matic

Polygon primed for hard fork aimed at reducing gas fee spikes: New details revealed

Ethereum layer-2 scaling solution Polygon will undergo a hard fork on Jan. 17 in order to address gas spikes and chain reorganizations issues that has affected user experience on the Polygon proof-of-stake (POS) chain. Polygon officially confirmed the hard fork event in Jan. 12 a blog post, which came after weeks of preliminary discussion on Polygon Improvement Proposal (PIP) forum page in late December. GET READY FOR THE HARDFORK The proposed hardfork for the #Polygon PoS chain will make key upgrades to the network on Jan 17th. This is good news for devs & users — & will make for better UX. You will NOT need to do anything differently. Details:https://t.co/RaBWDjEGrI pic.twitter.com/nipa15YQdZ — Polygon (@0xPolygon) January 12, 2023 A Polygon spokesperson also provided...

Uniswap’s 80% gains in July are in danger with UNI price painting a classic bearish pattern

Uniswap (UNI) looks ready to post its best monthly performance in more than a year as it rallied approximately 80% in July, but signs of an extended pullback in the near term are emerging. Uniswap price nearly doubles in July UNI’s price is having one of its best months ever, reaching nearly $9 on July 30 versus nearly $5 at the beginning of the month, best returns since January 2021’s 250% price rally. UNI/USD monthly price chart. Source: TradingView Merge FOMO an UNI “fee switch” proposal Uniswap’s gains primarily surfaced due to similar upside moves in a broader crypto market. But they turned out to be relatively massive due to an ongoing euphoria surrounding “the Merge.” Notably, the Ethereum blockchain’s potential transition ...

Polygon price risks 50% drop as MATIC paints inverted cup and handle pattern

Polygon (MATIC) has dropped by more than 40% from its record high of $2.92, established on Dec. 27, 2021. But if a classic technical indicator is to be believed, the token has more room to drop in the sessions ahead. MATIC price chart painting classic bearish pattern MATIC’s recent rollover from bullish to bearish, followed by a rebound to the upside, has led to the formation of what appears like an inverted cup and handle pattern — a large crescent shape followed by a less extreme upside retracement, as shown in the chart below. MATIC/USD three-day price chart featuring inverted cup and handle pattern. Source: TradingView In a “perfect” scenario, inverted cup and handle setups set the stage for a downturn ahead. As they do, the price tends to fall towards levels tha...

First cross-chain governance proposal passes on Aave

On Monday, the first cross-chain governance proposal passed on decentralized finance, or DeFi, borrowing and lending platform Aave (AAVE). According to DeFi Llama, the amount of total value locked on Aave is approximately $12 billion. As told by its developers, a proposal executed on Aave, which is built on the Ethereum (ETH) network, was sent to the Polygon (MATIC) FxPortal. The mechanism then read the Ethereum data and passed it for validation on the Polygon network. Afterward, the Aave cross-chain governance bridge contract received this data, decoded it and queued the action, pending a timelock for finalization. The development team wrote: The Aave cross-chain governance bridge is built in a generic way to be easily adapted to operate with any chain that supports the EVM [Et...

Polygon (MATIC) sees a strong oversold bounce after $250B crypto market rebound

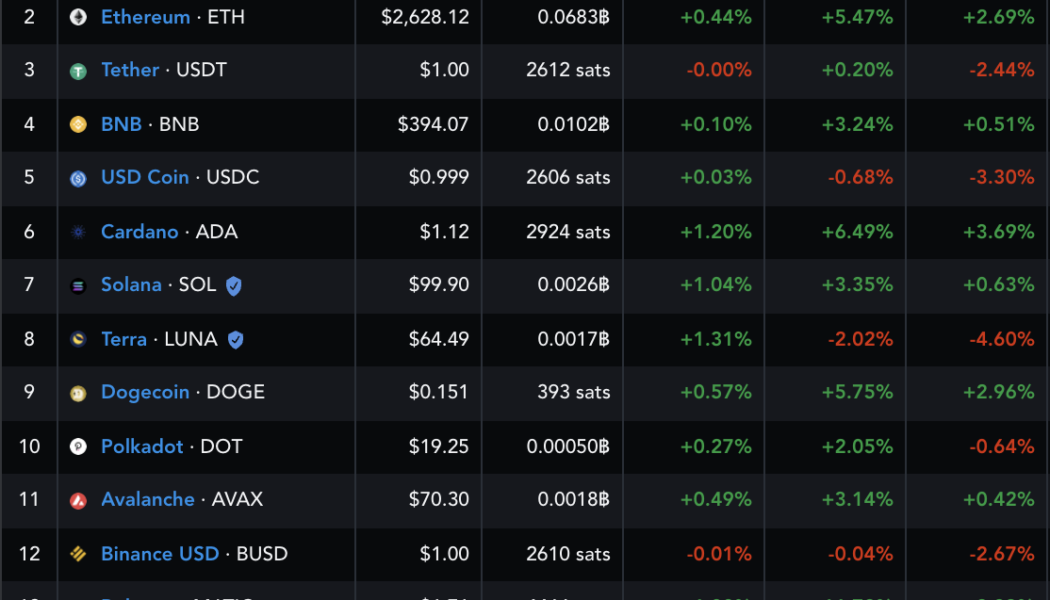

Polygon (MATIC) emerged as one of the best performers among high-ranking cryptocurrencies on Jan. 26 as the price rose nearly 17% to reach an intraday high at $1.825. The gains surfaced amid a synchronous rebound across the crypto market that started on Jan. 24. In detail, investors and traders poured in over $250 billion across digital assets, benefiting Bitcoin (BTC), Ether (ETH) and many others in the process. Performance of the top-fifteen cryptocurrencies in the last 15 days. Source: TradingView Polygon, a secondary scaling solution for the Ethereum blockchain, also cashed in on the crypto market rebound. The valuation of its native token, MATIC, rose from as low as $9.77 billion on Jan.24 to as high as $13.58 billion two days later. Meanwhile, its price jumped from $1....

Zero-knowledge scaling tech Plonky goes live on Polygon

On Monday, Polygon (MATIC), a layer-two Ethereum (ETH) scaling solution that is known for its fast transaction times and negligible gas fees, announced the launch of Plonky2, a zero-knowledge scaling technology, claimed to be the fastest in the world. Zero-knowledge algorithms ensure everything is correctly computed on layer two and return the succinct proof to Ethereum without sending the entire data. Instead of every miner (or staker) verifying every posted transaction, zero-knowledge allows the verification of simplified rolled-up proofs, thereby significantly speeding up the overall network. 1/2 We are proud to announce Plonky2, the world’s fastest ZK scaling tech! Plonky2 is a recursive SNARK that is ~100x faster than existing alternatives! Furthermore, it is Ethereum compatible...

Polygon upgrade quietly fixes bug that put $24B of MATIC at risk

Ethereum-based layer two scaling network Polygon has quietly fixed a vulnerability that put almost $24 billion worth of its native token MATIC at risk. According to a Dec. 29 blog post from Polygon, the “critical” vulnerability in the network’s Proof-of-Stake (PoS) Genesis contract was first highlighted by two whitehat hackers on Dec. 3 and Dec. 4 via blockchain security and bug bounty hosting platform Immunefi. All you need to know about the recent Polygon network update.✅A security partner discovered a vulnerability✅Fix was immediately introduced✅Validators upgraded the network✅No material harm to the protocol/end-users✅White hats were paid a bounty https://t.co/oyDkvohg33 — Polygon | $MATIC (@0xPolygon) December 29, 2021 The vulnerability put more than...

Here’s how Polygon is challenging the limitations of Ethereum, as told by co-founder Sandeep Nailwal

Polygon (MATIC), a layer-two network designed for scaling and application infrastructure development on Ethereum (ETH), has been making the rounds among blockchain enthusiasts as of late. From its $1 billion investment into zero-knowledge technology to co-launching a $200 million Web 3.0 social media initiative up to integrating with Opera’s web browser to make its decentralized apps accessible to 80 million Android mobile users, the network’s momentum is going strong. But partnerships and business aside, the technological capacities of the network, especially when compared to Ethereum, are also attracting the attention of many blockchain developers. In an exclusive interview with Cointelegraph, Polygon co-founder Sandeep Nailwal talked about the extent of the n...

Reddit co-founder and Polygon launch $200M Web 3.0 social media initiative

On Friday, Polygon and Alexis Ohanian’s venture capital firm, Seven Seven Six, announced a $200 million initiative backing projects operating at the intersection of social media and Web 3.0. The initiative will focus on gaming applications and social media platforms built on Polygon’s infrastructure. Ohanian co-founded Reddit in 2005, left in 2010 and returned as executive chairman in 2014 to lead a turnaround before resigning in 2020. He has been a seed investor in several prominent tech and blockchain firms such as Coinbase, Instacart, Sky Mavis — the developer of Axie Infinity — and Patreon. As an Ethereum scaling solution, Polygon’s ecosystem has expanded rapidly this year, with over 3,000 decentralized applications built on its network. Earlier this month, Polygon announced...

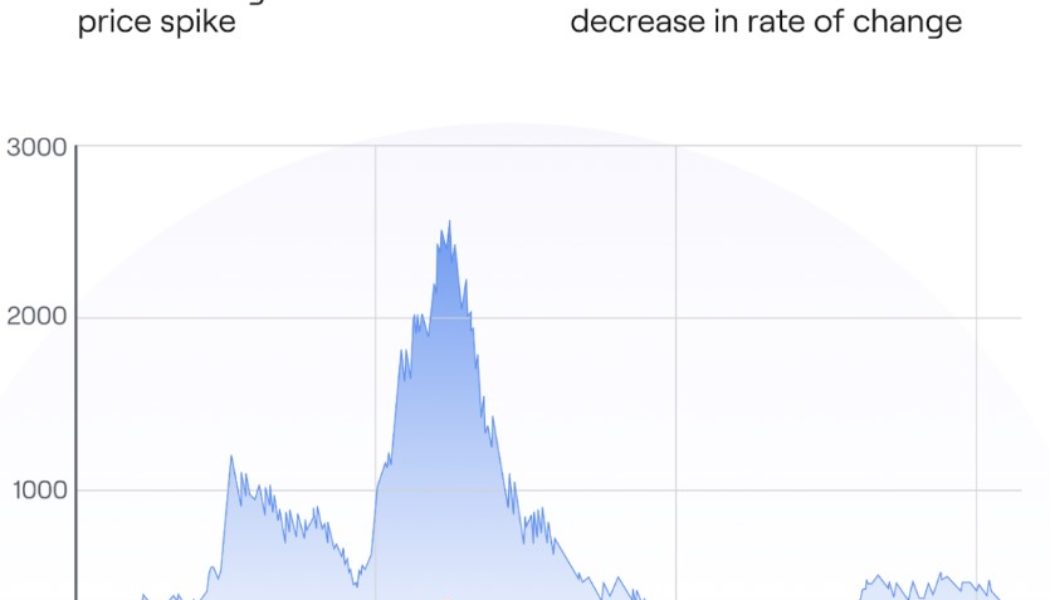

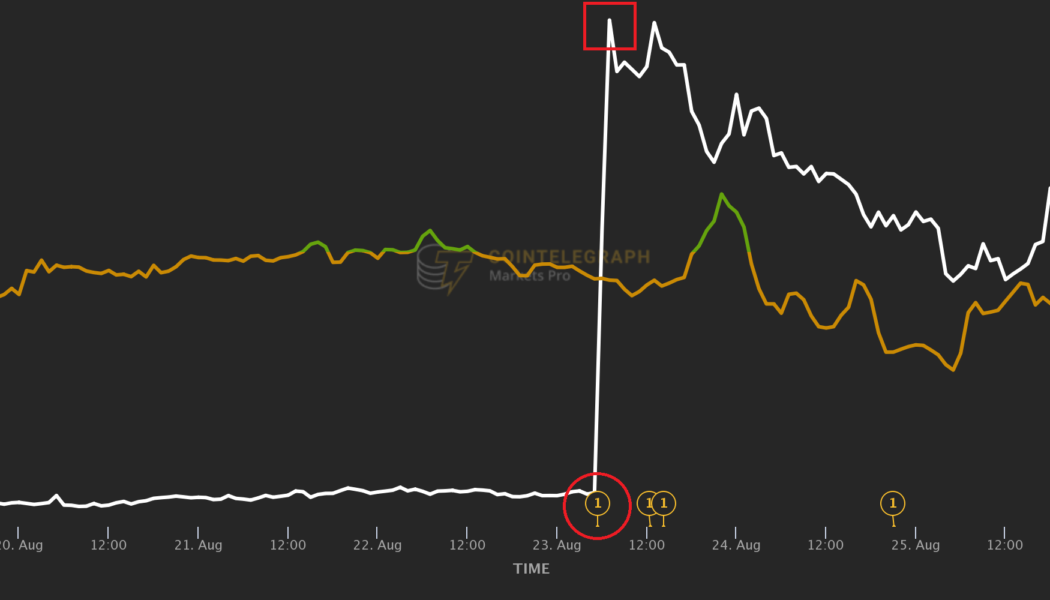

5 times quickfire crypto traders bought the news for double (or triple) digit profits

Why do crypto traders “buy the rumor, sell the news”? Simple. Because whispers of exchange listings or big-name partnerships reach very few people… while an article in Cointelegraph can reach hundreds of thousands of crypto enthusiasts in seconds. While insiders are quietly amassing tokens on rumors, the rest of us are completely ignorant of what may be coming. But with rumors, there are no guarantees. Which can lead to disappointment and serious loss of investment for those traders who gamble that they’re true… and end up wrong. So how can you possibly compete with thousands of other market participants when important news actually breaks? You’d have to be one of the very first to know in order to catch the price before it spikes. Look at the examples below — the time between a closely-gu...