investments

Hong Kong brokers line up for SFC approval ahead of new virtual asset trading legislation

Financial services providers in Hong Kong are already taking the first steps to provide services to retail investors, according to local reports. Brokers and fund managers in the region have reportedly asked for advice on licensing requirements ahead of new legislation. Lawmakers in Hong Kong passed an amendment to the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) in December 2022, which aligns with the region’s recent stance on broadening the possibility for crypto trading. The amendment introduces a new licensing scheme for virtual asset service providers, which will allow retail investors the ability to trade in virtual assets. Currently, virtual asset trading is restricted to professional investors or traders with proof of at least $1 million in bankable assets...

Top crypto funding stories of 2022

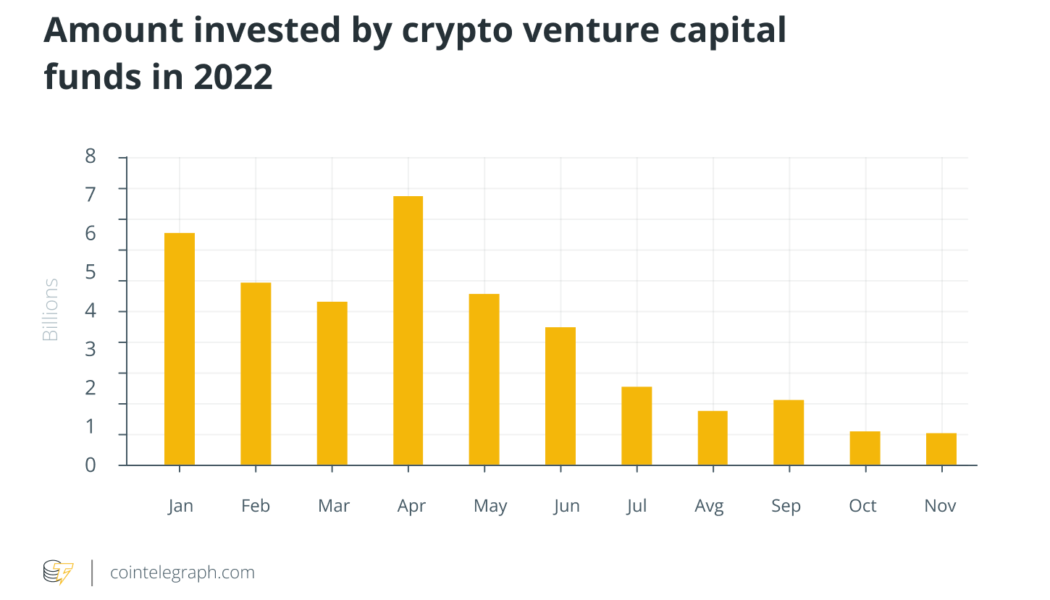

2022 was a watershed year for crypto venture capital, as investors poured tens of billions of dollars into blockchain-focused startups despite the overwhelmingly bearish trend in asset prices. Is the VC-dominated crypto funding model good for the industry? Only time will tell. Cointelegraph Research is still in the process of tallying all the funding figures for the year, but 2022 easily outpaced all other years in terms of total capital raised and deals completed. VC inflows were above $14 billion in each of the first two quarters before receding to just under $5 billion in the third quarter — still an impressive tally given the industry-wide contagion sparked by the sudden collapses of Celsius, Three Arrows Capital, Genesis, BlockFi and FTX, among others. Against this backdrop, we’...

Bithumb’s largest shareholder executive found dead following allegations of embezzlement

Mr. Park Mo, the vice president of Vidente, the largest shareholder of South Korean Cryptocurrency exchange Bithumb,was reportedly found dead in front of his home at 4 am, on the morning of Dec. 30. Prior to his death, Mr. Mo had been named as a primary suspect in an investigation launched by South Korean prosecutors for his alleged involvement in the embezzling funds at Bithumb-related companies, as well as, manipulating stock prices. In October 2021, the Financial Investigation Division of the Seoul Southern District Prosecutor’s Office launched an investigation into allegations made against Mr. Park Mo, which led to the seizing of Bithumb-affiliated companies such as Vident, Inbiogen, and Bucket Studio. Vident, a KOSDAQ-listed company, is known to be Bithumb’s la...

Sam Bankman-Fried denies moving funds from Alameda wallets

Sam Bankman-Fried, the former CEO of the now-defunct FTX exchange, has denied moving funds tied to Alameda wallets, days after he was released on a $250 million bond. On Dec. 30, Fried tweeted to his 1.1 million followers, denying any involvement in the movement of funds from Alameda wallets. In response to the allegations that he may have been responsible for moving funds out of Alameda wallets, he shared: “None of these are me. I’m not and couldn’t be moving any of those funds; I don’t have access to them anymore.” None of these are me. I’m not and couldn’t be moving any of those funds; I don’t have access to them anymore.https://t.co/5Gkin30Ny5 — SBF (@SBF_FTX) December 30, 2022 SBF’s tweet was in response to a news story published by Coint...

New research indicates boomers make better crypto investors

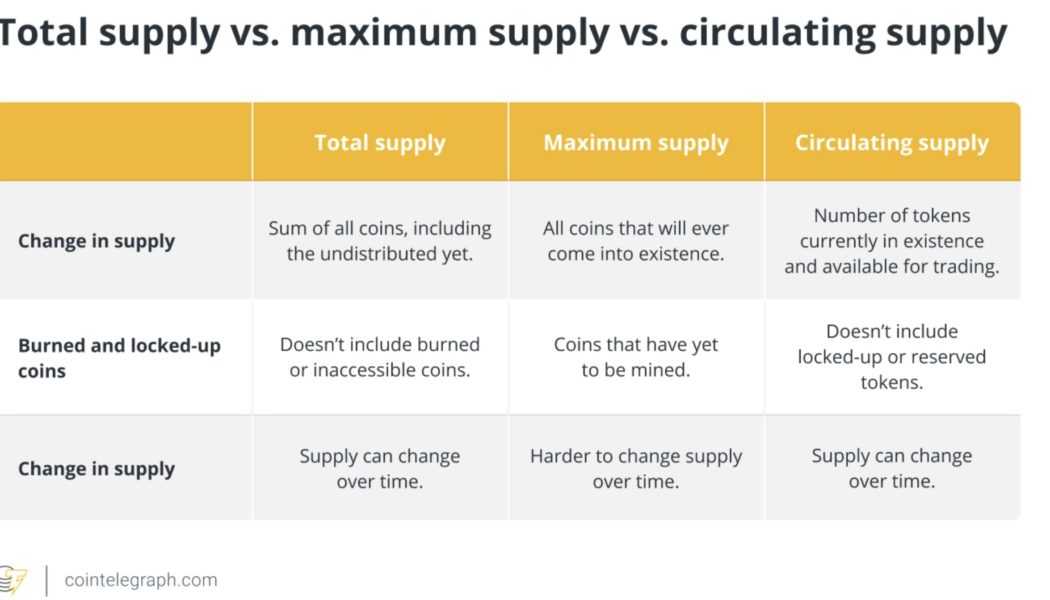

As a millennial, it’s hard to say this, but boomers are doing crypto better. They are taking research methods used in the traditional markets and applying them to crypto projects, according to a new report from Bybit and consumer research company Toluna. The report says that 34% of boomers spend “a few days” doing due diligence on a project before investing — 50% more than other generations. More concerning still, “64% of North American investors spend less than two hours or don’t DYOR at all.” Boomers are also more likely to focus their research on technical factors such as tokenomics, revenue and competitor landscape. Compare this with their younger compatriots, who are more likely to prize reputational elements such as a charismatic founder and “website aesthetics.” This shows that bein...

Mark Cuban to Bill Maher: ‘If you have gold, you’re dumb as fuck… Just get Bitcoin.’

Arguments over whether gold or Bitcoin (BTC) is a better store of value continue to occur across the cryptocurrency space and in traditional investment circles. On the latest episode of Bill Maher’s Club Random podcast, which aired on Dec. 26, billionaire owner of the Dallas Mavericks Mark Cuban advocated for Bitcoin being a better store of value than gold. In response to Maher openly admitting that he is “rooting against Bitcoin,” Cuban chimed in with a cheeky agreement, remarking, “I want Bitcoin to go down a lot further so I can buy some more.” Cuban went on to offer some friendly chastisement to Maher, saying, “If you have gold, you’re dumb as fuck,” before encouraging him to “just get Bitcoin.” [embedded content] The two then discussed the pros and cons of both asset catego...

Near Project’s Octopus Network lays off 40% of its staff amid crypto winter

Octopus Network, a decentralized app chain network natively built on NEAR Protocol, has announced that it will be “refactoring” to adapt to current market conditions. As part of its refactoring process, Octopus network will let go of roughly 40% of its team, which accounts for 12 out of 30 members. The remaining staff will also be subjected to a 20% salary cut, while its team token incentive will be suspended indefinitely. According to Louis Liu, the founder of the Octopus Network, although he has lived through previous crypto winters, “this winter is very different from the others.” Liu said he anticipates that this current “crypto winter will last at least another year, perhaps much longer,” adding that “most Web3 startups will not survive.” To survive the crypto winter, the founde...

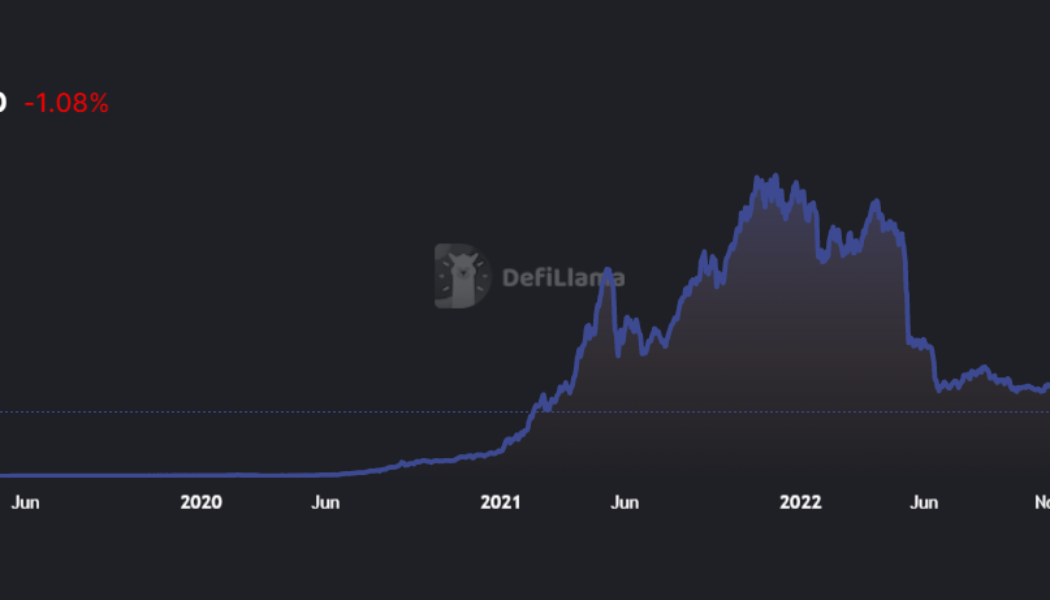

Blockchain VC funding surpasses 2021 total despite declining since May

It’s been a tough year for crypto, and venture capital activity confirms it. The collapse of FTX in November was the latest and most shocking in a series of closures of key market players this year — including Celsius, Voyager and BlockFi — that have shaken investor sentiment and wiped out $1.5 trillion in market capitalization from cryptocurrency space. Blockchain venture capital funding has been on a downward slope since May 2022, and November was no different, with inflows declining even further. However, the total capital inflows for 2022 have surpassed 2021 by almost $6 billion. According to Cointelegraph Research, VC funding declined 4.8% in November, totaling $840.4 million — down from $843 million in October. The Cointelegraph Research Terminal’s Venture Capital Database — which co...

SBF prosecutors reportedly dig into donations made to top US Democrats

The prosecutors investigating former FTX CEO Sam Bankman-Fried (SBF) have reportedly reached out to top members of the Democratic Party demanding information about the political donations made by the entrepreneur. Democratic members from the Democratic National Committee (DNC), the Democratic Congressional Campaign Committee (DCCC) and Congressman Hakeem Jeffries were contacted by SBF prosecutors for information to aid their ongoing investigations, according to a New York Times report. The United States attorney’s office for the Southern District of New York sent an email to the Democratic Party elections lawyer Marc Elias, asking for details on donations made by SBF. Similar emails were sent over to other members of the Democratic and Republican parties. The Royal Bahamas police arrested ...

Bitvavo to prefund locked DCG assets worth $296.7M amid liquidity crisis

The Digital Currency Group and its affiliates (DCG), which manages $296.7 million (280 million euros) in deposits and digital assets of crypto exchange Bitvavo for off-chain staking services, suspended repayments citing liquidity problems amid the bear market. However, Bitvavo announced to prefund the locked assets, preventing DCG-induced service disruption for users. With users proactively exploring self-custody options as a means to safeguard their funds, an acute liquidity crisis is expected to loom over exchanges. DCG cited liquidity problems as it suspended repayments, temporarily halting users from withdrawing their funds. Bitvavo, on the other hand, decided to prefund the locked assets to ensure that none of its users are exposed to DCG liquidity issues. “The current situation at DC...

Corporate America has finally taken notice of Web3 — US trademark lawyer

This year saw an influx of trademark applications filed by various companies looking to get in on the Web3 action. By November, a total of 4,999 trademark applications had been filed in the United States for cryptocurrencies and digital-related goods and services — according to United States Patent and Trademark Office-licensed trademark attorney Mike Kondoudis. Kondoudis believes the future of the Web3 ecosystem looks “bright” and “mainstream adoption is inevitable.” To learn more about the impact of Web3 trademark applications filed on the future of the Web3 ecosystem, Cointelegraph interviewed Kondoudis. Cointelegraph has covered a wide range of trademark application stories in 2022, ranging from luxury brands such as Hermès to car brands like Ford, all making a bid for ...

Only for foreign trade: Bank of Russia stands against free crypto investment

Russia’s central bank is ready to consider allowing cryptocurrency use within the country, but only as part of a legal experiment, said governor Elvira Nabiullina. “It’s possible to consider transactions through an authorized organization in the country as part of an experimental legal regime, but that would require a relevant law,” Nabiullina stated during a Bank of Russia press conference on Dec. 16. The Bank of Russia’s primary objection to crypto has always been that it cannot be used as a payment instrument, Nabiullina emphasized. She added that the central bank is also concerned about investor protection because the crypto market is highly volatile. While Russia formally does not prohibit its people from investing in crypto, the Bank of Russia believes that the mass adoption of crypt...