cryptocurrencies

UK financial watchdog extends registration deadline for some crypto firms

The Financial Conduct Authority, the United Kingdom’s financial regulator, has extended the temporary registration status of some firms offering crypto services beyond its Friday deadline. In a Tuesday statement, the FCA said “a small number of firms” in the crypto space will continue to have temporary registration status in the United Kingdom “where it is strictly necessary.” The financial regulator reiterated that temporarily exempting the crypto firms from its previously announced Friday deadline “does not mean that the FCA has assessed them as fit and proper” but included situations in which a company “may be pursuing an appeal” or was still in the process of winding down operations. “Only firms that are registered with us or on our list of firms with temporary registration can continu...

A retest is expected, but most analysts expect Bitcoin price to extend much higher

The mood across the cryptocurrency market has seen a notable improvement in the last week as prices are on the rise with Bitcoin (BTC) now trading near $48,000 while Ether (ETH) attempting to hold above $3,400. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has been oscillating around $48,000 since it broke out above $45,000 early on March 28 and bulls are now debating whether a bull run to $80,000 is on the cards. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the outlook for BTC moving forward and what levels to keep an eye on in case of a price pullback or another breakout to the upside. Bitcoin breaks above its 1-year moving average “Keeping it simple is often best” accordi...

MicroStrategy subsidiary will purchase Bitcoin after closing $205M crypto-collateralized loan

MacroStrategy, a subsidiary of business intelligence firm MicroStrategy, said it will purchase Bitcoin after obtaining a multimillion dollar loan from Silvergate Bank. In a Tuesday announcement, MicroStrategy said Silvergate issued a $205 million loan “secured by certain Bitcoin held in MacroStrategy’s collateral account.” The firm’s subsidiary MacroStrategy will be using the proceeds of the loan to purchase Bitcoin (BTC), pay fees and interest related to the loan and handle general corporate expenses. “The SEN Leverage loan gives us an opportunity to further our position as the leading public company investor in Bitcoin,” said MicroStrategy CEO Michael Saylor. “Using the capital from the loan, we’ve effectively turned our Bitcoin into productive collateral, which allows us to furthe...

Wonky Mars Protocol launch shows ecosystem expansion may not add to network value

New protocols are launching every day on different networks in the crypto space and the trend is likely to continue through this year. When looking at the top five networks by total value locked (TVL) — Ethereum (ETH), Terra (LUNA), Binance Smart Chain (BSC), Avalanche (AVAX) and Solana (SOL) — according to data from DeFiLlama, Ethereum have 579 protocols (including L1 and L2); Terra has 25, BSC has 348, Avalanche and Solana have 187 and 64 protocols, respectively. The low number of protocols and high TVL from Terra surely stand out as the outlier here. Terra’s TVL reached an all-time high at $20 billion in December 2021 before dropping to $13 billion during the January 2022 crash. To date, the ecosystem has managed to boost its liquidity back to $26 billion. With only 25 protoco...

ETF provider WisdomTree launches Solana, Cardano, Polkadot ETPs

The American exchange-traded fund (ETF) provider WisdomTree continues expanding its cryptocurrency products in Europe by launching three new crypto exchange-traded products (ETP) backed by Solana (SOL), Cardano (ADA) and Polkadot (DOT). WisdomTree announced Tuesday the launch of three new physically-backed crypto ETPs, including WisdomTree Solana (SOLW), WisdomTree Cardano (ADAW) and WisdomTree Polkadot (DOTW). The ETPs are already listed on major European digital exchanges like Deutsche Boerse’s Xetra, the Swiss SIX exchange and the Swiss Stock Exchange. The pan-European exchange Euronext is expected to list the crypto ETPs in Amsterdam and Paris on Thursday, the announcement notes. The ETPs are designed to offer investors in Europe another option to gain exposure to the price of Solana, ...

Interoperability-focused Stargate Finance (STG) aims to kick off DeFi 3.0

“Stargate Finance” has been trending on Twitter for the past week and while it’s too early to call for a full-blown DeFi bull market, traders have been shoveling funds into the project, which claims to be a “composable omni-chain native asset bridge.” Data from Cointelegraph Markets Pro and TradingView shows STG was listed on exchanges on March 17 and its price has climbed 438% from a low of $0.665 to a high of $3.58 on March 25. STG/USDC 1-hour chart. Source: TradingView Here’s a look at some of the developments with the protocol that have attracted DeFi users and boosted the price of STG ahead of its initial community auction. Cross-chain composability Interoperability has been a growing theme across the cryptocurrency ecosystem and this theme continues to expand as inv...

Japan plans to tighten crypto exchange regulation to enforce sanctions

Japan plans to amend its Foreign Exchange and Foreign Trade Act to bring crypto exchanges under the purview of laws that govern banks, a government official revealed on Monday. The proposed amendment is being carried out to prevent sanctioned countries from taking evasive actions using digital assets. Chief Cabinet Secretary Hirokazu Matsuno in a press conference said that the government is planning to introduce a bill to revise the Foreign exchange laws to include crypto exchanges. Fumio Kishida, the newly elected prime minister of the country, also supported the proposed revision and called for coordinated moves with Western allies to enforce the new laws. Under the revised foreign exchange laws, crypto exchanges, just like banks, will be required to verify and flag transactions ass...

Is Austin the next US crypto hub? Officials approve blockchain resolutions

Innovative cities across America are racing to become the next hot spot for cryptocurrency and blockchain adoption. Miami was the first city to adopt its own part of CityCoins last year, allowing it to implement its own cryptocurrency called “MiamiCoin” to be used for civic engagement. New York City has also made a name for itself as a crypto-friendly city by implementing educational initiatives and withMayor Eric Adams receiving his paycheck in Bitcoin (BTC) in January this year. Austin takes a strong stance Most recently, Austin — the state capital of Texas that goes by the slogan “Keep Austin Weird” — has taken a strong interest in cryptocurrency and blockchain technology. While Texas’ desire to lead the way for crypto innovation was established about a year ago when G...

What is a cryptocurrency mixer and how does it work?

The rapid expansion of cryptocurrencies and the development of crypto infrastructure and vulnerabilities like crypto mixers or tumblers have been a source of concern for government agencies in charge of financial security. Many people use crypto mixers to keep their cryptocurrency transactions private by mixing potentially identifiable cryptocurrency funds with vast sums of other funds. These services are often used to anonymize fund transfers between services and do not require Know Your Customer (KYC) checks. As a result, the risk of employing crypto mixers to launder money or conceal earnings is pretty considerable. Mixers and online gambling sites have the most severe money laundering issues, as they process the vast majority of dirty currencies. Mixers, for example, have consistently ...

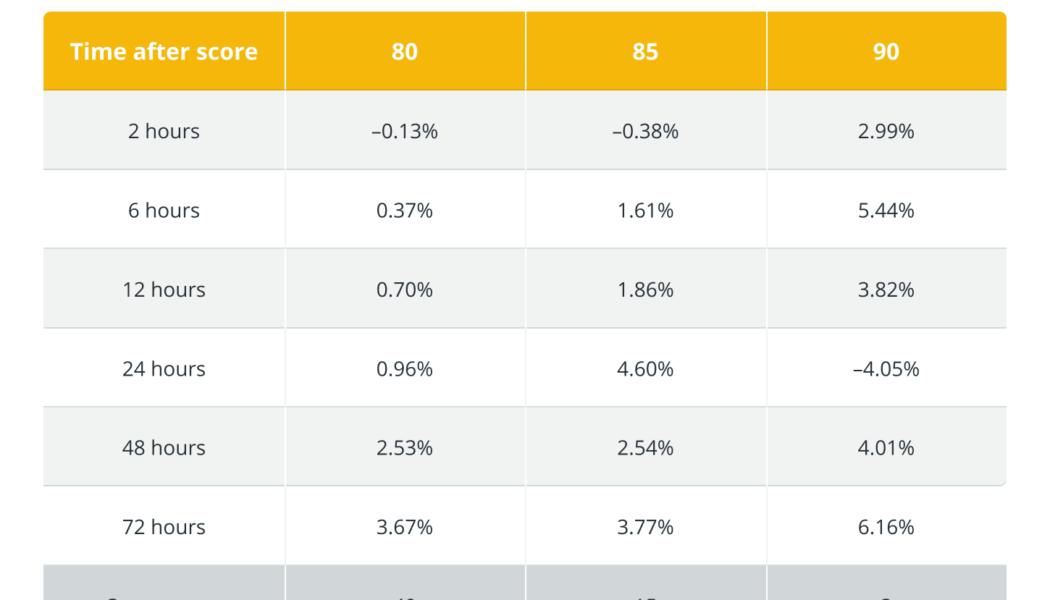

Here is how studying tokens’ price history helps patient traders enjoy consistent average gains.

Whether you consider cryptocurrency trading as art, science or a game of skill, one thing is beyond dispute: Those who excel at it are not the traders who maintain the longest series of lucky one-offs but those who establish sustainable trading processes yielding consistent returns. Ask a sample of seasoned pros if they would prefer to catch one obscure token’s 300%-in-a-day brush with fame or learn a strategy that systematically generates a 3% return on investment. You will be surprised how many of them (likely close to 100% of the sample) prefer modest yet systematic profits. How does one make their trading processes more systematic? One way is to rely on automated data analytics tools with a proven track record of consistent performance. One such tool is the VORTECS™ Score, an ar...

Privacy coins are surging. Will regulatory pressure stall their stellar run?

Recent weeks saw a massive surge of the so-called privacy coins’ prices — namely Monero (XMR), Dash (DASH), Zcash (ZEC) and Haven Protocol (XHV). As many other cryptocurrencies and the industry at large faced immense regulatory pressure amid the war in Ukraine, one narrative that began taking hold in the crypto space was the potential of such privacy-enhancing assets to provide investors a greater level of financial anonymity. But, can privacy coins deliver on Bitcoin’s (BTC) original promise? A good month for privacy-focused assets Over the past month, Monero has almost doubled its tally. With some minor oscillations, it rose from $134 on Feb. 24 to over $200 on March 26. ZEC showed even more impressive dynamics that hiked from $88 to $202 over the same period. DASH also pulled off ...

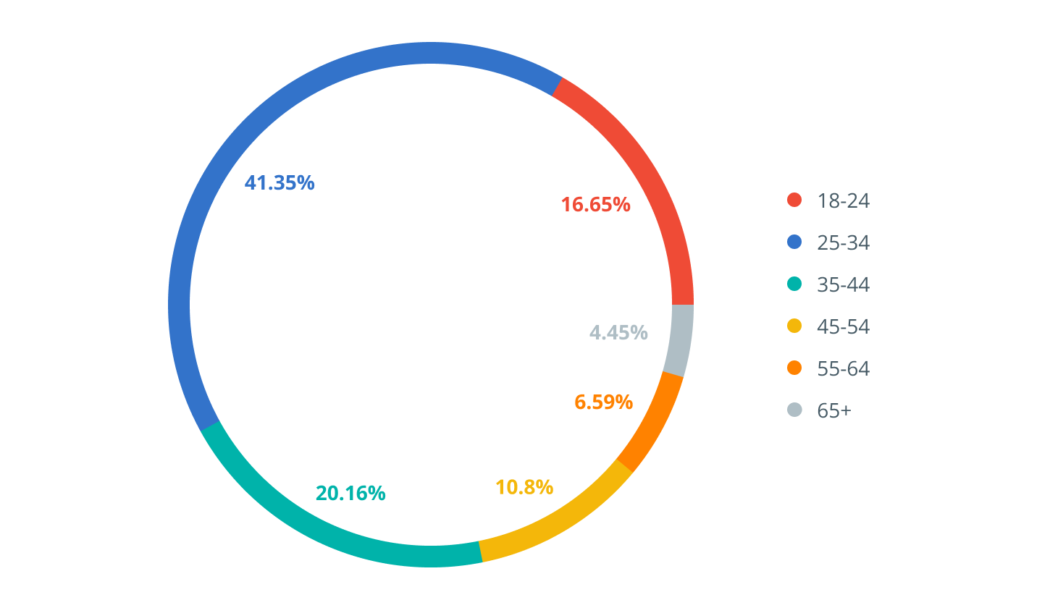

Love it or hate it, crypto’s vibe shift is now imminent

Last month, cultural critic Alison P. Davis published an article in The Cut titled “A Vibe Shift is Coming. Will Any of Us Survive It?” The “vibe shift” Davis was referring to had nothing to do with crypto. She was referring to a sea change in pop culture and social trends, particularly in view of GenZ’s ongoing ascendance into trendsetting and cultural relevance. Nevertheless, her positioning caught my eye because she aptly put her finger on something crucial that I’ve also been feeling, particularly as it relates to crypto. The paradigm shift toward the next cultural moment — whatever it is — is perceptible, even if it’s not palpable. We can’t quite make it out, but we know it’s in the room. The concrete conditions haven’t shifted yet, but the vibe most certainly has. In the days followi...