cryptocurrencies

Bitcoin ecosystem makes a U-turn recovery in global ATM installations

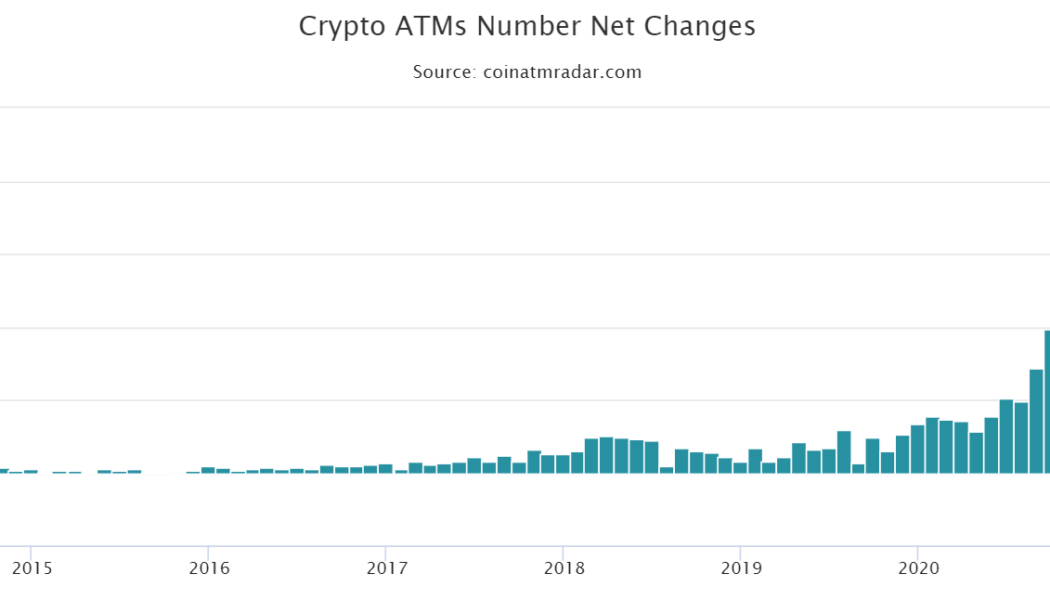

Bitcoin (BTC) ATM installations have marked a new comeback as June 2022 saw the reversal of the five-month-long downward trajectory for the first time this year. The global ATM installations worldwide fell consistently throughout the year, with May reporting the lowest number of 205 ATM installations. However, June saw the installation of over 882 ATM installations in just the first ten days. Chart showing the net change of cryptocurrency machines number installed and removed monthly. Source: Coin ATM Radar As evidenced by the above graph, May 2022’s drop reached a range that was last seen three years ago in 2019. Over the last two years, in 2020 and 2021, Bitcoin ATM installations grew consistently owing to friendlier regulatory landscapes amid a rewarding market when numerous crypt...

Crypto Biz: Stablecoins are paving the way for mass adoption of crypto, June 2–8

Stablecoins are a controversial subject in crypto. Questioning the legitimacy and backing of Tether (USDT) is a right of passage for many entering the crypto market for the first time. The meltdown of the Terra (LUNC; or the old LUNA) ecosystem left little doubt that algorithmic stablecoins don’t have a future beyond Do Kwon’s fantasies. Pesky regulators are constantly poking and prodding at dollar-pegged assets to carve out firmer rules on their usage. But, if you look beyond all the fear, uncertainty and doubt, stablecoins are providing liquidity to millions of people who don’t have access to dollars because of capital controls or sanctions, or because hyperinflation is destroying their local currency. This week’s Crypto Biz newsletter looks at the role of stablecoins in fueling e-...

Here’s how blockchains are helping to advance the global energy grid

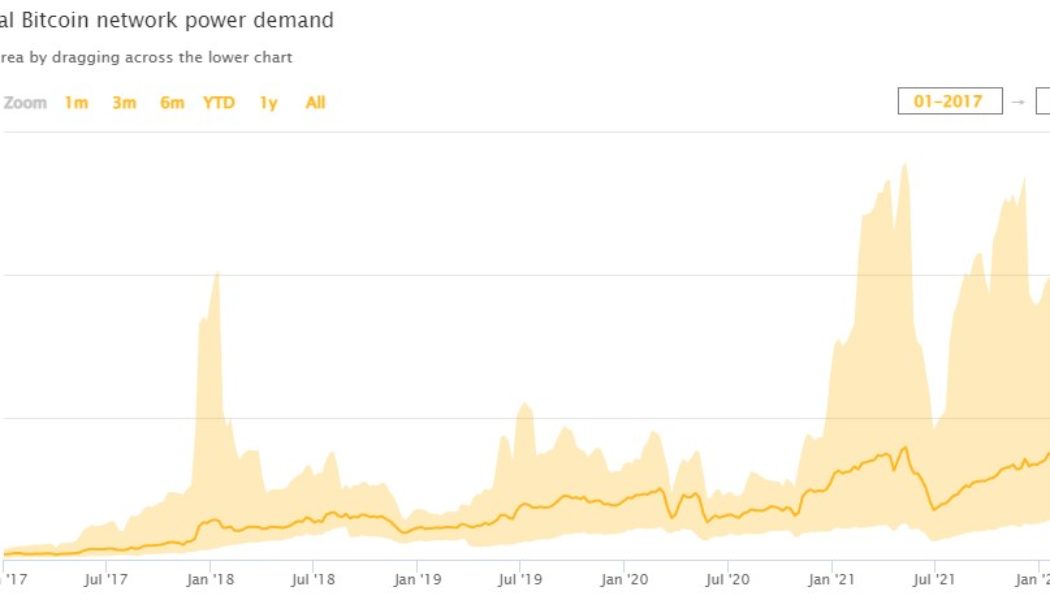

The blockchain industry’s impact on the energy sector has been a major source of controversy over the past five years. Governments and environmental protection advocates have routinely expressed concerns about the amount of energy required to keep the Bitcoin network secure. Data shows the network’s energy consumption now rivals the yearly energy consumed by some small countries. Historical Bitcoin network power demand. Source: CCAF While much of the debate has centered around the negative environmental impacts of Bitcoin (BTC) mining, the drive to maximize earnings from mining and integrate blockchain technology with the energy grid has also introduced new developments that have the potential to be beneficial in the long term. Here’s a look at several developments that have arisen out of ...

Mastercard to allow 2.9B cardholders to make direct NFT purchases

International payment processing giant Mastercard is expanding its payment network for nonfungible token (NFT) markets and Web3. The financial service provider announced that it has been working on expanding their payment networks to NFTs over the past year. The firm has partnered with a number of leading NFT marketplaces to allow 2.9 billion cardholders to directly make NFT purchases without buying crypto first. Currently, users need to buy crypto to bid on and buy NFTs. However, with the latest Mastercard partnership, billions of cardholders can now bypass the process of buying a transferring crypto to NFT marketplaces. The firm said: “These integrations are designed to make crypto more accessible and help the NFT ecosystem keep growing, innovating and bringing in more fans.” Mastercard ...

Crypto privacy is in greater jeopardy than ever before — here’s why

Despite the latest technology, the world has yet to crack the code for privacy and security online. But that isn’t the only big problem we need to worry about. Hackers and robbers are tricking innocent users into giving up their private information as society becomes increasingly digital — and virtual currencies have a role in all of this. Cryptocurrencies smashed records in 2022, with the market topping $2 trillion for the first time ever. And while this has been greeted with excitement by current investors, it’s made others more wary. Why? Because as the asset class grows, it becomes more appealing to malicious actors. And for evidence of this, you only need to look at the growing number of users being targets of cryptocurrency robberies. The big question is this: if these cr...

Traders target $1,400 Ethereum price after ETH drops closer to a critical support level

On June 8 the Ethereum network successfully underwent the merge to become proof-of-stake on its Ropsten testnet, but the news had little impact on ETH price. With the Ropsten upgrade now looking more like a buy the rumor, sell the news type of event, most analysts have kept a short-term bearish outlook for Ether price. Let’s take a look. ETH/USDT 1-day chart. Source: TradingView Can Ether escape the head and shoulders pattern? Twitter analyst, “Cactus”pointed out a bearish head and shoulders pattern and questioned whether Ether price would be able to follow the sharp downside that typically follows the completion of the pattern. ETH/USD 1-week chart. Source: Twitter Cactus said, “This is what we are getting excited about? Hard to be bullish any t...

Bitcoin price recovers $31.5K, but traders say ‘scam’ price action will bring more downside

Bitcoin’s (BTC) short-term price action has been dominated by whipsaws that trigger around the $31,000 to $32,000 level and the June 6 reversal at this point triggered a quick sell-off that pushed the price down to $29,200. Surprisingly, on June 7, the price rapidly reversed course as Bitcoin rallied back to $31,500, but given the current rejection at this level, traders are likely to proceed cautiously, rather than expect a quick surge to $35,000. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about the short-term outlook for BTC and what support levels to keep an eye on moving forward. A clear redistribution range The range-bound trading currently impacting Bitcoin was addressed by crypto analyst and pseudonymous Twitter user il Capo of Crypto, wh...

Chainalysis exec touts blockchain analysis to Senate homeland security committee

The collection and processing of information was a major theme at the United States Senate Committee on Homeland Security and Governmental Affairs (HSGAC) hearing titled, “Rising Threats: Ransomware Attacks and Ransom Payments Enabled by Cryptocurrency” on Tuesday. The committee hosted a panel of private-sector experts who discussed the problem of ransomware attacks and the challenges of collecting and using the information necessary to fight them. Committee chair Gary Peters of Michigan, who introduced the Strengthening American Cybersecurity Act in February, said the government lacks sufficient data even to understand the scope of the threat posed by ransomware attacks. Attackers almost exclusively ask for payment in cryptocurrency, he added. Several figures were trotted out to qua...

LINK marines rejoice after Chainlink 2.0 brings a new roadmap and staking

Passive income opportunities are one of the biggest draws in the cryptocurrency ecosystem because it gives investors an easy opportunity to grow their portfolio size regardless of the day-to-day price action. The latest token to get a bump in its price after announcing the upcoming implementation of staking is Chainlink (LINK), the decentralized oracle network that provides important off-chain information needed for the proper functioning of smart contracts. Data from Cointelegraph Markets Pro and TradingView shows that since bouncing off a low of $6.67 on June 4, the price of LINK has increased 35% to hit a daily high of $9.00 on June 7. LINK/USDT 4-hour chart. Source: TradingView Here’s a look at what the new developments in the Chainlink ecosystem that could be backing today’s pri...

Ethereum 2.0 vs. the top Ethereum killers|The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts give you the details about Ethereum 2.0, its main competitors, and how they differ from each other. To kick things off, we break down the latest news in the markets this week. Here’s what to expect in this week’s markets news breakdown: Bitcoin ‘Bart Simpson’ returns as BTC price dives 7% in hours: Bitcoin (BTC) price action failed to crack $32,000 and headed back to square one, sparking $60 million of long liquidations in the process. How much longer will we stay in the current price range? What is it going to take for Bitcoin to break out from here? Bad day for Binance with SEC investigation and Reuters exposé: The United States Securities and Exchange Commission...

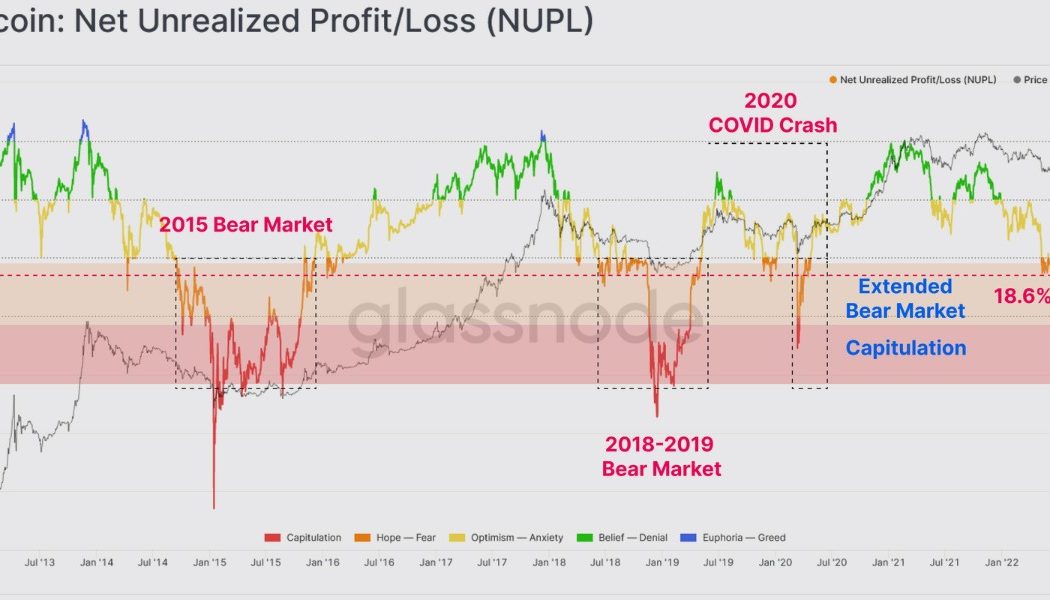

Traders think Bitcoin bottomed, but on-chain metrics point to one more capitulation event

The bull market euphoria that carried prices to new highs throughout 2021 has given way to bear market doldrums for any Bitcoin (BTC) buyer who made a purchase since Jan. 1, 2021. Data from Glassnode shows these buyers “are now underwater” and the market is gearing up for a final capitulation event. Bitcoin net unrealized profit/loss. Source: Glassnode As seen in the graphic above, the NUPL, a metric tha is a measure of the overall unrealized profit and loss of the network as a proportion of the market cap, indicates that “less than 25% of the market cap is held in profit,” which “resembles a market structure equivalent to pre-capitulation phases in previous bear markets.” Based on previous capitulation events, if a similar move were to occur at the current levels, t...

Reserve Rights (RSR) builds momentum ahead of its long-awaited mainnet launch

Bitcoin was created to give the average person a peer-to-peer economic system and a store of wealth asset that could provide financial autonomy and access to banking, especially for people living in places where financial services are sparse or non-existent. In the last five years, there have been a number of blockchain projects that aim to mirror Bitcoin’s original mission and the growing popularity of stablecoins further highlights the need for alternative financial models. One project that is beginning to see a bit of momentum is Reserve Rights (RSR), a dual-token stablecoin platform comprised of the asset-backed Reserve Stablecoin (RSV) and the RSR token which helps to keep the price of RSV stable through a system of arbitrage opportunities. Data from Cointelegraph Markets Pro an...