cryptocurrencies

Here are 3 altcoins that could surge once Bitcoin flips $35K to support

Bitcoin (BTC) and the wider cryptocurrency market are taking a breather after the rally on May 31. Meanwhile, most altcoins remain severely oversold, with most between 70% and 90% below their all-time highs. Total altcoin index capitalization What is clear is that fear is everywhere and blood is in the water. Risk-on markets are suffering worldwide, but it is exactly these kinds of conditions that create opportunities where professional money accumulates and adds to positions. Let’s take a look at three altcoins that could be positioned for a rebound if the broader market enters a new uptrend. ADA could be setting up for an 80% surge Cardano (ADA) has a significantly bullish update coming very soon. The much anticipated Vasil hard fork, which increases performance and adds more Plutu...

Tether’s reported bank partner Capital Union shares its crypto strategy

Capital Union, a Bahamas-based bank that reportedly holds a portion of reserves by the Tether (USDT) stablecoin issuer, has been itself actively involved in the cryptocurrency industry. The banking institution has rolled out crypto trading and custody services to its professional clients as part of the bank’s trading desk, a spokesperson for Capital Union told Cointelegraph on May 31. “We work with a few selected trading venues and liquidity providers and a handful of custodians and technology providers, which allows us to support a large variety of digital assets as part of our trading and custody services,” the firm’s representative said. Capital Union’s crypto-related services still represent a “fairly small portion” of its business, which is mainly focused on providing...

Basel Committee presses on with restrictive requirements for banks’ crypto holdings

The Basel Committee on Banking Supervision met Friday and discussed cryptocurrency, among other topics. The committee stated that it would soon publish its second consultative paper with the intention of finalizing guidelines on the prudential treatment of crypto exposure by banks by year-end. In a Tuesday press release, the committee issued the following statement, which was likely in reference to the recent collapse of the Terra ecosystem: “Recent developments have further highlighted the importance of having a global minimum prudential framework to mitigate risks from cryptoassets.” The committee began consultations on the banking sector’s risk exposure to cryptocurrency in 2021 and published a paper on its findings at that time. The committee divided crypto assets into...

Ethereum price moves toward $2,000, but analysts say it’s just another ‘relief rally’

On May 30, the cryptocurrency market experienced a much-needed bounce that saw Bitcoin (BTC) climb above $30,900 and Ether (ETH) rally 5.84% to $1,930, but analysts warn that it could be too early to expect a reversal. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the outlook for Ether moving forward and the major support and resistance levels to keep an eye on. A bounce off of major support The May 30 bounce in Ether came as “no surprise” to market analyst and pseudonymous Twitter user Rekt Capital, who posted the following chart, stating that “It’s more about how much #ETH will move from here.” ETH/USD 1-month chart. Source: Twitter Rekt Capital said: “Technically, #Ethereum could rally to as high as ~$2269 to flip it into new res...

On-chain data shows Bitcoin long-term holders continuing to ‘soak up supply’ around $30K

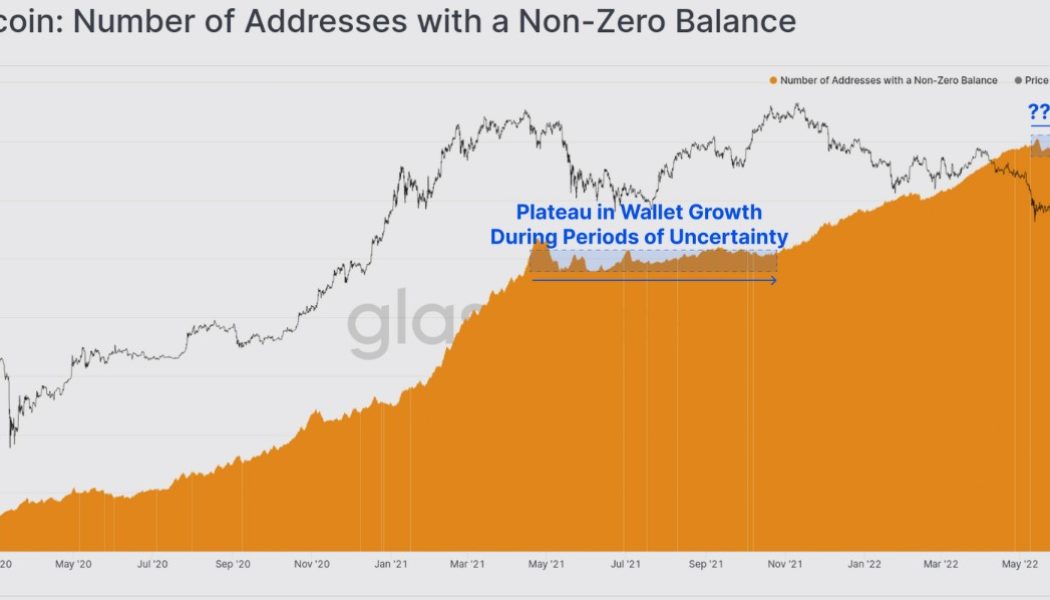

Bear markets are typically marked by a capitulation event where discouraged investors finally abandon their positions and asset prices either consolidate as inflows to the sector taper off or a bottoming process begins. According to a recent report from Glassnode, Bitcoin hodlers are now “the only ones left” and they appear to be “doubling down as prices correct below $30K.” Evidence of the lack of new buyers can be found looking at the number of wallets with non-zero balances, which has plateaued over the past month, a process that was seen after the crypto market sell-off in May of 2021. Number of Bitcoin addresses with a non-zero balance. Source: Glassnode Unlike the sell-offs that occurred in March 2020 and November 2018, which were followed by an upswing in on-chain activity tha...

Here’s how much Kazakh gov’t made off crypto mining in Q1 2022

The government of Kazakhstan, one of the world’s largest countries by the Bitcoin (BTC) mining hash rate distribution, has reported budget earnings derived from cryptocurrency mining. On May 30, Kazakhstan’s state revenue committee of the Ministry of Finance released a report on the amount of total energy fees paid by local crypto miners in the first quarter of 2022. According to the report, Kazakhstan’s budget added 652 million Kazakhstani tenge ($1.5 million) in energy fees from crypto mining in Q1 2022 after the government introduced a digital mining fee on Jan. 1, 2022. The committee stressed that a significant amount of the expected sum of fees has not been received by the budget as the government has shut down a wide number of crypto mining firms in order to “ensure energy security.”...

Terra (LUNA) 2.0 relaunches according to Do Kwon’s revival plan

Do Kwon, the co-founder and CEO of Terraform Labs, confirmed the relaunch of Terra’s new chain, Terra 2.0, which aims to revive the fallen Terra (LUNA) and TerraUSD (UST) ecosystem. Kwon’s revival plan for Terra involves hard forking the existing blockchain and reissuing LUNA tokens to existing investors based on a snapshot before the death spiral bled the LUNA and UST markets — effectively resulting in unrecoverable losses for investors. Pheonix-1 mainnet is now live and producing blocks – public node services, wallets and explorers should be going live shortly. pic.twitter.com/cpxiNKl6aX — Do Kwon (@stablekwon) May 28, 2022 Dubbed Phoenix-1, the Terra 2.0 mainnet went live today, May 28, as per the original timeline set by Terra developers and started producing blocks. ...

Finance Redefined: Uniswap breaches $1T volume, WEF 2022 discussion on Terra, and more

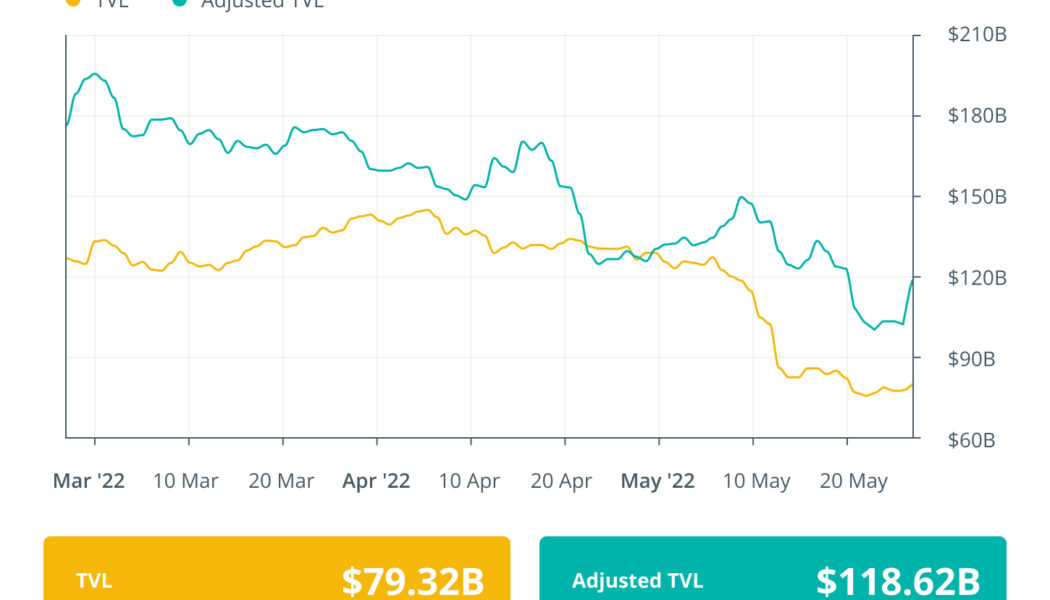

The decentralized finance (DeFi) ecosystem continues to struggle with the ongoing market volatility and after-effects of the Terra ecosystem collapse. Over the past week, major DeFi protocols showed signs of increased trading activity, with Uniswap breaching the $1 trillion trading volume mark. Terra remained the focus of most of the discussions around blockchain and crypto at the World Economic Forum (WEF), with analysts suggesting Terra was offering unsustainable yields. DeFi insurance protocol to pay out millions after Terra collapse, while interest in Ethereum Name Services (ENS) shattered new records. Top DeFi tokens by market cap had a mixed week of price action, with several tokens in the top 100 registering double-digit gains over the past week, while many others continue to trade ...

On-chain data flashes Bitcoin buy signals, but the bottom could be under $20K

Every Bitcoin investor is searching for signals that the market is approaching a bottom, but the price action of this week suggests that we’re just not there yet. Evidence of this can be found by looking at the monthly return for Bitcoin (BTC), which was hit with a rapid decline that “translated to one of the biggest drawdowns in monthly returns for the asset class in its history,” according to the most recent Blockware Solutions Market Intelligence Newsletter. Bitcoin monthly returns. Source: Blockware Solutions Bitcoin continues to trade within an increasingly narrow trading range that is slowly being compressed to the downside as global economic strains mount. Whether the price continues to trend lower is a popular topic of debate among crypto analysts and the dominant opini...

3 metrics contrarian crypto investors use to know when to buy Bitcoin

Buying low and selling high is easier said than done, especially when emotion and volatile markets are thrown into the mix. Historically speaking, the best deals are to be found when there is “blood on the streets,” but the danger of catching a falling knife usually keeps most investors planted on the sidelines. The month of May has been especially challenging for crypto holders because Bitcoin (BTC) dropped to a low of $26,782, and some analysts are now predicting a sub-$20,000 BTC price in the near future. It’s times like these when fear is running rampant that the contrarian investor looks to establish positions in promising assets before the broader market comes to its senses. Here’s a look at several indicators that contrarian-minded investors can use to spot opportune moments for ope...

WEMIX gains 200%+ after stablecoin and boosted staking rewards announcement

Blockchain-based gaming, also known as GameFi, is an up-and-coming sector that could potentially be one of the primary catalysts for kickstarting the mass adoption of blockchain technology. WEMIX, a gaming protocol that operates on the Klaytn network, aims to get in on the GameFi revolution and this week, the project’s native token (WEMIX) rallied even as the wider market continued to sell-off. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $1.27 on May 12, WEMIX price climbed 269% to hit a daily high at $4.70 on May 25 as its 24-hour trading volume increased to $652 million. WEMIX/USDT 1-day chart. Source: TradingView Three reasons for the price reversal for WEMIX are the upcoming launch of WEMIX 3.0, a series of project launches and partnershi...

Two key takeaways from Nansen’s UST stablecoin depeg report

As the dust settles on the cataclysmic collapse of the Terra ecosystem, an on-chain deep-dive carried out by blockchain analytics firm Nansen highlights two major takeaways. The cryptocurrency ecosystem was awash with varying speculatory theories around the cause of Terra’s algorithmic stablecoin UST’s decoupling from its $1 peg. The who and why seemed a mystery but the outcome was catastrophic, with UST dropping well below $1 while the value of Terra’s stablecoin token plummeting in value as a result. Nansen undertook an investigation leveraging on-chain data from the Terra ecosystem to the Ethereum blockchain in an effort to chart the chain of events that led to the UST depeg. [embedded content] It is worth noting that the report does not include potential off-chain events that cou...