cryptocurrencies

Crypto.com unblocks users, reverses glitched LUNA trades that made 30-40x

Crypto.com was one of the few crypto exchanges to keep LUNA trades open as Terra’s death spiral saw an unrecoverable price crash of LUNA and stablecoin UST. However, a technical glitch on Crypto.com’s mobile application allowed users to get away with a 30-40x profit on LUNA trades momentarily. On Friday, Crypto.com abruptly barred users from trading after an internal tool detected the system quoting incorrect prices for LUNA due to some error. Just when Crypto Twitter started raising concerns about trade reversals on the exchange, Kris Marszalek, CEO of Crypto.com, revealed details about a glitch that allowed users to make away with massive profits. There was a lot of customers who were buying at wrong prices and of course some also jumped onto the opportunity to exploit the glitch to the ...

Bitcoin price could bounce to $35K, but analysts say don’t expect a ‘V-shaped recovery’

Altcoins saw a relief bounce on May 13 as the initial panic sparked by Bitcoin’s sell-off Terra’s UST collapse and multiple stablecoins losing their dollar peg begins to decrease and risk loving traders look to scoop up assets trading at yearly lows. Daily cryptocurrency market performance. Source: Coin360 Despite the significant correction that occurred over the past week, Bitcoin (BTC) bulls have managed to claw their way back to the $30,000 zone, a level which has been defended multiple times during the 2021 bull market. Here’s a look at what several analysts have to say about the outlook for Bitcoin moving forward as the price attempts to recover in the face of multiple headwinds. Is a short squeeze pending? Insight into the minds of derivatives traders was provided by ...

Crypto donations fund ATVs and gas masks for Ukrainian military

Ukrainian officials have used funds from the crypto donation platform launched by the government to purchase supplies for the country’s military amid its ongoing war with Russia. In a Friday tweet, Ukraine’s minister of digital transformation, Mykhailo Fedorov, announced that the country had purchased five all-terrain vehicles, which “will come in handy for a challenging environment” — possibly referring to conditions near the front lines with Russia or where roads have been damaged or destroyed. Funds for three of the ATVs originated from Aid for Ukraine, a platform the government launched in March that accepts crypto donations “to support people in their fight for freedom.” Three ATVs for defenders are funded for crypto donations @_AidForUkraine, two more — supplied by the Minister of De...

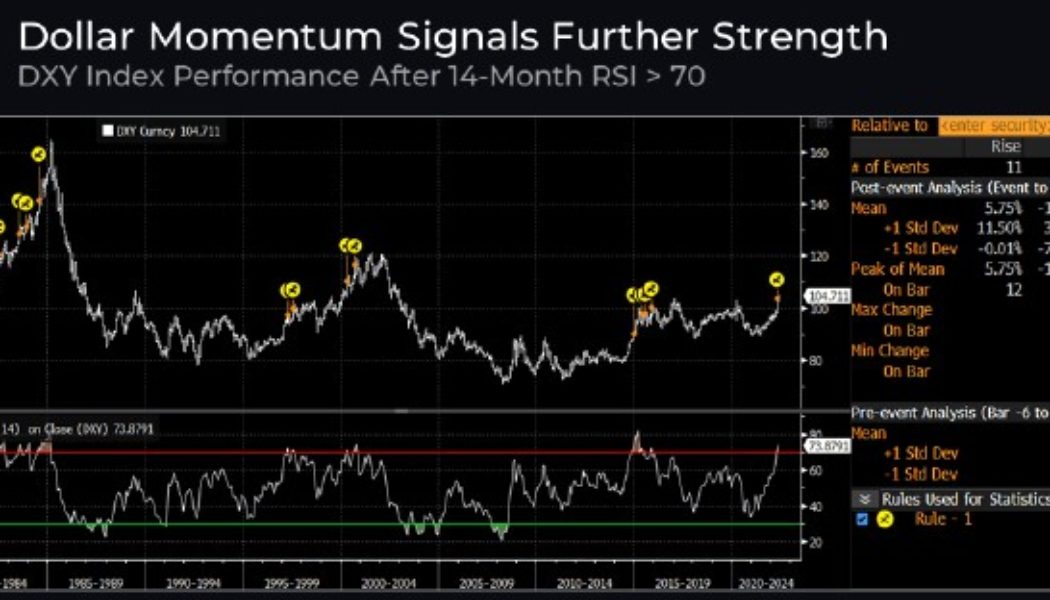

Buy the dip, or wait for max pain? Analysts debate whether Bitcoin price has bottomed

It has been a rough week for the cryptocurrency market, primarily because of the Terra ecosystem collapse and its knock-on effect on Bitcoin (BTC), Ethereum (ETH) and altcoin prices, plus the panic selling that took place after stablecoins lost their peg to the U.S. dollar. The bearish headwinds for the crypto market have been building since late 2021 as the U.S. dollar gained strength and the United States Federal Reserve hinted that it would raise interest rates throughout the year. According to a recent report from Delphi Digital, the 14-month RSI for the DXY has now “crossed above 70 for the first time since its late 2014 to 2016 run up.” DXY index performance. Source: Delphi Digital This is notable because 11 out of the 14 instances where this previously occurred “led to a strong...

No rescue for Terra: Swiss asset manager denies $3B LUNA/UST bail-out talks

GAM Investments has quashed fake news reports that surfaced on Friday that claimed the Swiss asset manager would invest some $3 billion to aid in the recovery of the Terra ecosystem, including LUNA and TrueUSD (UST) stablecoin. An announcement published on May 12 claimed that the firm was engaging in talks with Terraform Labs to assist in recovery attempts after Terra’s algorithmic stablecoin UST lost its $1 peg — causing a cataclysmic crash of the acclaimed blockchain protocol which had become a darling of the Decentralized Finance space. Cointelegraph has confirmed with GAM Investments that the press release was fabricated — with head of communications and investor relations Charles Naylor categorically labeling the release as fake news – which even included fake quotes from ...

Robinhood shares spike 30% after Sam Bankman-Fried buys $650M stake

Sam Bankman-Fried, the billionaire founder and CEO of cryptocurrency exchange FTX has acquired a substantial 7.6% stake in the popular online brokerage, Robinhood. The news was well received by the market, with Robinhood’s (HOOD) stock price initially soaring over 30% in after hours trading. At the time of writing the price has settled to a 24% overall gain. According to a securities filing made with the Securities and Exchange Commission on Thursday, Bankman-Fried purchased a total of $648 million in Robinhood shares at an average price of $11.52. The purchases disclosed by Bankman-Fried reportedly began in mid-March and continued through until Wednesday. In the securities filing, Bankman-Fried made it clear that he had, “no intention of taking any action toward changing or influenc...

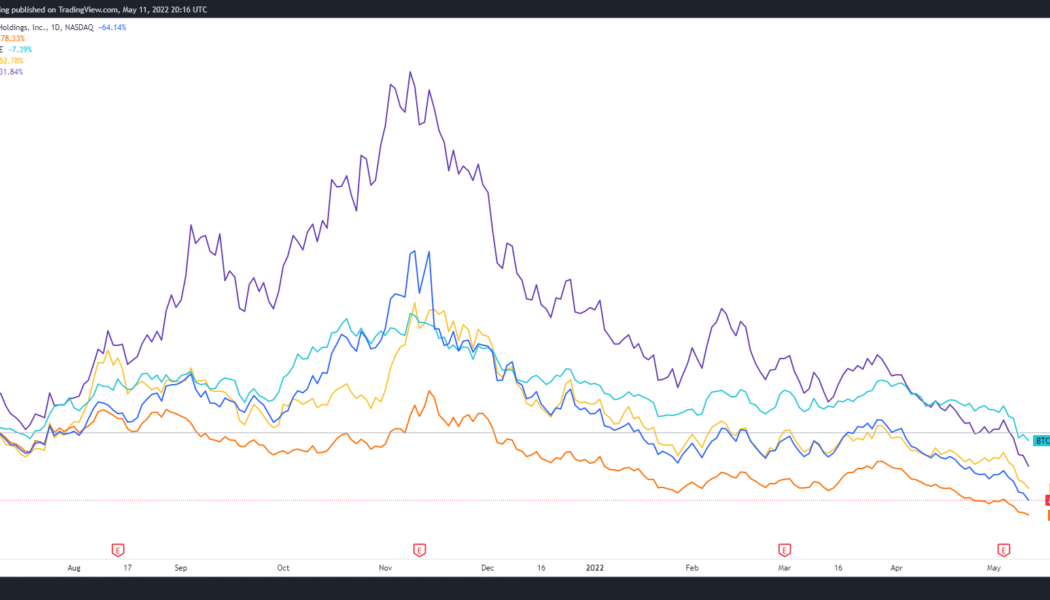

Crypto-associated stocks hammered as COIN and HOOD drop to record lows

Bad news continues to dominate crypto media headlines and May 12’s juiciest tidbit was the unexpected collapse of the Terra ecosystem. In addition to the weakness seen in equities, listed companies with exposure to blockchain startups and cryptocurrency mining have also declined sharply. Bitcoin mining stocks continue bleeding… Mining investors probably wish they had simply bought bitcoin instead at the beginning of 2022, as most bitcoin mining stocks have underperformed bitcoin by a wide margin. pic.twitter.com/anSoUEoUJ1 — Jaran Mellerud (@JMellerud) May 11, 2022 While it may be easy to blame the current pullback solely on Terra’s implosion, the truth is that the price of Bitcoin mining stocks has largely mirrored the performance of BTC since reaching a peak in November...

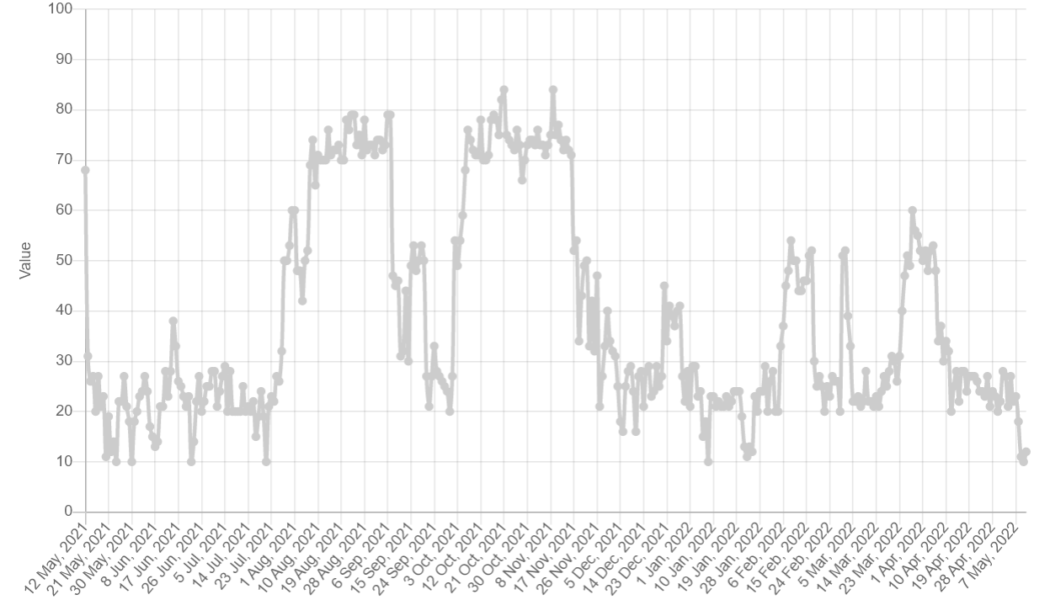

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...

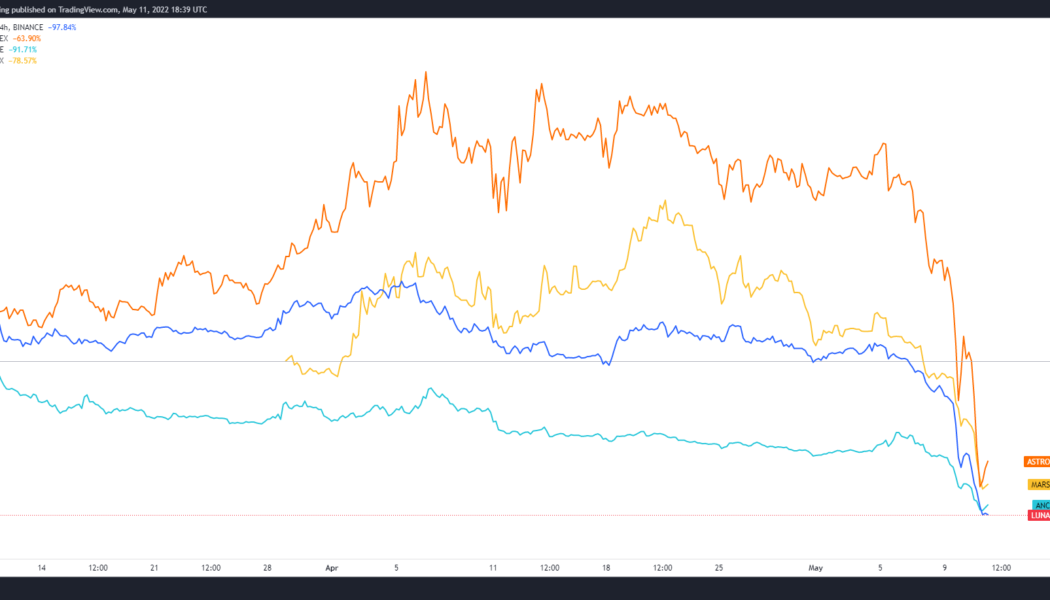

Terra contagion leads to 80%+ decline in DeFi protocols associated with UST

The knock-on effect of the collapse of Terra (LUNA) and its TerraUSD (UST) stablecoin have spread wide across the cryptocurrency market on May 11 as projects with any kind of association with the DeFi ecosystem have seen their prices hammered. The forced selling of the Bitcoin (BTC) holdings backing a portion of UST also influenced BTC’s current drop to $29,000 and analysts fear that DeFi platforms that have liquidity pools primarily comprised of UST and LUNA will collapse. LUNA, ANC, ASTRO and MARS in USDT pairings. 4-hour chart. Source: TradingView Terra-based protocols suffer Projects with the direst of outlooks are those that are hosted on the Terra protocol including Anchor Protocol (ANC), Astroport (ASTRO) and Mars Protocol (MARS). As shown in the chart above, ...

Rising global adoption positions crypto perfectly for use in retail

Even though the cryptocurrency market seems to be going through a bit of a lull at the moment, there’s no denying the fact that the industry has grown from strength to strength over the last few years, especially from an adoption perspective. To this point, a recent study revealed that the number of adults in the United States using digital assets for everyday purchases will increase by 70% by the end of the year when compared to 2021, with the metric rising from 1.08 million to 3.6 million users. The study’s chief author suggests that as the crypto market’s volatility continues to reduce — thanks to the growing use of stablecoins and central bank digital currencies (CBDCs) — more and more people will look at these offerings as a legitimate means of payment. In fact, by the end of 20...

The Fed cites its concern about stablecoins in its latest Financial Stability Report

The United States Federal Reserve Board released its semiannual Financial Stability Report on Monday. The report points to the volatility on commodities markets brought on by the Russian invasion of Ukraine, the spread of the omicron variant of COVID-19 and “higher and more persistent than expected” inflation as sources of instability. Stablecoins and some types of money market funds were singled out in the report and noted to be prone to runs. According to the Fed, stablecoins have an aggregate value of $180 billion, with 80% of that amount represented by Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). They are backed by assets that may lose value or become illiquid during stress, leading to redemption risks, and those risks may be exacerbated by a lack of transparency, the centra...