IT News

HealthTech Startups in Africa Reach All-Time High

Sourced from Getty Images. There are currently 180 actively operating health-tech focussed startups across the African continent, according to the High Tech Health: Exploring the African E-health Startup Ecosystem Report 2020 report, released by Disrupt Africa. According to the report, this number of startups has grown by 56.5 per cent over the last three years and has seen significant investment despite the COVID-19 pandemic as more than half of all funding to have gone into the space in the past five years was transacted in the first half of 2020. So far this year, e-health startups have raised over US$90 million. “Interest in the e-health space in Africa has accelerated in the last 18 months, and with the advent of the COVID-19 pandemic, there is a sudden spotlight on e-health startups,...

Indebted Eskom Turns to Sukuk Market for Funding

Sourced from REVE South Africa’s embattled national power utility Eskom has new plans to issue a $58 million (R1 billion) sukuk bond in a bid to diversify funding sources as borrowing costs rise. According to spokesperson Sikonathi Mantshantsha, Eskom has appointed a new lead arranger “to work towards establishing timelines for the issue.” The power utility currently has over R450 billion in debt and has yet to announce further plans to ask the South African governments for additional capital injections. What is a sukuk? According to IOL, a sukuk is a Shariah-compliant investment and an attractive alternative to conventional bonds. For all intents and purposes a sukuk – Arabic for ‘investment certificate’ – is issued for the purpose of raising money for utilisation within a corporation or ...

TymeBank is Recognised as One of South Africa’s Top 3 Digital Banks

Image sourced from Business Tech Only 18 months after launching, TymeBank has been rated as one of the top three digital banks in South Africa by SITEisfaction. This recognition follows on the recent Forbes accolade, which claimed TymeBank as the 2nd best bank in the country its high levels of customer satisfaction and key qualities like trust, banking fees, digital services and financial advice. In the latest report, which measures customer satisfaction with digital banking services, TymeBank was recognised for the bank’s user-friendliness, safety features and affordability. The latter was particularly appreciated by those who had recently switched, with the majority saying they switched because of the bank’s extremely low transaction fees and market-leading high-interest rates on all sav...

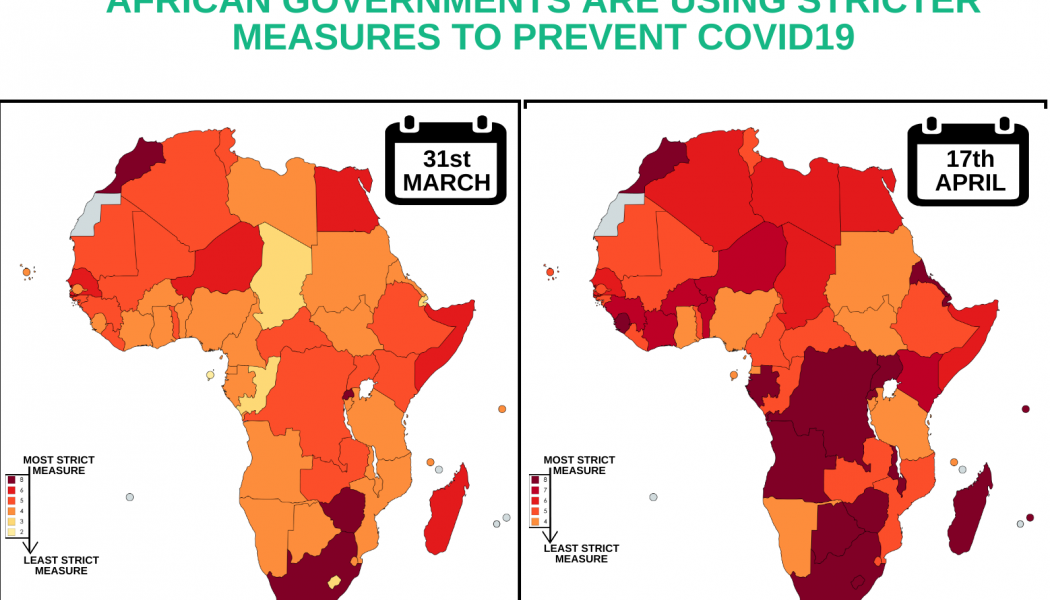

A Future Reimagined for African Economies Post-COVID-19

The COVID-19 pandemic has crippled African economies but also offers an opportunity to reinvent economic systems on the continent and make small businesses more resilient, says VP and Senior Director for Economic Growth at Creative Associates International’s. “We are seeing digital solutions and transformation and awareness among political and business leaders that we can do things now that maybe we didn’t even imagine before,” Creative’s Jim Winkler says. “The pandemic has woken us up.” Speaking at the Corporate Council on Africa (CCA)’s Leaders Forum, Winkler explains that traditional global supply chains were highly efficient, but also vulnerable to a shock-like COVID-19, leaving producers in Africa with no way to sell their products amid the pandemic. Winkler says an “unexpected silver...

Why Real-time Analytics are Crucial to Online Retail

In the digital age, data is a currency all on its own. The retail sector has lagged in leveraging the value of real-time data, due to a number of factors. However, given the current economic climate, they can no longer afford the luxury of remaining in the dark. The power of data is revealed through near real-time analytics, and it can deliver incredible benefits for the retail sector. Harnessing the power of daily sales and stock on hand data is the missing link in enabling Just in Time (JIT) manufacturing – the panacea where manufacturers produce just the right number of goods that are delivered at the right time to the right place to find their way into the hands of the right consumers. Visibility is the key The daily sales and stock data in retail hold a powerful repository of informat...