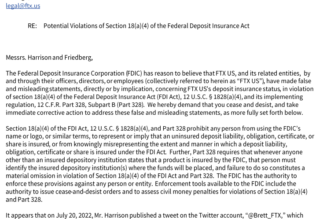

The blockchain research firm also predicts Bitcoin to continue recording better returns than the S&P 500 index in the incoming year

Crypto market analytics company Arcane has laid out its 2022 predictions for various digital assets and the industry at large. The research firm compiled a report highlighting numerous predictions around various aspects, including token prices, regulations, and the performance of different crypto coins.

Most notably, Arcane crowned Binance coin as the winner of 2021, explaining that it crushed both Ethereum and Bitcoin in returns.

Here’s a look at the other major predictions:

The fate of Ripple (XRP) and Cardano (ADA)

According to the research firm, the two alts will slip and lose their spot among the top 10 coins by market cap next year. Arcane noted in The Weekly Update report published yesterday that both Ripple and Cardano native tokens will be displaced by fast-gaining coins such as Terra’s LUNA. ADA and XRP currently sit in sixth and eighth place with a market capital of $48 billion and $40 billion.

The hype around meme coins will fade

The rate of adoption of meme coins significantly grew throughout 2021. Backed by influential figures like Elon Musk, meme coins stamped their place in the crypto sector especially in Q3. DOGE and SHIB came out atop, having recorded massive price and market capital gains. The two sit just outside the top 10 list at 12th and 13th, respectively. Nonetheless, the blockchain firm doesn’t see meme coins retaining their relevance next year, noting that most of will “fade into obscurity.”

Bitcoin will outshine the stock market (and gold)

Arcane Research also tipped the flagship cryptocurrency to yield better returns than the S&P 500 index. Bitcoin may not be the top gainer this year, but market data shows the flagship cryptocurrency is up by over 65% (year-to-date) as of writing. Meanwhile, the S&P 500 is struggling to pass the 30% mark. The firm contends that Bitcoin will once again edge the collective index of the world’s top 500 largest listed companies.

Smart contract platform alternatives will see more adoption and outperform Ethereum

The Buterin project lost the ‘only smart contracts platform’ title, and Arcane contends it now has no place at the top as a layer-one solution. This year, core tokens of alternatives like Terra, Solana, Avalanche, Fantom, and even Harmony have outperformed Ether by a great margin. The latter boasts of triple-figure gains compared to Bitcoin’s double-figures, but lags behind its alternatives that are up in the quintuple range.

More crypto entities will become listed on exchanges

Coinbase made headlines in April following the announcement that it was going public by listing on the NASDAQ exchange. Cryptocurrency exchanges like Kraken and FTX have since shown interest in carving a similar path by hinting at the possibility of going public.

Arcane’s report detailed that 2022 is the year when many of these crypto institutions will finally take the leap to become publicly traded companies. The report adds that many other crypto entities will achieve unicorn status, with some crossing the $5 billion valuation mark.

Bitcoin ETFs will cumulatively have more than 1M BTC next year

Crypto ETFs have been a hot topic in 2021, more so in the US, where the top financial market regulator (SEC) has rejected all direct crypto ETF applications. The watchdog has, however, given approvals to some of the crypto future ETFs. Arcane research data shows that cumulatively Bitcoin futures ETF hold nearly 850,000 – a figure projected to increase by over 150,000 next year.

Bitcoin’s hashrate will reach 300 EH/s; miners will be spread around the world

Prior to China’s extensive ban of crypto mining activity, the country led in terms of Bitcoin hashrate. For the first two months, China accounted for more than half of the global Bitcoin hashrate at 53.30% and 51.58%, respectively. The clampdown on mining and subsequent shutdown of mining centres pushed miners away from the country, with most choosing to settle in the US.

China’s mining dominance consequently fell gradually between March and July, becoming insignificant by the start of Q3. Meanwhile, the US saw an increase in hashrate and currently leads the charts. Arcane projects the hashrate to clock 300 EH/s and foresees the situation changing next year, with hashrate being distributed between different geographical regions.

The research and analytics firm also forecasted inflation to continue rising, MicroStrategy to make more BTC purchases, USDC to eclipse Tether in market rankings, and Bitcoin to remain linked to the VIX in the incoming year.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin, crypto blog, Crypto news, DeFi, Ethereum, OPINION