cryptocurrencies

$1 million rock NFT sells for a penny in all ore nothing error

It’s a hard rock life for one crypto user. A clumsy keystroke and the actions of a sniper bot caused a million-dollar mistake on March 10. A rock valued at 444 Ether (ETH), or $1.2 million, sold for 444 Wei ($0.0012) to a bot as the seller, DinoDealer, confused WEI and ETH. In a tweet, the seller said “in one click my entire net worth of ~$1 million dollars, gone.” How’s your week? Mine? I just erroneously listed @etherrock #44 for 444 wei instead of 444 eth♂️ Bot sniped it in the same block and trying to flip for 234 eth In one click my entire net worth of ~$1 million dollars, gone Is there any hope? Am I GMI? Can snipers show mercy? pic.twitter.com/yq9Itb2Ukb — Rock dust (@dino_dealer) March 10, 2022 The “bot sniped” refers to bot sniper...

Old but gold: Can digital assets become part of Americans’ retirement plans?

On March 11, the United States Department of Labor warned employers that sponsor 401(k) retirement plans to “exercise extreme care” when dealing with cryptocurrencies and other digital assets, even threatening to pay extra legal attention to retirement plans with significant crypto investments. Its rationale is familiar to any crypto investor: The risk of fraud aside, digital assets are prone to volatility and, thus, may pose risks to the retirement savings of America’s workers. On the other hand, we are seeing established players in the retirement market taking steps toward crypto. For one, retirement investment platform ForUsAll decided last year to implement crypto as an investment option for 401(k) fixed retirement accounts in partnership with Coinbase. Is this the beginning of a large...

Fact or fiction? Did ApeCoin (APE) really drop by 80% since launch?

ApeCoin (APE), the governance token of the well-known Bored Ape Yacht Club (BAYC) NFT project was airdropped to BAYC and Mutant Ape Yacht Club (MAYC) owners at 8.30 am EST on March 17 and only eight hours after APE became tradable in the open market, it has already jumped to the 110th most traded token ranked by CoinGecko, totaling $900 million in trading volume across all tracked platforms. As one would expect, there were some volatile price movements minutes after the airdrop and headlines show the price of APE dropping 80% since its launch. This raises the question of whether the ordinary BAYC and MAYC owner could have sold APE at $40 instead of $14, which it is trading for at the time of publishing. Let’s take a look at APE’s price minutes after the airdrop was claimed and the token li...

Binance tells regulators it will cease operations in Ontario… for real this time

Binance confirmed in an undertaking to the Ontario Securities Commission, or OSC, in Canada dated Wednesday that the crypto exchange will cease activities involving Ontario residents. Binance will also stop opening new Ontario accounts, and provide fee waivers and reimbursements to certain Ontario users under the administration of a third party, the company said. The undertaking appears to mark the end of a disagreement that started in June when Binance announced that it would no longer service Ontario accounts and customers were advised to close out active positions by the end of the year. The month prior to Binance’s announcement, the OSC introduced a new prospectus and registration requirements for cryptocurrency exchanges. In December, Binance told investors that it was allowed t...

Altcoin Roundup: Three layer-1 protocols see inflows amid choppy, volatile market conditions

Layer-1 (L1) protocols are the foundation of the decentralized application ecosystem, with the Ethereum network dominating the landscape in terms of the number of protocols launched on-chain and total value locked (TVL), followed by BNB Chain and Fantom. As the sideways market of 2022 drags on and serious projects use the time away from the frenzy of bull markets to work on development, several L1 protocols have been outperforming the field and making gains despite weakness in the wider crypto market. Here’s a look at three L1 protocols that are seeing growth in their decentralized finance (DeFi) communities and an influx of TVL on their networks. Waves Waves is a multi-purpose blockchain protocol that was originally launched in 2016 and has since undergone several transformations al...

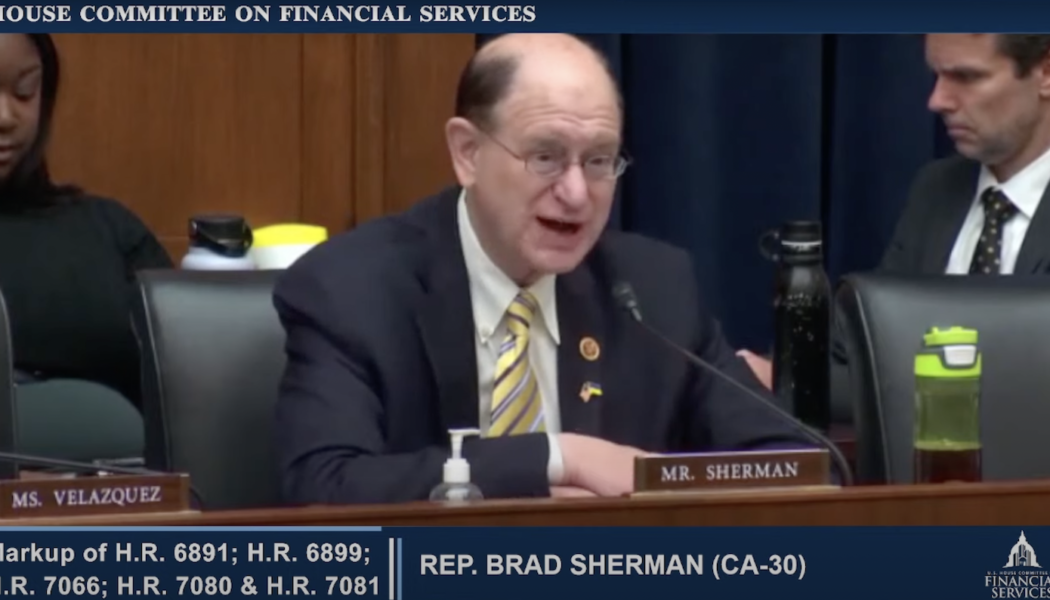

US lawmakers introduce bills that could force crypto exchanges to cut ties with Russian wallets

Representative Brad Sherman will be introducing a bill in the House aimed at cracking down on U.S. businesses handling crypto transactions for Russian banks and individuals. Speaking at a hybrid markup meeting with the House Financial Services Committee on Thursday, Sherman said he will be introducing a companion bill to Senator Elizabeth Warren’s legislation that would give the Biden administration “explicit authority to require that crypto exchanges that are subject to U.S. law stop facilitating transactions with Russian-based crypto wallets.” Warren first announced the legislation on March 8, later saying during a Senate Banking Committee hearing she will be introducing the bill on Thursday. Neither bill’s text is available through congressional records at the time of publication....

How do crypto monitoring and blockchain analysis help avoid cryptocurrency fraud?

The primary functions of a blockchain analysis tools include address classification, providing investigation tools, monitoring transactions and risk analysis. The ability to link blockchain addresses to real-world identities is one of the most common uses of blockchain analysis software. Such tools use a variety of ways to identify real-world items on the blockchain. For instance, standard blockchain analysis techniques include web scraping and clustering algorithms. Clustering is the most prevalent method for identifying entities like exchanges, payment processors and wallets in analysis tools. Similarly, web scraping is utilized to analyze the cryptocurrency market. It can keep track of price changes and preserve them for later use in your database. As a result, you’ll be able to r...

How blockchain intelligence can prevent Russia from evading sanctions

As pointed out by Caroline Malcolm, head of international policy at Chainalysis, the transparent nature of blockchain technology makes it relatively easy for crypto intelligence companies to track funds related to sanctioned entities. “We’re in quite a unique position because of the transparency and the permanency and the immutability of that public record,” explained Malcolm in an exclusive Cointelegraph interview. Governments around the world have expressed concerns that Russia could use crypto to evade sanctions imposed as a response to its military offensive against Ukraine. Addressing those concerns, Malcolm pointed out that in the last few years there has been substantial improvement in the crypto industry’s Anti-Money Laundering and counter-terrorism framewor...

Exodus crypto wallet starts trading on SEC-registered platform

Major software cryptocurrency wallet Exodus has gone public on the digital asset securities firm Securitize Markets following a $75 million crowdfund capital raise. Exodus’ shares started trading on Securitize on Wednesday, allowing investors from all across the United States and international investors from more than 40 countries to trade the Exodus Class A common stock. Trading under the ticker symbol EXOD, the Exodus Class A common stock is digitally represented on the Algorand blockchain via common stock tokens. Tokenized shares in @Exodus_io are now trading on Securitize Markets. Retail investors included! With 24-7 order placement, 8am-8pm ET trading hours, near-instant deposits and promotional $0 fee trading, get started here: https://t.co/h55WEoAQMr pic.twitter.com/JasA5C7Qbx — Sec...

Ukraine’s president signs law establishing regulatory framework for crypto

Volodymyr Zelenskyy, the president of Ukraine currently based in Kyiv, has signed a law establishing a legal framework for the country to operate a regulated crypto market. In a Wednesday announcement, Ukraine’s Ministry of Digital Transformation said Zelenskyy signed a bill named “On Virtual Assets,” first adopted by the country’s legislature, the Verkhovna Rada, in February. Crypto exchanges and firms handling digital assets will be required to register with the government to operate legally in Ukraine, and banks will be allowed to open accounts for crypto firms. The law endows Ukraine’s National Securities and Stock Market Commission with the power to determine the country’s policies on digital assets, issue licenses to businesses dealing with crypto and act as a financial watchdo...

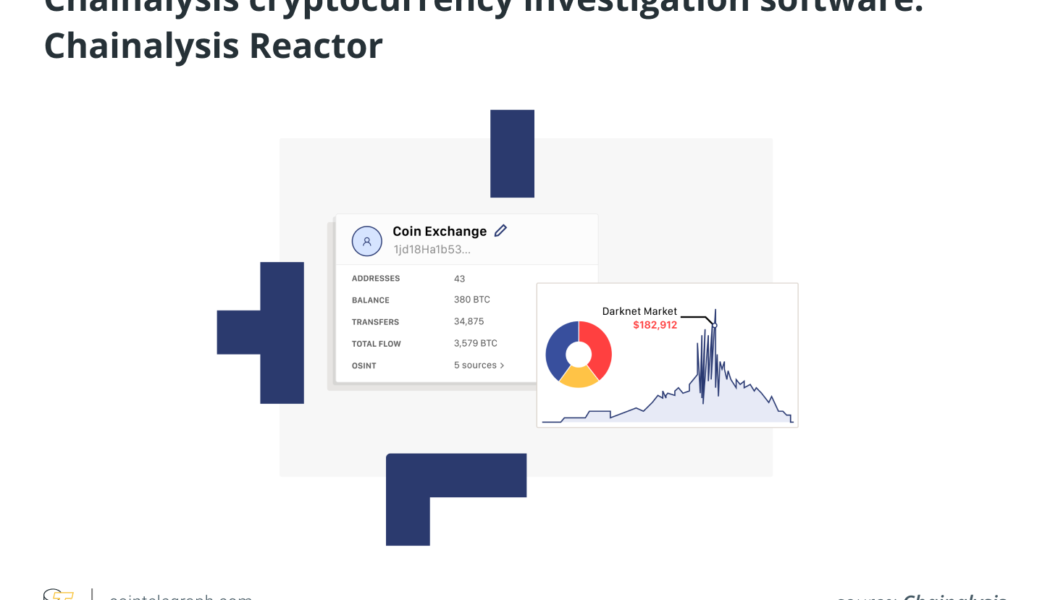

How Chainalysis helps in crypto monitoring and blockchain analysis?

Chainalysis has five different types of products that help in monitoring crypto assets. These are Chainalysis Business Data, Chainalysis KYT, Chainalysis Kryptos, Chainalysis Market Intel and Chainalysis Reactor. Chainalysis Business Data Chainalysis Business Data gives crypto companies an extra layer of customer intelligence, allowing them to understand their customers before and after leaving their platforms, customize product offerings and enhance customer experience. Furthermore, it allows companies to find the most avenues impacting the business and making data-driven decisions. Data is updated on a regular basis to ensure that relevant adjustments are made in response to the changing ecosystem. A simple data warehouse integration allows you to augment current information to...