Sanctions

Binance joins association to address compliance with global sanctions

Binance has become one of the first crypto firms to join the Association of Certified Sanctions Specialists, orACSS, in an effort to stay in compliance with global sanctions. In a Jan. 6 announcement, Binance said its team of sanctions compliance personnel would be undergoing training as part of the certification process at ACSS. According to the association’s website, the group offered an examination addressing “knowledge and skills common to all sanctions professionals in varied employment settings.” “The blockchain industry is still in its early years, and it’s our priority to continue upholding the highest level of compliance amid a fast-evolving space,” said Binance’s global head of sanctions, Chagri Poyraz. “At the end of the day, we want to continue setting the industry standard for...

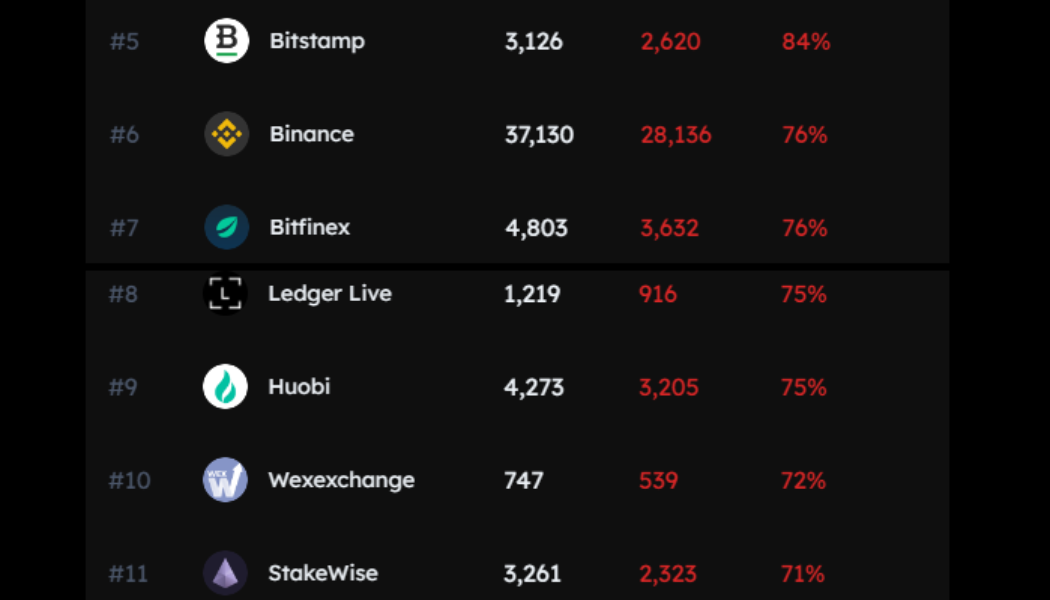

ETH staking on top exchanges contributes to Ethereum censorship: Data

For most crypto ecosystems, being compliant with federal sanctions have a negative impact on its global reach. However, when it comes to Ethereum, investors have significant power to decide the degree of compliance the ecosystem obeys. Nearly 60% of all post-Merge Ethereum blocks comply with the United States sanctions put forth by the Office of Foreign Assets Control (OFAC). While the crypto community stands against this transformation, many fail to realize their own contribution to helping Ethereum attain total OFAC compliance. One of the biggest factors harming Ethereum’s credible neutrality is the use of censoring MEV relays by crypto ecosystems and exchanges. Miner extractable value (MEV) relays work as a mediator between block producers and block builders, which are being used ...

Proactive sanctions can help spare the ecosystem: Chainalysis exec

As many countries, entities and even individuals face international sanctions, the crypto industry seeks to find its place among increasing regulations. Digital currencies have often been mentioned as an avenue for those subject to sanctions to divert them, such as in the recent case of Russia. In such instances, exchanges and other industry players need to understand where they stand compliance-wise. Research out of Harvard even suggested that central banks can use Bitcoin (BTC) to fight off sanctions. Speaking to Cointelegraph’s managing editor Alex Cohen at the Israel Crypto Conference, Chainalysis head of sanctions Andrew Fierman said sanctions are nuanced depending on the many factors which surround the situation. “When you’re looking at countries like Iran and North...

Binance still serving Russians while seeking clarity on EU crypto sanctions

In the weeks following new sanctions from the European Union, Binance has kept its doors open for non-sanctioned Russian nationals, but that does not mean that the firm isn’t complying with EU sanctions, according to Binance’s newly-appointed sanctions executive. Western sanctions against Russia have been a major challenge for Binance from day one, and the firm has been working hard to comply, Binance’s global head of sanctions Chagri Poyraz told Cointelegraph in an interview. Since the start of Russia’s invasion of Ukraine, Binance has comprehensively blocked several non-government-controlled territories of Ukraine, including annexed regions like Donetsk and Luhansk, Poyraz said. “There is still an active war going on in the region,” he noted, adding that Binance continu...

EU regulators ban cross-border payments from Russian crypto accounts

In a statement released on Oct. 6, the European Union introduced another set of sanctions against Russia due to the prolonged and recently escalated conflict in Ukraine. The new sanctions include a complete ban on cross-border crypto payments between Russians and the EU. This statement includes the prohibition of, “all crypto-asset wallets, accounts, or custody services, irrespective of the amount of the wallet.” New sanctions were installed as a response to Russia’s annexation of Ukrainian territory as the result of what the EU calls a “sham” referendum, along with troop mobilization and threats of nuclear escalation. The previous sanctions capped crypto payments from Russian to EU wallets at 10,000 euros (approximately $9,900). However, this new total ban on cross-border crypto...

Russia unlikely to choose Bitcoin for cross-border crypto payments: Analysis

Despite Russia pushing the idea of using cryptocurrencies for cross-border payments, the specific digital asset the government plans to adopt for such transactions still remains unclear. Russian authorities are quite unlikely to approve the use of cryptocurrencies like Bitcoin (BTC) for cross-border transactions, according to local lawyers and fintech executives. Bank of Russia needs to control cross-border transactions That Russia would allow Bitcoin or any other similar cryptocurrency to be usefor cross-border payments is “highly questionable” because such assets are “hard to control,” according to Elena Klyuchareva, the senior associate at the local law firm KKMP. Klyuchareva emphasized that the draft amendments to the legislation on cross-border crypto payments are not...

US Treasury sanctions 5 crypto addresses connected to Russian neo-Nazi paramilitary group

The United States Department of the Treasury added five cryptocurrency addresses tied to a neo-Nazi group involved in Russia’s war on Ukraine to list of entities sanctioned by the Office of Foreign Asset Control. In a Thursday notice, the U.S. Treasury designated 22 individuals and 2 entities, including many the government department claimed had furthered the Russian government’s objectives in Ukraine, to its list of Specially Designated Nationals, effectively barring U.S. persons and companies from dealing with them. Included in sanctions of one of the entities — a neo-Nazi paramilitary group called Task Force Rusich — were 2 cryptocurrency addresses for Bitcoin (BTC), 2 for Ether (ETH), and 1 for Tether (USDT). Treasury Secretary Janet Yellen said the sanctions were imposed as part of th...

Rep. Emmer demands an explanation of OFAC’s Tornado Cash sanction from Sec. Yellen

United States Congressman Tom Emmer sent a four-page letter to Treasury Secretary Janet Yellen on Tuesday regarding the Treasury Department’s sanctioning of cryptocurrency mixer Tornado Cash on Aug. 8. In his letter, Emmer posed a series of questions that seek to clarify the position of the Treasury Department’s Office of Foreign Assets Control (OFAC). Emmer said that OFAC, acting under Executive Order 13694 to place Tornado Cash on its Specially Designated Nationals and Blocked Persons List (SDN), has for the first time extended the EO’s definition of person or individual to include code. He pointed to the distinction made by the Treasury’s Financial Crimes Enforcement Network (FinCEN) between anonymizing services and anonymizing software to illustrate the issue he saw in OFAC’s action wh...

DeFi platform Oasis to block wallet addresses deemed at-risk

According to a new community Discord post on Thursday, decentralized finance platform Oasis.app says that sanctioned addresses will no longer be able to access the application. As a result of the change to the terms of service, wallets flagged as high risk are prohibited from using Oasis.app to manage positions or withdraw funds. Instead, such category of users must interact directly with the relevant underlying protocol where funds are stored or find another service. In explaining the decision, Oasis.app team member Gabriel said: “We’ve recently needed to update the Terms of Service of the Oasis.app front-end to comply with the relevant laws and regulations. In line with the latest regulations, Oasis.app has an updated Terms of Service. Any sanctioned addresses will no longer ...

TORN price sinks 45% after U.S. Treasury sanctions Tornado Cash — Rebound ahead?

Tornado Cash (TORN) has lost almost half its market valuation two days after being slapped with sanctions by the U.S. Treasury Department. The department accused Tornado Cash, a crypto mixer platform, of laundering more than $7 billion in cryptocurrencies, including a stash of $455 million allegedly stolen by North Korea-based hackers. Immediate reactions were followed by U.S.-based crypto companies, including Circle and Coinbase. In a controversial move, the popular crypto firms blocked the movements of their jointly-issued stablecoin USDC tied to Tornado Cash’s blacklisted smart contracts. TORN price drops 45% The news prompted traders to limit their exposure to TORN, Tornado Cash’s native token. On the daily chart, TORN’s price has slipped by approximately 45...

Anonymous user sends ETH from Tornado Cash to prominent figures following sanctions

On Tuesday, one day after the U.S. Treasury sanctioned cryptocurrency mixer Tornado Cash for its alleged role in cryptocurrency money laundering operations, intervals of 0.1 Ether (ETH) transactions began materializing from the smart contract to prominent figures such as Coinbase CEO Brian Armstrong and American television host Jimmy Fallon. It is not possible to trace the source of the transactions per Tornado Cash design, and as a result, either one individual or multiple individuals or entities could be involved in the operation. Notable individuals/companies who just received funds from a government-sanctioned entity: – Jimmy Fallon– Shaquille O’Neal– PUMA– Randi Zuckerberg– Logan Paul– Brian Armstrong– Steve Aoki– Uk...

US federal judge approves of Justice Dept criminal complaint on using crypto to evade sanctions

The United States Department of Justice may move forward on a criminal prosecution case against a U.S. citizen who allegedly violated sanctions through cryptocurrency. According to a Friday opinion filing in U.S. District Court for the District of Columbia, the unnamed individual who is the subject of a criminal investigation by the Justice Department allegedly sent more than $10 million in Bitcoin (BTC) from a U.S.-based crypto exchange to an exchange in a country for which the U.S. currently imposes sanctions — suggesting Russia, Cuba, North Korea, Syria, or Iran. The filing alleged the individual “conspired to violate the International Emergency Economic Powers Act” and conspired to defraud the United States. The individual allegedly “proudly stated the Payments Platform could circumven...