Smart Contracts

3 blockchain use cases that extend beyond crypto

Blockchain use cases have expanded far beyond cryptocurrency in recent years, with multiple industries embracing the technology in a wide range of fields, including healthcare, logistics and financial services. There are many factors behind the hype. Blockchains are decentralized, transparent and increase the capacity of a whole network, opening a window for solutions that require significant computational power. More importantly, they give users the capacity to control their assets, including their data, without relying on third parties. As blockchain evolves, companies across the world are working to find the best ways to implement the technology for a range of applications. To gain further insight, Cointelegraph reached out to projects disrupting industries and bringing blockchain...

Crypto companies aim to build trust within future products and services

The cryptocurrency ecosystem underwent a turbulent year in 2022. Criticism inside and outside of the crypto industry was fueled following the collapse of FTX, Celsius, Three Arrows Capital and the Terra ecosystem. A number of losses have been recorded from these events. Blockchain analytics firm Chainalysis released a report in December of last year, which noted that the depegging of Terra’s stablecoin, Terra USD Classic (USTC), saw weekly-realized losses peak at $20.5 billion. Findings further show that the subsequent collapse of Three Arrows Capital and Celsius in June 2022 saw weekly-realized losses reach $33 billion. While these events may have resulted in a loss of trust within the crypto ecosystem, it’s important to point out that blockchain technology and cryptocurrency have n...

Users need to go under the engine in Web3 — HashEx CEO

Hacking in Web3 is easy because it uses the same pattern that’s been used since the inception of the internet — pretending to be someone else. Due to the complexity and the “cool factor” of Web3 projects, one can easily — and mistakenly — assume that it takes Mr. Robot level of advanced hacking techniques to pull off a successful attack. In truth, however, it only takes a sinister ad placed on Google search results, an impostor Telegram group or a deviously-crafted email to break the security barriers of the Web3 ecosystem. Blockchain projects can use top-notch smart contracts, securely integrate crypto wallets and use best practices in each digital step across the board. But they still need help with the social aspect of user protection. Web3 takes the “ownership” from central entit...

Coinbase CEO: Regulate centralized actors but leave DeFi alone

Coinbase CEO Brian Armstrong has pushed for stricter regulations on centralized crypto actors but says decentralized protocols should be allowed to flourish given that open-source code and smart contracts are “the ultimate form of disclosure.” Armstrong shared his views on cryptocurrency regulation in a Dec. 20 Coinbase blog where he proposed how regulators can help “restore trust” and move the industry forward as the market continues to recover from the damage done by FTX and its shock collapse. But decentralized protocols aren’t part of that equation, the Coinbase CEO emphasized. “Decentralized arrangements do not involve intermediaries [and] open-source code and smart contracts are “the ultimate form of disclosure,” Armstrong explained, adding that on-chain, “transparency is built in by...

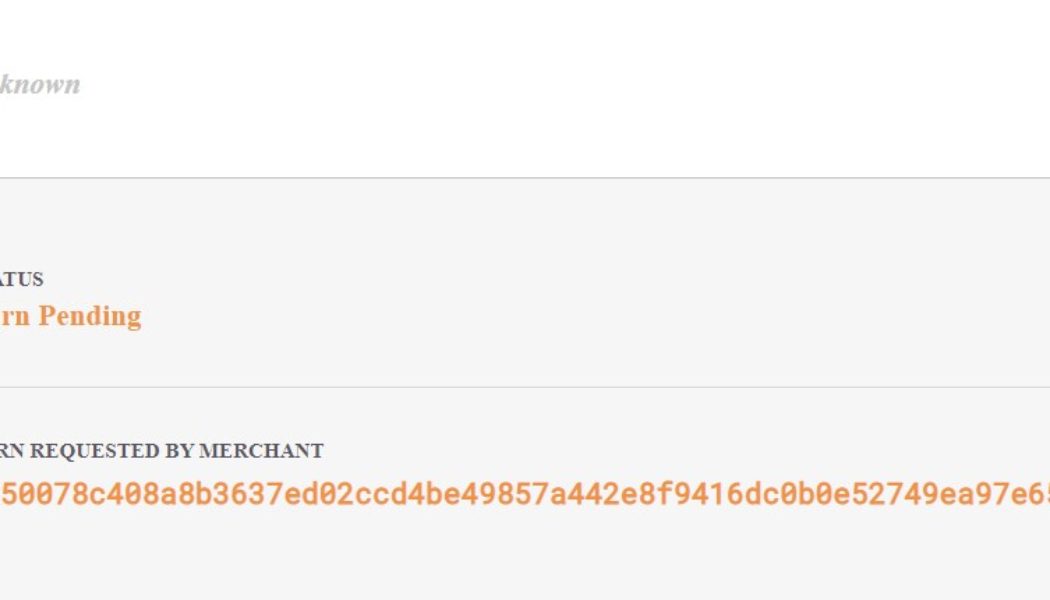

Alameda tried to redeem 3,000 wBTC days before bankruptcy: BitGo CEO

Mike Belshe, the CEO of digital asset custodian BitGo has confirmed that Alameda Research attempted to redeem 3,000 Wrapped Bitcoin (wBTC) in the days before FTX’s bankruptcy filing on Nov. 11. During a Dec. 14 Twitter Spaces hosted by decentralized finance (DeFi) researcher Chris Blec, Belshe confirmed the firm knocked back the redemption request because the unknown Alameda representative involved didn’t pass Bitgo’s security verification process and seemed unfamiliar with how the wrapped Bitcoin burning process worked. Full convo here. This part starts at 1:09:30. https://t.co/0KQg6bzd8k — Chris Blec (@ChrisBlec) December 14, 2022 “[The security details] didn’t match the process. So we held it up and we said no, no, no, no. This is not what the burn looks like. And we need to...

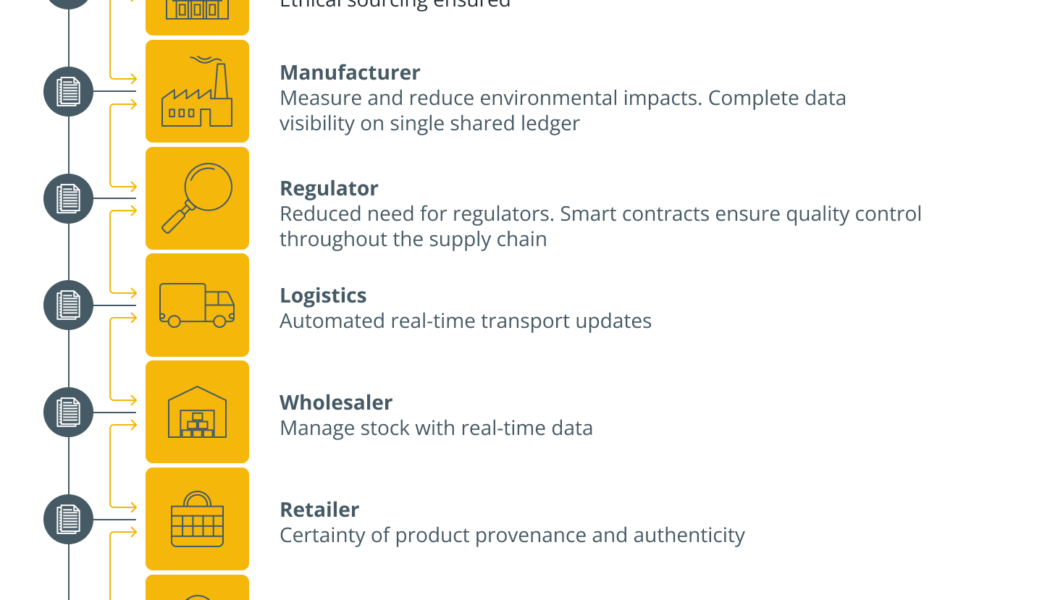

How blockchain technology is used in supply chain management?

To trace the activities along the supply chain more efficiently, concerned parties can access price, date, origin, quality, certification, destination and other pertinent information using blockchain. Traceability, as used in the supply chain sector, is the capacity to pinpoint the previous and current locations of inventory and a record of product custody. It involves tracking products as they move through a convoluted process, from raw materials to merchants and customers, after passing through many geographic zones. Traceability is one of the significant benefits of blockchain-driven supply chain innovations. As blockchain consists of decentralized open-source ledgers recording data, which is replicable among users, transactions happen in real-time. As a result, the blockchain can build...

Web3 sees 15 new scam smart contracts an hour: Solidus Labs

The Web3 and cryptocurrency space is seeing a significant amount of smart contract scams proliferating, with blockchain risk monitoring firm Solidus Labs saying it has detected on average 15 newly deployed scams every hour. Solidus Labs said on Oct. 27 that it had been monitoring 12 blockchains including Ethereum, Polygon and BNB Chain since Oct. 10, and in that time, had detected 188,525 smart contract scams. Former United States Consumer Financial Protection Bureau (CFPB) director, Kathy Kraninger, who is now Solidus’ vice president of regulatory affairs, said in the statement that “while some of the big rug pulls and scams make the news […] the full picture stemming from our data shows the vast majority of these scams go unnoticed.” The firm also shed some light on the number...

Smart contract-enabled insurance holds promise, but can it be scaled?

A new insurance world is coming where smart contracts replace insurance documents, blockchain “oracles” supplant claim adjusters, and decentralized autonomous organizations (DAOs) take over traditional insurance carriers. Millions of poor farmers in Africa and Asia will be eligible for coverages like crop insurance too, whereas before, they were too poor and too dispersed to justify the cost of underwriting. That is the vision, anyway, on display in the recent Smartcon 2022, a two-day conference that sought to provide “exclusive insights into the next generation of Web3 innovation.” Subsistence farms, where families basically live off what they grow and almost nothing is left over, account for as much as two-thirds of the developing world’s three billion rural people, according to the Unit...

MEVbots backdoor drains users’ Ethereum funds via arbitrage trading bot

MEV gain, an Ethereum (ETH) arbitrage trading bot built by MEVbots, which claims to provide stress-free passive income, has been actively draining its users’ funds via a fund-stealing backdoor. Arbitrage bots are programs that automate trading for profits based on historical market information. An investigation of MEVbots’ contract revealed a backdoor that allows the creators to drain Ether from its users’ wallets. Our analysis confirms what the @mevbots promotes for the so-called “MEV gain” has a fund-stealing backdoor. Do *NOT* fall prey to it https://t.co/z2eDqMF36b. And thanks @monkwithchaos for the heads-up https://t.co/dhSNGljoH0 pic.twitter.com/HWfCAwbae4 — PeckShield Inc. (@peckshield) September 23, 2022 The scam was first pointed out by Crypto Twitter’s @mo...

Many NFT projects lack adequate smart contract testing, says nameless founder

Jimmy McNelis, the founder of Web3 tech firm nameless, says there are too many NFT projects rushing to market without proper smart contract testing — potentially leading to millions lost. Speaking with Cointelegraph, McNelis suggested that a lot of NFT projects often rush to market without fully simulating how its smart contracts will work, even skipping extensive audits in some cases. McNelis said an example of this was observed during the sale of the Akutars NFT collection in February 2021 — featuring 15,000 tokens that went up for sale on Winklevoss-owned NFT marketplace Nifty Gateway. McNelis said while the NFT drop sold out, a major bug saw $33 million worth of Ether (ETH) generated from the sale locked up in a smart contract that the devs have no access to, explaining: “Tha...

Fork, yeah! Cardano Vasil upgrade goes live

After several months of delays, the Cardano Vasil upgrade and hard fork has finally gone live as of Thursday at 9:44 pm UTC, bringing “significant performance and capability” enhancements to the blockchain. The success of the Cardano mainnet hard fork was announced by blockchain company Input Output Hong Kong (IOHK) on Twitter on Thursday, while others also observed the hard fork tick over in a live Twitter Spaces with Cardano co-founder Charles Hoskinson. #Vasil mainnet HFC event successful! We’re happy to announce that today, at 21:44:00 UTC, the IOG team, in collaboration with the @CardanoStiftung, successfully hard forked the Cardano mainnet via a HFC event, thus deploying new #Vasil features to the chain.1/5 — Input Output (@InputOutputHK) September 22, 2022 IOHK previously stated the...

OpenSea to allow creators to host NFT drops directly through its homepage

OpenSea, the digital marketplace for crypto collectibles and non-fungible tokens (NFTs), has launched a new initiative to make it easier for creators to create and distribute NFTs on its marketplace. As part of this new immersive initiative, creators will be able to launch their NFT collections on their own customizable and dedicated drop pages, which the company hopes will allow for greater visibility and discoverability on the marketplace’s new homepage. Under the customizable drop pages, creators will now have the ability to share images and videos, provide team highlights, outline roadmaps, and more. According to the announcement: “Drop pages will include information about the drop, the minting schedule, a countdown clock, and of course – an NFT gallery. We’ll also allow collecto...