United States

Binance US will delist AMP following SEC claim token is a security

United States-based crypto exchange Binance.US said it will be delisting the AMP token “out of an abundance of caution” of possible enforcement by federal regulators. In a Monday blog post, Binance.US said it will be closing deposits of Amp (AMP) and removing the AMP/USD trading pair on Aug. 15 following the token’s mention in a legal action from the U.S. Securities and Exchange Commission, or SEC. The federal regulator filed a complaint against a former Coinbase product manager and two individuals in July that claimed that AMP and eight other cryptocurrencies were “crypto asset securities” that fell under the SEC’s purview. “We believe that, in some circumstances, delisting an asset best protects our community from undue risk,” said Binance.US. “We operate in a rapidly evolvin...

Ticketmaster scouts productization of enterprise NFTs beyond ticketing

A new job posting by America’s biggest ticketing company, Ticketmaster, reveals mainstream interest in exploring new revenue streams using nonfungible tokens (NFTs). Over the past two years, artists, musicians and the sports industry helped thrust the NFT ecosystem into the limelight as the technology served its purpose as a powerful fan engagement tool. Conversely, most of the general public boarded the hype train seeking profits via reselling collectibles in the secondary markets. With the NFT hype eventually slowing down by mid-2022, entrepreneurs and companies are looking for new use cases beyond collectibles. A study conducted by Big 4 accounting firm Deloitte in May 2022 highlighted the untapped potential of the crypto ecosystem to open up newer markets for the sports industry:...

Deposits at non-bank entities, including crypto firms, are not insured — FDIC

The United States Federal Deposit Insurance Corporation, or FDIC, has issued an advisory informing the public it “does not insure assets issued by non-bank entities, such as crypto companies.” In a Friday notice, the FDIC advised banks in the U.S. that they needed to assess and manage risks in third-party relationships with crypto firms. The government agency said that while deposits at insured banks were covered for up to $250,000, no such protections applied “against the default, insolvency, or bankruptcy of any non-bank entity, including crypto custodians, exchanges, brokers, wallet providers, or other entities that appear to mimic banks.” “Some crypto companies have misrepresented to consumers that crypto products are eligible for FDIC deposit insurance coverage or that customers are F...

Bill addressing stablecoins risks in US likely delayed until September: Report

Lawmakers in the United States House of Representatives have reportedly pushed back the timeline for considering a bill addressing the potential risks of stablecoins. According to a Monday report from the Wall Street Journal, people familiar with the matter said House members will likely delay voting on a stablecoin bill until September after being unable to complete a draft in time for a Wednesday committee meeting. The unresolved issues in the bill reportedly included provisions on custodial wallets from the Treasury Department and concerns from the Securities and Exchange Commission. Treasury Secretary Janet Yellen reportedly wanted to coordinate with the Biden administration for her response to the bill. Neither has publicly weighed in on the proposed legislation, but Yellen previously...

SEC listing 9 tokens as securities in insider trading case ‘could have broad implications’ — CFTC

Caroline Pham, one of five commissioners with the United States Commodity Futures Trading Commission, or CFTC, has expressed concerns about the possible implications of a case the U.S. Securities and Exchange Commission, or SEC, brought against a former product manager at Coinbase. In a Thursday statement, Pham said the SEC complaint against former Coinbase product manager Ishan Wahi, his brother Nikhil Wahi and associate Sameer Ramani “could have broad implications” beyond the case, given its labeling nine tokens as “crypto asset securities” falling under regulatory body’s purview. The complaint alleged that the Wahis and Ramani engaged in insider trading by using confidential information Ishan obtained from Coinbase with regard to which tokens would be listed on the exchange, in ord...

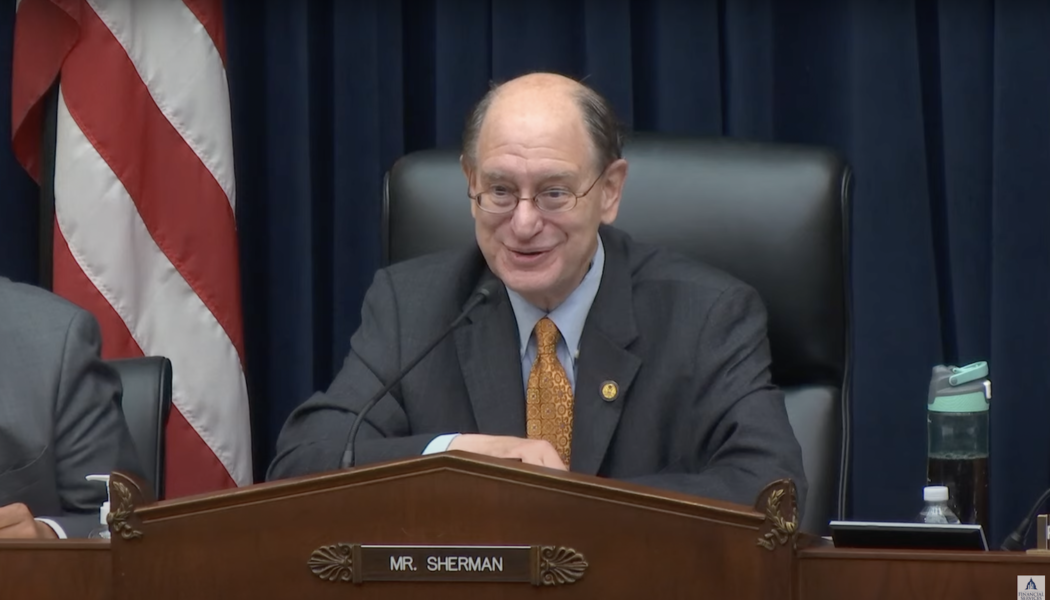

US lawmaker criticizes SEC enforcement director for not going after ‘big fish’ crypto exchanges

Brad Sherman, the congressperson who previously called for banning cryptocurrencies in the United States, criticized the Securities and Exchange Commission’s (SEC) approach to enforcement among major crypto exchanges. In a Tuesday hearing before the House Committee on Financial Services, Sherman said SEC enforcement director Gurbir Grewal needed to show “fortitude and courage” when pursuing securities cases against cryptocurrency exchanges in the United States. The lawmaker added that the SEC enforcement division had “gone after” XRP as a security, but not the crypto exchanges that processed “tens of thousands” transactions of the token. “If XRP is a security — and you think it is, and I think it is, why are these crypto exchanges not in violation of law and is it enough that the crypto ex...

Circle CSO lays out policy principles for stablecoins in US

Dante Disparte, Circle’s chief strategy officer and head of global policy who has previously testified at congressional hearings, has called on United States lawmakers to balance the risks with developing a regulatory path for stablecoins. In a Monday blog post, Disparte named 18 principles Circle had established as part of its effort to shape stablecoin policy in the United States. Circle, the company behind USD Coin (USDC) with a reported $54 billion in circulation, highlighted privacy concerns, “a level playing field” between banks and non-banks over a U.S. dollar-pegged digital currency, how stablecoins can coexist alongside a central bank digital currency, and the need for regulatory clarity. “Harmonizing national regulatory and policy frameworks for dollar digital currencies advances...

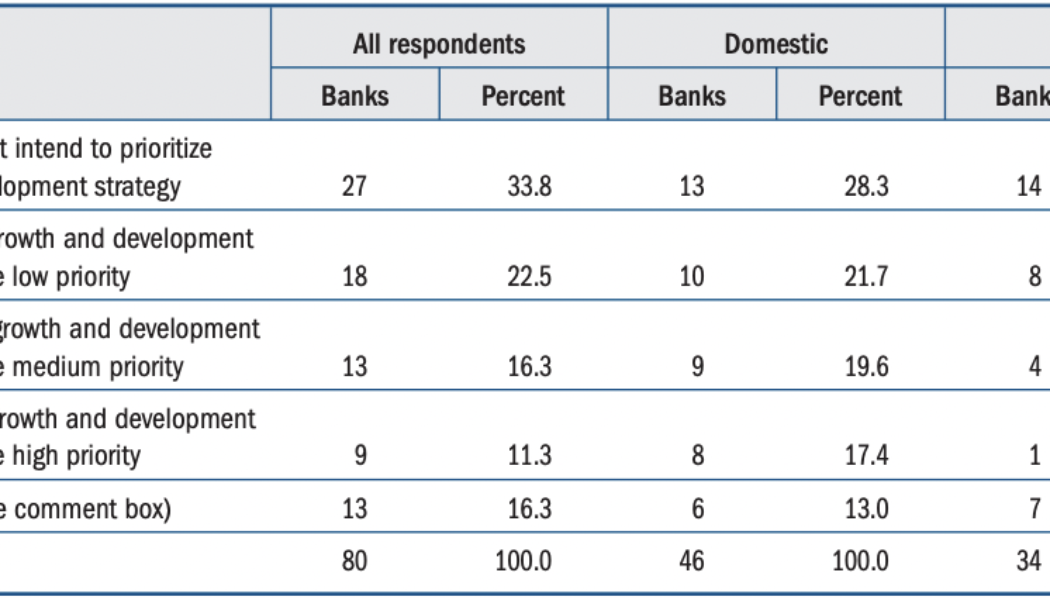

56% of banks say DLT and crypto are ‘not a priority’ in near future — Fed survey

A survey conducted by the Federal Reserve Board of the United States suggested that the majority of officials at major banks did not consider crypto-related products and services a priority in the near future. According to the results of a Fed survey released on Friday, more than 56% of senior financial officers from 80 banks said distributed ledger technology and crypto products and services were “not a priority” or were “a low priority” for their growth and development strategy for the next two years, while roughly 27% said they were a medium or high priority. However, roughly 40% of respondents in the survey said the technology was a medium or high priority for their banks for the next two to five years. Results of Fed survey from May 2022. Source: Federal Reserve Answers from surveyed ...

SEC commissioner Allison Lee departs, readying financial regulator for Jaime Lizárraga

Allison Herren Lee, one of five members of the United States Securities and Exchange Commission’s board, has officially left the regulatory body after more than three years as a commissioner. In a Friday announcement, chair Gary Gensler and commissioners Hester Peirce, Mark Uyeda, and Caroline Crenshaw said Lee had left the SEC, where in 2005 she started as a staff attorney at the agency’s enforcement division at a regional office in Denver. She moved on to be appointed a commissioner in 2019 under the former presidential administration, and later served as acting chair to the regulatory body for three months, until Gensler’s confirmation in April 2021. “Commissioner Lee has been a stalwart advocate for strong and stable markets, including by emphasizing the need for market participants to...

US Senate confirms Michael Barr as Fed vice chair for supervision

The United States Senate has confirmed the nomination of law professor Michael Barr to become the next vice chair for supervision for the Federal Reserve. In a 66-28 vote on the Senate floor on Wednesday, U.S. lawmakers confirmed Barr as vice chair for supervision of the Federal Reserve System for four years, filling the last seat on the seven-member board of governors. Barr, who was on the advisory board of Ripple Labs from 2015 to 2017, also served as the Treasury Department’s assistant secretary for financial institutions under former President Barack Obama, and taught courses on financial regulation at the University of Michigan. As vice chair for supervision, Barr will be responsible for developing policy recommendations for the Fed as well as overseeing the supervision and regulation...

US Treasury calls for public comment on digital asset policy, following Biden’s executive order

The United State Department of the Treasury has requested comments from the public on the potential opportunities and risks of digital assets in compliance with President Joe Biden’s executive order from March. In a Tuesday announcement, the U.S. Treasury said it was asking for input from the public that will “inform its work” in reporting to the president the possible implications of digital assets on the financial markets and payment infrastructures. Biden’s executive order directed the Treasury Department to take the lead among other government agencies in developing policy recommendations aimed at mitigating both systemic and consumer risks around cryptocurrencies. “For consumers, digital assets may present potential benefits, such as faster payments, as well as potential risks, includ...

US crypto regulation bill aims to bring greater clarity to DAOs

On June 7, United States Senators Cynthia Lummis and Kirsten Gillibrand launched the much anticipated Responsible Financial Innovation Act, proposing a comprehensive set of regulations that address some of the biggest questions facing the digital assets sector. By providing holistic guidance to the rapidly growing industry, the bill offers a bipartisan response to President Biden’s call for a whole-of-government approach to regulating crypto. Among its many proposals, the bill establishes basic definitions, provides an exemption for digital currency transactions and harmonizes the roles of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), delineating regulatory swim lanes and granting a significant jurisdictional expansion to the CFTC. The bi...