recession

Global recession may last until near 2024 Bitcoin halving — Elon Musk

Bitcoin (BTC) may spend the time until its next block subsidy halving battling recession, Elon Musk suggested. In a tweet on Oct. 21, the Tesla CEO revealed his belief that the world would only exit recession in Spring 2024. Musk: Recession will “probably” stay until Q2, 2024 After the United States entered a technical recession with its Q3 GDP data, debate continues over how much worse the scenario could get. For Musk, while long predicting the United States economy would enter a recession, the likelihood of a global downturn lingering is now real. Asked on Twitter how long he considered a recession to last, the world’s richest man was noncommittal, but erred on the side of years rather than months. “Just guessing, but probably until spring of ‘24,” he wrote, having also said that “it sur...

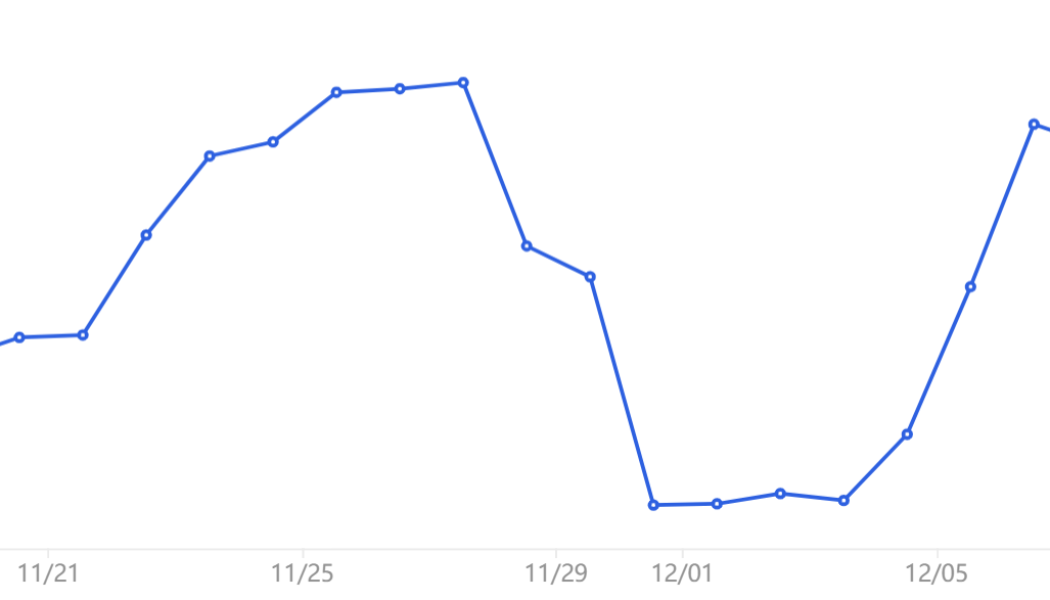

Bitcoin margin long-to-short ratio at Bitfinex reach the highest level ever

Sept. 12 will leave a mark that will probably stick for quite a while. Traders at Bitfinex exchange vastly reduced their leveraged bearish Bitcoin (BTC) bets and the absence of demand for shorts could have been caused by the expectation of cool inflation data. Bears may have lacked confidence, but August’s U.S. Consumer Price Index (CPI) came in higher than market expectations and they appear to be on the right side. The inflation index, which tracks a broad basket of goods and services, increased 8.3% over the previous year. More importantly, the energy prices component fell 5% in the same period but it was more than offset by increases in food and shelter costs. Soon after the worse-than-expected macroeconomic data was released, U.S. equity indices took a downturn, with the tech-he...

UBS raises US recession odds to 60%, but what does this mean for crypto prices?

On Aug. 30, global investment bank UBS increased its view on the risk of the United States entering a recession within one year to 60%, up from 40% in June. According to economist Pierre Lafourcade, the latest data showed a 94% chance of the economy contracting, but added that it “does not morph into a full-blown recession.” Partially explaining the difference is the “extremely low levels” of non-performing loans, or defaults exceeding 90 days from credit borrowers. According to Citigroup Chief Executive Jane Fraser, the institution “feels very good about” liquidity and credit quality. Furthermore, Reuters states that the financial industry wrote off merely 0.1% of its loans in the 2Q. The problem is that even in the now-improbable scenario of avoiding a...

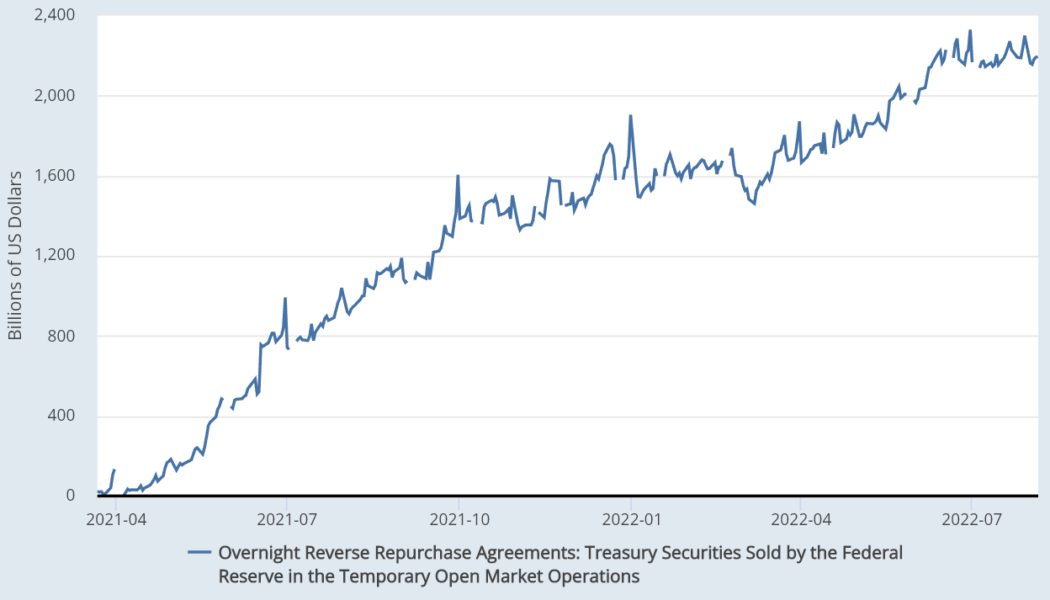

Fed reverse repo reaches $2.3T, but what does it mean for crypto investors?

The U.S. Federal Reserve (FED) recently initiated an attempt to reduce its $8.9 trillion balance sheet by halting billions of dollars worth of treasuries and bond purchases. The measures were implemented in June 2022 and coincided with the total crypto market capitalization falling below $1.2 trillion, the lowest level seen since January 2021. A similar movement happened to the Russell 2000, which reached 1,650 points on June 16, levels unseen since November 2020. Since this drop, the index has gained 16.5%, while the total crypto market capitalization has not been able to reclaim the $1.2 trillion level. This apparent disconnection between crypto and stock markets has caused investors to question whether the Federal Reserve’s growing balance sheet could lead to a longer than expecte...

Semantics? Analysts unpack ‘technical recession’ as crypto markets recover

Data from the United States commerce department suggests America has entered a technical recession, but market analysts have highlighted key metrics that suggest investors are optimistic. The American economy shrunk for the second consecutive quarter, according to government data released on July 28, fitting the criteria for a technical recession. The Biden Administration maintains that the U.S. is not in a recession, highlighting low unemployment rates and other metrics that counter the argument. Mati Greenspan, founder & CEO of Quantum Economics, addressed the topic in his latest QE newsletter, noting a paradoxical effect between the GDP drop and a surge in stocks and other risk assets. He attributed this move to the US Federal Reserve’s decision to raise interest rates by 0.75%, whi...

3 Bitcoin trading behaviors hint that BTC’s rebound to $24K is a ‘fakeout’

Bitcoin (BTC) price rallied toward $24,200 on July 28 after a near 10.5% surge that began a day earlier. The gains appeared after Federal Reserve Chairman Jerome Powell signaled intentions to slow down their prevailing tightening spree. They prompted some Bitcoin analysts to predict short-term upside continuation, with CryptoHamster seeing BTC at $26,000 next. It seems that the downside breakout was a false one, and the bullish flag has been validated. Let’s see how fast $BTC can reach those targets. #bitcoin $BTCUSD $ETH $ETHUSD #ビットコイン #биткойн #比特币 https://t.co/v6x4Ka23L7 pic.twitter.com/nKoEV8440X — CryptoHamster (@CryptoHamsterIO) July 28, 2022 But BTC’s potential to recover entirely from its ongoing bearish slumber appears low for at least three key reasons. Bitcoin bulls...

Will Ethereum Merge hopium continue, or is it a bull trap?

Ethereum is outperforming the broader cryptocurrency market as the highly anticipated Merge approaches, but the bigger picture is still largely bearish. Ethereum (ETH) has gained a whopping 48% over the past seven days, outperforming its big brother Bitcoin, which has only managed to achieve 19% in the same period. It’s also up 66% from its market cycle bottom of $918 on June 19, reaching its current price of $1549. However, the current Ethereum rally could be a bull trap with the macroeconomic clouds darkening. A bull trap is a signal indicating that a declining trend in a crypto asset has reversed and is heading upwards when it will actually continue downwards. The primary driver of recent momentum for the asset has been linked to announcements regarding its final switch to pr...

#EndSARS: VP Osinbajo urges States to send judicial panels’ progress reports

As plans for next year’s budget begins to gather pace, the National Economic Council (NEC) has endorsed the 2022-2024 Medium Term Expenditure Framework and Fiscal Strategy Paper (MTEF/FSP) which was presented to it at an emergency meeting of the Council today. Besides the MTEF presentation, the NEC also updated its focus on the reports of the State Judicial Panels set up across the country after last year’s #EndSARS protests. Vice President Yemi Osinbajo, SAN, urged States where the panels are still sitting to also send interim reports so as to measure progress. According to the Vice President, in a statement by his media aide Laolu Akande, the reports are now being received ahead of a Council meeting where presentations would be made on them, both for States where the panels have conclude...