government

US exceptionalism could be tested as digital assets find footing worldwide — Sheila Warren

Sheila Warren, CEO of the Crypto Council for Innovation and former head of data, blockchain and digital assets at the World Economic Forum, said the digital yuan may present certain challenges for the United States. However, regulators and lawmakers may want consider how to encourage digital innovation, as China is already “massively tech forward” for its residents. Speaking to Cointelegraph during Austin’s SXSW festival, Warren said that though she believed China’s digital yuan was unlikely to significantly affect retail payments in the United States, the adoption of the technology surrounding it could impact the dollar’s global dominance. The CCI CEO added that the Federal Reserve could make a “strong move” in preserving the dollar’s role by introducing a central ...

SEC pushes decisions on WisdomTree’s and One River’s applications for spot Bitcoin ETFs

The United States Securities and Exchange Commission has extended its window to approve or disapprove spot Bitcoin (BTC) exchange-traded fund (ETF) applications from asset managers WisdomTree and One River. According to separate Friday filings, the SEC will push the deadline for approving or disapproving a rule change allowing shares of the WisdomTree Bitcoin Trust and One River Carbon Neutral Bitcoin Trust to be listed on the Cboe BZX Exchange and New York Stock Exchange Arca, respectively. The regulator said it would extend its window for the decision on WisdomTree’s Bitcoin investment vehicle to May 15 and One River’s to June 2. The spot BTC ETF application from WisdomTree followed the SEC rejecting a similar offering from the asset manager in December 2021 after several delay...

Malaysian comms official calls the state to legalize crypto and NFTs

The Malaysian Ministry of Communications and Multimedia (KKMM) is reportedly backing the adoption of cryptocurrencies, with the deputy minister calling the government to legalize crypto. Deputy communications and multimedia minister Datuk Zahidi Zainul Abidin has urged Malaysia’s regulators to legalize certain use cases of cryptocurrencies and nonfungible tokens (NFT), local news agency Harian Metro reported on Monday. Zahidi pointed out that such measures would significantly support young people as the cryptocurrency industry has been growing increasingly popular among the younger generation. He also said that the KKMM is exploring ways to increase the participation of young people in the industry. The deputy minister noted that the decision on crypto regulation is up to Malaysia’s financ...

Qatar exploring digital banks and central bank digital currencies

The Qatar Central Bank (QCB) is reportedly investigating the possibility of launching a digital currency and issuing digital bank licenses. According to the head of the fintech section at QCB, Alanood Abdullah Al Muftah, the central bank is expected to set a direction for its future focus soon on a range of fintech verticals. Al Muftah noted that QCB will also determine whether Qatar can establish a central bank digital currency (CBDC). She explained: “Each central bank should study digital banks, considering their growing significance in the global market. We also see the direction of the market moving toward having a digital currency. However, it’s still being studied whether we’re having a digital currency or not.” While commenting on Qatar’s re...

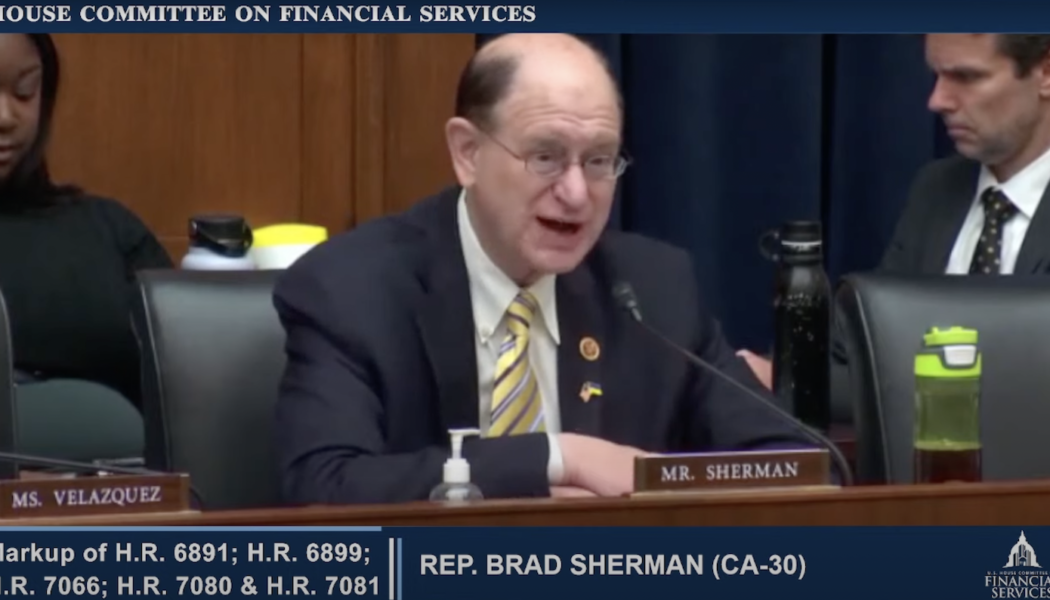

US lawmakers introduce bills that could force crypto exchanges to cut ties with Russian wallets

Representative Brad Sherman will be introducing a bill in the House aimed at cracking down on U.S. businesses handling crypto transactions for Russian banks and individuals. Speaking at a hybrid markup meeting with the House Financial Services Committee on Thursday, Sherman said he will be introducing a companion bill to Senator Elizabeth Warren’s legislation that would give the Biden administration “explicit authority to require that crypto exchanges that are subject to U.S. law stop facilitating transactions with Russian-based crypto wallets.” Warren first announced the legislation on March 8, later saying during a Senate Banking Committee hearing she will be introducing the bill on Thursday. Neither bill’s text is available through congressional records at the time of publication....

How blockchain intelligence can prevent Russia from evading sanctions

As pointed out by Caroline Malcolm, head of international policy at Chainalysis, the transparent nature of blockchain technology makes it relatively easy for crypto intelligence companies to track funds related to sanctioned entities. “We’re in quite a unique position because of the transparency and the permanency and the immutability of that public record,” explained Malcolm in an exclusive Cointelegraph interview. Governments around the world have expressed concerns that Russia could use crypto to evade sanctions imposed as a response to its military offensive against Ukraine. Addressing those concerns, Malcolm pointed out that in the last few years there has been substantial improvement in the crypto industry’s Anti-Money Laundering and counter-terrorism framewor...

Ukraine’s president signs law establishing regulatory framework for crypto

Volodymyr Zelenskyy, the president of Ukraine currently based in Kyiv, has signed a law establishing a legal framework for the country to operate a regulated crypto market. In a Wednesday announcement, Ukraine’s Ministry of Digital Transformation said Zelenskyy signed a bill named “On Virtual Assets,” first adopted by the country’s legislature, the Verkhovna Rada, in February. Crypto exchanges and firms handling digital assets will be required to register with the government to operate legally in Ukraine, and banks will be allowed to open accounts for crypto firms. The law endows Ukraine’s National Securities and Stock Market Commission with the power to determine the country’s policies on digital assets, issue licenses to businesses dealing with crypto and act as a financial watchdo...

Biden’s pick for Fed vice chair for supervision withdraws amid Republican objections

Former Federal Reserve Board governor Sarah Bloom Raskin has withdrawn her name for consideration as the central bank’s vice chair for supervision in an attempt to allow other nominations to move forward. According to a Tuesday tweet from Washington Post journalist Seung Min Kim, Raskin sent a letter to U.S. President Joe Biden withdrawing as his nominee for the next vice chair for supervision of the Federal Reserve, citing “relentless attacks by special interests.” The letter referred to Republican lawmakers who, she said, have “held hostage” her nomination since February. “Their point of contention was my frank public discussion of climate change and the economic costs associated with it,” said Raskin. “It was — and is — my considered view that the perils of climate change must be added ...

Commissioner Allison Lee announces her departure from the SEC

Securities and Exchange Commissioner Allison Herren Lee announced that she would be stepping down from her post at the end of her term in June. In a Tuesday announcement, Lee said that she will remain in the role until her successor has been confirmed. The SEC commissioner has spent less than three years at her current position, having been sworn in in 2019 to serve out the remainder of a five-year term expiring in June. With her departure, Lee, a Democrat who replaced former commissioner Kara Stein, will create a second vacancy at the SEC, with another left open by Republican Elad Roisman, who announced he would be leaving in January. Commissioner Hester Peirce, known to many in the space as the “Crypto Mom,” is currently the sole Republican on the five-member commission....

Valkyrie Investments‘ Leah Wald on Bitcoin ETFs and the future of digital assets

Cointelegraph sat down with Leah Wald, CEO of digital asset investment firm Valkyrie Investments, to learn more about the importance of a Bitcoin (BTC) exchange-traded fund (ETF) and the future of digital assets. For context, Valkyrie Investments was launched in 2020 and is one of the only asset managers to have three Bitcoin-adjacent ETFs trading on the Nasdaq. Valkyrie launched a Bitcoin Strategy ETF in October 2021 that offered indirect exposure to BTC with cash-settled futures contracts following a United States Securities and Exchange (SEC) approval for a similar ETF from ProShares. Valkyrie also has a balance sheet opportunities ETF that invests in public companies with exposure to Bitcoin. In addition, the investment firm’s Bitcoin Miners ETF began trading on the Nasdaq o...

Crypto-related stocks jump in positive reaction to executive order

The stock prices of crypto-related companies have jumped as the broader market reacted positively to President Joe Biden’s long-awaited executive order requiring US federal agencies to create a regulatory framework for digital assets, as well as exploring a future digital dollar. Coinbase (COIN) surged, up 10.5% at market close, while shares in Bitcoin-evangelist Michael Saylor’s MicroStrategy (MSTR) posted a 6.4% gain, according to TradingView. Blockchain-related exchanged-traded funds (ETFs) also enjoyed the markets’ renewed confidence in crypto, with ProShares Bitcoin Strategy ETF (BITO) gaining 10% and Valkyrie Bitcoin Strategy ETF (BTF) closing up 10.3%. Cryptocurrency mining companies enjoyed the largest gains with Riot Blockchain Inc. (RIOT) shares up 11.2% and Marathon Digital Hold...

Regulators and industry leaders react to Biden‘s executive order on crypto

Joe Biden has signed his 82nd executive order since being sworn into office in January 2021, directly addressing a regulatory framework for digital assets in a rare moment for the U.S. president. In a Wednesday announcement, the White House said President Biden’s executive order required government agencies to explore the potential rollout of a United States central bank digital currency as well as coordinate and consolidate policy on a national framework for crypto. Many media outlets previously reported the U.S. president had initially planned to sign the executive order in February, an event that was likely postponed following Russia’s military actions in Ukraine. The reaction from many industry leaders compared the executive order to a regulatory opportunity — Biden had rarely sp...