchanges, data from several studies suggest. The current bear market has accelerated the development of the cold wallet industry, while many centralized crypto exchanges were scrambling to maintain operations. According to a report by business intelligence firm Vantage Market Research, the revenue of global crypto trading platforms amounted to $330 million in 2021. Released on July 21, the report suggests that the global crypto exchange market revenue would reach a value of $675 million by 2028 with a compound annual growth rate (CAGR) of 12.7%. That’s at least half the CAGR related to the growth of the hardware wallet industry, other reports suggest. The global hardware wallet market repor...

Ether price stalls at $1,630 after gaining 50% in under a week

Price action across the cryptocurrency market was largely subdued on July 21, as traders took a day to digest gains over the past week and book profits following the biggest relief rally since early June. Amid speculation about what drove the recent rally, the Ethereum Merge has consistently ranked at the top of the list. The market rally shifted into high gear after a tentative date of Sept. 19 was set for the mainnet Merge. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a high of $1,620 on July 20, Ether’s (ETH) price retraced to a low of $1,463 in the early trading hours on July 21 and has since climbed back above support at $1,500. ETH/USDT 1-day chart. Source: TradingView Now that the initial price surge brought on by the Merge announcemen...

‘The market is acting this way because there is no regulation’ says Skale Labs’ Konstantin Kladko

The recent cryptocurrency bear market has uprooted decentralized finance (DeFi) and centralized finance (CeFi) projects in the crypto space. But past performance is not always indicative of future results. For starters, Ethereum’s price has already recovered 48% in the past few days ahead of the looming Merge upgrade. At the annual Ethereum Community Conference in Paris, Cointelegraph spoke to Skale Labs’ co-founder Konstantin Kladko regarding the market crisis. Sklae Labs is a decentralized network of blockchains built on Ethereum. Currently, it’s comprised of 28 blockchains where one can send tokens seamlessly from one chain to another. Here’s what Klado has to say about the recent contagion: “The market is acting this way because there is no regulatio...

What’s next for the future of Ethereum? Mihailo Bjelic from Polygon explains

With the transition to a scalable, energy light proof-of-stake blockchain (dubbed “the Merge”) at play for Ethereum, many have cast doubts on the popular coin’s future given the magnitude and complexity of the upgrade involved. But among prominent stakeholders, one particular project remains heavily bullish on Ethereum’s future, which is non-other than layer-two scaling solution Polygon. At the annual Ethereum Community Conference in Paris, Cointelegraph’s Events Manager Maria A. spoke to Polygon’s vice president of growth Mihailo Bjelic regarding the topic. Here’s what Mihailo had to say with regards to the Merge: “This is an upgrade on a live network that has millions of users, billions in capital, and tens of thousands of applications. It is never easy, but the Merge has been in t...

Bitcoin price dips under $23K after earnings report reveals Tesla sold 75% of its BTC

Easy come, easy go was the story on July 20 as the day started on a positive note with Bitcoin (BTC) climbing above $24,300, only to end the official trading day in the red after less than stellar Q2 earning news showed Tesla sold 75% of its Bitcoin and Minecraft reversed course by deciding to ban NFTs on its platform. Daily cryptocurrency market performance. Source: Coin360 A potential source of the afternoon downturn can be traced to Tesla’s Q2 earnings data, which showed that the electric car company sold off 75% of its Bitcoin holdings in order to add $963 million in cash to its balance sheet. So, not only forced selling from 3AC, $LUNA & $UST, but also Voyager, BlockFi and Celsius have been causing the markets to crash. On top of that, Tesla did sell 75% of their #Bitcoin pur...

Morgan Stanley encourages investors to buy battered El Salvador eurobonds

El Salvador’s Bitcoin (BTC) bet has somewhat backfired, with the top cryptocurrency currently trading at a 70% discount from its top. At a time when the Latin American nation is struggling with its debt, Morgan Stanley has given a buy call for the battered eurobond. Simon Waever, global head of emerging-market sovereign credit strategy at Morgan Stanley, told investors in a Tuesday note that El Salvador’s bonds are overly punished by the market conditions, despite the country having better financial metrics than many of its peers, reported Bloomberg. The note to investors read: “Markets are clearly pricing in a high probability of the autarky scenario in which El Salvador defaults, but there is no restructuring.” Waever noted that a country’s debt shouldn’t trade lower than $0.437 on the d...

21Shares launches S&P risk controlled Bitcoin and Ether ETPs

With cryptocurrency markets shrinking over 50% this year, 21Shares are working to replicate S&P Dow Jones Indices’ benchmarks with its new risk-adjusted crypto investment products. The Swiss crypto investment firm 21Shares has launched two new exchange traded products (ETP) offering investors exposure to the largest cryptocurrencies — Bitcoin (BTC) and Ether (ETH) — while aiming to soften volatility via rebalancing assets to the U.S. dollar (USD). The new products, the 21Shares S&P Risk Controlled Bitcoin Index ETP and 21Shares S&P Risk Controlled Ethereum Index ETP, will start trading on the Swiss SIX Exchange on July 20. The ETPs will trade under tickers SPBTC and SPETH, the firm announced on Wednesday. Both ETPs target a volatility level of 40%, which is achieved through dyn...

US Justice Department seized $500K in fiat and crypto from hackers connected to DPRK government

The United States Department of Justice has seized and returned roughly $500,000 in fiat and crypto from a hacking group tied to the North Korean government, which included two crypto payments made by U.S. health care providers. In a Tuesday announcement, the Justice Department said in conjunction with the FBI it had investigated a $100,000 ransomware payment in Bitcoin (BTC) from a Kansas hospital to a North Korean hacking group in order to regain access to its systems, as well as a $120,000 BTC payment from a medical provider in Colorado to one of the wallets connected to the aforementioned attack. In May, the FBI filed a seizure warrant for funds from the two ransom attacks and others laundered through China, which the Justice Department reported as worth roughly $500,000 total. “These ...

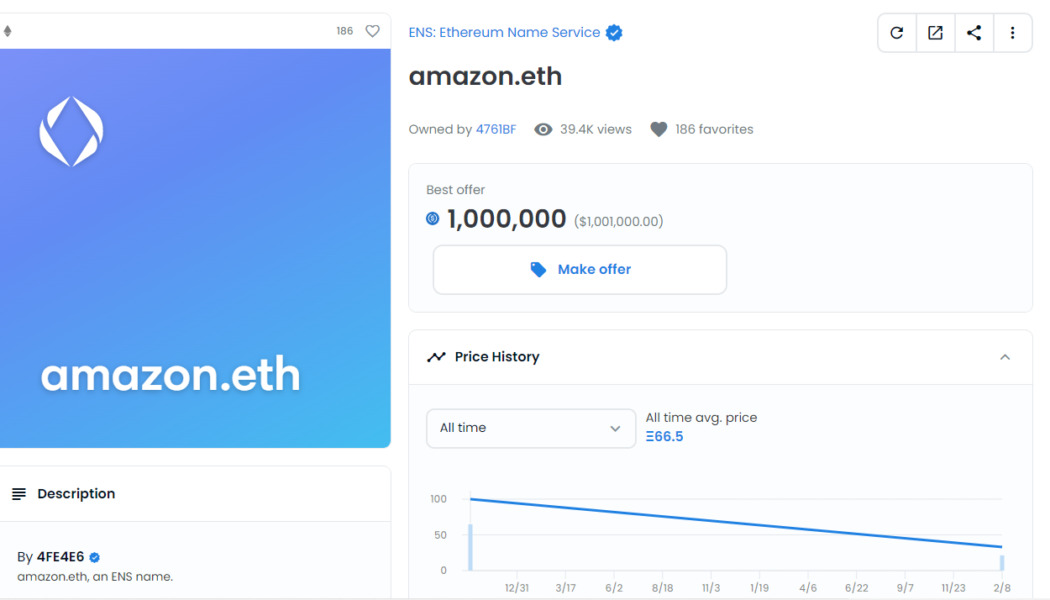

Amazon.eth ENS domain owner disregards 1M USDC buyout offer on Opensea

On Tuesday, the Ethereum Name Service, or ENS, domain Amazon.eth received an offer for 1 million USDC (a stablecoin pegged to the U.S. dollar) from an anonymous wallet address on OpenSea. The offer to buy the ENS domain went unanswered however, and no transaction took place. This is despite the last sale of the domain name being five months ago for 33 Ether (worth around $100,000 at that time). The expired million-dollar offer for Amazon.eth on OpenSea | Source: OpenSea It is unclear at the time of publication whether the owner simply was not informed of the offer, or did not consider it to be near fair value, or if the bidding and domain owner accounts were linked in an attempt to boost the price of the asset (in what is known as a “wash trade”). According to data from Op...

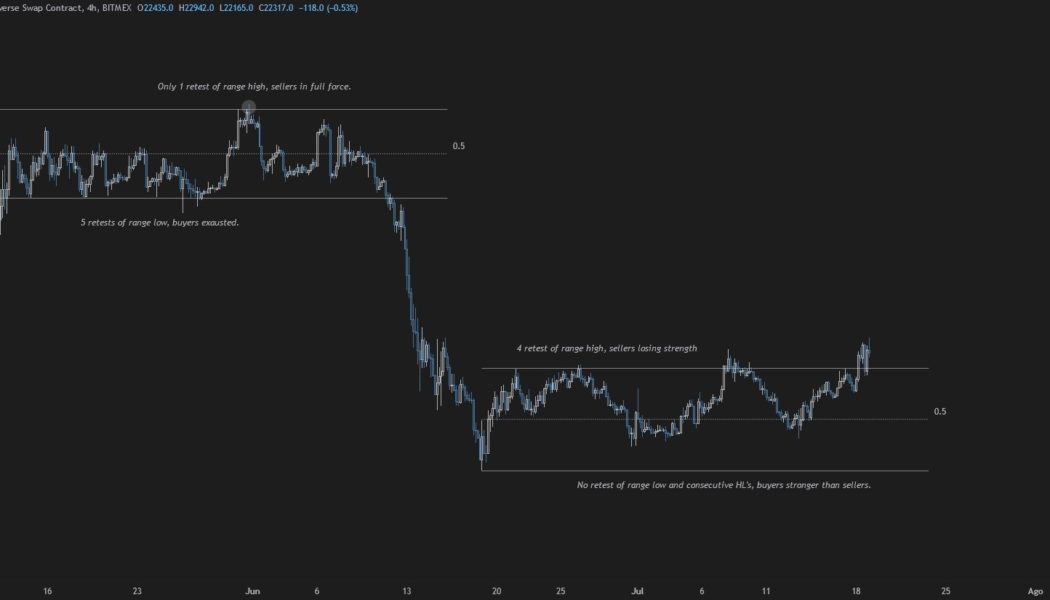

Bitcoin price holds $23.5K, leading bulls to say ‘it’s different this time’

Similar to Stockholm syndrome where captives develop a psychological bond with their captors, crypto winters have a way of flipping even the most bullish cryptocurrency supporters bearish in a short period of time. Evidence of this reality was on full display on July 19 after the recovery of Bitcoin (BTC) back above $23,000 was met with widespread warnings that the move was merely a fakeout before the market heads for new lows $BTC Not bad. But keep in mind that this still can turn into a classical fake out. My general thesis still remains, bear market rally pic.twitter.com/VxnH4mo6hW — Jimie (@Your_NLP_Coach) July 19, 2022 While the possibility of new lows being set in the future can’t be ruled out, here’s a look at analysts’ opinions on how this BTC breakout could be different than...

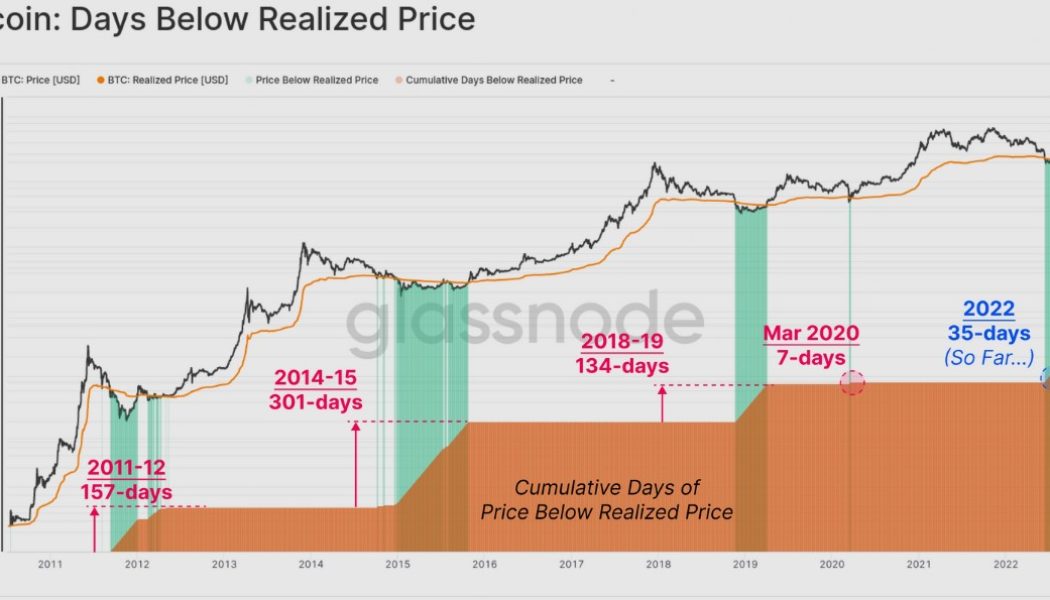

Data points to a Bitcoin bottom, but one metric warns of a final drop to $14K

“When will it end?” is the question that is on the mind of investors who have endured the current crypto winter and witnessed the demise of multiple protocols and investment funds over the past few months. This week, Bitcoin (BTC) once again finds itself testing resistance at its 200-week moving average and the real challenge is whether it can push higher in the face of multiple headwinds or if the price will trend down back into the range it has been trapped in since early June. According to the most recent newsletter from on-chain market intelligence firm Glassnode, “duration” is the main difference between the current bear market and previous cycles and many on-chain metrics are now comparable to these historical drawdowns. One metric that has proven to be a reliab...