AML

Crypto adoption via regulation: Setting rules for centralized exchanges

Centralized cryptocurrency exchanges have become the backbone of the nascent crypto ecosystem, making way for retail and institutional traders to trade cryptocurrencies despite a constant fear of government crackdowns and lack of support from policymakers. These crypto exchanges over the years have managed to put self-regulatory checks and implemented policies in line with the local financial regulations to grow despite the looming uncertainty. Cryptocurrency regulation continues to occupy mainstream debates and experts’ opinions, but despite public demand and requests from stakeholders of the nascent ecosystem, policymakers continue to overlook the rapidly growing sector that reached a market capitalization of $3 trillion at the peak of the bull run in 2021. Over the past five years...

Institutional crypto adoption requires robust analytics for money laundering

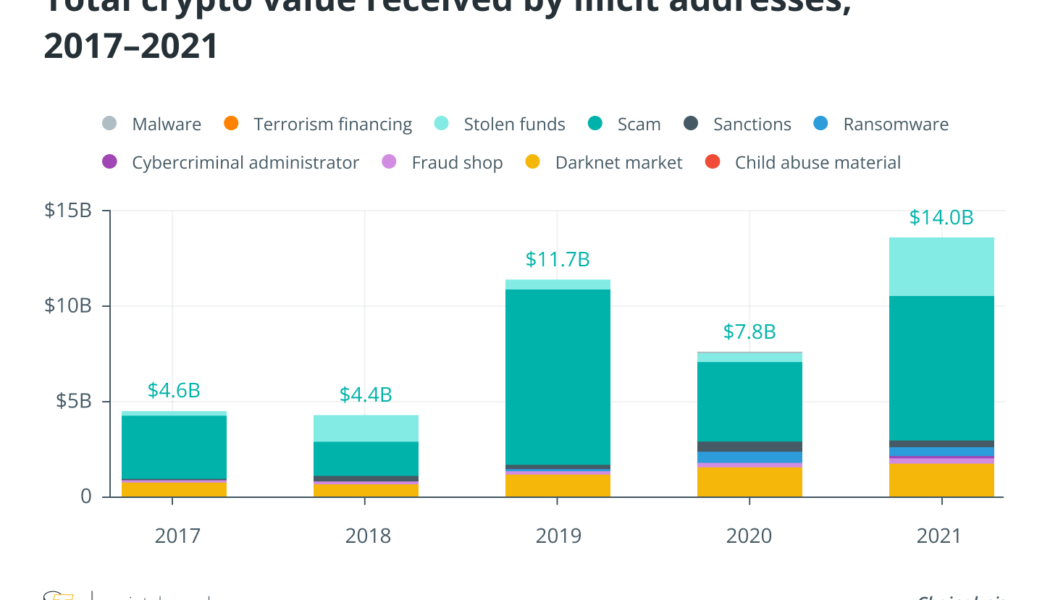

Institutions have begun to take crypto seriously and have entered the space in numerous ways. As noted in a previous analysis, this has resulted in banks and fintechs looking at custody products and services for their clients. However, as custodians of clients’ assets, banks must also ensure they are clean assets and stay compliant. This is where on-chain analytics solutions have a huge role to play in understanding patterns in transactions to identify money laundering and other spurious activities within the cryptocurrency and digital assets space. According to a report by Chainalysis, over $14 billion of illicit transactions took place in 2021. Therefore, it is critical to build the foundational infrastructure around Anti-Money Laundering (AML) to support the growing institutional ...

Japan preparing amendment to enforce FATF travel rules on crypto by May 2023: Report

Japan is expected to enact new rules on money transfers to prevent the use of crypto for money laundering, according to local news agency Nikkei. The changes will bring Japan up-to-date with Financial Action Task Force (FATF) recommendations. An amendment to the Act on Prevention of Transfer of Criminal Proceeds will be introduced in the National Diet on Oct. 3 that will add crypto to the so-called travel rules on money transfers, Nikkei reported. The rules will be amended to require exchange operators to collect customer information in transactions involving cryptocurrency and stablecoins — as they already do for cash transactions. The Foreign Exchange and Foreign Trade Act and the International Terrorist Asset-Freezing Act will be updated to reflect the same changes, which will go into e...

Georgia aims to adopt European crypto standards for Anti-Money Laundering

Georgia, one of the world’s most cryptocurrency-friendly countries, is moving to introduce new crypto regulations to pursue its ambitions to become a global crypto hub. Georgian lawmakers have prepared a new regulatory framework targeting digital business and cryptocurrency trading in the country, Georgian Minister of Economy and Vice Prime Minister Levan Davitashvili announced. Davitashvili said that a draft bill has been sent to the parliament and the amendments are expected to be passed in the autumn session, local news agency Business Media Georgia reported on Monday. According to the minister, the draft bill aims to coordinate local cryptocurrency laws with three major European Union directives, including the Payment Services Directive (PSD2), the Capital Requirements Directive (CRD) ...

Are non-KYC crypto exchanges as safe as their KYC-compliant peers?

Many see implementing Know Your Customer (KYC) tools in crypto as a deterrent to the Bitcoin (BTC) Standard, which has predominantly promoted anonymized peer-to-peer transactions. However, regulators stay put on promoting KYC and anti-money laundering (AML) implementations as a means to ensure investors’ safety and protection against financial fraud. While most crypto exchanges have begun implementing regulatory recommendations to remain at the forefront of crypto’s mainstream adoption, investors still have the choice to opt for crypto exchanges that promote greater anonymity by not imposing KYC processes. But does opting for the latter as an investor mean compromising on safety? A matter of trust Anonymity goes both ways in most cases. Owners of crypto exchanges running non-KYC (or ...

AML and KYC: A catalyst for mainstream crypto adoption

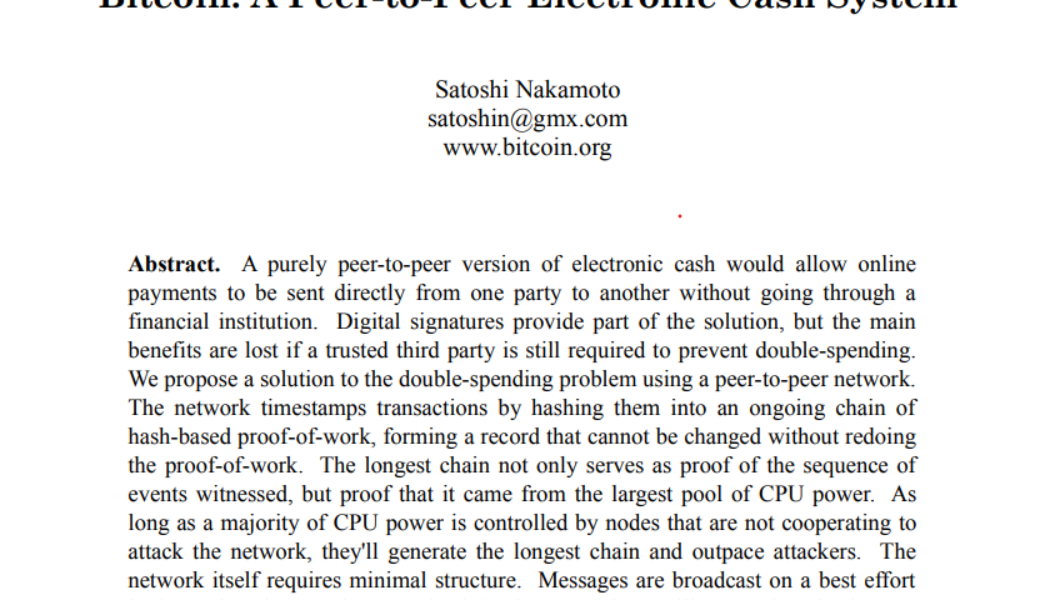

For Satoshi Nakamoto, the creator of Bitcoin (BTC), the motivation to create a new payment ecosystem from scratch in 2009 stemmed from the economic chaos caused by the banking sector’s over-exuberant and risky lending practices mixed accompanied by the bursting of the housing bubbles in many countries at the time. “And who do you think picked up the pieces after the fallout? The taxpayer, of course,” said Durgham Mushtaha, business development manager of blockchain analytics firm Coinfirm, in an exclusive interview with Cointelegraph. Satoshi recognized the need for a new monetary system based on equity and fairness — a system that gives back power into the hands of the people. A trustless system with anonymous participants, transacting peer-to-peer and without the need of a central ...

Indian law enforcement accuses WazirX exchange of aiding in laundering of $130M

India’s Enforcement Directorate (ED), the agency responsible for financial crimes, is looking at cryptocurrency exchanges suspected of processing transactions that sent more than 10 billion rupees, or about $130 million, from firms under investigation to international wallets. At least ten crypto exchanges are allegedly involved, according to an official who spoke to The Economic Times, and bank accounts of exchange WazirX have been frozen, the newspaper reported. Transactions of up to 1 billion rupees, or $1.3 million, were allegedly made in the names of people with no connections to the money by companies under investigation in a case involving instant loans. Thes companies often had ties to China. Even though Know Your Customer/Anti-Money Laundering (KYC/AML) procedures showed the trans...

BitMEX former executive pleads guilty to violating the Bank Secrecy Act

Another top executive joins three co-founders of the crypto exchange BitMEX, pleading guilty in the United States District Court for the Southern District of New York. The court case under the headline “U.S. v. Hayes et al.” goes on for two years, with BitMEX management being indicted for violating the U.S. Bank Secrecy Act. According to the Wall Street Journal, on Aug. 8, a one-time head of business development at BitMEX, Gregory Dwyer, admitted his guilt of violating the Bank Secrecy Act in court. As part of a plea deal, Dwyer would pay a $150,000 fine. As Manhattan Attorney Damian Williams commented on this development: “Today’s plea reflects that employees with management authority at cryptocurrency exchanges, no less than the founders of such exchanges, cannot willfu...

EU officials reach agreement on AML authority for supervising crypto firms

The European Council has reached an agreement to form an anti-money laundering body that will have the authority to supervise certain crypto asset service providers, or CASPs. In a Wednesday announcement, the council said it had agreed on a partial position of a proposal to launch a dedicated Anti-Money Laundering Authority, or AMLA. According to the regulatory body, the AML body will have the authority to supervise “high-risk and cross-border financial entities” including crypto firms — “if they are considered risky.” European Parliament member Ondřej Kovařík said EU officials had also reached a “provisional political agreement” on the government body’s Transfer of Funds Regulation. Not all the details of the revision are clear at the time of publication, but Cointelegraph reported that a...

BitMEX co-founder Benjamin Delo avoids jail, receives 30 months probation

Benjamin Delo the co-founder of cryptocurrency exchange BitMEX has been sentenced to 30 months probation for violating the Bank Secrecy Act (BSA), which is an anti-money laundering law. The sentence, handed down at a federal court in New York on June 15th, follows his guilty plea to charges in February of “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program” in his role at BitMEX. Prosecutors had argued Delo should serve a year in prison or at least receive a two-year probation along with six months of home detention, as was given to former CEO Arthur Hayes in May. For Delo, his lesser sentence closes the legal saga which started in October 2020 which also saw co-founders Hayes and Samuel Reed along with BitMEX’s first official employee Gregory (Gr...

Illicit crypto usage as a percent of total usage has fallen: Report

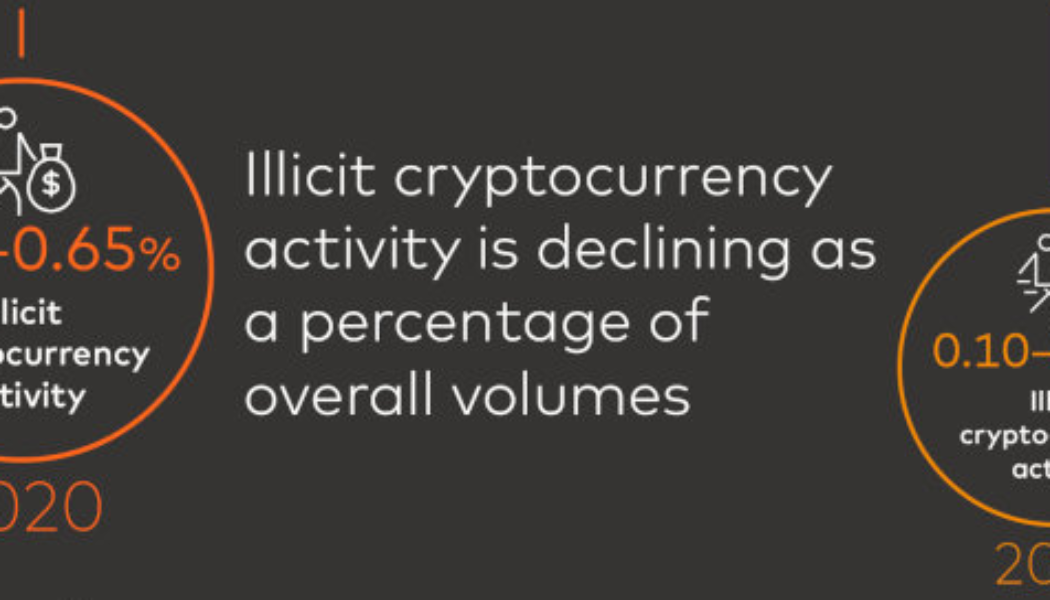

Illicit cryptocurrency activity in 2021 and the first quarter of 2022 has declined as a percentage of overall crypto activity, according to blockchain forensics firm CipherTrace. The cryptocurrency industry has long held a reputation in some jurisdictions as a haven for illegal activity. However, CipherTrace estimates that illicit activity was between 0.62% and 0.65% of overall cryptocurrency activity in 2020. The firm reported that it has now fallen to between 0.10% and 0.15% of overall activity in 2021. Source: CipherTrace In its Cryptocurrency Crime and Anti-Money Laundering Report released June 13, CipherTrace outlined that the top ten decentralized finance (DeFi) hacks in 2021 and Q1 2022 netted attackers $2.4 billion. Over half of that figure came from just two events, the largest be...

Information, AML/CFT steps are key to fighting international digital crime, DOJ report says

The United States Department of Justice (DOJ) released a report on international law enforcement related to digital assets Tuesday. It is the first of the approximately one dozen reports mandated in President Joe Biden’s March 9 executive order “Ensuring Responsible Development of Digital Assets.” The report, titled “How To Strengthen International Law Enforcement Cooperation For Detecting, Investigating, And Prosecuting Criminal Activity Related To Digital Assets,” was written with the collaboration of Departments of State, Treasury and Homeland Security, as well as the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC). Countries have varying degrees of capacity to deal with criminal activity due to the unique law enforcement challenges associated wi...