cryptocurrencies

Bitcoin miner prices will continue to fall, F2Pool exec predicts

The price of cryptocurrency mining hardware is likely to continue falling in the near future amid the ongoing crypto winter, according to an executive at major Bitcoin (BTC) mining pool F2Pool. Supporting 14.3% of the BTC network, F2Pool is one of the world’s biggest Bitcoin mining pools. On Tuesday, F2Pool released its latest mining industry update. Focusing on June 2022 BTC mining results, F2Pool’s report noted that the majority of Bitcoin mining companies like Core Scientific have opted to sell their self-mined Bitcoin recently. Bitfarms, a major Canadian BTC mining firm, sold 3,000 Bitcoin, or almost 50% of its entire BTC stake for $62 million ito reduce its credit facility in June. “I have studied almost 10 publicly traded industrial miners and found that they are...

Singapore’s financial watchdog considers further restrictions on crypto

The Monetary Authority of Singapore, or MAS, has been “carefully considering” adding restrictions that could affect how retail investors handle crypto, according to one of the government’s senior ministers. According to parliamentary records published on Monday, Singapore senior minister and MAS chair Tharman Shanmugaratnam said the financial watchdog may consider “placing limits on retail participation” for crypto investors as well as introducing rules on the use of leverage for crypto transactions. Shanmugaratnam also called for regulatory clarity among financial regulators around the world, “given the borderless nature of cryptocurrency markets.” In January, the MAS barred crypto service providers from advertising or marketing in public spaces, and was behind regulations to shut down cr...

ECB officials prepare for ‘harmonization’ of crypto regulations: Report

The European Central Bank, or ECB, will reportedly be preparing to implement a new law by warning European Union member states about the necessity of harmonizing regulations for crypto. According to a Sunday report from the Financial Times, the ECB was concerned about possible regulatory overlap between respective central banks in the EU and crypto companies as officials prepare to implement the Markets in Crypto-Assets, or MiCA, framework. The European Parliament, European Commission, and European Council reached an agreement on June 30 to bring crypto issuers and service providers within their jurisdictional control under a single regulatory framework. Regulators from 19 EU member states will reportedly attend a supervisory board meeting in July to discuss MiCA and its possible implement...

Are expiring copyrights the next goldmine for NFTs?

Although non-fungible tokens (NFTs) are most commonly known in the form of digital art, they exist in many other forms and represent much more than just art. In the creative industry, NFTs have been used by musicians such as Kings of Leon to release their latest album. In the sports industry, NFTs are created to record the highlights of major sporting events such as the NBA. In the consumer product industry, Nike, Gucci and many others are selling their digital branded products in the form of NFTs. A lot more real-world applications of NFTs are still to be explored and one of them is the digital publishing industry. The game-changing implications of publishing and promoting books with NFTs have already been discussed extensively by many. For example, the Alliance of Independent Autho...

The crypto industry needs a crypto capital market structure

The past few weeks have been interesting and have surfaced what we in the financial services industry call matters requiring attention, or MRAs. An MRA describes a practice that deviates from sound governance, internal controls and risk management principles. These matters that require attention have the potential to adversely affect the industry and increase the risk profile. I have always focused on technology and innovation-led business models — systems and interconnected elements of blockchain-powered business networks — redefining the transaction systems that power many industries, including financial services. A growing number of naysayers have become vocal about recent events, which have revealed extensive mismanagement, ill-defined and misgoverned systems, and general misrepr...

Hiring top crypto talent can be difficult, but it doesn’t have to be

Building a career or constructing a team in decentralized finance (DeFi) and crypto relies on finding talent, skills and the right attitude anywhere, in anyone. While this is no different than other industries, what makes ours unique are the much-needed, specialized skill sets combined with finding a good culture fit in an international and remote setting. Despite recent turbulence in markets, crypto companies continue building and growing. The increased energy and legitimacy in the industry over the years has many people wanting to make the switch from Web2 to Web3. This requires recruiters to sift through hundreds of applicants every month, but how do you find the right people who are enthusiastic about the ethos of the industry and excited to build impactful technology? Here are a few r...

Not giving up: VanEck refiles with SEC for spot Bitcoin ETF

VanEck, one of the first firms in the world to ever file for a Bitcoin (BTC) exchange-traded fund (ETF), is not giving up on its plans to launch a spot Bitcoin ETF in the United States. The firm has refiled an application for a physically-backed Bitcoin ETF with the U.S. Securities and Exchange Commission (SEC). Filed on June 24, VanEck’s latest Bitcoin ETF application comes months after the SEC rejected its previous spot Bitcoin ETF request on November 12, 2021. The securities regulator based its decision on the ETF on its alleged inability to meet standards to protect investors and the public interest as well as to “prevent fraudulent and manipulative acts and practices.” In the latest filing, VanEck provided a wide number of reasons for the SEC to approve a Bitcoin ETF this time. T...

Deutsche Bank analysts see Bitcoin recovering to $28K by December

Analysts from Deutsche Bank forecast Bitcoin (BTC) rebounding to $28,000 by December 2022 as the cryptocurrency market continues to grapple with gloomy times. Bitcoin and the wider cryptocurrency markets have endured a tough six months, with the value of BTC, in particular, enduring its worst quarter in 10 years. Macroeconomic conditions around the world have played a role, with stagnating markets and fears of inflation driving conventional stock markets and their crypto-counterparts down to painful lows. A report from Deutsche Bank analysts Marion Laboure and Galina Pozdnyakova provides an interesting perspective on the medium-term outlook for BTC. Their insights suggest that cryptocurrency markets have mirrored movements of the Nasdaq 100 and S&P 500 since late 2021. The pair believe...

Analysts identify 3 critical flaws that brought DeFi down

The cryptocurrency market has had a rough go this year and the collapse of multiple projects and funds sparked a contagion effect that has affected just about everyone in the space. The dust has yet to settle, but a steady flow of details is allowing investors to piece together a picture that highlights the systemic risks of decentralized finance and poor risk management. Here’s a look at what several experts are saying about the reasons behind the DeFi crash and their perspectives on what needs to be done for the sector to make a comeback. Failure to generate sustainable revenue One of the most frequently cited reasons for DeFi protocols struggling is their inability to generate sustainable income that adds meaningful value to the platform’s ecosystem. Fundamental Design Princ...

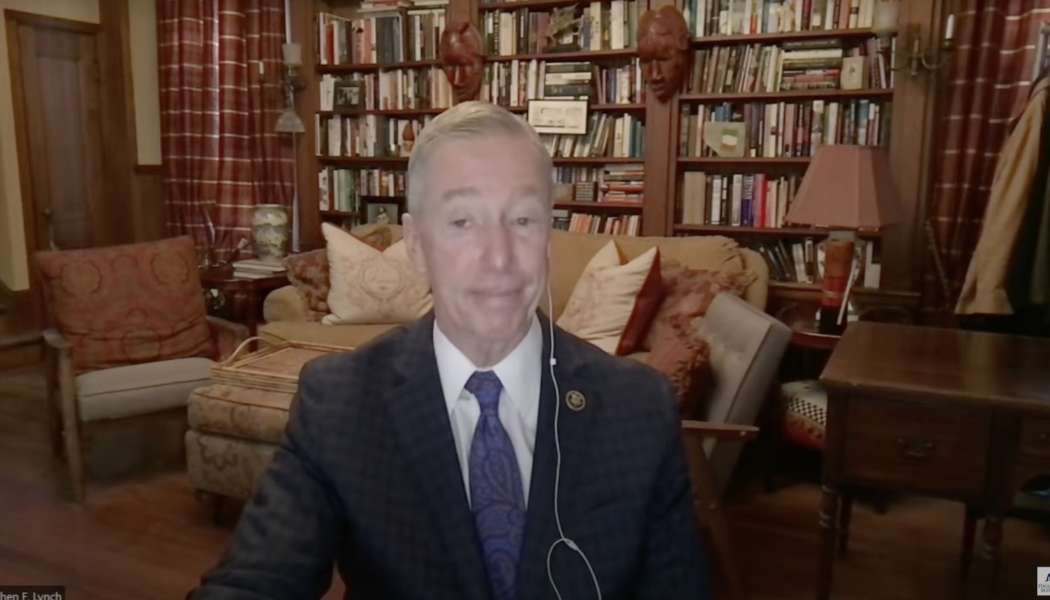

US lawmakers say crypto industry has a ‘tech bro’ problem hurting innovation

According to some United States lawmakers in the House Financial Services Committee, the lack of diversity in the financial technology space could be hurting many companies’ bottom lines. In a Thursday virtual hearing on “Combatting Tech Bro Culture,” U.S. lawmakers and witnesses discussed how women and people of color were underrepresented in leadership positions in the financial technology industry, including crypto firms. Massachusetts Representative Stephen Lynch cited data that only 2% of venture capital funding went to firms in which the founders were women, while only 1% went to those with black founders, and 1.8% for Latinx. According to Lynch and some on the committee, this trend suggested an “old boys club” culture in companies including those involved with cryptocurrencies, in w...

US govt delays enforcement of crypto broker reporting requirements: Report

The provision in the U.S. infrastructure bill signed into law in November, which will require financial institutions and crypto brokers to report additional information, could reportedly be delayed. According to a Wednesday report from Bloomberg, the United States Department of the Treasury and Internal Revenue Service may not be willing to enforce crypto brokers collecting information on certain transactions starting in January 2023, citing people familiar with the matter. The potential delay could reportedly affect billions of dollars related to capital gains taxes — the Biden administration’s budget for the government for the 2023 fiscal year previously estimated modifying the crypto tax rules could reduce the deficit by roughly $11 billion. Under the current infrastructure bill, Sectio...