government

Israel puts the brakes on cash to spur digital payments

Authorities in Israel on Monday has in put in place further restrictions on cash payments as a means to combat illegal activity and spur digital payments in the country. Since January 2019, Israeli businesses and consumers have been subject to limits on cash payments under the Law for the Reduction in the Use of Cash. It’s aimed at shifting the country’s citizens and businesses toward digital payments, allowing authorities to more easily track tax evasion, black market activity, and money laundering. From August 1, the limits on cash payments have been tightened to 6,000 Israeli Shekel (NIS), equivalent to $1,760 United States dollars (USD) for business transactions and NIS 15,000 ($4,400 USD) in personal transactions. Further restrictions are expected to follow in the future, prohib...

Dubai permits full operation to FTX subsidiary FZE via first MVP license

On Friday, FZE, a subsidiary of crypto exchange FTX, was awarded Dubai’s first Minimal Viable Product (MVP) license, allowing full operation of the exchange in the region. Dubai’s Virtual Asset Regulatory Authority (VARA) issued the operating license to FZE under the MVP program, which according to Helal Saeed Almarri, the director general of Dubai WTC Authority, is designed for secure and sustainable growth in Dubai. For now, the FTX FZE exchange’s operations are in the test phase and will be focused on providing various crypto services. According to FTX CEO Sam Bankman-Fried, the newly licensed exchange will operate under a model incorporating regulatory oversight and Financial Action Task Force (FATF) compliance controls catering to Tier 1 international financial markets. In addit...

Deposits at non-bank entities, including crypto firms, are not insured — FDIC

The United States Federal Deposit Insurance Corporation, or FDIC, has issued an advisory informing the public it “does not insure assets issued by non-bank entities, such as crypto companies.” In a Friday notice, the FDIC advised banks in the U.S. that they needed to assess and manage risks in third-party relationships with crypto firms. The government agency said that while deposits at insured banks were covered for up to $250,000, no such protections applied “against the default, insolvency, or bankruptcy of any non-bank entity, including crypto custodians, exchanges, brokers, wallet providers, or other entities that appear to mimic banks.” “Some crypto companies have misrepresented to consumers that crypto products are eligible for FDIC deposit insurance coverage or that customers are F...

Final candidates for next UK prime minister have made pro-crypto statements

Rishi Sunak, the former chancellor of the Exchequer, and Liz Truss, Secretary of State for Foreign, Commonwealth and Development Affairs, two of the final candidates to become the next prime minister for the United Kingdom, have both previously expressed pro-crypto views. With Prime Minister Boris Johnson soon to be out of office, Sunak and Truss are competing to be the next leader of the Conservative Party and the country, with their views on digital assets likely to influence financial policy. Under Johnson, Sunak requested that the country’s Royal Mint create a nonfungible token as part of an effort to make the United Kingdom a global crypto hub. A member of Parliament who served as chancellor from 2020 until resigning in July, Sunak previously said the U.K. government would prioritize ...

Thai SEC launches digital hotline for Zipmex users

In the aftermath of the Thai cryptocurrency exchange Zipmex stopping withdrawals last week, local financial regulators are stepping in to look into potential losses by investors. Thailand’s Securities and Exchange Commission (SEC) is taking action to collect all necessary information from investors on how they have been affected by issues on Zipmex. The regulator officially announced on July 25 that Zipmex customers can submit information via an online forum on the Thai SEC’s official website. The SEC has received a number of complaints from people affected by Zipmex after the crypto exchange temporarily suspended withdrawals of the Thai baht and digital assets on Wednesday, the regulator said. “In the past, the SEC issued a letter requesting the company [Zipmex] to provide an efficient sy...

Demand for widely used euro stablecoin is huge, says DeFi expert

The market capitalization of Tether (USDT), a United States dollar-pegged stablecoin, is currently over $65 billion. USD Coin (USDC), another stablecoin backed by the U.S. dollar, clocks in near $55 billion. Some reports estimate that the total market cap of dollar-backed stablecoins is over $160 billion. Despite this success of dollar-based stablecoins, there has not been a euro stablecoin that is even remotely comparable in size. By the end of June, the U.S.-based company Circle announced that it will launch its own euro stablecoin, Euro Coin (EUROC), on the Ethereum blockchain. With a euro-based stablecoin, uncomplicated euro transfers will be possible worldwide in the future, as is currently the case with the U.S. dollar. Instead of the eurozone-based business, Circle has opted to issu...

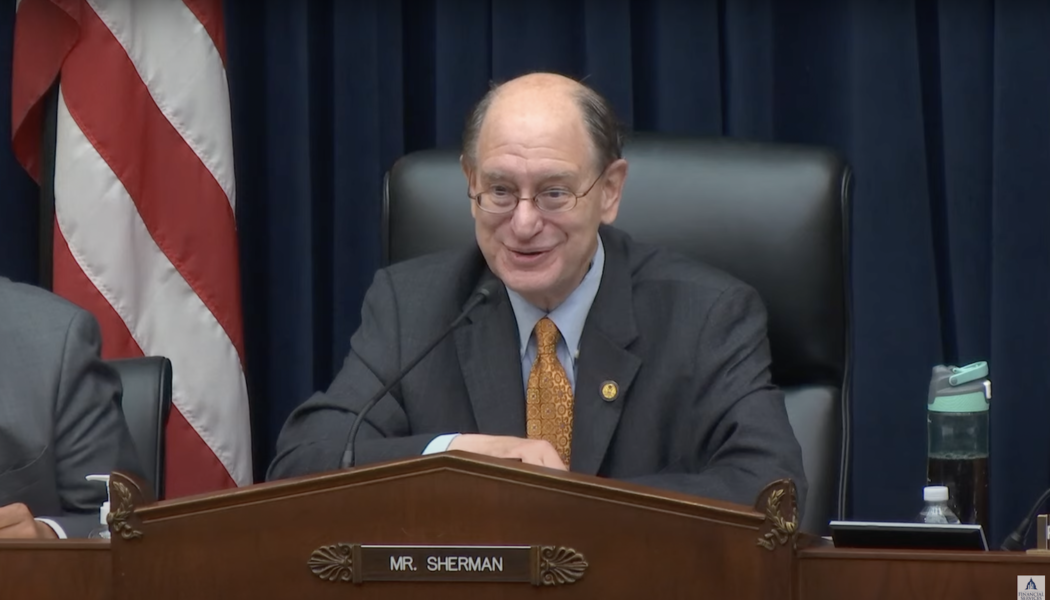

US lawmaker criticizes SEC enforcement director for not going after ‘big fish’ crypto exchanges

Brad Sherman, the congressperson who previously called for banning cryptocurrencies in the United States, criticized the Securities and Exchange Commission’s (SEC) approach to enforcement among major crypto exchanges. In a Tuesday hearing before the House Committee on Financial Services, Sherman said SEC enforcement director Gurbir Grewal needed to show “fortitude and courage” when pursuing securities cases against cryptocurrency exchanges in the United States. The lawmaker added that the SEC enforcement division had “gone after” XRP as a security, but not the crypto exchanges that processed “tens of thousands” transactions of the token. “If XRP is a security — and you think it is, and I think it is, why are these crypto exchanges not in violation of law and is it enough that the crypto ex...

The regulatory implications of India’s crypto transactions tax

The Indian crypto landscape lost some momentum this year as the government introduced two laws demanding crippling taxes on crypto-related unrealized gains and transactions. India’s first crypto law, which requires its citizens to pay a 30% tax on unrealized crypto gains, came into effect on April 1. A commotion among the Indian crypto community followed as investors and entrepreneurs tried to decipher the impact of the vague announcement with little or no success. Knowing that India’s second crypto law — a 1% tax deduction at source (TDS) on every transaction — would translate into an even greater impact on trading activities, numerous crypto entrepreneurs from India considered moving bases to friendlier jurisdictions. Following the imposition of additional taxes, Indian crypto exchanges ...

SEC commissioner Allison Lee departs, readying financial regulator for Jaime Lizárraga

Allison Herren Lee, one of five members of the United States Securities and Exchange Commission’s board, has officially left the regulatory body after more than three years as a commissioner. In a Friday announcement, chair Gary Gensler and commissioners Hester Peirce, Mark Uyeda, and Caroline Crenshaw said Lee had left the SEC, where in 2005 she started as a staff attorney at the agency’s enforcement division at a regional office in Denver. She moved on to be appointed a commissioner in 2019 under the former presidential administration, and later served as acting chair to the regulatory body for three months, until Gensler’s confirmation in April 2021. “Commissioner Lee has been a stalwart advocate for strong and stable markets, including by emphasizing the need for market participants to...

US Senate confirms Michael Barr as Fed vice chair for supervision

The United States Senate has confirmed the nomination of law professor Michael Barr to become the next vice chair for supervision for the Federal Reserve. In a 66-28 vote on the Senate floor on Wednesday, U.S. lawmakers confirmed Barr as vice chair for supervision of the Federal Reserve System for four years, filling the last seat on the seven-member board of governors. Barr, who was on the advisory board of Ripple Labs from 2015 to 2017, also served as the Treasury Department’s assistant secretary for financial institutions under former President Barack Obama, and taught courses on financial regulation at the University of Michigan. As vice chair for supervision, Barr will be responsible for developing policy recommendations for the Fed as well as overseeing the supervision and regulation...

US Treasury calls for public comment on digital asset policy, following Biden’s executive order

The United State Department of the Treasury has requested comments from the public on the potential opportunities and risks of digital assets in compliance with President Joe Biden’s executive order from March. In a Tuesday announcement, the U.S. Treasury said it was asking for input from the public that will “inform its work” in reporting to the president the possible implications of digital assets on the financial markets and payment infrastructures. Biden’s executive order directed the Treasury Department to take the lead among other government agencies in developing policy recommendations aimed at mitigating both systemic and consumer risks around cryptocurrencies. “For consumers, digital assets may present potential benefits, such as faster payments, as well as potential risks, includ...