Singapore

DBS bank reports 4X growth in Bitcoin buys on DDEx exchange in June

A major cryptocurrency selloff in June 2022 has sparked more interest in Bitcoin (BTC) from institutional investors, according to data from one of the biggest banks in Singapore. The total number of trades on DDEx more than doubled in June 2022 as compared to April 2022 amid the growing investor appetite for digital assets like Bitcoin and Ether (ETH). Buy orders on DDEx accounted for 90% of all trades in June as cryptocurrencies traded at notable discounts in mid-2022, DBS said. Compared to April 2022, the amount of Bitcoin purchased on DDEx in June saw a fourfold increase, while the quantity of ETH grew 65%, DBS reported. “With the digital asset industry experiencing unprecedented volatility, investors who believe in the long-term prospects of digital assets are gravitating towards trust...

Crypto lender Hodlnaut seeks judicial management to avoid forced liquidation

Singapore-based crypto lending platform Hodlnaut is seeking judicial management to manage its ongoing liquidity crisis and avoid the forced liquidation of assets in the current bear market. The crypto lender informed its users in a Tuesday announcement that they have applied to the Singapore High Court to be placed under judicial management. The firm said: “We are aiming to avoid a forced liquidation of our assets as it is a suboptimal solution that will require us to sell our users’ cryptocurrencies such as BTC, ETH and WBTC at these current depressed asset prices. Instead, we believe that undergoing judicial management would provide the best chance of recovery.” Judicial management is a law in Singapore that allows financially troubled firms to rehabilitate themselves. Und...

Zipmex gets 3 month protection in Singapore amid halted withdrawals

Cryptocurrency exchange Zipmex has gotten a chance to sort out liquidity issues as a court in Singapore has granted the firm with more than three months of creditor protection. Singapore’s High Court has ruled to give each of the five Zipmex entities a moratorium until Dec. 2, 2022 to come up with a restructuring plan, Bloomberg reported on Monday. The action aims to protect Zipmex from potential creditor lawsuits during the moratorium period after the exchange abruptly halted crypto withdrawals on its platform in mid-July. The cryptocurrency has since resumed partial withdrawals from Zipmex’s trade wallet but is yet to resume all withdrawals. Zipmex sought creditor protection for a period of six months subsequently after halting withdrawals, filing five moratorium applications on July 27....

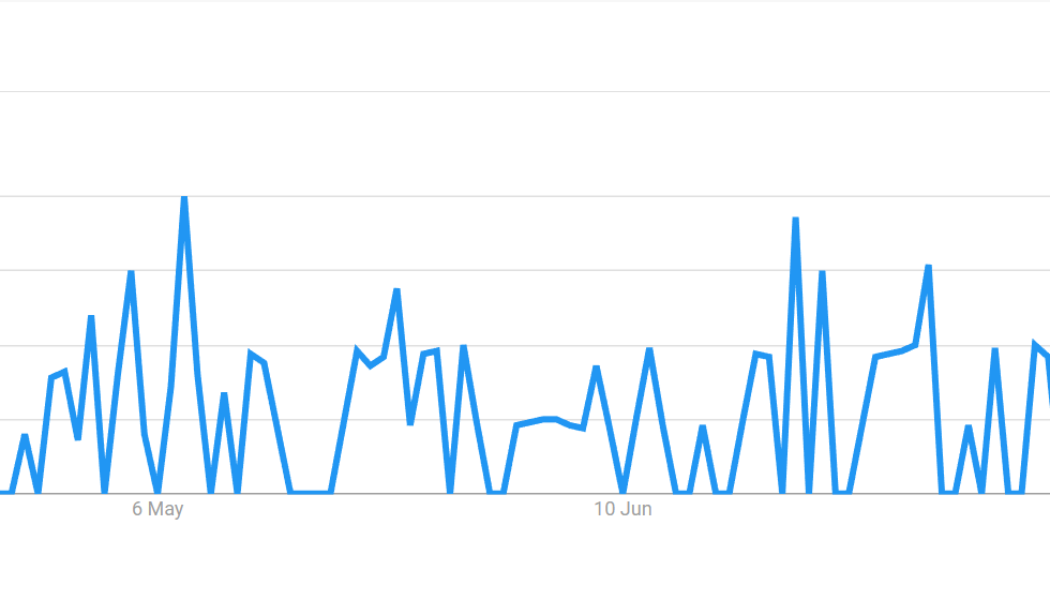

Nigeria becomes the most crypto-obsessed nation after April crash: Report

The crypto market crash in April saw most cryptocurrencies lose more than 60% of their valuation from the top, leading to an overall downturn in trading activity, investor interest and venture capital investment. A recent study has highlighted nations’ growing curiosity and interest in crypto after the April crash. The research was based on Google Trends data of popular crypto search terms that often reflect increased interest in the crypto market. The search history of each nation was then compiled to give an overall search score. The countries at the top of the list appear to be most eager to buy the dip. The Coingecko research highlighted a significant rise in curiosity among Nigerians after the crypto market downturn in April. The Nigerian population searched the term ‘cryptocurr...

The lasting agony of 3AC: Law Decoded, July 18-25

The late spring and summer months of 2022 would be remembered not only for their extreme temperatures across the globe but also for a crushing streak of large crypto companies falling apart. Terra Lab in May, Celsius in June and now, the lasting agony of a Singapore-based crypto hedge fund Three Arrows Capital (3AC). Technically, 3AC was ordered for liquidation by a court in the British Virgin Islands on June 27, but it was last week, which has seen some further developments around the firm. The liquidators of 3AC are brutally demanding access to the company’s Singapore headquarters due to the “virtual radio silence from the management/directors of the Company.” They believe the office may contain cold wallets or information on how to access 3AC trading accounts, which the liquidator...

Crypto lender Vauld seeks protection against creditors: Report

Singapore crypto exchange Vauld Group is seeking a moratorium against its creditors — a move that would give the troubled lender more time to restructure its business after collapsing asset prices impacted its operations earlier this month. Vauld filed an application in Singapore on July 8 seeking a moratorium order, The Wall Street Journal reported Wednesday. If granted, the moratorium would provide the distressed lender more time to seek out a proper restructuring plan. The Journal said a Singaporean moratorium order is similar to Chapter 11 bankruptcy in the United States, although the moratorium helps the company avoid complete closure. Vauld issued a statement on July 11 informing the public that it would pursue a moratorium order to give management “the breathing space it requires to...

Singapore’s financial watchdog considers further restrictions on crypto

The Monetary Authority of Singapore, or MAS, has been “carefully considering” adding restrictions that could affect how retail investors handle crypto, according to one of the government’s senior ministers. According to parliamentary records published on Monday, Singapore senior minister and MAS chair Tharman Shanmugaratnam said the financial watchdog may consider “placing limits on retail participation” for crypto investors as well as introducing rules on the use of leverage for crypto transactions. Shanmugaratnam also called for regulatory clarity among financial regulators around the world, “given the borderless nature of cryptocurrency markets.” In January, the MAS barred crypto service providers from advertising or marketing in public spaces, and was behind regulations to shut down cr...

CBDC may threaten stablecoins, not Bitcoin: ARK36 exec

Central bank digital currencies (CBDCs) do not pose any direct threat to cryptocurrencies like Bitcoin (BTC) but are still associated with risks in relation to stablecoins, one industry executive believes. According to Mikkel Morch, executive director at the digital asset hedge fund ARK36, a state-backed digital currency like the U.S. dollar doesn’t necessarily have to be a competitor to a private or a decentralized cryptocurrency. That’s because the use cases and value proposition of the decentralized digital assets “often go beyond the realm of simple transactions,” Morch said in a statement to Cointelegraph on Thursday. The exec referred to Federal Reserve Chair Jerome Powell who earlier this year hinted that the United States government would not stop a “well regulated, privately issue...

Weekly Report: India mulls 28% GST on crypto, Tether to launch Pound Sterling-backed stablecoin, FalconX secures $150M raise and more

Here are all the exciting headlines you missed in the NFT, DeFi and crypto niches across regulations and business verticals. Crypto broker FalconX raises $150 million, reaching an $8 billion valuation US-based firm digital assets brokerage on Wednesday disclosed it had raised $150 million in the latest financing round led by Singaporean wealth group GIC and Swiss firm B Capital. Other investors that took part include private equity firm Thoma Bravo, Tiger Global Management, and investment manager Adams Street. Notably, the series D funding round comes when crypto entities suffer losses and try to stay afloat. Falcon X’s total funding now stands at $430 million, having secured a massive $210 million from its Series C funding. Its valuation has more than doubled from $3.75 billion to $8...

JPMorgan secures DeFi partnership in Singapore as crypto giants leave for Dubai

The Monetary Authority of Singapore is partnering with JPMorgan Chase to lead a pilot program exploring the DeFi niche The move is an initiative to explore the economic potential and value-adding use cases of crypto by the central bank of Singapore The project involves creation of tokenised bonds and deposits in a liquidity pool for DeFi applications The Monetary Authority of Singapore recently announced Project Guardian, a pilot digital asset program to examine the potential of tokenisation of bonds on public blockchains. The project intends to establish a liquidity pool of tokenised bonds and deposits. Involved would be trusted financial players who will serve as trust anchors, including JP Morgan Chase & Co, DBS Bank Ltd, and digital asset venture Marketnode. Project Guardian ...

Finance Redefined: Maker founder proposes endgame, Singapore explores DeFi and more

The past week in the decentralized finance (DeFi) ecosystem saw many new developments, including the rebirth of the Terra 2.0 blockchain. Meanwhile, Binance’s incubation platform Binance Labs launched a $500 million fund to support and promote Web3 adoption. Singapore’s central bank partnered with JP Morgan to explore DeFi applications in wholesale funding markets by establishing tokenized bonds. KuCoin launched its very decentralized wallet with DeFi and nonfungible token support. The top-100 DeFi tokens showed signs of a breakout from a month-long bearish trend, with most of the tokens showing overall gains in the past seven days. Maker founder proposes MetaDAOs and synthetic ETH in ‘Endgame Plan’ MakerDAO co-founder Rune Christensen has issued a new monumental proposal to push the proje...

Singapore to explore digital asset tokenization on public chains

The Monetary Authority of Singapore (MAS) has launched Project Guardian, a blockchain-based digital assets trial that will use tokenization. The project will include regulated financial institutions serving as “trust anchors,” with a pilot involving JP Morgan, DBS Bank and Marketnode, the SGX joint venture for bonds. The Project Guardian initiative, which was announced during the Asia Tech x Singapore Summit on Tuesday, was spearheaded by Deputy Prime Minister and Coordinating Minister for Economic Policies Heng Swee Keat. It will see MAS explore decentralized finance (DeFi) applications in wholesale funding markets by establishing a liquidity pool of tokenized bonds and deposits to execute borrowing and lending on a public blockchain-based network. According to MAS chief finte...