cryptocurrencies

EU officials reach agreement on AML authority for supervising crypto firms

The European Council has reached an agreement to form an anti-money laundering body that will have the authority to supervise certain crypto asset service providers, or CASPs. In a Wednesday announcement, the council said it had agreed on a partial position of a proposal to launch a dedicated Anti-Money Laundering Authority, or AMLA. According to the regulatory body, the AML body will have the authority to supervise “high-risk and cross-border financial entities” including crypto firms — “if they are considered risky.” European Parliament member Ondřej Kovařík said EU officials had also reached a “provisional political agreement” on the government body’s Transfer of Funds Regulation. Not all the details of the revision are clear at the time of publication, but Cointelegraph reported that a...

How crypto is attracting some institutional investors — Huobi Global sales head

James Hume, head of sales at Huobi Global, said that while some institutional investors have gotten “cold feet” over crypto, many with billions of dollars are exploring the space. Speaking to Cointelegraph at the European Blockchain Convention on Tuesday, Hume said that the crypto exchange had observed increasing interest from institutional investors within the last one to two years in entering the digital asset space. According to Hume, it took a long time for certain firms and hedge funds to “build teams, raise capital and understand the infrastructure” to participate in crypto, estimating that 20–30 firms with more than $1 billion could start trading within the year. “I think it’s a pretty exciting time,” said Hume. “A lot of the more speculative bets in crypto… Some have got a bit of c...

‘Unique phenomenon’: All 5B toncoins mined on PoS TON blockchain

The TON Foundation, an organization developing the Telegram-initiated blockchain project, the TON blockchain, on Tuesday officially announced that TON miners have mined the final toncoin. “Tens of thousands of miners have mined the entire issuance of toncoins, which was about 5 billion tokens,” TON Foundation founding member and core developer Anatoly Makosov said in a statement to Cointelegraph. The last toncoin was mined on June 28, he noted. The end of toncoin mining marks a major milestone in TON’s distribution, starting its new era as an entirely PoS blockchain. From now on, new toncoins will only enter circulation via PoS validation, the TON Foundation said. That will result in a cut in the total influx of new toncoins into the network by around 75% to the existing l...

Bitcoin’s bottom might not be in, but miners say it ‘has always made gains over any 4-year period’

Your favorite trader is saying Bitcoin (BTC) bottomed. At the same time, the top on-chain indicators and analysts are citing the current price range as a “generational buy” opportunity. Meanwhile, various crypto and finance media recently reported that Bitcoin miners sending a mass of coins to exchanges are a sign that $17,600 was the capitulation move that pins the market bottom. There’s so much assurity from various anon and doxed analysts on Crypto Twitter, yet Bitcoin price is still in a clear downtrend, and the metrics don’t fully reflect that traders are buying every dip. A critical component of BTC price that many investors often overlook is the condition and sentiment of Bitcoin miners, which is exactly why Cointelegraph had a chat with Rich Ferolo of Blockware Solutions and ...

Celsius denies allegations on Alex Mashinsky trying to flee US

Troubled crypto lending firm Celsius is putting their best foot forward to recover operations alongside CEO Alex Mashinsky, who currently stays in the United States, the company has claimed. A spokesperson for Celsius has denied rumors that the company’s CEO tried to flee the U.S. last week amid the ongoing liquidity crisis of the Celsius Network. The representative told Cointelegraph on Monday that the firm continues working on restoring liquidity, stating: “All Celsius employees — including our CEO — are focused and hard at work in an effort to stabilize liquidity and operations. To that end, any reports that the Celsius CEO has attempted to leave the U.S. are false.” Celsius’ statement came shortly after Mike Alfred, co-founder of the crypto analytics firm Digital Assets Data, took to T...

Swiss National Bank exec: Regulators may favor centralized stablecoins after Terra crisis

Swiss National Bank (SNB) deputy head Thomas Muser talked to Cointelegraph editor Aaron Wood and discussed the ongoing trends in central bank digital currencies (CBDCs), stablecoins, and regulations, during the recently concluded European Blockchain Convention (EBC) 2022. Talking about the innovation and adoption of private stablecoins and plans of central banks regarding the CBDC launch, Moser said both could co-exist. He said that CBDC’s function would be very basic and private stablecoin issuers can add services on top of them to meet retail customers’ needs. When asked about the recent collapse of the Terra’s UST and its subsequent impact on regulations, Moser said that the recent spiral crash of the Terra and its decentralized algorithmic stablecoin UST could have a lastin...

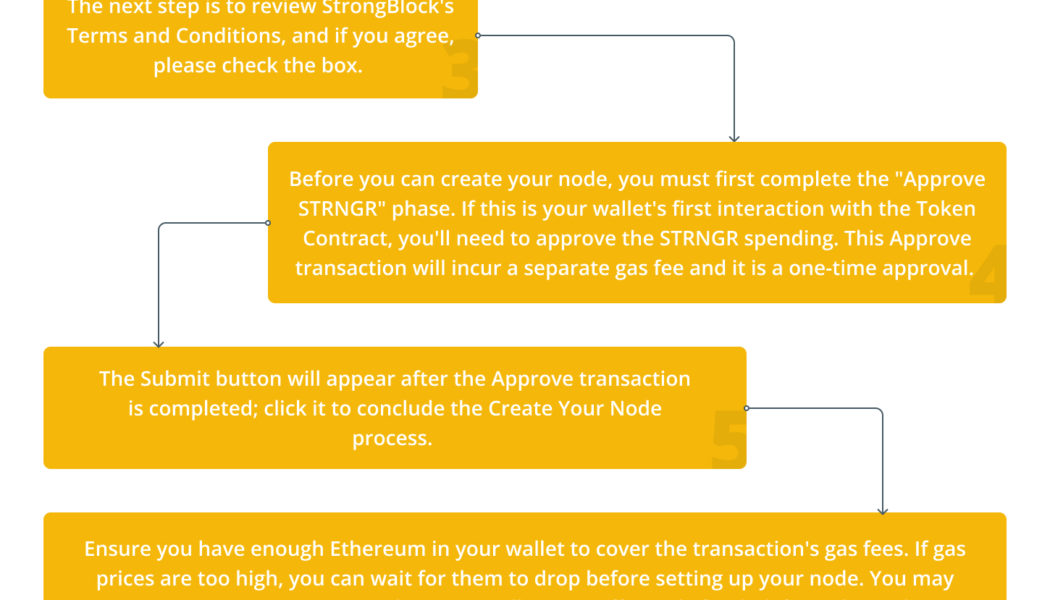

What is StrongBlock (STRONG) and how does it work?

The digital financial environment continues to develop almost every second, which is no surprise to those in the crypto sector. Among such technological advancements, a new project called StrongBlock has popularized the concept of the node as a service (NaaS) on the blockchain. NaaS is an alternative to running entire blockchain nodes on your own; it provides developer infrastructure and tools for setting up and managing blockchain nodes. Connected blockchain nodes relay, transmit and store decentralized blockchain data. But, what is a blockchain node? A node, also known as a Full Node, is a device that stores the blockchain’s whole transaction history. But, who is behind the creation of the StrongBlock ecosystem? The StrongBlock team includes CEO David Moss and chief technology offi...

White hat hacker attempts to recover ‘millions’ in lost Bitcoin, finds only $105

Joe Grand, a computer engineer and hardware hacker known by many for recovering crypto from hard-to-reach places, spent hours breaking into a phone only to find a fraction of a Bitcoin. In a YouTube video released on Thursday, Grand traveled from Portland to Seattle in an effort to potentially recover “millions of dollars” in Bitcoin (BTC) from a Samsung Galaxy SIII phone owned by Lavar Sanders, a local bus operator. Sanders originally purchased the BTC in July 2016 in a “super sketchy” way, paying a person at a cafe and storing the crypto in a wallet on the phone before putting it in storage and losing track of the device. After finding the phone in 2021, Sanders couldn’t recall the swipe password, but remembered setting up the option of erasing the data if too many incorrect attempts wer...

Crypto brokerage FalconX raises $150M at $8B valuation

Despite the ongoing bearish trend in cryptocurrency markets, venture capital firms continue pouring capital into major industry players like FalconX. FalconX, the institutional-level digital asset platform and crypto brokerage, has raised $150 million in fresh funding as part of its Series D financing round. Completed in early June, the funding round values FalconX at $8 billion, more than doubling from its previous Series C-round valuation of $3.75 billion in August 2021, the firm announced to Cointelegraph on Wednesday. The firm has now raised more than $430 million in total. FalconX’s latest investment round was led by the Singaporean sovereign wealth fund GIC and Facebook’s Eduardo Saverin-backed B Capital Group. Other investors included prominent industry investors and VC firms like T...

Binance-owned Trust Wallet adds buy option via Binance Connect

Trust Wallet, a major self-custodial cryptocurrency wallet owned by the Binance crypto exchange, has completed a significant integration to enable easier crypto purchases. The Trust Wallet platform has integrated Binance’s official fiat-to-crypto provider Binance Connect, allowing users to purchase more than 200 crypto assets directly from credit or debit cards, the firm announced to Cointelegraph on June 22. Trust Wallet’s new crypto buy option is designed to simplify the process of buying crypto, enabling verified Trust Wallet users to fund their wallet with more than 40 fiat currencies. In order to add funds on Trust Wallet via Binance Connect, users will need to proceed with the similar Know Your Customer (KYC) checks to those on Binance. “It will keep a similarly high standard and pro...

Deloitte and NYDIG set up alliance to help businesses adopt Bitcoin

Professional services giant Deloitte is getting increasingly serious about Bitcoin (BTC) amid the ongoing market downturn, setting up a major initiative to promote BTC adoption. Deloitte has partnered with the Bitcoin-focused financial services firm, New York Digital Investment Group (NYDIG), to help companies of all sizes implement digital assets. According to a joint announcement on Monday, NYDIG and Deloitte are launching a strategic alliance to create a centralized approach for clients seeking advice to adopt Bitcoin products and services. The companies will work together to enable blockchain and digital asset-based services across multiple areas involving Bitcoin-related products, including banking, loyalty and rewards programs, employee benefits and others. According to the announcem...

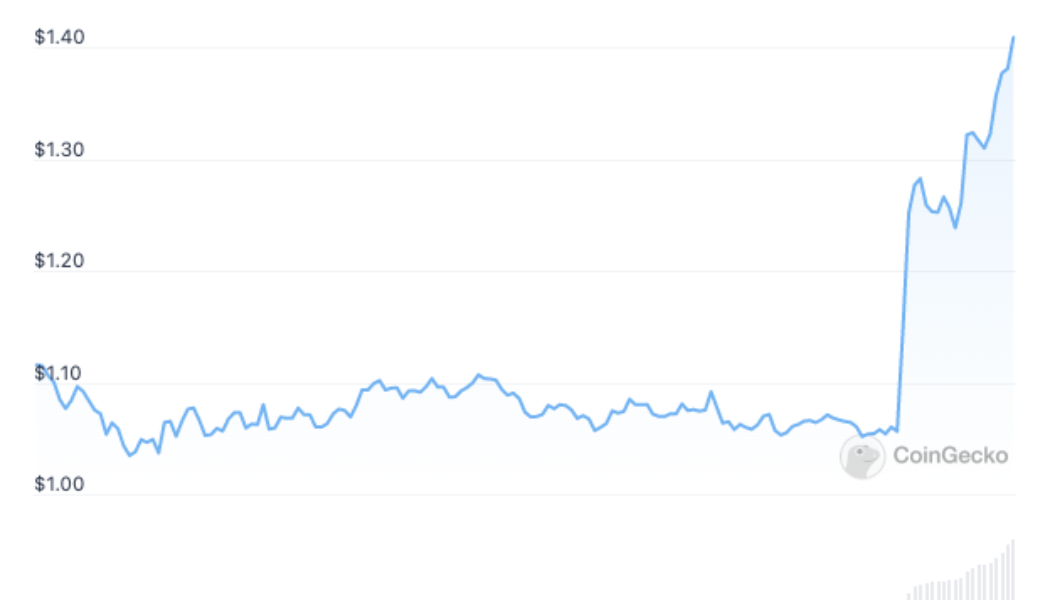

Synthetix racks up over $1M in daily fees as SNX token value surges 100%

Layer-2 scaling solution Synthetix recently collaborated with liquidity provider Curve Finance to create Curve pools for sETH/ETH, sBTC/BTC, & sUSD/3CRV, allowing investors to cheaply convert synths such as sETH to Ether (ETH). Given the investors’ willingness to hold tokens instead of synths, the protocol racked up over $1.02 million in trading fees — overshadowing Bitcoin’s (BTC) daily performance by five times. Synthetix, Ethereum-based decentralized finance (DeFi) protocol, created a buzz across the crypto ecosystem after witnessing a sudden increase in trading activities and an unprecedented comeback of its in-house token, SNX, during an unforgiving bear market. Crypto fees of popular projects. Source: cryptofees.info As a direct result of the massive trading volumes, the SNX...