cryptocurrencies

Bitcoin is discounted near its ‘realized’ price, but analysts say there’s room for deep downside

There are early signs of the “dust settling” in the crypto market now that investors believe that the worst of the Terra (LUNA) collapse looks to be over. Viewing Bitcoin’s chart indicates that while the fallout was widespread and quite devastating for altcoins, BItcoin (BTC) has actually held up fairly well. Even with the May 12 drop to $26,697 marking the lowest price level since 2020 multiple metrics suggest that the current levels could represent a good entry to BTC. BTC/USDT 1-day chart. Source: TradingView The pullback to this level is notable in that it was a retest of Bitcoin’s 200-week exponential moving average (EMA) at $26,990. According to cryptocurrency research firm Delphi Digital, this metric has historically “served as a key area for prior...

China returns as 2nd top Bitcoin mining hub despite the crypto ban

The Chinese government has not managed to take down cryptocurrency operations as part of its crypto ban last year as China has re-emerged as one of the world’s largest Bitcoin (BTC) mining hubs, according to a new report. China became the second-largest Bitcoin hash rate provider as of January 2022, months after the local government banned all crypto operations in the country, according to the latest update from the Cambridge Bitcoin Electricity Consumption Index (CBECI) shared with Cointelegraph on May 17. Bitcoin miners in China accounted for 21.1% of the total global BTC mining hash rate distribution as of early 2022, following only the United States, which produced 37.8% of the total hash rate as of January, according to the data. China was once the world’s largest Bitcoin m...

MakerDAO price rebounds as DAI holds its peg and investors search for stablecoin security

Its been a rough couple of weeks for the cryptocurrency market. Bitcoin (BTC) price is nowhere near the price estimates of most analysts, multiple stablecoins lost their peg and the demise of one of the top decentralized finance (DeFi) platforms sparked an event that resulted in $900 billion vanishing from the total crypto market capitalization. In the midst of the widespread fallout, MakerDAO (MKR) managed to turn crisis into opportunity and the collapse of TerraUSD (UST) has brought renewed attention to DAI, the longest-running decentralized stablecoin. Data from Cointelegraph Markets Pro and TradingView shows that as the collapse of Terra (LUNA) price accelerated from May 9 to May 12, MKR climbed 66.2% from a low of $952 on May 12 to its current value of $1,587. MKR/USDT 1-da...

California regulator will revisit long-running ban on crypto donations on May 19

A California state regulator may be looking at overturning a ban on cryptocurrency donations to political campaigns which has been in effect since 2018. According to its May 2022 agenda, California’s Fair Political Practices Commission, or FPPC, has scheduled a “pre-notice discussion” on Thursday on the use of cryptocurrencies f campaign contributions in the state. The commission said it will be considering drafting amendments to its regulations requiring that “no contribution may be made or received in cryptocurrency.” In September 2018, the FPPC voted to ban both sending and receiving crypto contributions for political campaigns in the state of California, due to concerns the donations “might be utilized to circumvent contribution limits and prohibitions, or by foreign entities to ...

BIFI gains 100%+ after Beefy Finance adds new vaults and stablecoin liquidity pools

Winston Churchill’s statement to “never let a crisis go to waste” can be applied across many aspects of society, including the recent carnage seen in the crypto market. Last week’s volatility is likely to have newer investors and those who took on heavy losses questioning the future of the burgeoning asset class, but in every bear trend there is a silver lining. One platform that appears to be capitalizing on the void created by TerraUSD’s (UST) collapse is Beefy Finance (BIFI), a multi-chain yield optimizing decentralized finance protocol. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $387.80 on May 14, BIFI spiked 168.13% to hit a daily high of $1,040 on May 16 amids a 684% increase in its 24-hour trading volume. BIFI/USDT 4-hour chart. Sourc...

US federal judge approves of Justice Dept criminal complaint on using crypto to evade sanctions

The United States Department of Justice may move forward on a criminal prosecution case against a U.S. citizen who allegedly violated sanctions through cryptocurrency. According to a Friday opinion filing in U.S. District Court for the District of Columbia, the unnamed individual who is the subject of a criminal investigation by the Justice Department allegedly sent more than $10 million in Bitcoin (BTC) from a U.S.-based crypto exchange to an exchange in a country for which the U.S. currently imposes sanctions — suggesting Russia, Cuba, North Korea, Syria, or Iran. The filing alleged the individual “conspired to violate the International Emergency Economic Powers Act” and conspired to defraud the United States. The individual allegedly “proudly stated the Payments Platform could circumven...

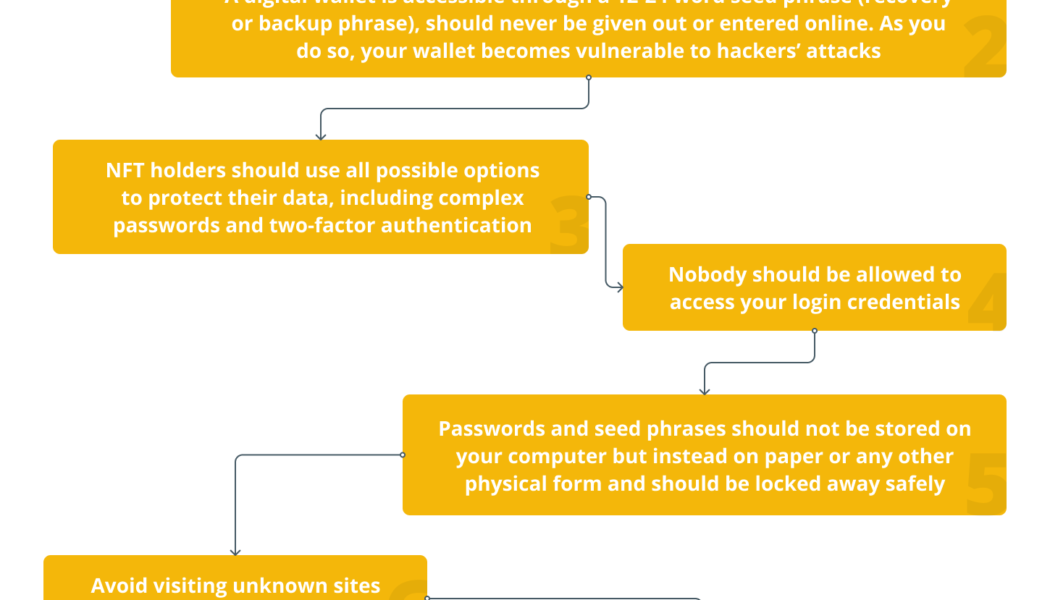

Life-changing money: The 10 most expensive NFTs sold to date

Nonfungible tokens, or NFTs, are turning out to be a treasure store with prices striding into the millions of dollars. Instances of an NFT garnering more than $69 million or a tweet fetching $2.9 million are not a fantasy, but an incredible reality. In 2021, an NFT by digital artist Beeple, or Mike Winkelmann, sold for a whopping $69 million, making NFTs a media hotshot and opening the floodgates for a string of other NFT sales, many of these in millions of dollars. Prompted by the plentiful talk about NFTs, stars like Paris Hilton, Lindsay Lohan, Eminem, Grimes and many more have hopped onto the NFT bandwagon. In 2022, NFTs have been garnering attention from investors, artists and collectors alike. Let’s take a glance at the 10 most expensive NFTs sold to date: Beeple’s Crossroads — $6.6 ...

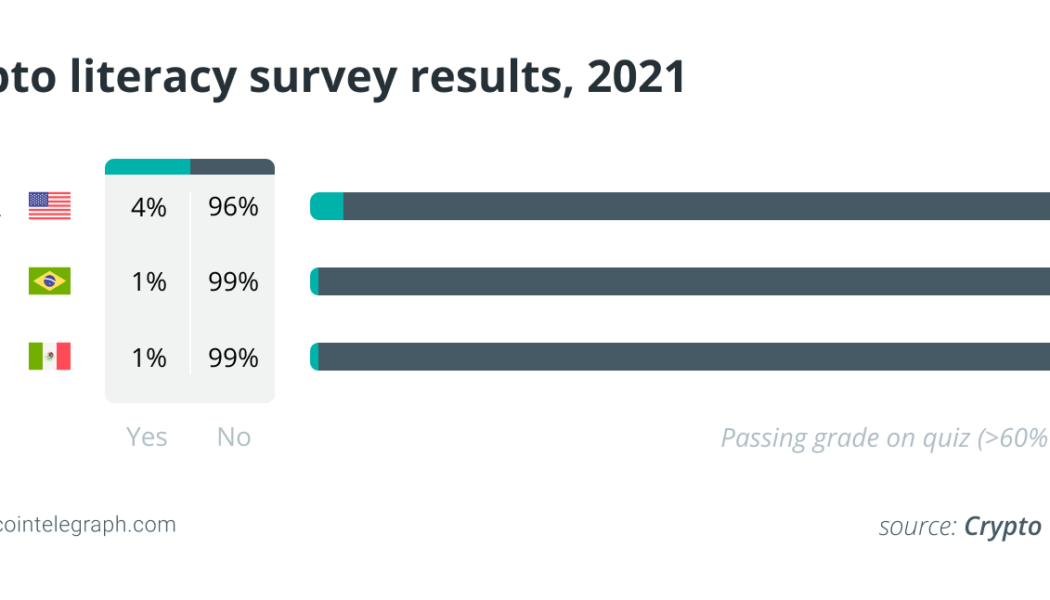

Accessibility is the main barrier to crypto adoption — Here are the solutions

Accessibility is a pain point for cryptocurrency adoption that has been discussed for years, yet still, it is pertinent as ever. This issue was most recently recognized by the United States government as we’ve seen Treasury Secretary Janet Yellen discuss during her remarks on digital assets policy and regulation. There are barriers that are limiting accessibility to cryptocurrencies, such as financial education and technological resources, and it is our duty as developers and leaders in this revolutionary industry to address them. Studies have shown that only 33% of adults across the globe are financially literate. With many projects in the decentralized finance (DeFi) space focusing on providing individuals without access to traditional financial institutions and tools for earning, ...

Welcome to Mars: I own everything, have total privacy and life has never been better

This is a parody of the article published by the World Economic Forum titled “Welcome to 2030. I Own Nothing, Have No Privacy And Life Has Never Been Better.” Welcome to Mars. Welcome to my city, or should I say “our city” because I, like every other inhabitant, is a stakeholder in it. No, I don’t mean “shareholder,” as this isn’t a dystopian future run by private companies. My city on Mars has a decentralized governance structure just like the greater Mars. It is not a corporation nor is it a militarized state. It is a set of institutions governed directly by The People. As a result of this system, we have police that spread peace instead of violence. We have financial systems that spread wealth instead of creating poverty. We have institutions that are open instead of closed and transpar...

Terra (LUNA) trading volume surge 200% as market adjusts to death spiral

It took just seven days for the Terra (LUNA) ecosystem to spiral down as prices came crashing from $85 on May 5 to nearly $0 on May 12. As the market slowly gained clarity on what transpired, the trading volume of LUNA saw a steep recovery of over 200% over the weekend. As a result of UST de-pegging, which crashed the LUNA market, LUNA investors mirrored the price dip as CoinGecko recorded the decline of trading volumes to $178.6 million on May 13 — a number that was last seen in February 2021. Falling trading volume of LUNA. Source: CoinGecko Terraform Labs CEO and co-founder Do Kwon sought damage control on the same day as he proposed a revival plan for Terra’s comeback, which involves compensating UST and LUNA holders for holding the tokens during the crash. Despite the risks...

DeFi attacks are on the rise — Will the industry be able to stem the tide?

The decentralized finance (DeFi) industry has lost over a billion dollars to hackers in the past couple of months, and the situation seems to be spiraling out of control. According to the latest statistics, approximately $1.6 billion in cryptocurrencies was stolen from DeFi platforms in the first quarter of 2022. Furthermore, over 90% of all pilfered crypto is from hacked DeFi protocols. These figures highlight a dire situation that is likely to persist over the long term if ignored. Why hackers prefer DeFi platforms In recent years, hackers have ramped up operations targeting DeFi systems. One primary reason as to why these groups are drawn to the sector is the sheer amount of funds that decentralized finance platforms hold. Top DeFi platforms process billions of dollars in transactions e...

On-chain privacy is key to the wider mass adoption of crypto

Innovations in the crypto space appear daily. Whether through decentralized applications or new ways to implement and use nonfungible tokens (NFTs) within decentralized finance, blockchain technology is innovating at the speed of light. The only thing missing? Widespread adoption. One thing holding this back is the very public nature of the blockchain. DeFi, as it operates now, lacks meaningful privacy. In order to catalyze broad adoption for businesses, governments and individuals, those executing blockchain transactions should expect regular, consistent privacy. First, we need to define what privacy means. It does not mean pseudonymity, which cryptocurrency purports to have now. Meaningful privacy means that a personal financial account will not be traced and an individual’s wealth will ...