Mining

Nvidia to pay $5.5M as part of SEC case concerning ‘inadequate disclosures’ around crypto mining

The United States Securities and Exchange Commission, or SEC, has announced that it has settled charges against Nvidia — the company behind graphics cards used by many crypto miners — in regards to “inadequate disclosures.” In a Friday announcement, the SEC said that Nvidia failed to disclose that mining cryptocurrencies was “a significant element of its material revenue growth” based on sales of its graphics processing units, or GPUs, during the 2018 fiscal year. The company has agreed to pay a $5.5 million penalty and will be subject to a cease-and-desist order based on violations of the Securities Act of 1933 and disclosures required by the Securities Exchange Act of 1934. According to the SEC, Nvidia reported growth in revenue around its gaming business in 2018, but also had informatio...

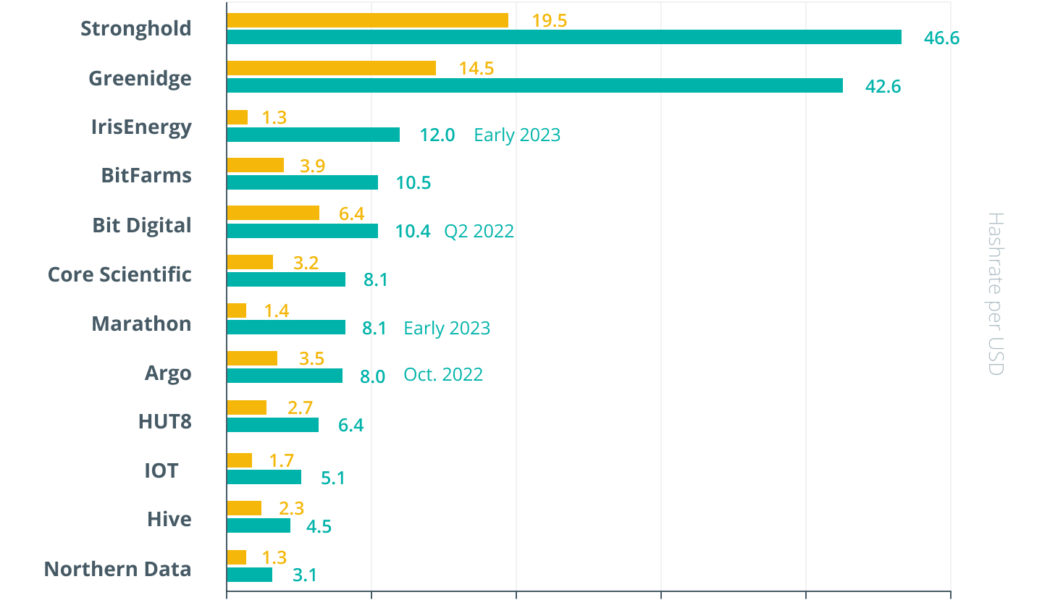

Controlling 17% of BTC hash rate: Report on publicly listed mining firms

The Cointelegraph Research Terminal, the leading provider of premium databases and institutional-grade research on blockchain and digital assets, has added a new report to its expanding library. The latest paper looks at a particular group of players in the Bitcoin (BTC) mining industry. Published by crypto consulting firm Crypto Oxygen, the report highlights the current landscape of publicly listed crypto mining companies that control approximately 17% of the total hash rate of the entire Bitcoin network. The crypto mining industry is a quickly growing and evolving sector. In January this year, a United States-based company Core Scientific went public via a special purpose acquisition company (SPAC) merger, making it the largest publicly traded crypto mining company in revenue and h...

Weekly Report: New York resolute on blocking PoW mining

Planned launch of EFT Securities and Cosmos ETPs delayed Volt Capital’s Imran Khan predicts DAOs will touch $1 trillion in AUM by 2032 New York is closer to endorsing a two-year moratorium on PoW mining Ethereum layer two Optimism seeks to embrace governance structure EPL Club Liverpool reportedly eyeing a crypto shirt sponsor Launch of three crypto ETFs in Australia dealt with a delay Last week, three exchange-traded funds and the first of their kind in Australia were scheduled to list on the Cboe Australia. However, hours before going live on April 27, the securities and derivatives exchange said that products would be delayed pending prior checks. Cboe Australia held back in detailing the delay, only promising an update in the coming days. According to a report by the Australi...

Monthly Report: The Central Africa Republic follows El Salvador’s footsteps in Bitcoin adoption

Kraken exchange offers traders the first Dirham trading pairs following the recent UAE licensing Central Africa Republic follows El Salvador in adopting a Bitcoin as legal tender Fort Worth, Texas, to become the first city mining cryptocurrency. Cuba is issuing licenses to persons/organisations that want to operate digital assets Deus Finance suffers another flash loan exploit in less than two months, this time losing more than $13.4 million. Here are last month’s top headlines across the crypto regulation, adoption, mining and crime verticals Kraken approved to operate in UAE as Bybit launches crypto options trading Following the wave of licensing of crypto entities in the Middle East, Kraken revealed on April 26 that it had been approved by the Abu Dhabi Global Market (ADGM) to oper...

Law Decoded: The difference between New York City and New York State, April 25-May 2

Last week, New York dominated crypto media headlines in very different ways. In New York State, the local Assembly voted in favor of the bill that would ban for two years any new mining operations that rely on proof-of-work (PoW) consensus mechanisms and use fossil fuel-generated energy. A temporary moratorium, which could be extended after the state’s Department of Environmental Conservation provides its assessments of the industry’s carbon footprint, marks the first major legislative attack on PoW mining on environmental grounds in the United States. The push mobilized the community — after digital asset advocacy groups rang the alarm on Twitter. Then, proponents of the ban had to endure three hours of a heated debate to narrowly pass the draft. There’s hope for an even tighter fig...

Has New York State gone astray in its pursuit of crypto fraud?

The Empire State made two appearances on the regulatory stage last week, and neither was entirely reassuring. On April 25, bill S8839 was proposed in the New York State (NYS) Senate that would criminalize “rug pulls” and other crypto frauds, while two days later, the state’s Assembly passed a ban on non-green Bitcoin (BTC) mining. The first event was met with some ire from industry representatives, while the second drew negative reviews, too. However, this may have been more of a reflex response given that the “ban” was temporary and principally aimed at energy providers. The fraud bill, sponsored by State Senator Kevin Thomas, looked to steer a middle course between protecting the public from scam artists while encouraging continued innovation in the crypto and blockchain sector. It...

Go green or go home? What the NY State mining moratorium could mean for crypto industry

On April 26, the State of New York put itself at the forefront of the regulatory struggle with crypto, as its Assembly voted for a two-year moratorium on crypto mining operations that use energy generated by fossil-fuel power plants. Depending on how one looks at it, this development could either signal a new alarming legislative trend or a trigger that would accelerate the digital asset industry’s movement toward a more sustainable path. Moratorium with further evaluation The lower chamber of the NY state legislature, the Assembly, passed a bill that would put a two-year hold on any new mining operations using the proof-of-work (PoW) consensus mechanism, as well as on the renewal of existing permits. The bill, S6486D/A7389C, is marketed by its sponsors as a necessary act of complian...

ECB official blasts the ‘lawless frenzy of risk-taking’ associated with crypto

Fabio Panetta has proposed heavier taxes and more stringent anti-money laundering requirements He argued that the continued correlation of crypto assets with the equities could be potentially destructive to the financial system Italian economist and ECB board member in charge of steering the creation of a digital Euro, Fabio Panetta, has called for coordinated efforts by global regulatory authorities to launch additional measures toward regulating the cryptocurrency sector. Regulating crypto-assets According to an extract from a published speech, Panetta argued the idea of cryptocurrencies to create a trustworthy coin remains a dream, observing that currently, crypto tokens take long periods to transfer and are a source of instability and insecurity. Labelling crypto a Ponzi sch...

ECB official blasts the ‘lawless frenzy of risk-taking’ associated with crypto

Fabio Panetta has proposed heavier taxes and more stringent anti-money laundering requirements He argued that the continued correlation of crypto assets with the equities could be potentially destructive to the financial system Italian economist and ECB board member in charge of steering the creation of a digital Euro, Fabio Panetta, has called for coordinated efforts by global regulatory authorities to launch additional measures toward regulating the cryptocurrency sector. Regulating crypto-assets According to an extract from a published speech, Panetta argued the idea of cryptocurrencies to create a trustworthy coin remains a dream, observing that currently, crypto tokens take long periods to transfer and are a source of instability and insecurity. Labelling crypto a Ponzi sch...

‘Something sure feels like it’s about to break’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week in an uncertain place facing uncertain times — is $40,000 now resistance? The largest cryptocurrency has just closed a fourth red weekly candle in a row, something that has not happened since June 2020. As cold feet over the macro market outlook continues to be the norm, there seems little to comfort bulls as the week gets underway — and Bitcoin is not done selling off yet. On the back of $4,000 in losses over the past four days alone, price targets now focus on retests of liquidity levels further towards $30,000. It is not all doom and gloom — long-term hodlers and key participants such as miners are showing a more positive stance when it comes to Bitcoin as an investment. With that in mind, Cointelegraph takes a look at the forces at work when it comes to ...

US lawmakers sound alarm to EPA over environment concerns of crypto mining

United States House of Representatives member Jared Huffman and 12 other lawmakers have requested the Environmental Protection Agency, or EPA, assess crypto mining firms potentially violating environmental statutes. In a letter addressed to EPA administrator Michael Regan on Wednesday, Huffman said he and other Democratic House members had “serious concerns” around crypto firms in the United States reportedly contributing to greenhouse gas emissions and not operating in accordance with either the Clean Air Act or the Clean Water Act. The lawmakers identified efforts to “re-open closed gas and coal facilities” as a means to produce energy for crypto mining operations as a particular area of concern, as well as “energy-inefficient” proof-of-work mining for Bitcoin (BTC), Ether (ETH), Monero ...

Russian central bank needs to ease up digital asset projects, governor says

Elvira Nabiullina, governor of the Bank of Russia, has admitted that Russia’s central bank might have taken a bit too tough a stance on digital assets and should look to reconsider that. On Thursday, the Russian State Duma reappointed Nabiullina as Bank of Russia governor, marking the third time for her to take the post since she started serving in the position back in 2013. At the official Duma session, Nabiullina talked about many measures that Russia has been taking and is planning to adopt in order to help the government mitigate the impact of massive Western sanctions against the Russian economy. As part of the government’s measures to maintain the economy, the Bank of Russia is working to bring the topic of digital financial assets to a “working state,” Nabiullina stated. She emphasi...