cryptocurrencies

Inflation spikes in Europe: What do Bitcoiners, politicians and financial experts think?

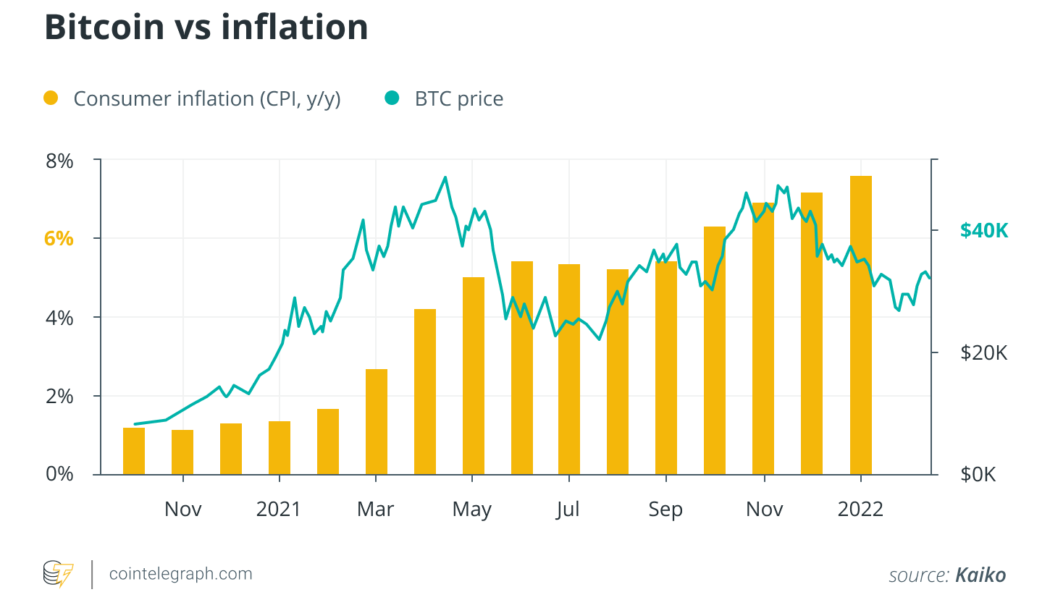

Rising prices are grabbing headlines all over the world. Across the pond in the United States, inflation recently broke a 40-year record. The situation is severe in Europe, with prices rising over 5% across the Eurozone and 4.9% in the United Kingdom. While prices rise, Bitcoin (BTC) is flatlining at around $39,000. It poses many questions: Is Bitcoin an effective hedge against rising prices, what role can Bitcoin play in a high inflation environment and did Bitcoiners know that inflation was coming? Experts from the world of Bitcoin, finance and even European politics responded to these questions, sharing their views with Cointelegraph about the alarming price rises in Europe. From data analysts Kaiko’s monthly report, the Bitcoin price marched ahead of inflation, implying...

Crypto-related stocks jump in positive reaction to executive order

The stock prices of crypto-related companies have jumped as the broader market reacted positively to President Joe Biden’s long-awaited executive order requiring US federal agencies to create a regulatory framework for digital assets, as well as exploring a future digital dollar. Coinbase (COIN) surged, up 10.5% at market close, while shares in Bitcoin-evangelist Michael Saylor’s MicroStrategy (MSTR) posted a 6.4% gain, according to TradingView. Blockchain-related exchanged-traded funds (ETFs) also enjoyed the markets’ renewed confidence in crypto, with ProShares Bitcoin Strategy ETF (BITO) gaining 10% and Valkyrie Bitcoin Strategy ETF (BTF) closing up 10.3%. Cryptocurrency mining companies enjoyed the largest gains with Riot Blockchain Inc. (RIOT) shares up 11.2% and Marathon Digital Hold...

Regulators and industry leaders react to Biden‘s executive order on crypto

Joe Biden has signed his 82nd executive order since being sworn into office in January 2021, directly addressing a regulatory framework for digital assets in a rare moment for the U.S. president. In a Wednesday announcement, the White House said President Biden’s executive order required government agencies to explore the potential rollout of a United States central bank digital currency as well as coordinate and consolidate policy on a national framework for crypto. Many media outlets previously reported the U.S. president had initially planned to sign the executive order in February, an event that was likely postponed following Russia’s military actions in Ukraine. The reaction from many industry leaders compared the executive order to a regulatory opportunity — Biden had rarely sp...

Bitcoin rallied, but analysts say it’s ‘more of the same’ until $46K becomes support

“Volatility” is the word of the month and that is exactly what cryptocurrency investors saw today as Bitcoin rallied after concerns over the Biden administration’s executive order on crypto turned out to be a ‘nothingburger’. Data from Cointelegraph Markets Pro and TradingView shows that after trading near the $39,000 mark for the past few days, the price of Bitcoin (BTC) spiked 10.42% to an intraday high at $42,606 on as cautious traders flooded back into the market. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what traders and analysts in the market are saying about this latest move and the areas of support and resistance to keep an eye on. “Different pump, same story” Wednesday’s move for Bitcoin was just a repeat of recent be...

Dubai establishes virtual asset regulator and announces new crypto law

Sheikh Mohammed bin Rashid Al Maktoum, the ruler of Dubai in the United Arab Emirates who holds several positions including prime minister, has announced a new law on virtual assets as well as the establishment of a crypto regulator. In a Wednesday announcement, Sheikh Al Maktoum said he had issued a law creating a legal framework for crypto in the Emirate of Dubai aimed at protecting investors and “designing much-warranted international standards” for industry governance. In addition, the ruler said a newly formed Dubai Virtual Asset Regulatory Authority, or VARA, would have enforcement powers in the Emirate’s special development zones and free zones with the exception of the Dubai International Financial Centre. “Approving the virtual asset law and establishing the Dubai Virtual As...

How to navigate cryptocurrency tax implications amidst the CPA shortage

Cryptocurrency is a hot topic worldwide, especially with prices of Bitcoin (BTC), Ethereum (ETH) and other cryptocurrencies hitting higher thresholds and resulting in another banner year for investors. While the earnings look good on paper, one factor is often left to consider –– that is, crypto taxes. It is not uncommon for traders to take advantage of the constant fluctuations, buy the dip, sell the uptrend, and repeat it frequently. Unfortunately, each transaction is considered a taxable event, making the conversation about cryptocurrency taxes a daunting one. The impending crackdown on cryptocurrency taxation only spurs on the need to start the conversation. This crackdown is far from recent, with 2021 headlines of an IRS chief stating the country was losing trillions of dollars in unp...

Happy International Women’s Day! Leaders share their experiences in crypto

The International Women’s Day theme this year is #BreakTheBias, so Cointelegraph spoke to 10 leaders in the blockchain industry about their experiences as women in Web3 and gathered their advice. From discussing barriers to entry to nonfungible tokens and role models, the following comments are from women in the U.S., Latin America, Europe and Asia. When asked what the current barriers to entry that women may face when considering careers in crypto, Dr. Cagla Gul Senkardes, Co-founder of the Istanbul Blockchain Women Association and lecturer at Istanbul Bilgi University, flatly answered “bias.” Speaking from a more academic point of view, Senkardes sees gender bias and culturally constructed ideologies in the context of cryptofeminism, the concept of havin...

Which Terra-based coins have the most explosive potential? | Find out now on The Market Report live

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss which Terra-based coins you should be looking out for in 2022. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up, the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they debate which Terra-based coin has the most explosive potential. Will it be Bourgi’s pick of StarTerra, which capitalizes on blockchains’ biggest trends — play-to-earn, nonfungible tokens (NFTs) and staking — basically combining multiple multibillion-dollar industri...

Swiss crypto bank Sygnum secures in-principal approval in Singapore

Sygnum Singapore, a subsidiary of Switzerland-based cryptocurrency bank Sygnum, is expanding services after securing new regulatory approval from local authorities. The company announced Tuesday that Sygnum Singapore received in-principle approval from the Monetary Authority of Singapore (MAS) to offer three additional regulated activities under capital markets services (CMS) license. The CMS license was initially granted in 2019, allowing Sygnum Singapore to conduct asset management activities. The latest in-principle regulatory approval upgrades Sygnum Singapore to enable new tools like providing corporate finance advisory services, dealing with tokenized capital market products and digital assets, as well as offering custodial services for asset and security tokens. With the additional ...

Mama Bitcoin: Fishing for female empowerment with crypto in West Africa

Mama Bitcoin is the pseudonym claimed by a young Senegalese Bitcoiner called Bineta. Her business, Bleu comme la mer, was the first retailer in Senegal (and possibly West Africa) to accept crypto as payment. She’s also the first generation of her family to read and write proficiently. The name Mama Bitcoin takes inspiration from the initials of her name, while the “mama” not only reflects her motherly instincts but serves to inspire other women in West Africa to get into blockchain technology and Bitcoin (BTC). She told Cointelegraph: “There are very few women that are active in the blockchain space around the world and the situation is no different in Senegal. I wanted to shine a light on being a woman in the crypto industry.” Bineta first stumbled across Bitcoin in early 2017 thank...

FinCEN includes crypto in alert on Russia potentially evading sanctions

The United States Financial Crimes Enforcement Network, or FinCEN, a bureau of the Treasury Department, has warned financial institutions to consider crypto as a possible means Russia may attempt to use to evade sanctions related to the country’s military action in Ukraine. In a Monday alert, FinCEN reminded U.S.-based financial institutions “with visibility into cryptocurrency” and convertible virtual currency, or CVC, to report any activity that could be considered a potential way for Russia to evade sanctions imposed by the U.S. and its allies. While the U.S. watchdog said that the Russian government using CVCs to evade large scale sanctions was “not necessarily practicable,” financial institutions were obligated to report such activities from Russian and Belarusian individuals named in...

European Parliament will hold vote on crypto bill without PoW provision

The parliament of the European Union has scheduled a vote on a framework aimed at regulating cryptocurrencies after addressing concerns over proof-of-work mining. In a Monday Twitter thread, European Parliament Committee on Economics and Monetary Affairs member Stefan Berger said the committee will vote on the Markets in Crypto Assets, or MiCA, framework on March 14 following the submission of a final draft of the bill. As the rapporteur — the person appointed to report on proceedings related to the bill — Berger said the legislation will no longer include text that some had interpreted as a possible ban on proof-of-work crypto mining. “With MiCA, the EU can set global standards,” said Berger. “Therefore, all those involved are now asked to support the submitted draft & to vote for MiC...