cryptocurrencies

Quantum computing firm simulates adoption of crypto payments

Multiverse Computing, a quantum computing firm with offices in Canada and Spain, has partnered with the Bank of Canada to run simulations on how the adoption of cryptocurrency might proceed as a payment method. In a Thursday announcement, Multiverse Computing said it used its equipment as part of a proof-of-concept project with the Bank of Canada to generate examples of how non-financial firms may end up adopting crypto. The quantum simulations used scenarios with 8 to 10 financial networks with more than 1.2 octillion possible configurations. According to the firm, it was “important to develop a deep understanding of interactions that can take place in payments networks” to understand how companies may adopt different forms of payments. The simulations suggested crypto payments may end up...

Wikimedia community supports proposal to stop foundation from accepting crypto donations

Requests for comments on a proposal urging the Wikimedia Foundation to stop accepting donations in cryptocurrency have closed, with the majority of users voting in favor. According to a Tuesday update on the proposal, roughly 71%, or 232 out of 326, Wikimedia contributors who responded requested that the Wikimedia Foundation — the nonprofit that hosts Wikipedia — stop accepting cryptocurrency donations. The arguments in favor of the proposition included environmental concerns surrounding Bitcoin (BTC) transactions and “the risk to the movement’s reputation for accepting cryptocurrencies.” The community first opened the proposal to comment on Jan. 10, expanding the discussion to include topics like El Salvador adopting BTC as legal tender, crypto as a tool for illicit financial activities, ...

New crypto card by Nexo allows users to pay without selling Bitcoin

Major cryptocurrency loan company Nexo has officially launched a crypto-backed Mastercard card enabling users to pay for services with cryptocurrencies like Bitcoin (BTC) without selling their crypto. Nexo has partnered with Mastercard and the peer-to-peer payment startup DiPocket to launch the Nexo Card, a crypto card allowing cardholders to use their crypto as collateral rather than selling it, the firm announced to Cointelegraph on Wednesday. The card is linked to a Nexo-provided, crypto-backed credit line allowing to use of multiple assets as collateral, including but not limited to Bitcoin, Ether (ETH) and the Tether (USDT) stablecoin. “The Nexo Card functions through Nexo’s crypto-backed credit lines, which means that funds for your purchases come from your available credit lin...

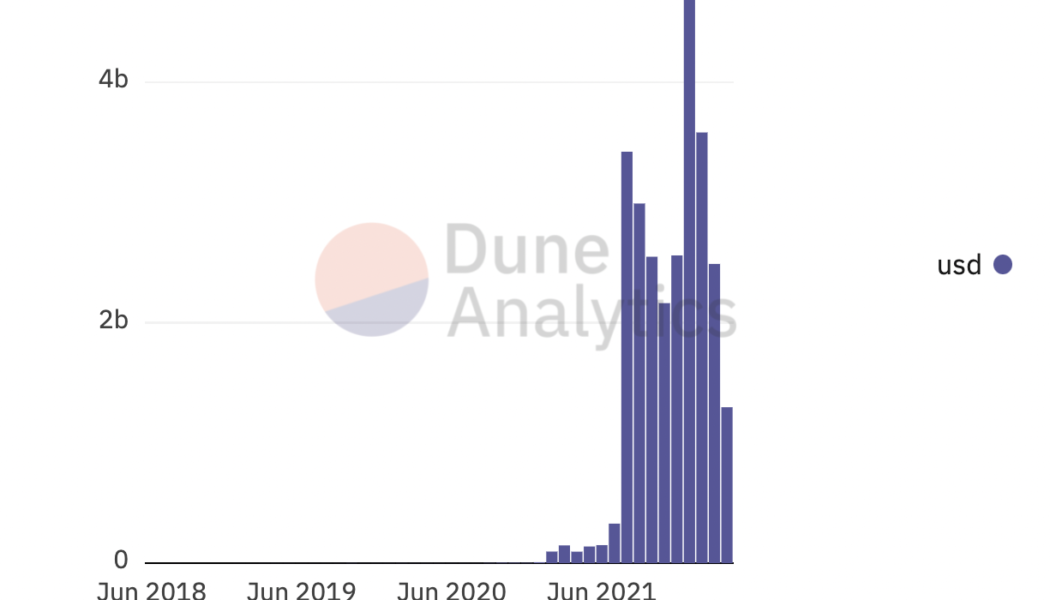

Is the surge in OpenSea volume and blue-chip NFT sales an early sign of an NFT bull market?

In the last two months, OpenSea began to cool down from its New Year’s bull run and many nonfungible token (NFT) pundits began to speculate about the beginning of a bear market once sales took a slight downward trend after closing out a record-breaking $5 billion in total volume sales in January. However, for the last seven days, the total sales volume has already exceeded the $1 billion mark and just a week into April, it seems the NFT markets are waking up to a resurgence of blue-chip caliber projects. Cue the “spring awakening.” OpenSea Monthly Volume. Source: DuneAnalytics @rchen8 Traders searching for the next Bored Ape Yacht Club (BAYC) project have patiently waited for another project to come in with the same force and brand equity. Some top contenders have been emerging...

Bitcoin price slides below $40K following a ‘lackluster’ breakout

Extreme fear is once again the dominating sentiment across the cryptocurrency community after Bitcoin (BTC) faced another day of trading below the $40,000 level and the United States grapples with the highest Consumer Price Index (CPI) print since 1981. Crypto Fear & Greed Index. Source: Alternative.me Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt to rally above $40,000 ran into a wall of resistance at $40,650 and BTC price eventually tumbled back below $39,600. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the current state of Bitcoin and what could potentially come next as financial markets grapple with an increasing amount of uncertainty. Bitcoin is simply re-testing a major S/R zone ...

What are the worst crypto mistakes to avoid in 2022? | Find out now on The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss the worst mistakes you should avoid making in crypto. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they talk about the worst crypto mistakes to avoid making in 2022. First up, we have Bourgi, who thinks investors should avoid “analysis paralysis.” In other words, don’t overanalyze. Make decisions based on firm conviction. Don’t just look at the price of a coin or token you’re interested...

Kava turns bullish as Ethereum Co-Chain launch initiates push toward EVM compatibility

Protocols in the Cosmos ecosystem have seen a significant amount of growth in 2022 due to the intensifying focus on blockchain interoperability and compatibility with the Ethereum network. One protocol that has seen a buildup in momentum since the middle of March is Kava, a project that is developing a co-chain architecture for the Cosmos and Ethereum network. Data from Cointelegraph Markets Pro and TradingView shows that the price of Kava’s native token KAVA has climbed 72.3% after hitting a low of $2.92 on March 13 to establish a daily high of $5.03 on April 8. KAVA/USDT 1-day chart. Source: TradingView Three reasons for the increase in price and momentum for KAVA include the Ethereum Co-Chain beta launch, the launch of a $750 million developer incentive program and a series o...

Bitcoin price dip to $39.2K places BTC back in ‘bear market’ territory

The cryptocurrency market took a turn for the worse on April 11 after concerns related to rising inflation, the prospect of several more interest rates by the U.S. Federal Reserve and fear of a global food shortage led to widespread weakness across global financial markets. Data from Cointelegraph Markets Pro and TradingView shows that bears broke through the bulls’ defensive line at $42,000 in the early trading hours on Monday to drop Bitcoin (BTC) to a daily low of $39,200 and several analysts project even lower prices in the short-term. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about Monday’s move lower and whether or not traders should expect more downside over the coming days. $40,000 or bust The dip below $40,000 was foreshadowed b...

EU bans providing ‘high-value crypto-asset services’ to Russia

The Council of the European Union has cut Russians off from certain cryptocurrency services as part of a package of restrictive measures against Russian President Vladimir Putin’s “brutal aggression against Ukraine and its people.” In a Friday announcement, the EU council said it would be closing potential loopholes in using digital assets for Russian entities and individuals to evade sanctions with a “prohibition on providing high-value crypto-asset services” to the country. The action was one of three financial measures the European Commission proposed alongside banning transactions and freezing assets connected to four Russian banks as well as a “prohibition on providing advice on trusts to wealthy Russians.” Russian Prime Minister Mikhail Mishustin claimed on Thursday that Russians hol...

Binance receives in-principle approval to operate in Abu Dhabi

Binance, the world’s biggest crypto exchange in terms of trading volume, received in-principle approval to operate in Abu Dhabi, marking its third regulatory approval in the Middle Eastern region after Bahrain and Dubai. The in-principle approval from the Abu Dhabi Global Market (ADGM) allows Binance to operate as a broker-dealer in digital assets including cryptocurrencies — marking yet another milestone for the crypto exchange, which envisions to operate as a fully-licensed firm. @binance, one of the world’s leading #blockchain and #cryptocurrency platforms, received an IPA from the #ADGM Financial Services Regulator Authority. pic.twitter.com/jhHenzaahE — Abu Dhabi Global Market (@ADGlobalMarket) April 10, 2022 ADGM serves as an international financial free zone within the c...

Number of UK crypto firms operating under FCA temporary registration status drops

The number of firms permitted to offer crypto services to U.K. residents under temporary registration status from the Financial Conduct Authority has dropped from 12 to five. According to a Thursday update to its list of “Cryptoasset firms with Temporary Registration,” the United Kingdom’s financial regulator named CEX.IO, Revolut, Copper, Globalblock and Moneybrain as companies in the crypto space allowed to operate in the country in addition to the 34 registered crypto asset firms the FCA has approved since August 2020. The FCA said on March 30 that it would be extending the temporary registration status for “a small number of firms where it is strictly necessary,” which included 12 companies at the time. In the United Kingdom, firms permitted to “carry out crypto ...