cryptocurrencies

Further downside is expected, but multiple data points suggest Bitcoin is undervalued

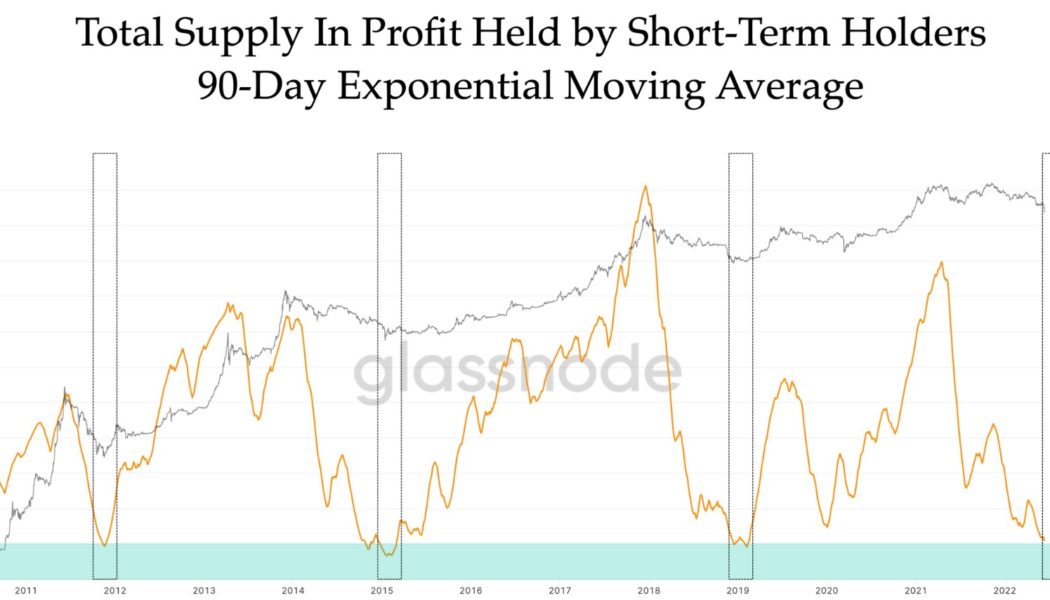

The outlook across the cryptocurrency ecosystem continue to dim as the sharp downtrend that was initially sparked by the collapse of Terra now appears to have claimed the Singapore-based crypto venture capital firm Three Arrows Capital (3AC) as its next victim. As large crypto projects and investment firms begin to collapse on a weekly basis, the prospect of a long, drawn out bear market is a reality investors are beginning to accept. Based on a recent Twitter poll conducted by market analyst and pseudonymous Twitter user Plan C, 41.6% of respondents indicated that they thought the Bitcoin (BTC) bottom will fall between the $17,000 to $20,000 range. Total Bitcoin supply in profit held by short-term holders. Source: Twitter Addresses holding at least 1 BTC hits a new ...

This oracle data provider platform has surpassed 4 million nodes since inception

Can a fully-functional oracle network ecosystem that anonymously collects and validates geospatial (location-specific) data exist? One blockchain firm seems to have gotten the gist of the idea. Founded in 2012, XY Labs and its namesake protocol XYO, which is built on the Ethereum blockchain, seek to reward participants for the genesis, interpretation, analysis, and storage of data to be called upon for specific problems. There are currently over 4 million nodes worldwide on the XYO network. In a recent ask-me-anything (AMA) session with Cointelegraph Markets Pro, Arie Trouw, founder of XY Labs, explained that fundamental to the XYO system is a special type of payload called BoundWitnesses. It contains a list of user-input data points that are signed by one or more nodes in the XYO ne...

Former president of the New York Stock Exchange joins Uniswap Labs as an advisor

On Wednesday, Uniswap announced that former New York Stock Exchange president Stacey Cunningham will join the company as an advisor. Cunningham served as the first female president of the New York Stock Exchange after beginning her career as a trader on its floor. She said in a statement that she believes in the potential of Uniswap’s commitment to fairer markets.Uniswap is betting on her experience with TradFi translating over to DeFi to further help them evolve their place in Web3. Cunningham has also been listed as one of BBC’s 100 Women, and joined the NYSE board of directors in December 2021. 1/ We are beyond honored to welcome Stacey Cunningham @stacey_cunning, former president of the New York Stock Exchange @NYSE, as an Advisor to Uniswap Labs. — Uniswap Labs (@Uniswap) J...

Seized crypto safe with US Marshals Service? Not so much, new audit reveals

The Office of the Inspector General (OIG) for the United States Department of Justice conducted an extensive audit of the cryptocurrencies seized by the U.S. Marshals Service (USMS) — revealing the dire need for the federal agency to revamp its existing crypto management and policy systems. OIG’s audit on the seized cryptocurrencies found the USMS implementing adequate safeguards over its storage and access. However, the agency was found to be using spreadsheets to maintain track of the inventory owing to the inability of the existing system, Consolidated Asset Tracking System (CATS), for daily management of crypto assets. As of June 2021, the USMS managed nearly 200 DOJ cryptocurrency seizures. We looked at the USMS’s management of seized cryptocurrency, and found that the ...

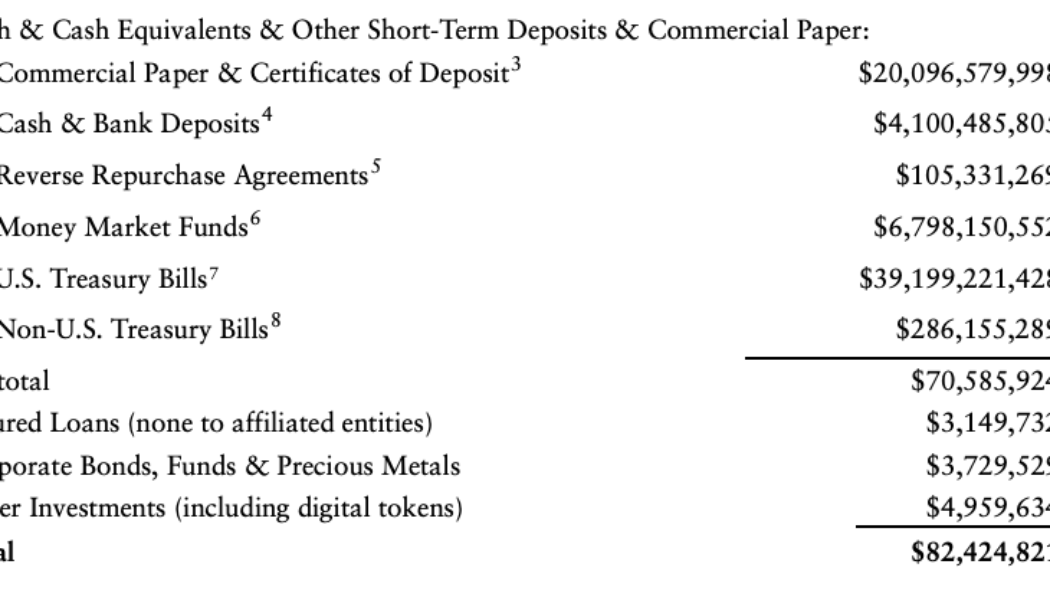

Tether aims to decrease commercial paper backing of USDT to zero

The major stablecoin company Tether is looking to eventually get rid of commercial paper backing for its U.S. dollar-based stablecoin Tether (USDT). Tether issued an official statement on Wednesday to deny reports alleging that Tether’s commercial paper portfolio is 85% backed by Chinese or Asian commercial papers and is being traded at a 30% discount. The stablecoin firm called such allegations “completely false,” reiterating that more than 47% of total USDT reserves are now the “United States Treasuries.” In its latest assurance opinion issued in May, Tether reported that commercial paper makes up less than 25% of USDT’s backing, amounting to around $21 billion as of March 31. USDT’s backing asset breakdown. Source: Tether’s assurance opinion released in May 2022 According to the latest ...

EU commissioner reiterates need for ‘regulating all crypto-assets’

Mairead McGuinness, the Commissioner for Financial Services, Financial Stability and Capital Markets Union at the European Commission, is moving forward with a discussion on regulating cryptocurrencies amid three major events in the space. In written remarks for a speech in Brussels on Tuesday, McGuinness said the Celsius Network’s recent suspension of withdrawals, as well as the crash of Terra (originally LUNA, now LUNA Classic, or LUNC), show the need for crypto-asset regulation in the European Union. She added that ongoing concerns about crypto potentially being used to circumvent sanctions on Russia were also a factor. “Regulating all crypto-assets — whether they’re unbacked crypto-assets or so-called “stablecoins — and crypto-asset service providers is necessary...

Taxes of top concern behind Bitcoin salaries, Exodus CEO says

Major cryptocurrency wallet provider Exodus continues paying its employees in Bitcoin (BTC) despite the ongoing bear market, with the total market cap dropping below $1 trillion on Monday. Since launching its software crypto wallet back in 2015, Exodus has been paying its staff 100% in BTC, Exodus co-founder and CEO JP Richardson told Cointelegraph. The company continued to pay all its 300 employees in BTC even during major market downturns, by providing monthly payroll based on their salary in U.S. dollars. “For example, if Bitcoin is $30,000 per token, and someone makes $15,000 a month, they’ll get half a Bitcoin on the first of that month,” Richardson noted. In addition to converting each salary to BTC each month, Exodus also adds a small percentage to every “paycheck” to account for th...

Taxes of top concern behind Bitcoin salaries, Exodus CEO says

Major cryptocurrency wallet provider Exodus continues paying its employees in Bitcoin (BTC) despite the ongoing bear market, with the total market cap dropping below $1 trillion on Monday. Since launching its software crypto wallet back in 2015, Exodus has been paying its staff 100% in BTC, Exodus co-founder and CEO JP Richardson told Cointelegraph. The company continued to pay all its 300 employees in BTC even during major market downturns, by providing monthly payroll based on their salary in U.S. dollars. “For example, if Bitcoin is $30,000 per token, and someone makes $15,000 a month, they’ll get half a Bitcoin on the first of that month,” Richardson noted. In addition to converting each salary to BTC each month, Exodus also adds a small percentage to every “paycheck” to account for th...

Music Stocks and Cryptocurrencies Hit by Recession, Inflation Fears

Music and other entertainment stocks fell sharply on Monday (June 13), following a string of worrisome events and expectations the Federal Reserve will make a substantial rate hike to slow inflation. The S&P 500 declined 3.9%, putting the index in bear market territory — down more than 20% from its high in January. The Nasdaq declined 4.7%. Radio broadcaster Cumulus Media fell 20.3% to $9.17, the largest decline of any music-related stock on Monday. Cumulus is “thinly traded and has high leverage,” Noble Capital Markets’ Michael Kupinsky tells Billboard in an email response. “Both are issues when [the stock is] out of favor and the market has its sights on an economic downturn.” Radio stocks had the worst day among music-related companies on Monday as four leading companies’ stocks dro...

Binance resumes withdrawals as many retail crypto investors monitor exchanges

Major crypto exchange Binance has announced that it had resumed Bitcoin withdrawals after more than three hours amid extreme market volatility. In an update during what many are calling cryptocurrency’s “Black Monday,” Binance said on its website the exchange would be processing Bitcoin (BTC) network withdrawals within “the next couple of hours” following the resumption of activity. The platform announced Monday that it had temporarily paused BTC withdrawals, with CEO Changpeng Zhao saying on Twitter that all user funds were “SAFU.” #Bitcoin network withdrawals have now resumed on #Binance.https://t.co/FhxXi3LeBg — Binance (@binance) June 13, 2022 While BTC trading activity on Binance seems to have been restored, withdrawals for users on Celsius have remained frozen since...

Binance.US faces class-action lawsuit over LUNA and UST sale

Binance.US, the sister company of global cryptocurrency exchange Binance, is facing a class-action lawsuit from investors for the sale of LUNA and TerraUSD (UST). A group of investors filed a class-action lawsuit in the Northern District of California on Monday, alleging that Binance sold unregistered securities in the form of LUNA and UST to investors and mislead them into buying them. The lawsuit was filed by law firms Roche Freedman and Dontzin Nagy & Fleissig on behalf of several investors who lost their money during the recent LUNA and UST spiral collapse. The lawsuit alleged that Binance.US is not registered as a broker-dealer in the United States and thus clearly violates U.S. securities laws. The plaintiffs in the case accused the crypto exchange of knowingly promoting a f...

How to survive in a bear market? Tips for beginners

Usually, bear markets bring about a feeling of uncertainty in any investor. Even more so for a newcomer, for whom it can feel like the end of the world. It may even be common knowledge that during bull cycles, investors are sure of making gains. Whereas in bear markets such as this, an unimaginable amount of pessimism sets in. The co-founder and strategic lead at the Kylin Network, Dylan Dewdney, told Cointelegraph that the two major mistakes that investors make while feeling anxious are “One, over-investing and two, not investing with conviction.” “You need to find the sweetspot where you have enough conviction in your investments while managing the resources devoted to them such that you are 100% comfortable with being patient for a long time. Lastly, bear markets are where the magic rea...