cryptocurrencies

Canada to host Bitfury’s new 28MW crypto mining facility

Blockchain company Bitfury announced the launch of a new crypto-mining data center in Ontario, Canada. The new crypto mining center adds to the list of existing Canadian sites currently operating in Drumheller, Alberta and Medicine Hat. Bitfury partnered with Hut 8 Mining, a Toronto Stock Exchange-listed Bitcoin (BTC) mining company, to set up mining operations across North America. The new crypto mining facility in Ontario is expected to operate at 16 megawatts (MW) by the end of this month. Bitfury mining facility in Medicine Hat. Source: Hut 8 According to the announcement, Bitfury has plans to add 12MW capacity in the coming months, which will bring up the total capacity of the mining facility to 28MW by May end. However, the company highlighted that the facility could be potentia...

Crypto community welcomes Ethereum zkSync testnet

zkSync, a provider of zero-knowledge blockchain solutions, has announced the successful deployment of its Rollup protocol on the Ethereum (ETH) testnet. The deployment is seen as a positive development by proponents of Ethereum, as it removes the need for human operators to validate transactions. Last year, the creators of zkSync described their vision for a permissionless, Turing-complete rollout that allows decentralized applications (DApps) to be deployed in a low-cost and scalable layer-2 environment. Users will supposedly have “a better” experience on this network, according to the official announcement by Matter Labs. One of the major issues when utilizing the Ethereum blockchain is its prohibitively high gas fees. As a result, many users and developers have mig...

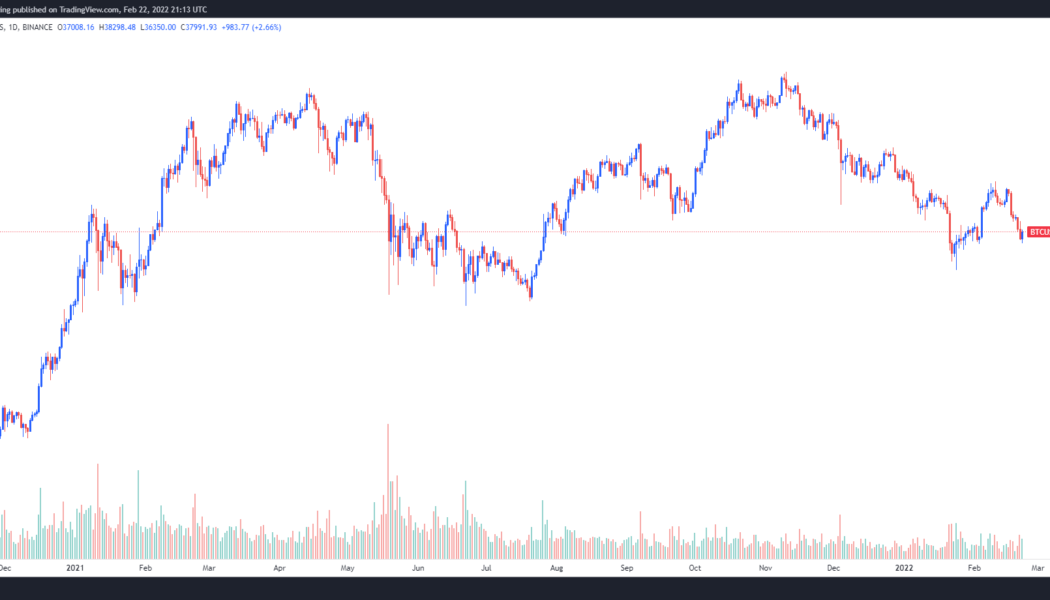

Bitcoin price could ‘probe lower’ as volumes dip and macroeconomic issues loom overhead

Bitcoin’s sell-off appears to be taking a pause even though the United States rolled out new sanctions against Russia on Feb 22. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) continues to hover slightly below $38,000, which some analysts have identified as a significant support and resistance zone. BTC/USDT 1-day chart. Source: TradingView Here’s a closer look at what analysts are saying about Bitcoin price and what levels to keep an eye on in the short-term. 25% of entities are underwater On-chain data outlet, Glassnode, posted the following chart analyzing the percentage of entities in profit and the analysts concluded “that the proportion of on-chain entities in profit is oscillating between 65.78% and 76.7% of the network.” Percent...

Tourism in El Salvador up 30% since Bitcoin adoption, minister says

El Salvador’s adoption of Bitcoin (BTC) as legal tender in September 2021 has triggered a notable surge not only for its gross domestic product (GDP) but also for the local tourism development. According to Salvadoran Tourism Minister Morena Valdez, the tourism industry in El Salvador has surged more than 30% since the adoption of the Bitcoin law in September 2021. “We did a poll to check the activity according to the before and after of Bitcoin. The tourism sector increased in November and December. This increased by more than 30%,” Valdez said in an interview with the local news agency El Salvador News English on Monday. Boom! El Salvador’s tourism has grown by 30% since the Bitcoin Lawhttps://t.co/i8t6JRHD1a#ElSalvador #BitcoinLaw #bitcoin #bitcoininvestment #Abtc #tourism #BitcoinCity ...

Komodo (KMD) rallies 54% after major push to expand interoperability with AtomicDEX

Interoperability between separate blockchain networks has become a major theme in the cryptocurrency market over the past year, but several major exploits — such as the $321 million Wormhole exploit — have highlighted the difficulties in achieving cross-chain transfers in a secure manner. One protocol that has been gaining traction in February thanks to its alternative approach to achieving cross-chain interoperability is Komodo, an open, composable multichain platform that is home to the AtomicDEX wallet and non-custodial decentralized exchange. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $0.446 on Feb. 20, the price of the platform’s KMD token surged 54% to a daily high of $0.687 on Feb. 22. KMD/USDT 4-hour chart. Source: TradingView Three r...

Future of finance: US banks partner with crypto custodians

Grayscale Investments’ latestreport “Reimagining the Future of Finance” defines the digital economy as “the intersection of technology and finance that’s increasingly defined by digital spaces, experiences, and transactions.” With this in mind, it shouldn’t come as a surprise that many financial institutions have begun to offer services that allow clients access to Bitcoin (BTC) and other digital assets. Last year, in particular, saw an influx of financial institutions incorporating support for crypto-asset custody. For example, Bank of New York Mellon, or BNY Mellon, announced in February 2021 plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients. Michael Demissie, head of digital assets and advanced solutions at BNY ...

OpenSea planned upgrade stalls as phishing attack targets NFT migration

Just yesterday, OpenSea announced a smart contract upgrade, which requires users to migrate their listed NFTs from Ethereum (ETH) blockchain to a new smart contract. As a direct result of the upgrade, users that don’t migrate over from Ethereum risk losing their old, inactive listings — which currently require no gas fees for migration. Major nonfungible token (NFT) marketplace OpenSea has reportedly fallen victim to an ongoing phishing attack within hours after announcing a week-long planned upgrade to delist inactive NFTs on the platform. However, the urgency and short deadline opened up a small window of opportunity for hackers. Within hours after OpenSea’s upgrade announcement, reports across multiple sources emerged about an ongoing attack that targets the soon-to-be-delis...

Mining worldwide: Where should crypto miners go in a changing landscape?

One of the main themes among the crypto community in 2021 was China’s aggressive policy toward mining, which led to a complete ban on such activities in September. While mining as a type of financial activity has not gone away and is unlikely to disappear, Chinese cryptocurrency miners had to look for a new place to set up shop. Many of them moved to the United States — the world’s new mining mecca — while some left to Scandinavia and others to nearby Kazakhstan, with its cheap electricity. Mining activities can’t stay under the radar forever, and governments around the world have begun to raise concerns over electricity capacity and power outages. Erik Thedéen, vice-chair of the European Securities and Markets Authority — who also serves as director general of the Swedish Fina...

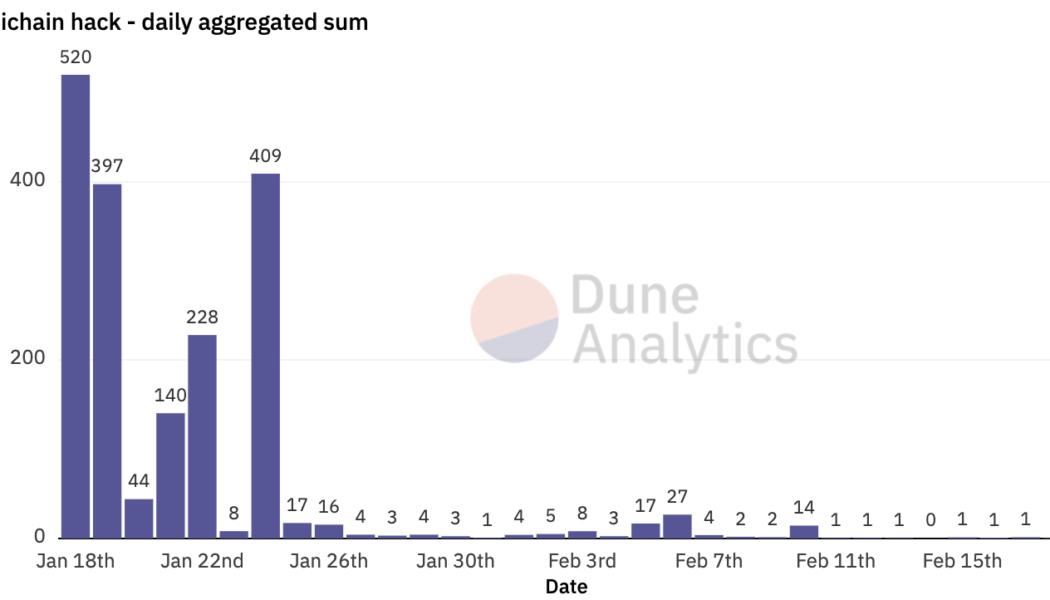

Multichain recovers $2.6M stolen funds, to reimburse losses on condition

After a month-long fight against an ongoing exploit, cross-chain router protocol Multichain announced the recovery of nearly 50% of the total stolen funds, worth nearly $2.6 million of cryptocurrencies. The team has also released a compensation plan to reimburse the users’ losses. On Jan. 10, blockchain security expert Dedaub alerted Multichain about two vulnerabilities in its liquidity pool and router contracts — affecting eight cryptocurrencies including wrapped ETH (WETH), wrapped BNB (WBNB), Polygon (MATIC) and Avalanche (AVAX). 1/3 We recently identified the “phantom functions” code pattern, which would have led to likely the largest crypto hack ever. Your code may be vulnerable! You need to check for the pattern in your Solidity/EVM code! https://t.co/pxRqCQFbnS — Dedaub ...

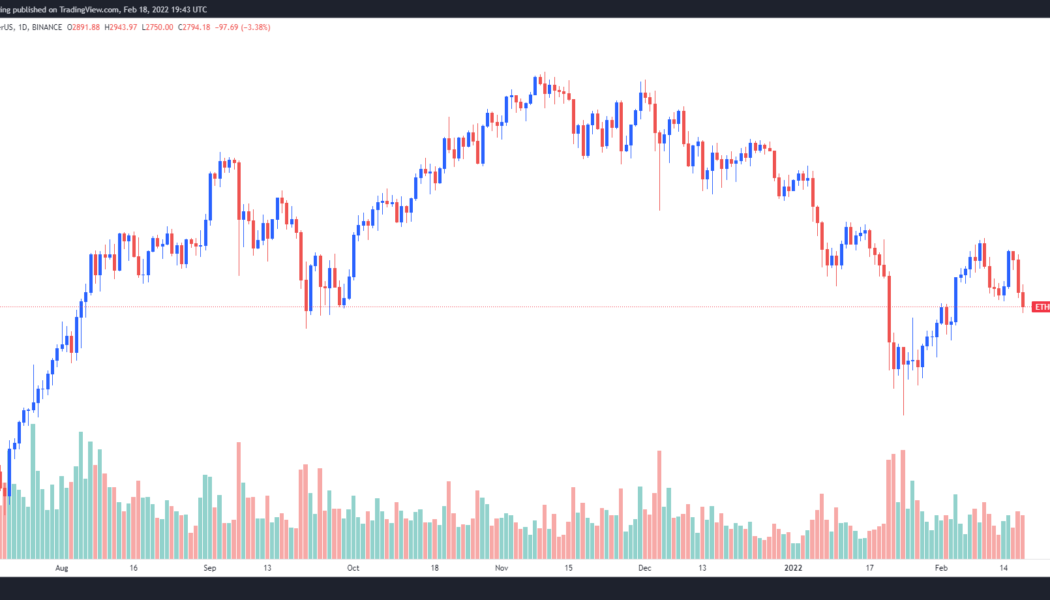

Analyst say Ethereum price could fall to $1,700 if the current climate prevails

Bitcoin (BTC) and Ether (ETH) price are still being hard hit by the current wave of volatility and this is leading traders to go back to the drawing board and readjust their short-term expectations. On Feb.17, Bitcoin price briefly dipped below $40,000 and Ether failed to hold support at $2,900, raises the chance of a drop to $2,500. Data from Cointelegraph Markets Pro and TradingView shows that after hovering near the $2,900 support level through the morning trading hours, Ether was hit with a wave of selling that dropped it to an intraday low of $2,752. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about the price drop for Ether and whether or not more downside is expected as global tensions continue to rise. Ethereum’s nex...