Sanctions

Monero avoids crypto market rout, but XMR price still risks 20% drop by June

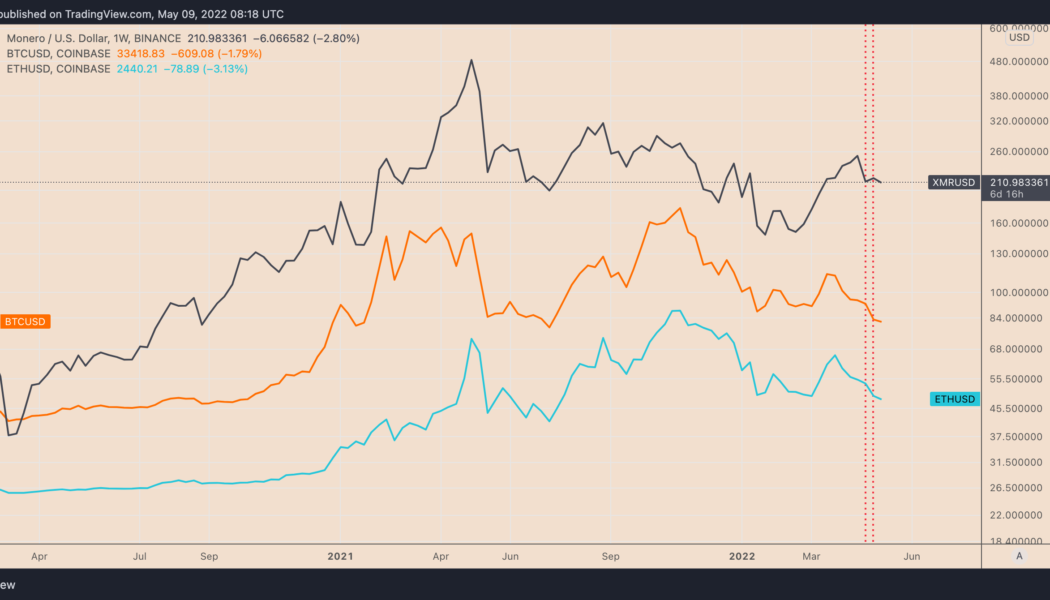

Monero (XMR) has shown a surprising resilience against the United States Federal Reserve’s hawkish policies that pushed the prices of most of its crypto rivals — including the top dog Bitcoin (BTC) — lower last week. XMR price closed the previous week 2.37% higher at $217, data from Binance shows. In comparison, BTC, which typically influences the broader crypto market, finished the week down 11.55%. The second-largest crypto, Ether (ETH), also plunged 11% in the same period. XMR/USD vs. BTC/USD vs. ETH/USD weekly price chart. Source: TradingView While the crypto market wiped off $163.25 billion from its valuation last week, down nearly 9%, Monero’s market cap increased by $87.7 million, suggesting that many traders decided to seek safety in this privacy-focused coin. XMR near ...

Cuban central bank makes it official: VASP licensing coming in May

In a move that could potentially foster the growth of Cuba’s nascent tech industry, the Banco Central de Cuba (BCC), the country’s central bank, will begin issuing licenses for Bitcoin (BTC) and other virtual asset services providers, or VASPs. According to the Official Gazette No. 43 published Tuesday, which includes a Central Bank of Cuba resolution, anyone wanting to provide virtual-asset-related services must acquire a license first from the central bank. It reads: “The Central Bank of Cuba, when considering the license request, evaluates the legality, opportunity and socioeconomic interest of the initiative, the characteristics of the project, the responsibility of the applicants and their experience in the activity.” Furthermore, the document states that those organizations that do n...

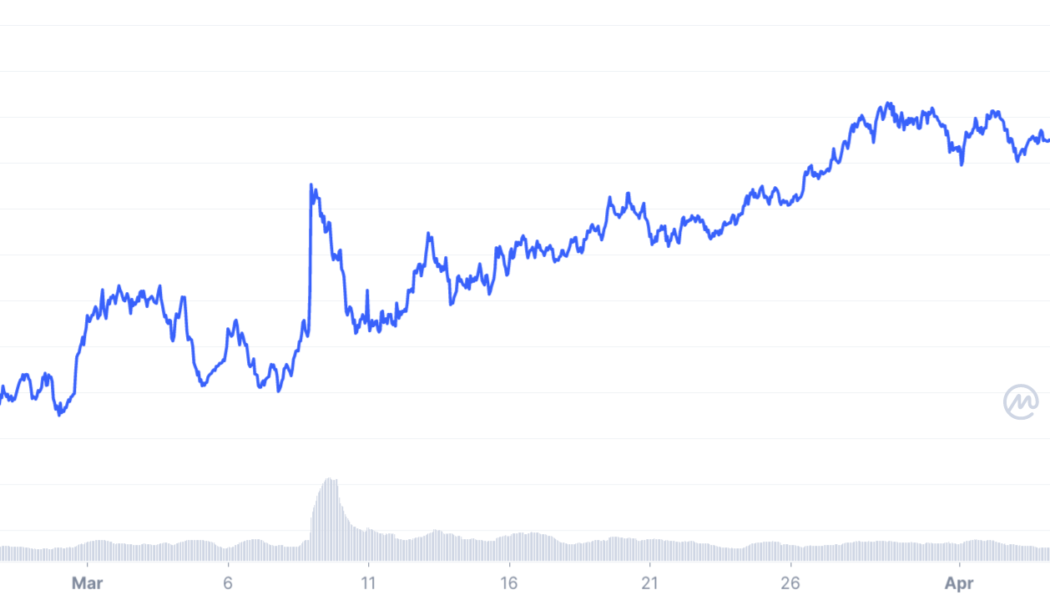

Monero ‘falling wedge’ breakout positions XMR price for 75% rally

Monero (XMR) price dropped by nearly 10% three days after establishing a week-to-date high around $290 on April 24. Nonetheless, several technical indicators suggest that the XMR/USD pair is poised to resume its uptrend over the next few months. Falling wedge breakout underway Notably, XMR’s price broke out of its “falling wedge” structure in late March. It continued its move upside in the later daily sessions, with rising volumes indicating bullish sentiment among Monero traders. Traditional analysts consider falling wedges as bullish reversal patterns, i.e., the price first consolidates within a contracting, descending channel, followed by a strong bounce to the upside. As a rule, the falling wedge’s breakout target comes to be near the level at length equal to th...

US Treasury Dept sanctions 3 Ethereum addresses allegedly linked to North Korea

The United States Treasury Department has added three Ethereum wallet addresses to sanctions allegedly linked to the hacker group responsible for the theft of more than $600 million in crypto from nonfungible token game Axie Infinity’s Ronin sidechain. In a Friday update, the Treasury Department’s Office of Foreign Assets Control, or OFAC, listed three Ethereum addresses to its Specially Designated Nationals restrictions for North Korea’s Lazarus Group. U.S. authorities, including the Federal Bureau of Investigation and the Cybersecurity and Infrastructure Security Agency, have targeted the group over its alleged role in taking more than 173,600 Ether (ETH) and 25.5 million USD Coin (USDC) from the Ronin sidechain in March — the tokens were worth more than $600 million at the time. The U.S...

Russian central bank needs to ease up digital asset projects, governor says

Elvira Nabiullina, governor of the Bank of Russia, has admitted that Russia’s central bank might have taken a bit too tough a stance on digital assets and should look to reconsider that. On Thursday, the Russian State Duma reappointed Nabiullina as Bank of Russia governor, marking the third time for her to take the post since she started serving in the position back in 2013. At the official Duma session, Nabiullina talked about many measures that Russia has been taking and is planning to adopt in order to help the government mitigate the impact of massive Western sanctions against the Russian economy. As part of the government’s measures to maintain the economy, the Bank of Russia is working to bring the topic of digital financial assets to a “working state,” Nabiullina stated. She emphasi...

US Treasury Dept lists crypto mining firm in latest sanctions against Russia

The United States Treasury Department has added Russia-based crypto mining services provider BitRiver and several subsidiaries as firms facilitating the evasion of sanctions. In a Wednesday announcement, the Treasury Department’s Office of Foreign Assets Control, or OFAC, said it was taking action against BitRiver AG as well as 10 of its Russia-based subsidiaries, naming the companies as ‘Specially Designated Nationals’. Firms and individuals listed as such by OFAC have their assets blocked and “U.S. persons are generally prohibited from dealing with them.” According to the U.S. Treasury, the actions against BitRiver and its subsidiaries were based on them allegedly facilitating “sanctions evasion for Russian entities,” hinting crypto may have played a role in helping Russia’s govern...

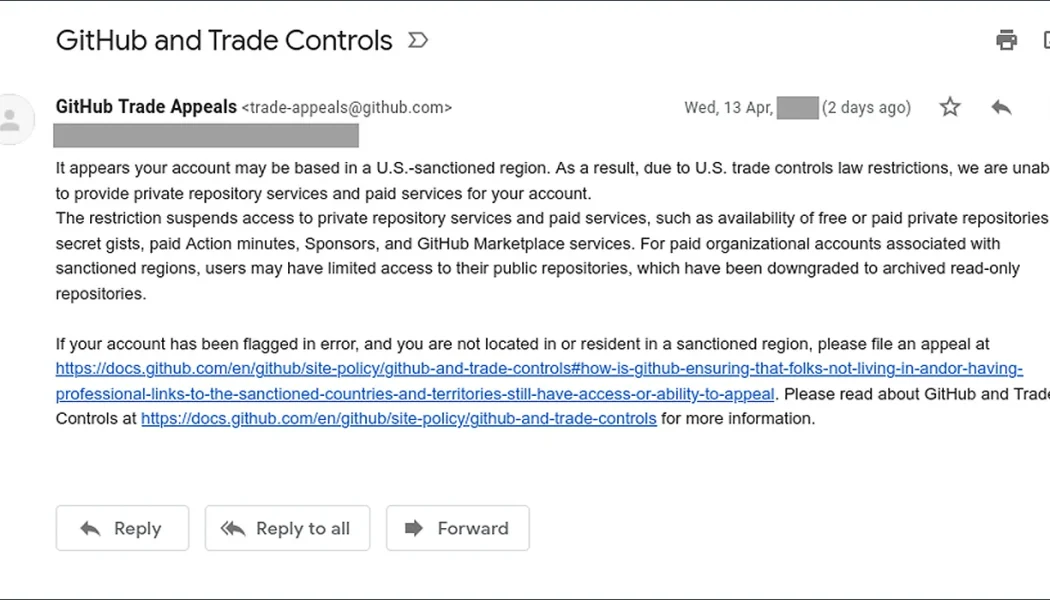

Github suspends accounts of Russian developers linked to sanctioned firms

Major developer platform Github has reportedly blocked more than a dozen accounts of Russian developer’s associated with organizations sanctioned by the United States government. The sanctioned accounts include some of the largest banks in Russia: Sberbank and Alfa-Bank, as well as individual developers with links to the sanctioned firms. However, many individual accounts with no links or ties to sanctioned firms were also blocked in the process, Researcher Sergey Bobrov, who reportedly has no links to any such firm, reported that his account was suspended on April 15 and then immediately restored. My github account is unlocked, thanks everyone. The ban was related to the sanctions imposed on my previous employer. — Sergey Bobrov (@Black2Fan) April 15, 2022 Another individ...

Tornado Cash says it’s using Chainalysis oracles to block access from OPAC sanctioned addresses

On Friday, Tornado Cash announced that it was using oracle contracts from Chainalysis to block wallet addresses sanctioned by the U.S. Office of Foreign Assets Control, or OFAC. The move comes after the U.S. Department of the Treasury linked North Korean cybercriminal Lazarus Group as an alleged perpetrator for the recent $600 million+ Ronin Bridge exploit. As told by blockchain analytics firm Elliptic, the hackers have sent approximately $80.3 million worth of Ether (ETH) through Tornado Cash. “Maintaining financial privacy is essential to preserving our freedom; however, it should not come at the cost of non-compliance,” said the Tornado Cash team. Tornado Cash is a popular cryptocurrency mixture used to obfuscate the trail of transactions for privacy. The Chainalysis S...

EU bans providing ‘high-value crypto-asset services’ to Russia

The Council of the European Union has cut Russians off from certain cryptocurrency services as part of a package of restrictive measures against Russian President Vladimir Putin’s “brutal aggression against Ukraine and its people.” In a Friday announcement, the EU council said it would be closing potential loopholes in using digital assets for Russian entities and individuals to evade sanctions with a “prohibition on providing high-value crypto-asset services” to the country. The action was one of three financial measures the European Commission proposed alongside banning transactions and freezing assets connected to four Russian banks as well as a “prohibition on providing advice on trusts to wealthy Russians.” Russian Prime Minister Mikhail Mishustin claimed on Thursday that Russians hol...

Monero defies crypto market slump with 10% XMR price rally — what’s next?

Privacy-focused cryptocurrency Monero (XMR) rallied by nearly 9.5% in the past week compared with the crypto market’s decline of 8.5% in the same period. What’s more, the XMR/USD pair has broken above a strong, multi-month resistance trendline, hinting at more upside ahead. XMR price action XMR’s price was down by a modest 0.87% on April 10 from its two-month-high of $245 established a day before. However, the cryptocurrency still outperformed its top rivals, including Bitcoin (BTC) and Ether (ETH), on a weekly timeframe. Speculations about entities using Monero to bypass sanctions could have boosted its appeal among investors. Meanwhile, The American research group Brookings warned last month that Monero, the first in the line of privacy coins, could...

US sanctions Russia’s largest darknet market and crypto exchange Garantex

The United States Department of the Treasury’s Office of Foreign Assets Control has announced it will impose sanctions on darknet market Hydra and virtual currency exchange Garantex. In a Tuesday announcement, the Treasury Department said it had worked with the Department of Justice, the Federal Bureau of Investigations, the Drug Enforcement Administration, the Internal Revenue Service Criminal Investigation and Homeland Security Investigations to sanction the Russia-based darknet marketplace as well as Garantex. The move from the U.S. government agencies came the same day the German Federal Criminal Police announced it had shut down Hydra’s servers in Germany and seized more than $25 million worth of Bitcoin (BTC) connected to the marketplace. Illegaler #Darknet-Marktplatz „Hydra Market“ ...

Bank of Japan official calls for G7 nations to adopt common crypto regulations

A senior official from the Bank of Japan (BOJ) has warned G7 nations that a common framework for regulating digital currencies needs to be put in place as quickly as possible. G7 refers to the Group of Seven, an inter-governmental political forum made up of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States. The statement comes in response to the continued conflict between Russia and Ukraine, as cryptocurrencies and their potential applications for skirting economic sanctions falls under increasing scrutiny. The head of the BOJ’s payment systems department, Kazushige Kamiyama, told Reuters that using stablecoins makes it very easy to “create an individual global settlement system,” which would in turn make it easier for nation states to evade more t...