cryptocurrencies

Hong Kong’s Securities and Futures Commission warn of nonfungible token risks

On Monday, Hong Kong’s Securities and Futures Commission (SFC) released a statement warning investors about the risks of nonfungible tokens, or NFTs, which have soared in popularity in recent years. The regulatory body wrote: “As with other virtual assets, NFTs are exposed to heightened risks, including illiquid secondary markets, volatility, opaque pricing, hacking and fraud. Investors should be mindful of these risks, and if they cannot fully understand them and bear the potential losses, they should not invest in NFTs.” However, it appears that the SFC’s specific concern lies in the securitization of NFTs. “The majority of NFTs observed by the SFC are intended to represent a unique copy of an underlying asset such as a digital image, artwork, music or...

CertiK shares security tips following third BAYC security compromise in six months

On June 4, the popular nonfungible token, or NFT, project Bored Ape Yacht Club (BAYC) suffered its third security compromise this year. Nearly 142 Ether (ETH) ($250,000) worth of NFTs was stolen after hackers gained access to the Discord account of a BAYC community manager and posted a message with a link to a fake website. The link advertised a limited-time free-NFT giveaway to users who connected their wallets, which were then drained of NFTs. During two prior occasions in April, hackers breached BAYC’s Discord and Instagram pages and managed to siphon 91 NFTs, worth over $1.3 million at the time of the second attempt, via a phishing link. As told by blockchain security firm CertiK, hackers quickly moved stolen funds to obfuscation platform Tornado Cash, making it imposs...

5 metrics to monitor before investing in crypto during a bear market

Cryptocurrency bear markets destroy portfolio value and they have a dangerous tendency to drag on for longer than anyone expects. Fortunately, one of the silver linings of market-wide pullbacks is that it gives investors time to re-focus and spend time researching projects that could thrive when the trend turns bullish again. Here’s five areas to focus on when deciding whether to invest in a crypto project during a bear market. Is there a use case? The cryptocurrency sector has no shortage of flashy promises and gimmicky protocols, but when it comes down to it there are only a handful of projects that have delivered a product that has demand and utility. When it comes down to determining if a token should continue to be held, one of the main questions to ask is “Why does this project ...

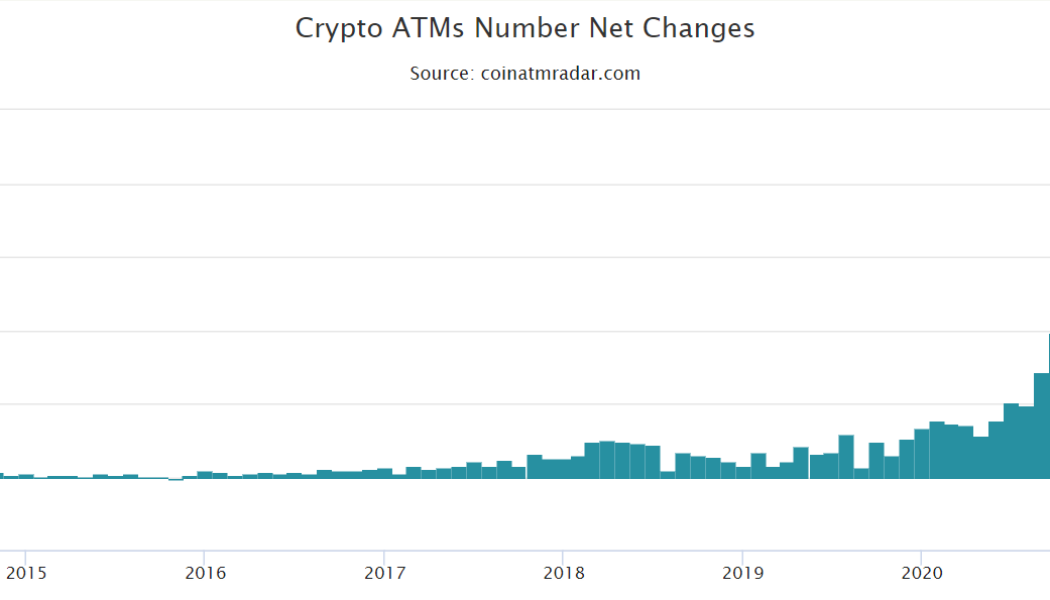

Bitcoin ATM installations record low in May, biggest drop since 2019

Bitcoin (BTC) ATM installations across the globe have seen a steep decline throughout the year 2022, with May recording just 202 new BTC ATMs, a range last seen three ago in 2019. Over the past five months since January, Bitcoin ATM installations saw a gradual slowdown, eventually falling down 89.75% from December 2021’s 1971 new installations. However, data from Coin ATM Radar reveal an evident comeback in the installation numbers as the world saw 817 Bitcoin ATMs getting installed in June — in just the first five days. Net change of cryptocurrency machines number installed and removed monthly. Source: Coin ATM Radar Some of the key factors contributing to the slowdown of crypto ATM installations include geopolitical tensions across the world, unclear or anti-crypto regulations, market sa...

CBDCs can “kill” private crypto: India’s RBI deputy governor to IMF

In discussion with the International Monetary Fund (IMF), T Rabi Sankar, the deputy governor of the Reserve Bank of India (RBI), reflected an anti-crypto stance as he spoke about India’s potential to disrupt the crypto and blockchain ecosystem. Rabi Sankar started the conversation by highlighting the success of the Unified Payments Interface (UPI), India’s in-house fiat-based peer-to-peer payments system — which has seen an average adoption and transaction growth of 160% per anum over the last five years. “One of the reasons it is so successful is because it’s simple,” he added while comparing UPI’s growth with blockchain technology. According to Rabi Sankar: “Blockchain, which was introduced six-eight years before UPI started, even today is being referred to as a potentially revolut...

Fed governor explains who needs crypto regulation and why demand for it is growing

Regulation is needed to open the crypto ecosystem to a larger public, United States Federal Reserve Board Governor Christopher Waller told an audience at the SNB-CIF Conference on Cryptoassets and Financial Innovation in Zurich, Switzerland. Financial intermediaries can help manage risk for new crypto users, but cannot eliminate it, Waller said, and new and fast-growing financial products need public confidence to survive. The banking official used historical examples to show the relationship between technical innovation, regulation and the amassing of fortunes. “New technology — and a lack of clear rules — meant some new fortunes were made, even as others were lost,” Waller said. Experienced investors know how to operate in unregulated marketplaces and may not need or want regulation, Wal...

5 reasons why Bitcoin could be a better long-term investment than gold

The emergence of forty-year high inflation readings and the increasingly dire-looking global economy has prompted many financial analysts to recommend investing in gold to protect against volatility and a possible decline in the value of the United States dollar. For years, crypto traders have referred to Bitcoin (BTC) as “digital gold,” but is it actually a better investment than gold? Let’s take a look at some of the conventional arguments investors cite when praising gold as an investment and why Bitcoin might be an even better long-term option. Value retention One of the most common reasons to buy both gold and Bitcoin is that they have a history of holding their value through times of economic uncertainty. This fact has been well documented, and there’s no denying that gold has ...

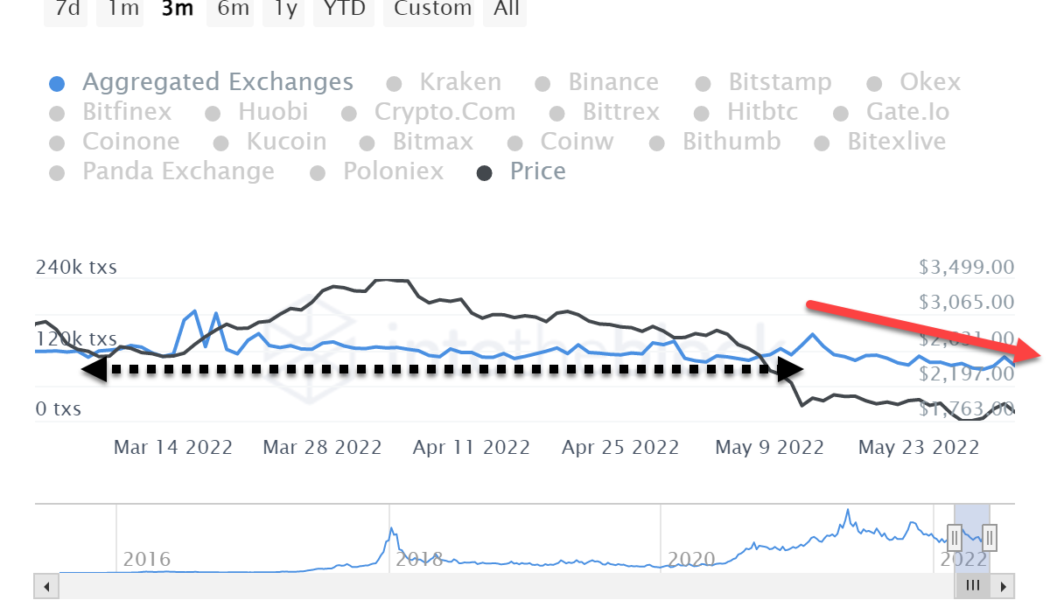

Ethereum’s Merge FOMO isn’t priced in, making a spike to $2.6K a possibility

In a May 30 tweet, Ethereum (ETH) core developer Tim Beiko confirmed that the much-anticipated Ropsten testnet trial of the Merge from proof-of-work to proof-of-stake can be expected “around June 8 or so.” Interestingly, Ether’s price action is relatively unchanged despite the unexpected bullish announcement. There was a +10% spike on May 30, but those gains were given back between May 31 and June 2. It is very likely that the Merge — currently anticipated in August — has yet to be priced in, giving traders and investors a possible early entrant advantage. It’s essential to monitor on-chain data From an investing and trading viewpoint, cryptocurrency markets have a distinct disadvantage in comparison with regulated markets and transparency. The stock market is chock full of legally r...

401(k) provider ForUsAll sues US Labor Dept over anti-crypto compliance release

ForUsAll, a 401(k) retirement provider, filed suit against the United States Department of Labor (DOL) and Martin Walsh as Labor secretary in U.S. District Court in Washington, D.C. on Thursday. The company is seeking the withdrawal of a DOL compliance assistance release issued in March, citing the Administrative Procedure Act, which safeguards against arbitrary official encroachment on private rights. The DOL release warned that the department’s Employee Benefits Security Administration is expected to “conduct an investigative program” aimed at 401(k) plans that contain cryptocurrency. ForUsAll CEO Jeff Schulte told Cointelegraph: “The government is suddenly trying to restrict the type of investments Americans can choose to make because they’ve decided today that they don’t like a certain...

Major crypto firms reportedly cut up to 10% of staff amid bear market

Gemini, a cryptocurrency trading platform founded by brothers Cameron and Tyler Winklevoss, is the latest industry firm to lay off a significant part of its staff due to unfavorable market conditions. Winklevoss’ crypto business Gemini Trust reportedly cut 10% of its employees amid the ongoing bear crypto market, the founders wrote in a notice to employees on June 2, as Bloomberg reported. As part of its first major headcount cut, Gemini will refocus on products that are “critical” to the firm’s mission, the brothers said, adding that “turbulent market conditions” are “likely to persist for some time.” The notice reportedly reads: “This is where we are now, in the contraction phase that is settling into a period of stasis — what our industry refers to as “crypto winter. […] Thi...

Investors’ perception of crypto is changing for the better: Economist survey

A report published by the Economist paints a bright future for cryptocurrency adoption, with survey respondents anticipating growing demand in the near future. Economist Impact published findings of its ‘Digimentality Report’, delving into consumer trust in digital payments and the stumbling blocks that have hampered the digitization of basic monetary functions. The data obtained provide food for thought and perspective, as it compares trends from previous surveys on the subject carried out in 2020 and 2021. Information was gleaned from a consumer survey completed by 3,000 consumers in early 2022, with half of the respondents living in developed economies including the United States, United Kingdom, France, South Korea, Australia and Singapore. The other half were respondents hailing from ...

NY Fed president urges colleagues to prepare for coming digital payment transformation

Get ready for a fundamental change in money and payments, John Williams, president and CEO of the Federal Reserve Bank of New York, told central bank officials, academics and financial industry leaders from around the world on Wednesday. Williams delivered the opening remarks at an invitation-only workshop on monetary policy implementation co-hosted by the New York Fed and Columbia University. The central banker dismissed much of the digital asset space with a single-sentence observation that not all cryptocurrencies are backed by non-crypto assets. Central bank digital currencies (CBDCs) and stablecoins backed by safe, liquid assets have the potential for innovation, he continued. Related: The United States turns its attention to stablecoin regulation Williams did not elaborate on the pos...