Senate

Ticketmaster Plans to Blame Scalpers for Taylor Swift Debacle at Senate Hearing

Don’t expect Live Nation’s Joe Berchtold to be quoting Taylor Swift’s “Anti-Hero” during Tuesday’s Senate Judiciary Committee hearing on ticketing. Unlike the pop star’s “I’m the problem it’s me” chorus-turned-meme, the company’s president and CFO plans to take aim at who he says are the real culprits behind Swift’s disastrous Nov. 15 presale: scalpers. While the Live Nation-owned Ticketmaster was villainized for weeks following the presale for Swift’s upcoming The Eras Tour that both broke single-day sales records and threw fans into a fury over service issues, according to a prepared opening statement reviewed by Billboard, Berchtold plans to lay much of the blame on scalpers who used illegal bots to attack the online sale. The statement — to be delivered Tuesday (Jan. 24) in Washington,...

US Senate committee hearing on FTX fail brings gaps in regulatory authority to light

United States Commodity Futures Trading Commission chair Rostin Behnam told a Senate Agriculture, Nutrition, and Forestry Committee meeting Dec. 1 that his agency’s regulations contain “core elements that have served the markets for decades.” But as the fallout from the FTX collapse gets sorted out, notable gaps in current legislation have come to light, Behnam and the senators agreed. Sen. Tina Smith called the FTX collapse “shocking, not surprising,” and said that future crises will continue to occur as long as regulatory gaps remain. Behnam pointed out that the Securities and Exchange Commission has the authority to require basic safeguards be in place, such as separation of house and customer money and best execution of investment trades. “We know how to do this,” Behnam said. Non...

Crypto Biz: Institutions short Bitcoin as SBF is ‘deeply sorry’ for FTX collapse

The monumental collapse of FTX will go down as one of the biggest corporate scandals of all time. But, at least Sam Bankman-Fried, or SBF, is sorry. On Nov. 22, the disgraced founder of FTX penned a letter to his former employees describing his role in the company’s bankruptcy. “I never intended this to happen,” he wrote. “I did not realize the full extent of the margin position, nor did I realize the magnitude of the risk posed by a hyper-correlated crash.” Get this: SBF still thinks the company can be saved because “there are billion of dollars of genuine interest from new investors.” Shouldn’t he be preoccupied with trying to avoid jail right now? Bitcoin (BTC) and the broader crypto market have been reeling in the wake of the scandal. While this has allowed many diamond handed hodlers ...

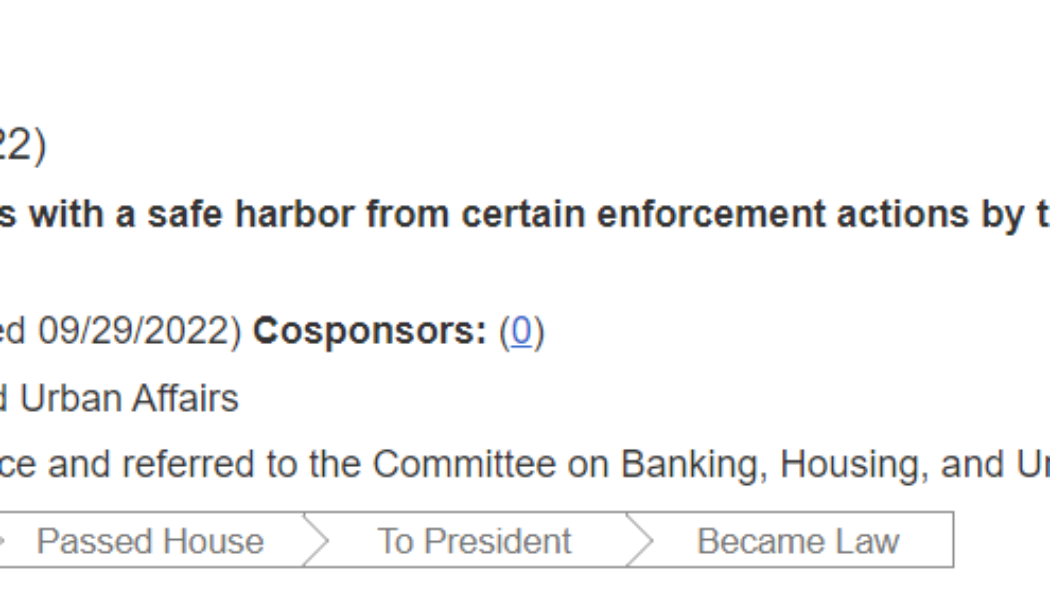

US senator bill seeks to cushion crypto exchanges from SEC enforcement actions

United States Senator Bill Hagerty, a member of the Senate Banking Committee, introduced legislation seeking a safe harbor for cryptocurrency exchanges from “certain” Securities and Exchange Commission (SEC) enforcement actions. The Digital Trading Clarity Act of 2022, introduced by Sen. Hagerty, aims to provide regulatory clarity around two primary concerns plaguing crypto exchange establishments — (i) the classification of digital assets and (ii) related liabilities under existing securities laws. A bill to provide digital asset intermediaries with a safe harbor from certain enforcement actions by the Securities and Exchange Commission, and for other purposes. Source: congress.gov Sen. Hagerty outlined an overview of the problems amid regulatory hurdles: “The current lack of regulatory c...

Sen. Lummis: My legislation would empower the SEC to protect consumers

The United States has been the global financial leader since World War II when the U.S. dollar became the world reserve currency. Consequently, Americans have enjoyed benefits like greater buying power, easier access to capital and low-interest rates—including on our national debt. Unfortunately, we face a growing threat to that dominance, from our national debt on the one hand and China’s ascendance and their own digital currency on the other. If the U.S. dollar lost its position as the world reserve currency, it would mean higher U.S. interest payments, more expensive debt repayments and a skyrocketing deficit. The best time to address a crisis is before it begins and the United States still has the opportunity to right our fiscal ship and set ourselves on course for continued financial ...

US Senate confirms Michael Barr as Fed vice chair for supervision

The United States Senate has confirmed the nomination of law professor Michael Barr to become the next vice chair for supervision for the Federal Reserve. In a 66-28 vote on the Senate floor on Wednesday, U.S. lawmakers confirmed Barr as vice chair for supervision of the Federal Reserve System for four years, filling the last seat on the seven-member board of governors. Barr, who was on the advisory board of Ripple Labs from 2015 to 2017, also served as the Treasury Department’s assistant secretary for financial institutions under former President Barack Obama, and taught courses on financial regulation at the University of Michigan. As vice chair for supervision, Barr will be responsible for developing policy recommendations for the Fed as well as overseeing the supervision and regulation...

US crypto regulation bill aims to bring greater clarity to DAOs

On June 7, United States Senators Cynthia Lummis and Kirsten Gillibrand launched the much anticipated Responsible Financial Innovation Act, proposing a comprehensive set of regulations that address some of the biggest questions facing the digital assets sector. By providing holistic guidance to the rapidly growing industry, the bill offers a bipartisan response to President Biden’s call for a whole-of-government approach to regulating crypto. Among its many proposals, the bill establishes basic definitions, provides an exemption for digital currency transactions and harmonizes the roles of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), delineating regulatory swim lanes and granting a significant jurisdictional expansion to the CFTC. The bi...

Chainalysis exec touts blockchain analysis to Senate homeland security committee

The collection and processing of information was a major theme at the United States Senate Committee on Homeland Security and Governmental Affairs (HSGAC) hearing titled, “Rising Threats: Ransomware Attacks and Ransom Payments Enabled by Cryptocurrency” on Tuesday. The committee hosted a panel of private-sector experts who discussed the problem of ransomware attacks and the challenges of collecting and using the information necessary to fight them. Committee chair Gary Peters of Michigan, who introduced the Strengthening American Cybersecurity Act in February, said the government lacks sufficient data even to understand the scope of the threat posed by ransomware attacks. Attackers almost exclusively ask for payment in cryptocurrency, he added. Several figures were trotted out to qua...