Cosmos

Crypto traders eye ATOM, APE, CHZ and QNT as Bitcoin flashes bottom signs

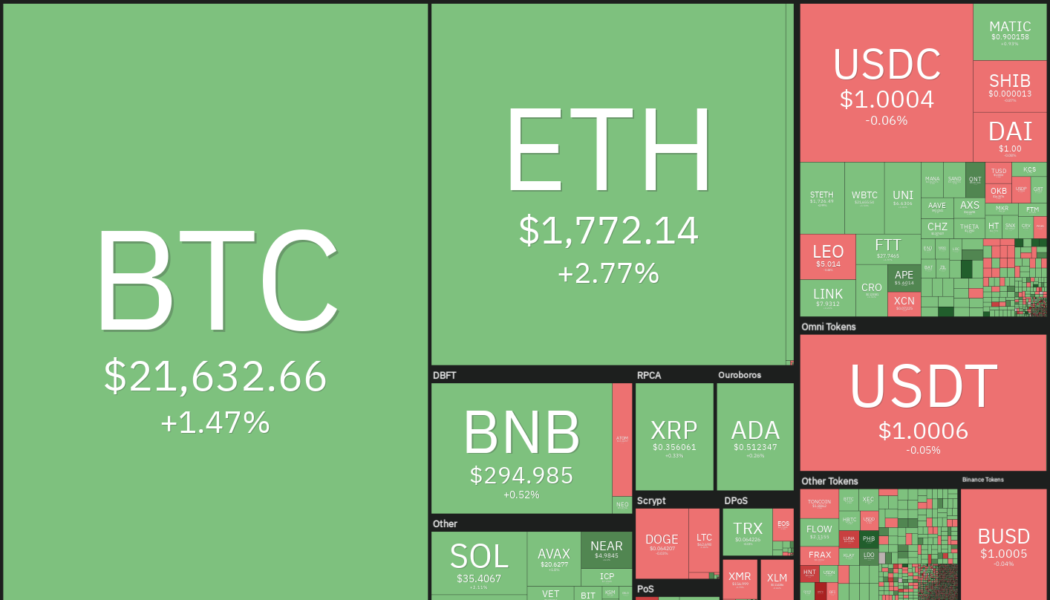

The United States equities markets rallied sharply last week, ending a three-week losing streak. The S&P 500 rose 3.65% last week while the Nasdaq Composite soared 4.14%. Continuing its close correlation with the U.S. equities markets, Bitcoin (BTC) also made a strong comeback and is trying to end the week with gains of more than 7%. The sharp rally in the stock markets and cryptocurrency markets are showing signs of a bottoming formation but it may be too early to predict the start of a new bull move. The equities markets may remain on the edge before the release of the U.S. inflation data on Sept. 13 and the Federal Reserve meeting on Sept. 20-21. Crypto market data daily view. Source: Coin360 Along with taking cues from the equities markets, the cryptocurrency space has its own impo...

A range-break from Bitcoin could trigger buying in ADA, ATOM, FIL and EOS this week

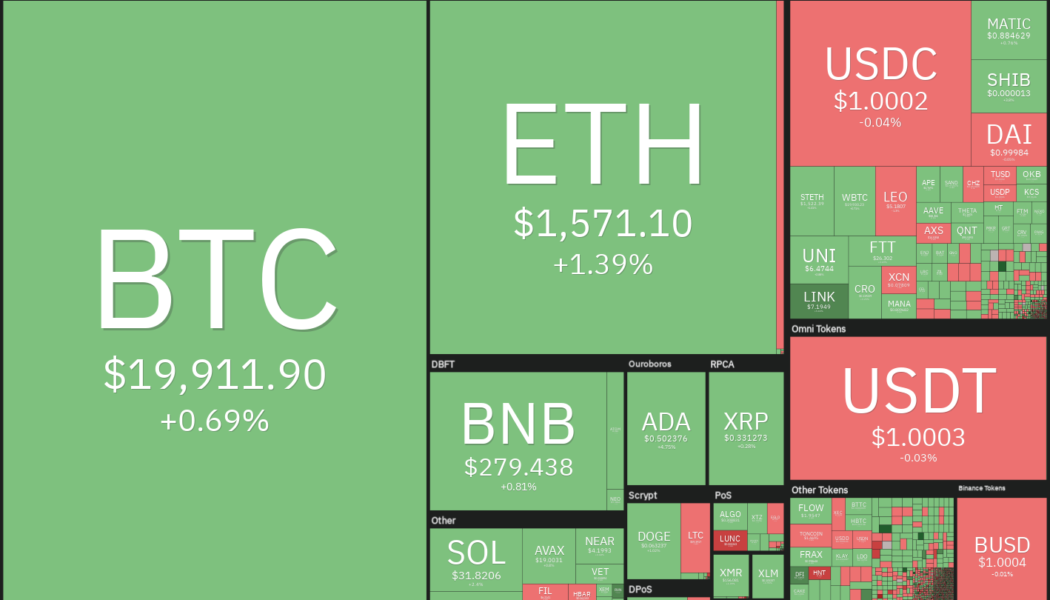

The decline in the United States equities markets last week extended the market-wide losing streak to three consecutive weeks. The Nasdaq Composite fell for six days in a row for the first time since 2019. The markets negative reaction to a seemingly positive August jobs report suggests that traders are nervous about the Federal Reserve’s future steps and its effects on the economy. Weakness in the U.S. equities markets pulled Bitcoin (BTC) back below $20,000 on Sept. 2 and bears sustained the price below the level during the weekend. This pulled Bitcoin’s market dominance to just under 39% on Sept. 4, its lowest level since June 2018, according to data from CoinMarketCap. Crypto market data daily view. Source: Coin360 Although the sentiment remains negative and it is difficult to call a b...

1xBit and COSMOS: Innovating Crypto Betting

Everything is in place to ensure that no one is left out. This is especially true on 1xBit, where the crypto gambling site just added the ATOM tokens as a payment method on its website. It is a welcome development for crypto and casino lovers when considering the benefits of ATOM tokens. What are ATOM Tokens ATOM tokens are the native cryptocurrency for the Cosmos Blockchain. Suffice it to say that Cosmos is the project name while ATOM is the digital currency that fuels the network. The founders of the DApps project, the Tendermint, released the Cosmos whitepaper in 2016 to develop a crypto project that thrives where Bitcoin and the early Blockchains have failed. The Cosmos project’s sole goal is to develop a faster, inexpensive, and environmentally friendly system – all these are where ot...

You Can Now Experience COSMOS on 1xBit

COSMOS is taking crypto betting into the future: convenient, scalable, and lucrative. COSMOS has become the most recent cryptocurrency to join the 1xBit family bringing convenience in the revolutionary crypto betting one step further. With speedy transactions, easy-to-use software, and inter-blockchain communication, COSMOS is about to revolutionize the already groundbreaking betting on 1xBit and lead crypto gambling into the future. What is COSMOS Protocol? COSMOS is a Proof-of-Stake-powered crypto project that provides users with fast, easy access across multiple blockchains. Finding its origins in the Tendermint protocol, a major contributor founded in 2014, COSMOS released its whitepaper in 2016 and began token sales in 2017. The protocol is the brainchild of the founders of Tend...

Rocky road lies ahead, but here’s 5 altcoins that still look bullish

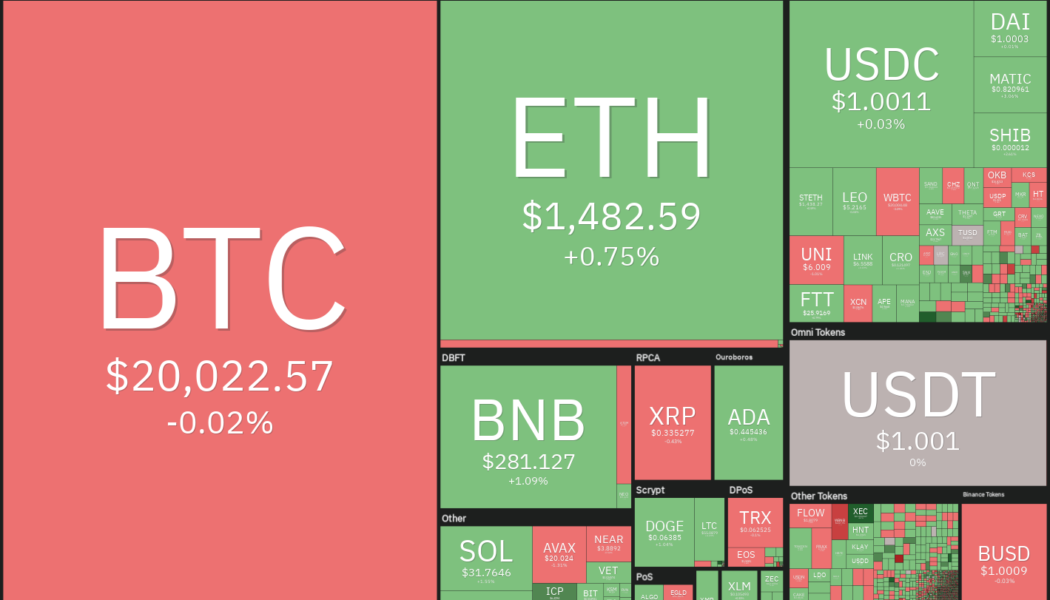

The United States equities markets plunged on Aug. 26 following Federal Reserve Chair Jerome Powell’s speech where he reiterated the central bank’s hawkish stance. Continuing its correlation with the equities market, Bitcoin (BTC) and the cryptocurrency markets also witnessed a sharp selloff on Aug. 26. Bitcoin has declined about 14% this month, making it the worst performance for August since 2015 when the price had dropped 18.67%. That may be bad news for investors because September has a dubious record of a 6% average loss since 2013, according to data from CoinGlass. Crypto market data daily view. Source: Coin360 Although buying in a downtrending market is not a good strategy, traders can keep a close watch on cryptocurrencies that are outperforming the markets because, in case of any ...

ATOM price is reaching for the Cosmos, but why?

As a market crash takes place, assets become oversold and typically there’s an “oversold bounce,” “return to mean,” “mean reversion,” or some price snapback to the bottom of the pre-crash range. Afterward, the asset under study either consolidates, continues the downtrend, or returns to the bullish uptrend if the downside catalyst was not significant enough to break the market structure. That’s all basic trading 101. This week Cosmos (ATOM) price appears to be following this path, and the altcoin is showing a bit of strength with a 35% gain since Aug. 22. But why? Depending on how you look at it, and technical analysis is by all means a subjective process, ATOM price is either in an ascending channel, or one could say a rounding bottom pattern is present with price close to breaking ...

Top 5 cryptocurrencies to watch this week: BTC, SHIB, MATIC, ATOM, APE

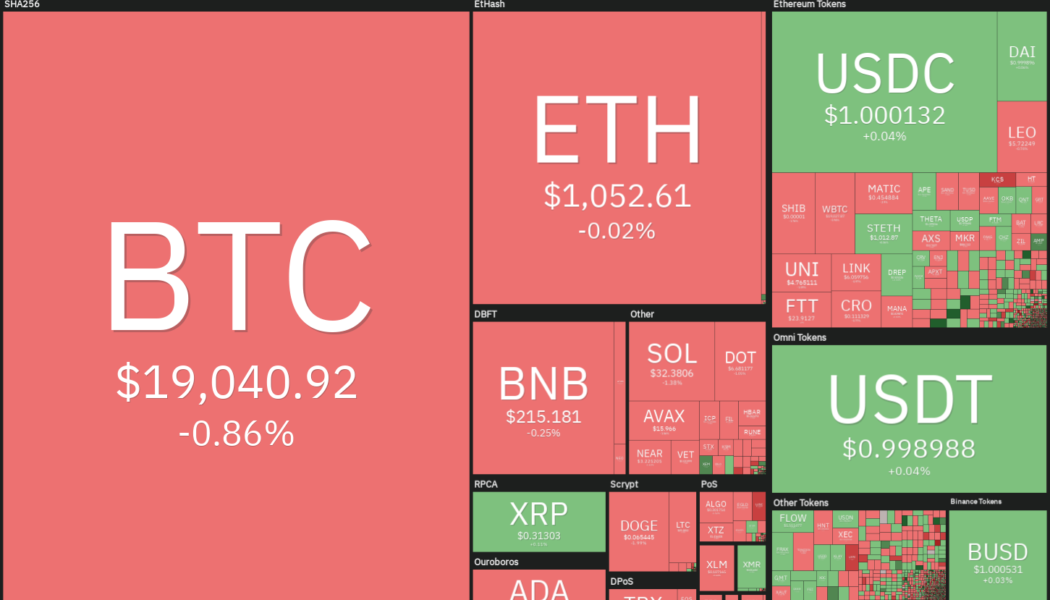

The bears are attempting to sink Bitcoin (BTC) below $19,000 to further cement their advantage over the crypto market. Analysts watching Bitcoin’s MVRV-Z Score, a metric which measures how high or low Bitcoin’s price is relative to “fair value,” expect an even deeper fall before the bottom is finally reached. However, economist, trader and entrepreneur Alex Krueger pointed out that Bitcoin’s volume hit an all-time high in June. Usually, the highest volume in a downtrend is indicative of capitulation and that “creates major bottoms.” If Bitcoin follows the historical pattern of the 2018 bear market, Krueger expects the bottom to form in July. Crypto market data daily view. Source: Coin360 Due to the tight correlation between Bitcoin and the S&P 500, crypto traders will have to keep a cl...

Ignite CEO announces departure after seven years

Peng Zhong, the chief executive officer of Ignite — formerly Tendermint and backer of the Cosmos ecosystem — has announced he will be leaving the firm. In a Friday tweet to his more than 20,000 followers, Zhong said Friday will be his last day at Ignite, where he has been working as CEO since May 2020. Prior to that, the now-former Ignite CEO was chief design officer at the firm’s Kuala Lumpur and Toronto offices since he started in 2015. It’s unclear what led to his decision to leave the company. Today is my last day at Ignite. Thank you for the camaraderie we shared as we built out this ecosystem. It’s been an honor to be a part of this team and this community. I will miss you. — Peng Zhong (@zcpeng) July 1, 2022 Ignite, formerly known as Tendermint, is a core contributor to the Co...

These are the least ‘stable’ stablecoins not named TerraUSD

The recent collapse of the once third-largest stablecoin, TerraUSD (UST), has raised questions about other fiat-pegged tokens and their ability to maintain their pegs. Stablecoins’ stability in question Stablecoin firms claim that each of their issued tokens is backed by real-world and/or crypto assets, so they behave as a vital component in the crypto market, providing traders with an alternative in which to park their cash between placing bets on volatile coins. They include stablecoins that are supposedly 100% backed by cash or cash equivalents (bank deposits, Treasury bills, commercial paper, etc.), such as Tether (USDT) and Circle USD (USDC). At the other end of the spectrum are algorithmic stablecoins. They are not necessarily backed by real assets but depend on financial engin...

Terra contagion leads to 80%+ decline in DeFi protocols associated with UST

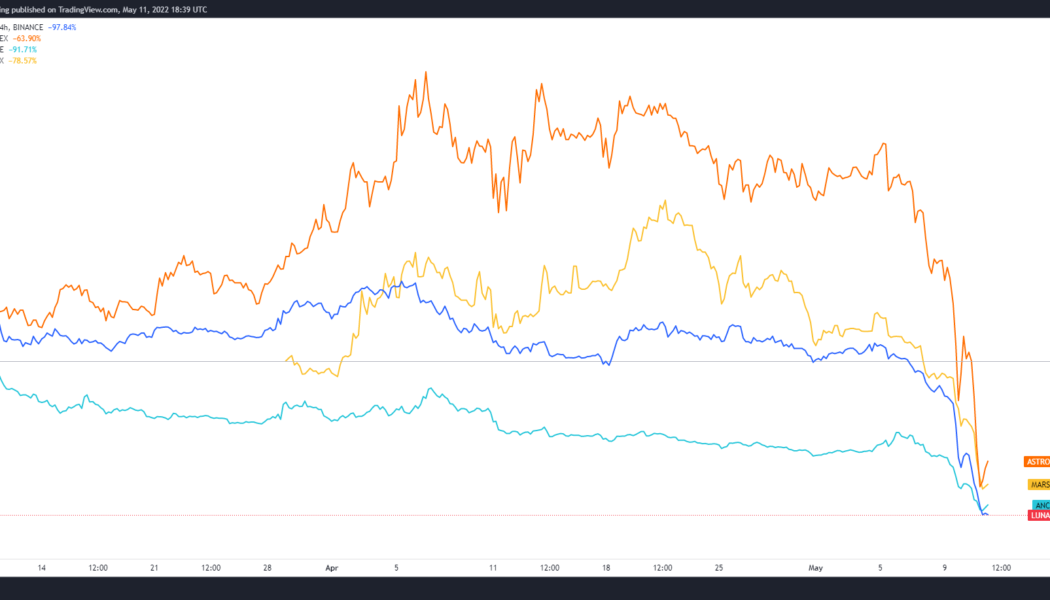

The knock-on effect of the collapse of Terra (LUNA) and its TerraUSD (UST) stablecoin have spread wide across the cryptocurrency market on May 11 as projects with any kind of association with the DeFi ecosystem have seen their prices hammered. The forced selling of the Bitcoin (BTC) holdings backing a portion of UST also influenced BTC’s current drop to $29,000 and analysts fear that DeFi platforms that have liquidity pools primarily comprised of UST and LUNA will collapse. LUNA, ANC, ASTRO and MARS in USDT pairings. 4-hour chart. Source: TradingView Terra-based protocols suffer Projects with the direst of outlooks are those that are hosted on the Terra protocol including Anchor Protocol (ANC), Astroport (ASTRO) and Mars Protocol (MARS). As shown in the chart above, ...

Three new crypto ETFs to begin trading in Australia this week

Australians will soon have more options for spot cryptocurrency exchange-traded funds (ETFs) after a previous hold-up was given the green light this week and new funds entered the ETF market. The latest update came late on May 9 as Cboe Australia issued a round of market notices that three funds previously delayed are expected to begin trading on Thursday, May 12. They include a Bitcoin ETF from Cosmos Asset Management, plus Bitcoin (BTC) and Ethereum (ETH) spot ETFs from 21Shares. Cboe Australia and Cosmos did not immediately respond to a request for comment, but a spokesperson from 21Shares confirmed to Cointelegraph: “We’re listing on May 12, this Thursday. The downstream issues are resolved.” On April 26, a day before three of the first crypto ETFs were set to launch, the Cboe Au...

Failure to launch: Australia’s first 3 crypto ETFs all miss launch day

The launch of Australia’s first three Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETF) scheduled for today, has been delayed as a result of further “checks” needing to be completed. The exchange listing the Bitcoin Spot ETF from Cosmos Asset Management, Cboe Australia, released a statement late Tuesday stating that “standard checks prior to the commencement of trading are still being completed” and a “further update will be provided in the coming days.” Cboe issued the same notice regarding two spot ETFs issued by 21Shares also scheduled for launch today, a Bitcoin ETF and an Ethereum ETF. It’s unclear why the products are delayed with the Australian Financial Review reporting that a “service provider downstream” — an entity such as a prime broker or major institution with the ...