cryptocurrencies

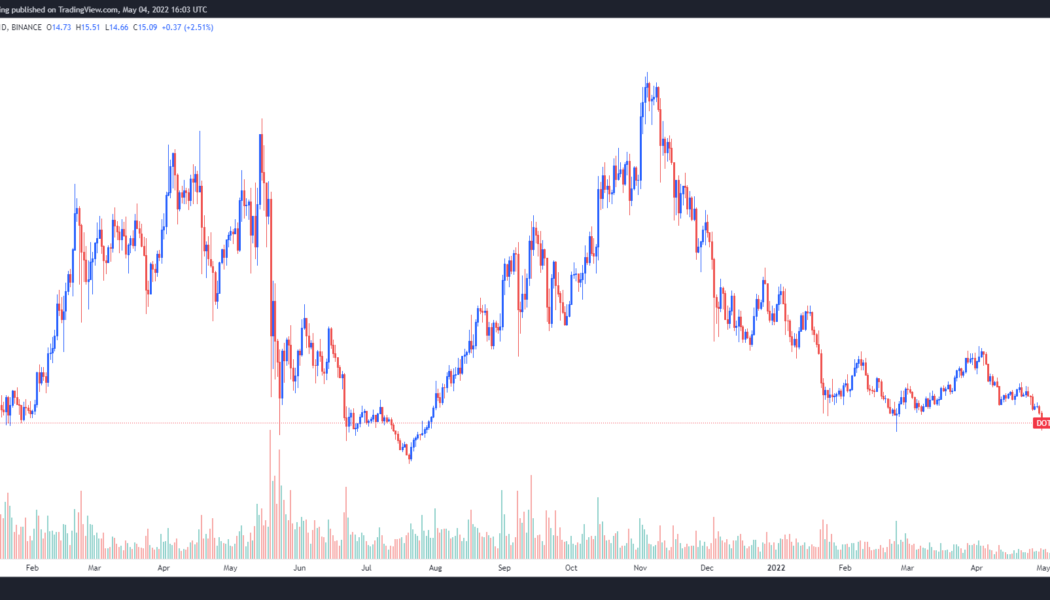

Will Polkadot (DOT) price reverse course now that cross-chain messaging is live?

Development within the Polkadot (DOT) ecosystem has been slowly unfolding over the past year and a half, and the work put in by developers is finally starting to bear fruit as parachain auctions finish and the first chains launch on the mainnet. The next phase of interoperability within the ecosystem is set to kick off now that cross-chain functionality is about to go live. This next step will allow Polkadot-based parachains to communicate with each other and transfer assets between chains. After passing community vote, v0.9.19 has been enacted on Polkadot. This upgrade included a batch call upgrading Polkadot’s runtime to enable parachain-to-parachain messaging over XCM and upgrading #Statemint to include minting assets (like NFTs) and teleports. pic.twitter.com/uqIB5di2Q1 — Polkado...

CFTC commissioner appoints crypto-experienced CME Group director as chief counsel

Kristin Johnson, one of five commissioners currently serving at the United States Commodity Futures Trading Commission, or CFTC, has announced that a CME Group executive director with experience in crypto will be joining her staff. In a Thursday announcement, Johnson said Bruce Fekrat will be her chief counsel at the CFTC starting on June 1. Fekrat worked as an executive director and associate general counsel at the CME Group for more than eight years, where he was lead regulatory counsel for issues including digital assets. During his time at the derivatives marketplace, he regulated cryptocurrency reference rates and helped in the development of financial products including Bitcoin (BTC) and Ether (ETH) derivatives. Nominated by U.S. President Joe Biden in September 2021, Johnson was swo...

Markets are weak, but ALGO, FXS and HNT book a 20%+ rally — Here’s why

Large-cap cryptocurrency continue to slump as investors await comments from the Federal Open Markets Committee regarding the exact size of the next interest rate hike. There are, however, a few bright spots in the market and select altcoins managed to post double-digit gains in trading on May 3, thanks to a big-time partnership announcement and cross-protocol collaborations that led to a spike in demand. Data from Cointelegraph Markets Pro and TradingView shows that three of the biggest gainers over the past 24-hours were Algorand (ALGO), Frax Share (FXS) and Helium (HNT). Algorand The pure proof-of-stake blockchain network had, perhaps, one of the most notable partnership deals for a crypto project in recent months after this week’s announcement that it had been selected as the offi...

Markets are weak, but ALGO, FXS and HNT book a 20%+ rally — Here’s why

Large-cap cryptocurrency continue to slump as investors await comments from the Federal Open Markets Committee regarding the exact size of the next interest rate hike. There are, however, a few bright spots in the market and select altcoins managed to post double-digit gains in trading on May 3, thanks to a big-time partnership announcement and cross-protocol collaborations that led to a spike in demand. Data from Cointelegraph Markets Pro and TradingView shows that three of the biggest gainers over the past 24-hours were Algorand (ALGO), Frax Share (FXS) and Helium (HNT). Algorand The pure proof-of-stake blockchain network had, perhaps, one of the most notable partnership deals for a crypto project in recent months after this week’s announcement that it had been selected as the offi...

MicroStrategy may explore ‘future yield generation opportunities’ on 95,643 BTC holdings

Business intelligence firm MicroStrategy said it will consider opportunities for yield generation on 95,643 “unencumbered” Bitcoin (BTC) held by its subsidiary MacroStrategy. In MicroStrategy’s report for the first quarter of 2022 released on Tuesday, the firm said it “may conservatively explore future yield generation opportunities on unencumbered MacroStrategy bitcoins” as a consideration following a $205 million BTC-collateralized loan issued by Silvergate Bank in March. As of March 31, MicroStrategy held a total of 129,218 BTC, which the firm reported had a carrying value of roughly $2.9 billion, reflecting cumulative impairment losses of more than $1 billion and an aggregate cost of $4 billion. “The original cost basis and market value of MicroStrategy’s bitcoin were $3.967 billion an...

MicroStrategy may explore ‘future yield generation opportunities’ on 95,643 BTC holdings

Business intelligence firm MicroStrategy said it will consider opportunities for yield generation on 95,643 “unencumbered” Bitcoin (BTC) held by its subsidiary MacroStrategy. In MicroStrategy’s report for the first quarter of 2022 released on Tuesday, the firm said it “may conservatively explore future yield generation opportunities on unencumbered MacroStrategy bitcoins” as a consideration following a $205 million BTC-collateralized loan issued by Silvergate Bank in March. As of March 31, MicroStrategy held a total of 129,218 BTC, which the firm reported had a carrying value of roughly $2.9 billion, reflecting cumulative impairment losses of more than $1 billion and an aggregate cost of $4 billion. “The original cost basis and market value of MicroStrategy’s bitcoin were $3.967 billion an...

Crypto Bahamas: Regulations enter critical stage as gov’t shows interest

The crypto community and Wall Street converged last week in Nassau, Bahamas, to discuss the future of digital assets during SALT’s Crypto Bahamas conference. The SkyBridge Alternatives Conference (SALT) was also co-hosted this year by FTX, Sam Bankman-Fried’s cryptocurrency exchange. Anthony Scaramucci, founder of the hedge fund SkyBridge Capital, kicked off Crypto Bahamas with a press conference explaining that the goal behind the event was to merge the traditional financial world with the crypto community: “Crypto Bahamas combines the crypto native FTX audience with the SkyBridge asset management firm audience. We are bringing these two worlds together to create a more equitable financial system.” Traditional finance eyes crypto as regulations take shape The combination of traditional ...

Law Decoded: The difference between New York City and New York State, April 25-May 2

Last week, New York dominated crypto media headlines in very different ways. In New York State, the local Assembly voted in favor of the bill that would ban for two years any new mining operations that rely on proof-of-work (PoW) consensus mechanisms and use fossil fuel-generated energy. A temporary moratorium, which could be extended after the state’s Department of Environmental Conservation provides its assessments of the industry’s carbon footprint, marks the first major legislative attack on PoW mining on environmental grounds in the United States. The push mobilized the community — after digital asset advocacy groups rang the alarm on Twitter. Then, proponents of the ban had to endure three hours of a heated debate to narrowly pass the draft. There’s hope for an even tighter fig...

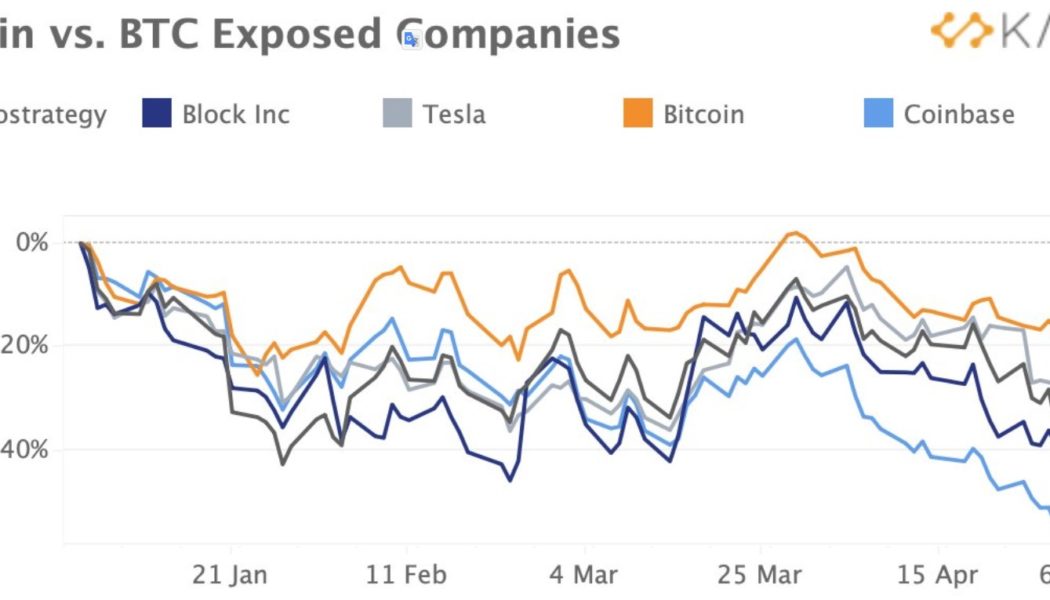

Fed FOMC comments and Bitcoin ‘bear channel’ could kickstart a decline to $28K

The start of May has seen a continuation of the weakness in crypto and equities markets and at the moment, there is no indication of any short-term factors that could reverse the bearish trend. Equities markets are also in a downtrend and according to researcher Clara Medalie, the price of stocks from companies with exposure to Bitcoin (BTC) have also taken a notable hit. Bitcoin vs. BTC exposed companies. Source: Twitter Medalie said: “Block, Tesla, Microstrategy and Coinbase are down between 20%–50%.” Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt by Bitcoin (BTC) bulls to rally above $39,000 was easily defended by bears, resulting in a pullback to the $38,200 level. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts ...

EU commissioner calls for global coordination on crypto regulation

Mairead McGuinness, the commissioner for financial services, financial stability and capital markets union at the European Commission, is calling for global regulators to work together to address potential risks in the crypto market. In a Sunday opinion piece in political media outlet The Hill, McGuinness said the European Union and the United States could help lead the world in a regulatory approach for cryptocurrencies that considers the benefits of the innovative technology while addressing “significant risks.” The EU commissioner pointed to the volatility of certain assets, the risk of insider trading, the possibility of crypto being used by Russia to evade sanctions and environmental concerns. “To make rules on crypto fully effective, crypto requires global coordination and joint inte...

Smart money is accumulating Ethereum even as traders warn of a drop to $2.4K

The upcoming Ethereum merge is one of the most widely discussed topics in the crypto sector and analysts have a wide range of perspectives on how the transition to proof of stake could impact Ether’s price. ETH/USDT 1-day chart. Source: TradingView Whales accumulate ahead of the merge A deeper dive into the ongoing accumulation of Ether by whale wallets was provided by cryptocurrency intelligence firm Jarvis Labs, which posted the following chart looking at the percentage change in whale wallet holdings versus ET price. Ether whale holding change. Source: Twitter The color of the dots relates to the price of Ether, with the chart showing that whale wallets began decreasing their holdings when the price was above $4,000 and they didn’t start to reaccumulate unti...

Binance to drive crypto and blockchain awareness among Indian investors

Crypto exchange Binance announced the parallel launch of three key educational initiatives to fast-track educating Indian investors and students about the cryptocurrency and blockchain ecosystem. While recognizing the importance of investors’ awareness of crypto and blockchain, Binance highlighted that Indian regulators and policymakers cite the lack of education as an area of concern, which currently hinders the widespread adoption of crypto. Primarily targeting the student demographic in India, one of the three educational initiatives launched by Binance involves the initiation of the ‘Blockchain for Good’ Ideathon, a platform for college students to come up with solutions for making crypto more accessible and inclusive. Binance also partnered with India-based crypto influencers and educ...