cryptocurrencies

Memecoins eye major revamps in an effort to return to their former glory

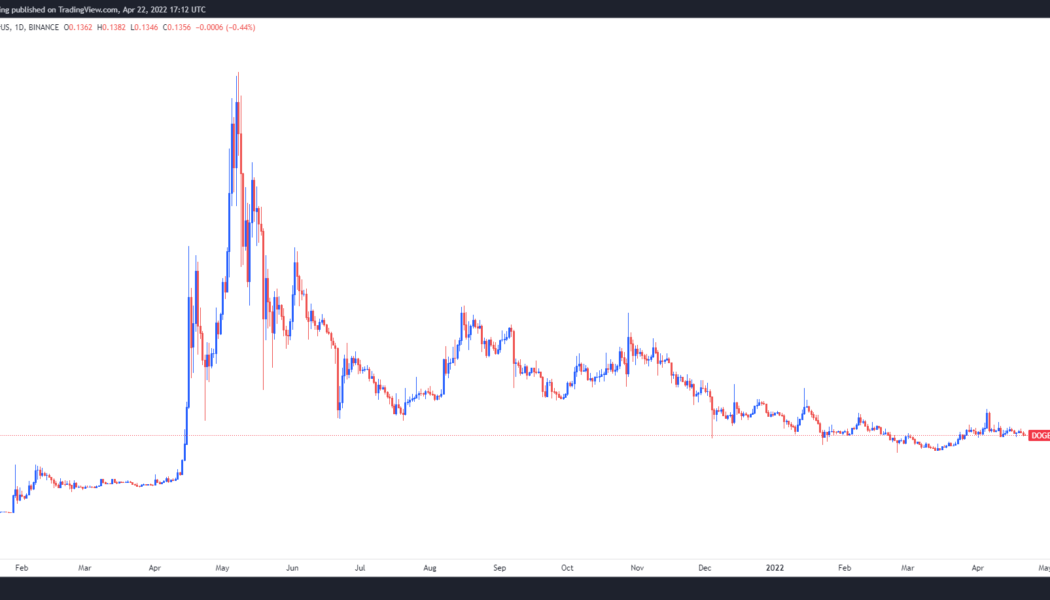

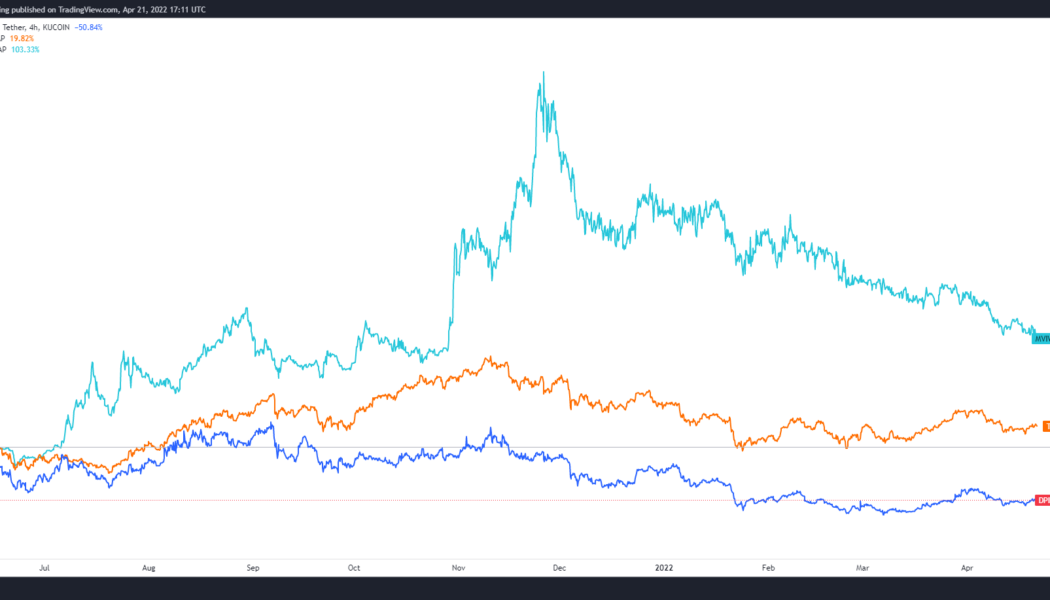

Memecoins briefly took the cryptocurrency market by storm in 2021 after steady attention and shilling from big-name influencers like Elon Musk and Mark Cuban helped propel coins like Dogecoin (DOGE) to 100x gains. As one should expect, in the crypto market, rapidly rising prices have a tendency to reverse course just as fast and many of the formerly high-flying meme tokens now find themselves struggling for survival as the market matures and investors look for real-world use cases. Let’s take a look at some of the most popular memecoins of 2021 to see whether they were just a flash in the pan or if there are fundamental developments that may prove fruitful in the long-term. Dogecoin DOGE is the original memecoin and it helped kick off the rally of ‘21 after its price skyrockete...

The new HM Treasury regulations: The good, the bad and the ugly

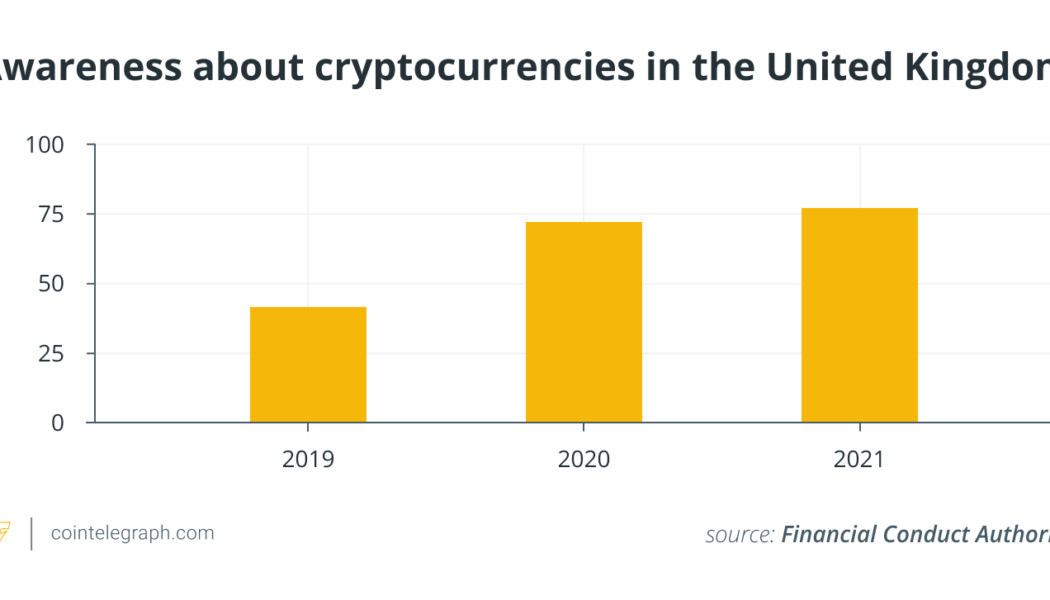

As the 2021-2022 United Kingdom tax year finished on April 5, 2022, Her Majesty’s Treasury announced they were paving the way for the U.K. to become a global crypto asset technology hub. This could mean that the previously not particularly crypto-friendly U.K. is changing its strategy and trying its hand at making crypto investments more attractive. But what are the potential scenarios at play? The Financial Conduct Authority (FCA), a financial regulatory body in the U.K., in its “Cryptoasset consumer research 2021” report, shows that approximately 2.3. million adult U.K. citizens held crypto in 2021, a 21% rise year-over-year. It seems natural that with rising interest and potential crypto mass adoption, HM Treasury would revisit its crypto regulations. This is especially true when ...

Quantum computing to run economic models on crypto adoption

By many accounts, quantum computing (QC), which uses atomic “spin” instead of an electrical charge to represent its binary 1’s and 0’s, is evolving at an exponential rate. If QC is ever realized at scale, it could be a boon for human society, helping to improve crop yields, design better medicines and engineer safer airplanes, among other benefits. The crypto sector could profit too. Just last week, for instance, a Bank of Canada-commissioned project simulated cryptocurrency adoption among Canadian financial organizations using quantum computing. “We wanted to test the power of quantum computing on a research case that is hard to solve using classical computing techniques,” said Maryam Haghighi, director of data science at the Bank of Canada, in a press release. But, othe...

Binance.US leaves Blockchain Association to form own DC government affairs team

Binance.US announced today that it is creating a team in Washington to engage with lawmakers on digital asset policy. Simultaneously, it has withdrawn from the advocacy group Blockchain Association. Both organizations sides have been tight-lipped about the split, commenting publicly only with short statements. A Binance.US spokesperson told Cointelegraph, “We believe it’s time we had a clear voice with meaningful impact in the emerging policy debates around digital assets and cryptocurrencies in Washington. We are excited to establish our own Government Affairs team in D.C. to actively engage in direct and constructive dialogue with U.S. policymakers on smart regulation that increases clarity and trust, while allowing American innovation and leadership to flourish in crypto.” Binance found...

Russian central bank needs to ease up digital asset projects, governor says

Elvira Nabiullina, governor of the Bank of Russia, has admitted that Russia’s central bank might have taken a bit too tough a stance on digital assets and should look to reconsider that. On Thursday, the Russian State Duma reappointed Nabiullina as Bank of Russia governor, marking the third time for her to take the post since she started serving in the position back in 2013. At the official Duma session, Nabiullina talked about many measures that Russia has been taking and is planning to adopt in order to help the government mitigate the impact of massive Western sanctions against the Russian economy. As part of the government’s measures to maintain the economy, the Bank of Russia is working to bring the topic of digital financial assets to a “working state,” Nabiullina stated. She emphasi...

Analysts say Bitcoin has ‘already capitulated,’ target $41.3K as the most hold level

Traders’ struggle to build sustainable bullish momentum persisted across the cryptocurrency market on April 20 after prices slid lower during the afternoon trading session and ApeCoin (APE) appaers to be one of the few tokens that is defying the current market-wide downturn. Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt by Bitcoin (BTC) bulls to breakout above $42,000 was soundly rejected by bears, resulting in a pullback to a daily low of $40,825 before the price was bid back above $41,000. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several market analysts are saying about the weakness in Bitcoin and what levels traders are looking at as a good spot for opening new positions. Whales accumulate near $...

IMF global financial stability report sees complex roles for cryptocurrency, DeFi

According to the International Monetary Fund’s Global Financial Stability report released Tuesday, the war in Ukraine — following hard on the heels of the coronavirus pandemic — has led to a tightening of global financial conditions. Rapid changes in fintech and the uses and misuses of cryptocurrency play into the jumble of challenges facing the global economy. According to the report, the pandemic and war have led to an accelerated “cryptoization” in emerging markets due to increased speculative interest during the pandemic and then attempts to evade sanctions. Given compliance within the crypto industry, the use of cryptocurrency to evade sanctions is impractical, the report found. The use of mixers, decentralized exchanges and privacy coins may allow some circumvention, but it wou...

Half of assessed jurisdictions don’t have ‘adequate laws and regulatory structures’ — FATF

The Financial Action Task Force, or FATF, reported that many countries, including those with virtual asset service providers (VASPs), are not in compliance with its standards on Combating the Financing of Terrorism (CFT) and Anti-Money Laundering (AML). In a report released Tuesday on the “State of Effectiveness and Compliance with the FATF Standards,” the organization said 52% of the assessed jurisdictions in 120 countries had “adequate laws and regulatory structures in place” to assess risks and verify beneficial owners of companies. In addition, the FATF reported that only 9% of countries were “substantially effective” in this area. “Countries need to prioritize their efforts and demonstrate improvements in recording, reporting and verifying information regarding legal perso...

Cointelegraph’s experts reveal their crypto portfolios | Watch now on The Market Report

On this week’s show, Cointelegraph’s resident experts reveal exactly what percentages of their portfolios are allocated to what coins and why. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they reveal their crypto portfolios. We kick things off with Bourgi, whose top holdings are BTC with 67%, ETH with 20%. No surprise there but what about the rest? It’s an interesting mix, to say the least so make sure you stick around to find out. Next, we have Yuan, whose top three holdings are 35% BTC, 28% Terra...

Silvergate Bank revenue soar in Q1 as institutional crypto trading activity falls

On Tuesday, Silvergate Bank, a crypto-fiat gateway network designed for financial institutions, announced its results for the first quarter of 2022. During this period, its revenue and net income grew by 93% and 94% year-over-year, respectively, to $59.9 million and $24.7 million. The company is most notable for its Silvergate Exchange Network, or SEN, which facilitates U.S. dollar and euro transfers between cryptocurrency exchanges and institutional investors. Despite its growth, however, institutional interest in crypto took a significant hit in Q1 due to the ongoing bear market. As told by Silvergate, the amount of SEN transfers it facilitated decreased from $167 billion in Q1 2021 to $142 billion in Q1 2022. Simultaneously, as part of broader industry trends, Bitcoin (BTC) and Ethereum...

Crypto exchange CoinDCX raises $135M funding to support Indian Web3

Crypto exchange CoinDCX became India’s first crypto business to complete a Series D funding round, raising $135 million in support of various Web3 and crypto initiatives in the country. The latest funding round resulted in CoinDCX doubling its valuation to $2.15 billion, which was led by Pantera and Steadview and saw participation from prominent investors including Kingsway, DraperDragon and Republic. Existing investors such as B Capital Group — a venture capitalist firm from Facebook co-founder Eduardo Saverin — Coinbase, Polychain and Cadenza also joined in on the oversubscribed funding round to increase their investments in the crypto exchange. Excited to share that CoinDCX has raised over USD 135 million, in our latest Series D funding round. Another step closer to our dream of m...