cryptocurrencies

Impermanent loss challenges the claim that DeFi is the ‘future of France’

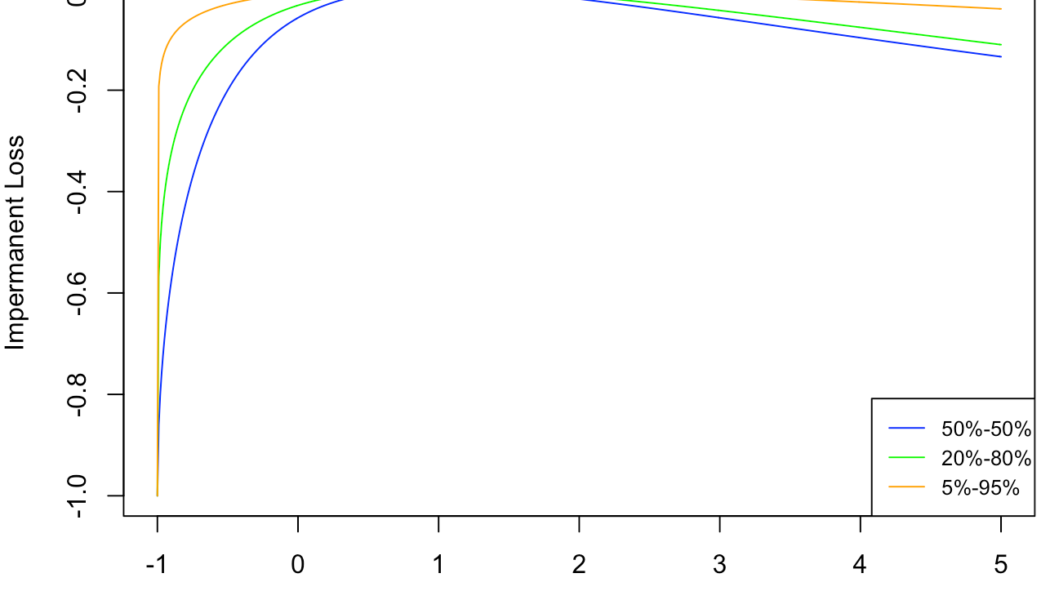

Impermanent loss is one of the most recognized risks that investors have to contend with when providing liquidity to an automated market maker (AMM) in the decentralized finance (DeFi) sector. Although it is not an actual loss incurred from the liquidity provider’s (LP) position — rather an opportunity cost that occurs when compared with simply buying and holding the same assets — the possibility of getting less value back at withdrawal is enough to keep many investors away from DeFi. Impermanent loss is driven by the volatility between the two assets in the equal-ratio pool — the more one asset moves up or down relative to the other asset, the more impermanent loss is incurred. Providing liquidity to stablecoins, or simply avoiding volatile asset pairs, is an easy way to reduce impermanen...

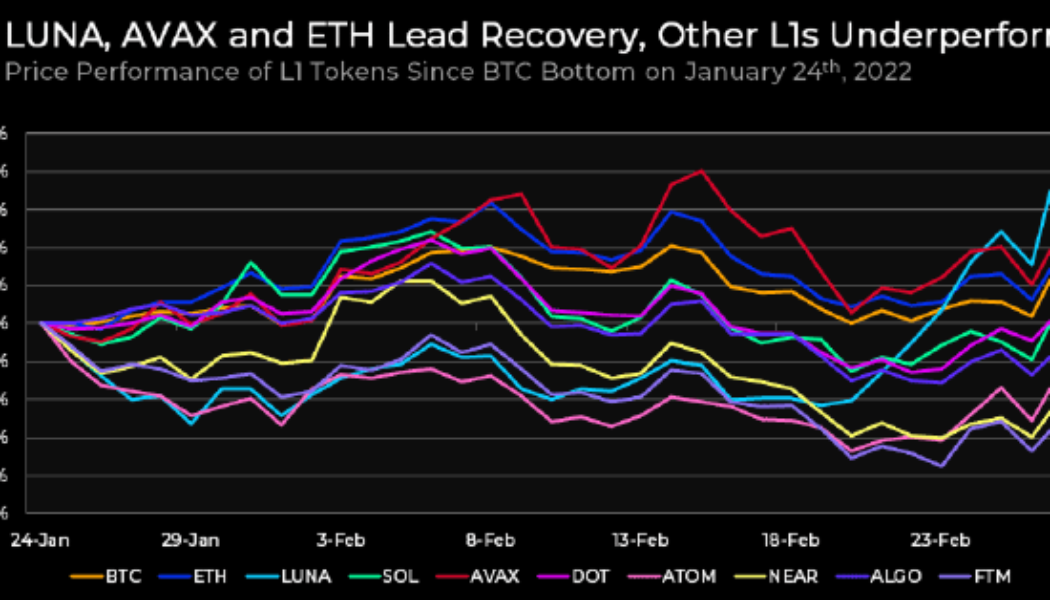

Terra, Avalanche and Osmosis lead the L1 recovery while Bitcoin searches for support

The layer-one (L1) ecosystem has received increased attention in recent months as users search for new investment opportunities in the Cosmos (ATOM), Fantom (FTM) and NEAR. Following January’s market sell-off, where Bitcoin (BTC) price dropped to bottom below $34,000, much of the L1 field has struggled to regain its momentum. Price performance of L1 tokens since Jan. 24. Source: Delphi Digital According to data from Delphi Digital, since the BTC bottom on Jan. 24, the only L1 to experience a notable gain in price include Terra (LUNA), Avalanche (AVAX) and Ethereum (ETH). Terra ecosystem growth The price growth seen in LUNA was in large part due to the announcement from the Luna Foundation Guard that it had raised $1 billion to form a Bitcoin reserve for the ecosystem’s Terra US...

Crypto industry seeks to educate, influence US lawmakers as it faces increasing regulation

Interaction between the cryptocurrency industry and Capitol Hill is becoming ever more intensive as efforts to regulate crypto grow in tandem with its popularity. The surge in crypto industry lobbying last year was given some concrete parameters in February by crypto analytics startup Crypto Head. It released a report showing that the crypto companies that spent the most money on lobbying in 2021 were Robinhood, Ripple Labs, Coinbase and the Blockchain Association. These organizations were the lobbying leaders during the past five years as well, although with different rankings. Here is what the United States crypto-lobbying landscape looks like today. Metrics of influence Robinhood spent $1.35 million on lobbying in 2021 and was the only crypto-related organization to spend more than $1 m...

Ukraine finds unlikely ally in efforts to bar Russian access to crypto: The Central Bank of Russia

Recently, Ukraine has called for “sabotage” of everyday Russians’ crypto assets due to an ongoing war between the two countries. Among many, its European allies have also voiced mounting concerns that Russia may use crypto to bypass Western sanctions. But ironically, it appears that one of the greatest proponents of barring everyday Russians and financial institutions from accessing cryptocurrencies is actually the Central Bank of Russia, or CBR, itself. As reported by local news outlet tass.ru on Thursday, the CBR continues to adhere to its position of proposing to ban the issuance, mining, and circulation of cryptocurrencies in the Russian Federation. A CBR official stated: “The Central Bank currently supports the position that was previously announced ...

Altcoin Roundup: JunoSwap, Solidly and VVS Finance give DeFi a much-needed refresh

Decentralized finance (DeFi) was the talk of the town in early 2021, but it has since taken a back seat to more appealing sectors like nonfungible tokens (NFTs), memecoins and blockchain gaming. Now that cross-chain bridges and interoperability have allowed for the easier migration of assets to competing chains, a new class of DeFi protocols is arising to challenge those left from 2021. Here’s a look at three DeFi projects that have launched on some of the up-and-coming layer-1 blockchain networks, catching the eye of the crypto community. VVS Finance VVS Finance is the largest DeFi protocol on the Cronos network, a project that emerged out of the Crypto.com ecosystem which has since been fully rebranded to Cronos (CRO). The goal of VVS Finance is to offer instant swaps with low fees...

What is the Crypto Fear and Greed Index?

Various Crypto Fear and Greed Index signals that influence the behavior of traders and investors include Google trends, surveys, market momentum, market dominance, social media and market volatility. To determine how much greed is trending in the market, examine trending search phrases. For instance, a high volume of Bitcoin-related searches means a high degree of greed among investors. This factor accounts for 10% of the index value. Historically, increases in Bitcoin-specific Google searches have been correlated with an extreme volatility in crypto prices. To calculate the number each day, the Bitcoin Fear and Greed Index considers a few other factors, such as surveys, which account for 15% of the index value. Surveys with participants of over 2000 drive the index value higher, indicatin...

REN price gains 65% after Catalog launch brings a cross-chain DEX to its blockchain

Decentralized finance projects like Ren pumped in 2021, only to finish the year right back where they started as high fees on Ethereum (ETH) led to decreased activity for many protocols and DeFi took a backseat to more popular sectors like nonfungible tokens (NFTs). Now, it appears as though that downtrend is in the process of reversing course after recent global events highlighted the benefits of DeFi and holding assets outside the traditional financial system. This week REN price climbed 69% from a low of $0.247 on Feb. 24 to a daily high of $0.418 on March 3. REN/USDT 4-hour chart. Source: TradingView Three reasons for the potential price reversal in REN are the launch of its first layer-one application Catalog, the launch of VarenX on Polygon and several new partnerships and inte...

Bitcoin slides under $39K, leading some traders to forecast a weekend ‘oversold bounce’

March 4 saw another day of seesaw price action for Bitcoin (BTC) and the wider cryptocurrency market as the global economic fallout from the ongoing conflict in Ukraine weighs heavily on a majority of the world’s financial markets. Data from Cointelegraph Markets Pro and TradingView shows that after holding $41,000 in the early trading hours on March 4, a wave of selling in the afternoon dropped the price of BTC below $39,100. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts have to say about the outlook for BTC moving forward as the world faces a period of increased economic uncertainty. A potential retest of $38,000 BTC/USD 1-week chart. Source: Twitter According to Rekt Capital, $43,100 is an important level for BTC because the last time Bitcoin clo...

City-building startup Praxis secures $15M in Series A Funding

Peter Thiel-backed city-building startup Praxis has raised $15 million in Series A funding from a variety of crypto venture firms led by Paradigm Capital, Sam Bankman-Fried‘s Alameda Research and Three Arrows Capital. Dryden Brown of New York University and Charlie Callinan of Boston College co-founded Praxis, formerly Bluebook Cities, in 2019. they described their goal as: “building the city-crypto state to realize a more vital future,” according to the company website. Praxis wants to pivot away from “artificially scarce metaverses” to build a city-state that is organized around “shared values,” rather than the “labor market principles of the Industrial Age.” The cryptocurrency-run city will reportedly focus heavily on functional architecture and environmental technology. Money made from...

Anti-war Russians start donating crypto to support Ukraine

While the West is growing increasingly concerned over Russia’s potential use of cryptocurrencies to evade sanctions, some Russians are using their Bitcoin (BTC) to help Ukrainian people. Pavel Muntyan, a renowned Russian animation producer and creator of the animated web series “Mr. Freeman,” has called on anti-war Russians to support Ukrainian citizens amid Russia’s ongoing military attack on the country. Muntyan took to Twitter on Tuesday to announce the opening of a cryptocurrency donation address for Russians who want to support Ukrainian people anonymously as Russia has banned its citizens from helping people in Ukraine. On Feb. 27, Russia’s General Prosecutor’s Office officially warned that any assistance to Ukrainians amid Russia’s “special operation” in the country would be conside...

Analysts say bulls will aim for $48K now that Bitcoin’s ‘accumulation phase’ has begun

Investor sentiment across the cryptocurrency ecosystem has seen a significant shift in the positive direction over the past week, despite events in the wider world. Currently, Bitcoin (BTC) is back above $43,500 and many altcoins are also witnessing double-digit gains. Crypto Fear & Greed index. Source: Alternative The ongoing conflict in Ukraine and recent actions taken by governments to limit access to banking services may have helped to shine a light on the value of holding cryptocurrencies, which offers some protection against uncontrollable events and what some might perceive as government overreach. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has oscillated between $43,350 and $45,400 on March 2 as the world awaits some form of resolution to th...

Dogecoin community donates $53K to Ukraine as country hints at upcoming airdrop

With the price of the meme-based token Dogecoin (DOGE) higher than that of the Russian ruble, Ukraine opened to DOGE donations for the first time. Ukraine’s Minister of Digital Transformation Mikhail Fedorov announced on Wednesday that the token had “exceeded Russian ruble in value” — though the ruble has dropped significantly against the U.S. dollar in the wake of U.S. and EU sanctions, its price has been lower than DOGE’s since January 2021. According to data from Cointelegraph Markets Pro, the price of Dogecoin is roughly $0.13 at the time of publication, having fallen by less than 1% over the last 24 hours. However, Fedorov’s message on Twitter also called for DOGE proponents including Tesla CEO Elon Musk and Dogecoin founder Billy Markus to donate to Ukraine’s militar...