cryptocurrencies

Crypto vs. physical: Musk-Saylor inflation debate boils down to scarcity

As rising inflation threatens to eat up further the purchasing power of the global fiat ecosystem, finding the perfect hedge against a falling economy has become the need of the hour — especially for the general public across the world. Joining this discussion online, Tesla CEO Elon Musk asked publicly about the probable inflation rate over the next few years to gauge the notion of global investors. Sharing his thoughts on the matter, American billionaire and MicroStrategy CEO Michael J. Saylor opined that with rising inflation, he expects the capital cash flow will move away from traditional fiat into scarce assets such as Bitcoin (BTC). USD consumer inflation will continue near all time highs, and asset inflation will run at double the rate of consumer inflation. Weaker currencies ...

Bank of Israel issues draft guidelines on cryptocurrency AML/CFT

On Friday, the Bank of Israel published a draft regulation on Anti-Money-Laundering and Combatting the Financing of Terrorism (AML/CFT) risk management for the banks facilitating crypto-to-fiat transactions. The move hints at the Israeli government’s preparations to legalize and regulate the relationship between banks and virtual currency service providers (VASPs). The document cites the customers’ increased involvement with digital assets as the rationale for the new policy: “In view of the increase in customer activity in virtual currencies, and the resulting increase in customer requests to transfer money […] the Banking Supervision Department today published a draft circular dealing with managing AML/CFT risks derived from the provision to customers of payment services relat...

23-year-old Australian buys $314k property via planned crypto investments

A young resident from Queensland, Australia played the long game of accumulating Bitcoin (BTC) and Ethereum (ETH) over several years to eventually overcome the soaring real estate prices during the 2020 bull run and own his dream home. The 23-year-old Loi Nguyen started his journey as an investor back in 2017 by purchasing a few hundred dollars worth of BTC, ETH and traditional stocks. However, his interest in crypto reached new heights while pursuing an Economics degree: “Crypto came back into my life when I did a course at the uni on inflation. I learned that Bitcoin can be disinflationary.” Speaking to news.com.au, Nguyen revealed that the lower interest rates (less than 0.5%) offered by traditional banks could never help him break into the real estate market. By following a dollar-cost...

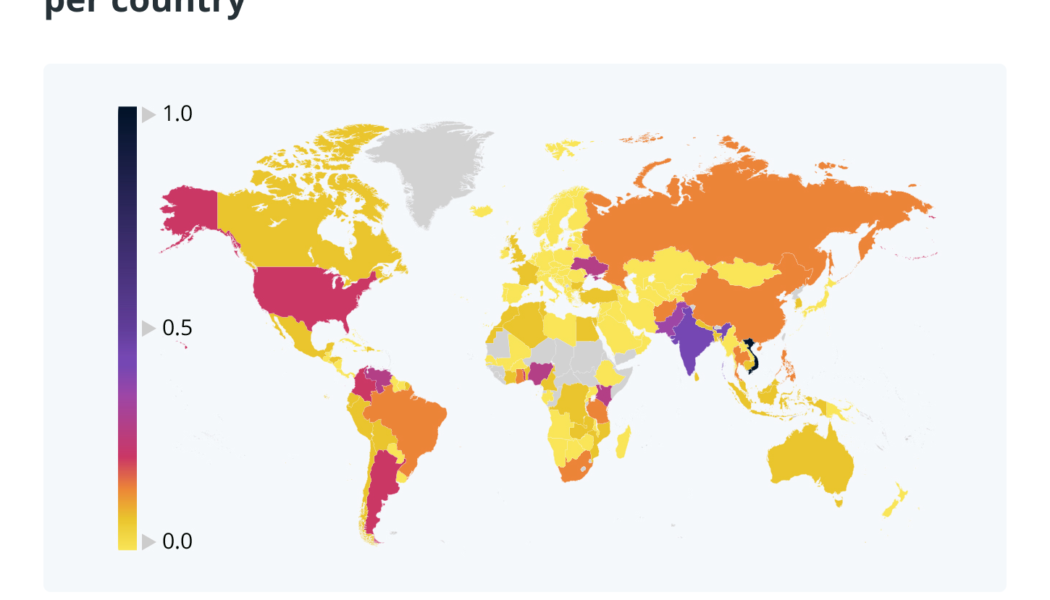

US and EU double down on measures against Russia potentially using crypto to evade sanctions

The United States and the European Union have announced new actions targeting Russia’s economy and wealthy individuals as a report suggests Vladimir Putin’s allies have attempted to circumvent sanctions using cryptocurrency in foreign countries. In a Friday announcement, the White House said leadership from the United States, Canada, France, Germany, Italy, Japan, the United Kingdom and the European Union will take additional actions aimed at economically isolating Russia in response to President Vladimir Putin’s military invasion of Ukraine. The announcement includes banning imports of many Russian goods, banning the export of luxury goods to Russia and guidance for the U.S. Treasury Department to monitor the country’s attempts to evade existing sanctions. “Treasury’s expansive actions ag...

Ally or suspect? The war in Ukraine as a stress test for the crypto industry

It has been two weeks since Russia kicked off the first large-scale military action in Europe in the 21st century — a so-called “special operation” in Ukraine. The military conflict immediately triggered devastating sanctions against the Russian economy from the United States, the European Union and their allies and has put the crypto industry in a position that is both highly vulnerable and demanding. As the world watches closely, the crypto space must prove its own standing as a mature and financially and politically responsible community, and it must defy the allegations of being a safe haven for war criminals, authoritarian regimes and sanctioned oligarchs. Up to this point, it has been going relatively well. But despite reassurances from industry opinion leaders, some experts say that...

In defense of crypto: Why digital currencies deserve a better reputation

Ever since its inception and throughout its turbulent journey toward mainstream acceptance, crypto has elicited both enthusiasm and trepidation in equal measure. After the unfair battering it has received over the years, the time has come to defend digital currencies. Unfortunately for crypto, first impressions count. Bitcoin (BTC) initially gained a tawdry reputation in its early years as the currency of choice for illicit activities — favored by dark web users, ransomware hackers, drug traffickers and money launderers worldwide. But, the world has changed since the first Bitcoin was mined in January 2009. There are now more than 18 million of them in circulation, and more than 90,000 people have $1 million or more stashed away in Bitcoin, according to cryptocurrency data-tracking firm Bi...

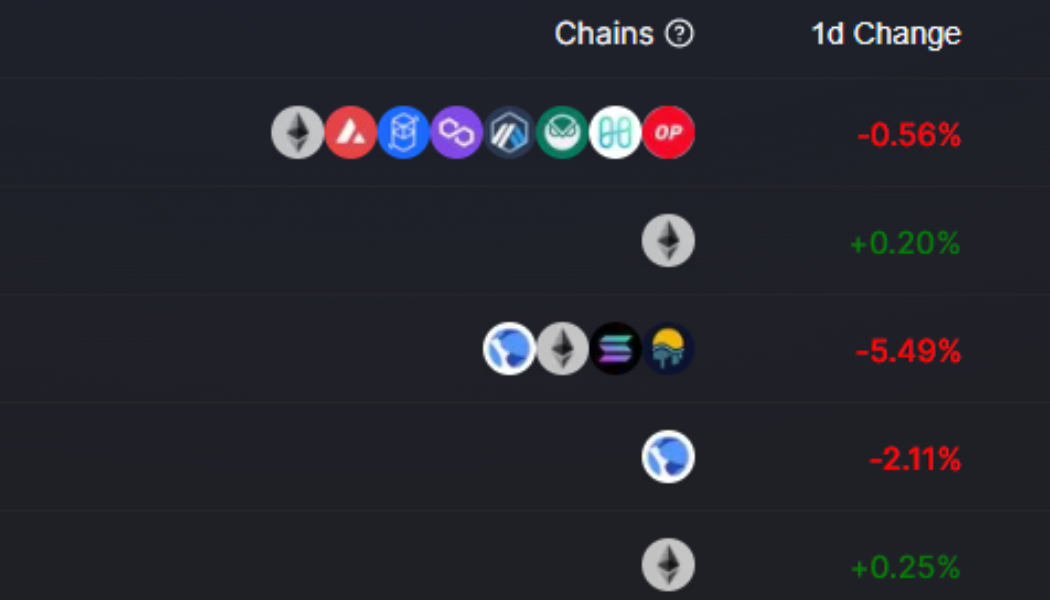

Altcoin Roundup: DeFi token prices are down, but utility is on the rise

The decentralized finance (DeFi) sector has been sitting in the backseat since whipping up a frenzy in the summer of 2020 through the first quarter of 2021. Currently, investors are debating whether the crypto sector is in a bull or bear market, meaning, it’s a good time to check in on the state of DeFi and identify which protocols might be setting new trends. Here’s a look at the top-ranking DeFi protocols and a review of the strategies used by users of these protocols. Stablecoins are the foundation of DeFi Stablecoin-related DeFi protocols are the cornerstone of the DeFi ecosystem and Curve is till the go-to protocol when it comes to staking stalbecoins. Top 5 protocols by total value locked. Source: Defi Llama Data from Defi Llama shows four out of the top five protocols in terms of to...

Terraform Labs donates $1.1B for Luna Foundation Guard‘s reserves

On Friday, Do Kwon, founder and CEO of Terraform Labs, which develops the blockchain ecosystem consisting of Terra Luna (LUNA) and the TerraUSD stablecoin (UST), announced that TFL had donated 12 million LUNA, or $1.1 billion at the time of publication to the Luna Foundation Guard (LFG). LFG launched in January to grow the Terra ecosystem and improve the sustainability of its stablecoins. Kwon noted that the funds, denominated in LUNA, will be burned to mint UST to grow the LFG‘s reserves: “We will keep growing reserves until it becomes mathematically impossible for idiots to claim de-peg risk for UST.” UST is an algorithmic stablecoin with a theoretical exchange rate of 1:1 with the U.S. dollar and is in part maintained by swapping of/for LUNA tokens when its market value deviates from it...

Immutable X (IMX) gains 50% following the close of a $200M fundraising round

Non-fungible token (NFT) projects have been hard hit by the price decline across the cryptocurrency ecosystem and the current bearish conditions have spared few tokens from a price collapse. One project that is attempting to get back on solid footing is Immutable X (IMX), an NFT-focused layer-2 (L2) scaling solution for the Ethereum (ETH) network designed to offer near-instant transactions and zero gas fees for minting and trading. Data from Cointelegraph Markets Pro and TradingView shows that the price of IMX has climbed 69.6% since hitting a low of $1.09 on March 7 to hit a daily high of $1.86 on March 11. IMX/USDT 4-hour chart. Source: TradingView Three reasons for the reversal in IMX include the completion of a $200 million Series C funding round, the launch of new projects on the plat...

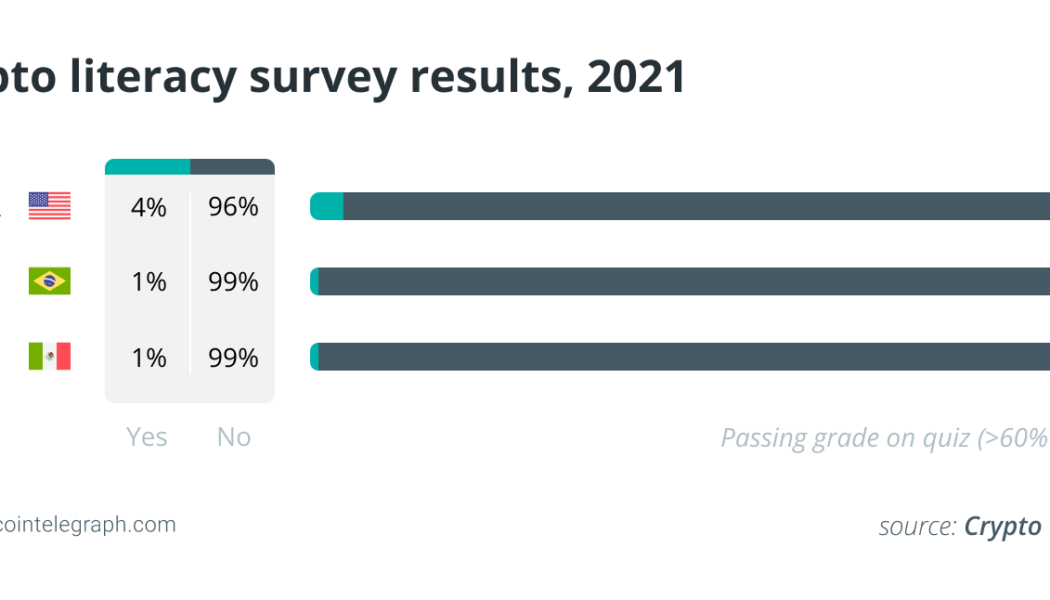

Crypto education can bring financial empowerment to Latin Americans

In October 2021, it was estimated that approximately 15% of the world’s supply of Bitcoin (BTC) was in circulation in Latin America. According to a recent report released by Crypto Literacy, however, 99% of Brazilian and Mexican respondents failed a basic assessment on crypto literacy. Crypto adoption is well underway across the region — on the rise even — but, people still lack a basic understanding of its underlying technology and use cases. When this lack of basic crypto literacy is considered in the context of developing markets across Latin America, where the use cases for blockchain technologies hold real significance, it becomes a serious concern. Latin American populations who lack crypto literacy risk missing out on stablecoins that can offer protection against Latin America...

Fantom Foundation issues clarification statement about departure of Andre Cronje and Anton Nell

Recently, media outlet Rekt.news made striking accusations about Fantom Opera, a layer-1 blockchain, after the foundation’s technical adviser Andre Cronje and senior solutions architect Anton Nell announced they were leaving the crypto space entirely. Almost immediately, concerns from the community arose after Nell tweeted, “There are around ~25 apps and services that we are terminating on 03 April 2022.” In the now-deleted Rekt article, it alleged the following: “Fantom, Solidly, SpookySwap, Abracadabra, Geist: multiple projects all entwined into a system designed to extract maximum value for a small set of insiders who are now steadily exiting the stage.” However, on Friday, the Fantom Foundation published a statement regarding alleged “factual inaccuracies,” “debunked claims” ...

FBI director: Russia overestimates its ability to bypass US sanctions using crypto

Christopher Wray, the director of the Federal Bureau of Investigation, said that fiat was a more likely avenue for Russia to explore in circumventing sanctions, given the United States’ ability to block efforts using crypto. In a Thursday hearing of the Senate Select Committee on Intelligence, New Mexico Senator Martin Heinrich asked the FBI director if Russia might respond to the economic impact of the United States banning imports of the country’s oil and gas by using reserves of gold, China’s currency or cryptocurrency. Director Wray said the FBI and its partners had “built up significant expertise” on digital assets, citing the department’s recent work in seizing large amounts of tokens as evidence there were vulnerabilities in using crypto to get around sanctions. “The Rus...