government

Biden to sign executive order on crypto, authorize all-government effort to consolidate regulation

Later today, U.S. President Joe Biden will sign a long-anticipated executive order on digital assets. Despite fears that the order may resound a regulatory clampdown on the industry, the language of the document is fairly favorable, the key focus being the coordination and consolidation of various agencies’ efforts within a unified national policy. The order designates six key areas of the federal government’s involvement with the digital asset ecosystem — consumer and investor protection, financial stability, financial inclusion, responsible innovation, the United States’ global financial leadership and combating illicit financial activity — and directs specific agencies to lead in designated policy and enforcement domains. The Department of the Treasury will take the lead in developing p...

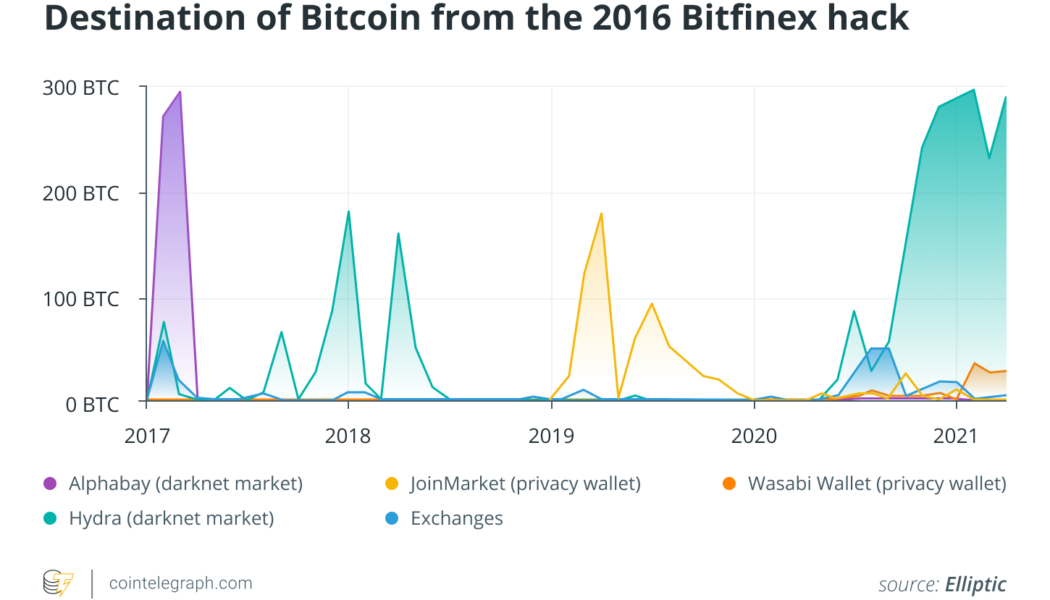

Blockchain forensics is the trusted informant in crypto crime scene investigation

The seizure by the U.S. Department of Justice of $3.6 billion worth of Bitcoin (BTC) lost during the 2016 hack of Bitfinex’s cryptocurrency exchange has all the ingredients of a Hollywood film — eye-popping sums, colorful protagonists and crypto cloak-and-dagger — so much so that Netflix has already commissioned a docuseries. But, who are the unsung heroes in this action-packed thriller? Federal investigators from multiple agencies including the new National Cryptocurrency Enforcement Team have painstakingly followed the money trail to assemble the case. The Feds also seized the Colonial Pipeline ransoms paid in crypto, making headlines last year. The Internal Revenue Service (IRS) seized $3.5 billion worth of crypto in 2021 in non-tax investigations, according to the recently releas...

Are crypto and blockchain safe for kids, or should greater measures be put in place?

Crypto is going mainstream, and the world’s younger generation, in particular, is taking note. Cryptocurrency exchange Crypto.com recently predicted that crypto users worldwide could reach 1 billion by the end of 2022. Further findings show that Millennials — those between the ages of 26 and 41 — are turning to digital asset investment to build wealth. For example, a study conducted in 2021 by personal loan company Stilt found that, according to its user data, more than 94% of people who own crypto were between 18 and 40. Keeping children safe While the increased interest in cryptocurrency is notable, some are raising concerns regarding the ways those under the age of 18 are interacting with digital assets. These challenges were highlighted in UNICEF’s recent “Prospects for children in 202...

Wyoming’s state stablecoin: Another brick in the wall?

For a state with a small-town feel, Wyoming moves with big-city alacrity when it comes to things crypto. According to the bipartisan bill introduced into its legislature last week, a Wyoming stablecoin could debut before the end of 2022. The announcement caught even Wyoming banker and cryptocurrency champion Caitlin Long by surprise. “Didn’t know it was coming,” tweeted the Avanti Bank CEO. It also raises some questions: Is a stablecoin really needed by Wyoming’s citizens? Is it feasible? Will it upset the state’s commercial banks including its recently chartered special purpose depository institutions (SPDIs) like Avanti which has issued a stablecoin-like product itself? Moreover, is a state-issued stablecoin even constitutional? And, aren’t there enough stablecoins around alr...

Crypto could bypass President Biden’s ‘devastating’ sanctions on Russian banks and elites: Report

The sanctions announced by United States President Joe Biden in response to Russia’s attack on Ukraine did not include cutting the country off from payments on the SWIFT system or cryptocurrency transfers. In a Thursday announcement from the White House, Biden said the U.S. and its allies and partners would be enforcing sanctions aimed at imposing “devastating costs” on Russia due to “Putin’s war of choice against Ukraine.” The U.S. president announced that the country would sever its financial system from Russia’s largest bank, Sberbank, as well as impose “full blocking sanctions” on VTB Bank, Bank Otkritie, Sovcombank OJSC, Novikombank, and their subsidiaries. Biden also named several elite nationals who have “enriched themselves at the expense of the Russian state” as part of the ...

Law Decoded: Bitcoin’s censorship resistance capacity enters the spotlight, Feb. 14–21

Amid the barrage of last week’s regulatory news, from rumors of Joe Biden’s upcoming executive order on digital assets to another round of the Russian government’s crypto tug of war, the storyline that was arguably the most consequential for the mainstream narrative on the social effects of crypto has been the one around the Canadian government’s standoff with the Freedom Convoy. The government’s invocation of emergency powers to put down a protest movement — combined with the movement’s financial infrastructure being one of the main attack vectors — has led many observers to appreciate with renewed vigor Bitcoin’s capacity to resist state financial censorship. If a government as “civilized” as Canada’s can arbitrarily cut off a group it doesn’t like from the financial system, then any sta...

Russia’s Finance Ministry introduces digital currency bill, brushes off Central Bank’s objections

Russia’s Ministry of Finance has upped the stakes in its drawn-out showdown against the country’s Central Bank by formally introducing a bill that proposes to regulate digital assets rather than banning them. On Feb. 21, the Ministry introduced a draft of the federal law “On digital currency” to the government. This stage of the legislative process precedes the bill’s introduction to the parliament for consideration. The agency cited the “formation of a legal marketplace for digital currencies, along with determining rules for their circulation and range of participants” as the rationale for the initiative. Emphasizing that the bill does not seek to endow digital currencies with legal tender status, its authors define cryptocurrencies as an investment vehicle. The bill proposes a licensing...

Future of finance: US banks partner with crypto custodians

Grayscale Investments’ latestreport “Reimagining the Future of Finance” defines the digital economy as “the intersection of technology and finance that’s increasingly defined by digital spaces, experiences, and transactions.” With this in mind, it shouldn’t come as a surprise that many financial institutions have begun to offer services that allow clients access to Bitcoin (BTC) and other digital assets. Last year, in particular, saw an influx of financial institutions incorporating support for crypto-asset custody. For example, Bank of New York Mellon, or BNY Mellon, announced in February 2021 plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients. Michael Demissie, head of digital assets and advanced solutions at BNY ...

Mining worldwide: Where should crypto miners go in a changing landscape?

One of the main themes among the crypto community in 2021 was China’s aggressive policy toward mining, which led to a complete ban on such activities in September. While mining as a type of financial activity has not gone away and is unlikely to disappear, Chinese cryptocurrency miners had to look for a new place to set up shop. Many of them moved to the United States — the world’s new mining mecca — while some left to Scandinavia and others to nearby Kazakhstan, with its cheap electricity. Mining activities can’t stay under the radar forever, and governments around the world have begun to raise concerns over electricity capacity and power outages. Erik Thedéen, vice-chair of the European Securities and Markets Authority — who also serves as director general of the Swedish Fina...

Clarity pushed back: Russian government fails to forge a consolidated stance on crypto regulation

On Feb. 18, the Russian Ministry of Finance kicked off public consultations on the rules of cryptocurrency issuance and transactions. While a welcome development, it is less than the country’s crypto space had expected to get. Earlier in the week, the government announced that by Feb. 18, a bill containing the finance ministry and central bank’s consolidated position on crypto regulation would be drafted. Updated estimates suggest that it will take at least another month for draft legislation to see the light. The main reason for the delay appears to be the central bank’s renewed resistance, which just several days ago seemed to have been overcome. Here is a roundup of the latest twists in this rocky ride. Round 1: Central bank’s ban proposal On Jan. 20, the Central Bank of Russia (CBR) is...

Georgia lawmakers consider giving crypto miners tax exemptions in new bill

Five members of the Georgia House of Representatives have introduced a bill that would exempt local crypto miners from paying sales and use tax. On Monday, Georgia Representatives Don Parsons, Todd Jones, Katie Dempsey, Heath Clark, and Kasey Carpenter introduced HB 1342, a bill which has yet to be titled. The legislation proposes to amend the state tax code “to exempt the sale or use of electricity used in the commercial mining of digital assets” and would likely only apply to commercial miners operating in a facility of at least 75,000 square feet — roughly 6,968 square meters. The proposed bill is the latest in the series of state-level measures aiming to encourage crypto miners to set up shop. In January, Illinois lawmakers introduced a bill which would extend tax incentives for data c...

Biden expected to issue executive order on crypto and CBDCs next week: Report

The White House will reportedly be issuing an executive order as early as next week directing government agencies to study different aspects of the digital asset space with the goal of creating a comprehensive regulatory framework. In a Thursday report from Yahoo! Finance, Jennifer Schonberger said an official familiar with the matter within the Biden administration revealed the executive order could arrive as soon as next week. The directive from President Biden would reportedly order the Office of the Attorney General, the State Department, and the Treasury Department to study the potential rollout of a U.S.-issued central bank digital currency. In addition, the Director of the Office of Science and Technology Policy — the newly appointed Alondra Nelson — would provide an evaluation on t...