Finance

Naira stable at parallel, official market

Nigeria’s naira remained stable against the U.S. dollar at the unofficial market on Friday, data posted on abokiFX .com, a website that collates parallel market rates in Lagos showed. The data posted showed that the naira closed at N485.00 at the black market, the same rate it exchanged hands with the greenback in the previous session on Thursday. Similarly, the local unit remained stable at the official market. Data posted on the FMDQ Security Exchange window where forex is officially traded showed that the domestic unit again closed at N410.00 at the trading session of the NAFEX window on Friday. Friday’s performance came to be as forex supply slumped significantly. The naira experienced an intraday high of N394.00 and a low of N436.40 before closing at N410.00 on Friday, the same rate i...

5 Institutional Funds Invested in Bitcoin by Late 2020

We saw the astronomical comeback of bitcoin last year, with a lot of people rushing to buy bitcoin. Throughout the first six months of 2020, bitcoin sold under $5,009, however, its price went over $20,000 by the end of the year. It is thought that the growth in institutional funds invested in Bitcoin was the major reason for the increase in the price of bitcoin and the bullish run it experienced. This is because digital assets are fast becoming a class asset. Due to the increased gains of bitcoin and its capacity to hedge against inflation, there is a growth in the number of institutional funds being invested in bitcoin. Also, bitcoin is simple to buy and sell via p2p platforms and easy to make micro remittances. Check out the updated list of where to buy Bitcoin in South Africa. Instituti...

N60 billion mint: PDP demands sack of finance minister

The Peoples Democratic Party, PDP, has called for the sack of Finance Minister, Zainab Ahmed, over what it described as an attempt to mislead Nigerians. The call follows her denial of the revelations by the Edo state Governor, Godwin Obaseki, that N60 billion was printed in March to support federal allocation to states.” Edo State governor Godwin Obaseki had earlier in the week, lamented the sorry state of the nation’s economy, stressing that the federal government had to order the printing of currency to the tune of N60 billion to share among the tiers of government, a claim dismissed by the Finance, Budget and National Planning Minister, Zainab Ahmed. In a statement signed by Kola Ologbondiyan, national publicity secretary of the party, the PDP maintained that “the admission by Central B...

Zeepay Ghana Acquires Zambian Mobile Money Platform

Image sourced from Modern Ghana Zeepay Ghana has revealed its plans to acquire a majority stake (51%) in Zambian company Mangwee Mobile Money – although, it is not yet known how much Zeepay paid for the majority stake. “The merger is the first of its kind – that two indigenous African fintech companies in mobile money operations have come together to grow. It represents a wind of change ongoing on the African continent,” reads a statement from Zeepay. Managing Director of Zeepay, Andrew Takyi-Appiah believes that this deal will allow Zeepay to expands its operations through Southern Africa. He says “this will give Zeepay access to Mozambique, Malawi, Angola and Namibia amongst others in our efforts to capture Africa’s $70billion remittance market and opportunity to deploy our award-winning...

Federal government okays N20.1 billion for Nigerian customs equipment

The federal government has approved a total of N20,114,002871 for the acquisition of various operational equipment for the Nigerian Customs Service (NCS). The Minister of Finance, Budget and National Planning, Zainab Ahmed, disclosed this to State House Correspondents after the federal executive council (FEC) meeting presided over by Vice President, Yemi Osinbajo at the presidential villa on Wednesday. The Minister said further that Council also approved the sum of N539,277,673 for the construction of the Federal Inland Revenue Service (FIRS) building at the Ilupeju Medium and Small Taxpayers’ office in Lagos. On the breakdown of contracts approved for Customs, the Minister said a total of 427 operational vehicles, worth N14.55 billion and nine assorted gunboats worth N5,564,002,871 were a...

Payroll fraud: Gombe approves N1.49 billion for biometric system installation

The Gombe State Government has approved the sum of N1.499 billion for the supply and installation of biometric attendance system to check payroll fraud in the state’s civil service. Muhammad Magaji, the state’s Commissioner of Finance and Economic Development, stated this, on Wednesday, while addressing newsmen after the 12th State’s Executive Council meeting. Magaji said the initiative tagged “Gombe state Integrated Payroll Payment Gateway and Human Resource Management Information System’’ would help to reduce, if not eliminate, payroll fraud. According to him, when installed, the system would increase transparency in the payment of salaries and pensions, as well as effectively manage the state’s human resource capacities at both state and local government levels. He stated that the initi...

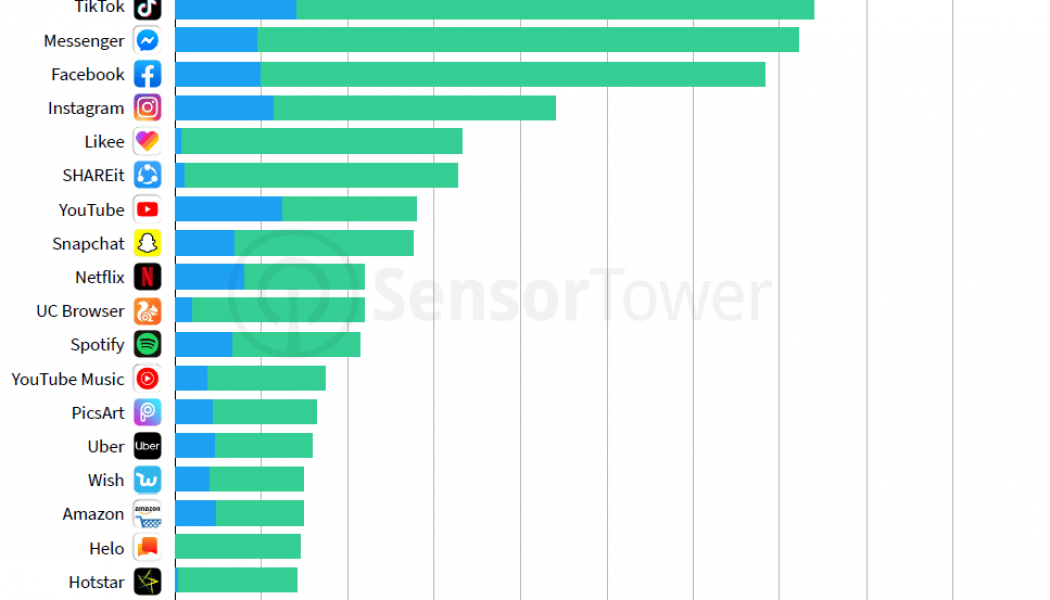

Luno Records $8.3 Billion in Transactions Worldwide

Luno has recorded $8.3 billion in transactions worldwide after recently adding nearly a million new South African customers to its crypto platform. An estimated 15% of South Africans have invested in bitcoin – the second-highest percentage in the world according to the Global Web Index, beating even the USA and Japan. With over 2.1 million users in South Africa, Luno has around the same number of clients as South African Twitter users according to Statistica. It’s also the fifth most popular finance app on iPhone and third on Android – ahead of most of Africa’s biggest banks. A three-month average reveals that more than 145,000 South Africans installed the Luno app each month from November 2020 – January 2021. /* custom css */ .tdi_3_090.td-a-rec-img{ text-align: left; }.tdi_3_090.td-a-rec...

SendSpend Launches Across Sub-Sahara Africa

Image sourced from Sara Fuerte SendSpend has officially launched its global payment system which enables the unbanked to pay online and remit money instantly to each other using only a smartphone. Simply put, millions of unbanked customers throughout Africa with an Internet connection and access to a smartphone will soon be able to use SendSpend, a payment system not restricted to a particular mobile network or financial institution. The platform, which is now available in South Africa, is entirely digital and free for consumers, who can use SendSpend within minutes of registering via a downloaded App. “SendSpend is committed to enhance and uplift the lives of people in underserved local communities. Financial inclusion is a primary focus in achieving one of the UN’s Sustainable Developmen...

Analysts: Printing currency could hurt economy

Analysts have expressed concerns over a recent claim that the federal government resorted to printing money to augment the monthly allocation to the three tiers of government, warning that it could heighten inflationary pressure with dire consequences for the country’s exchange rate and economy. The analysts, in separate interviews with newsmen, warned that a sustained policy of printing the currency, if not well managed, would hurt the economy. The concern came on the heels of recent revelation by Governor of Edo State, Mr. Godwin Obaseki, that due to the dwindling revenue in the face of declining oil revenue arising from the growing sources of alternative sustainable energy, the federal government had to print money to augment the amount available for sharing by the federal, state and lo...