deribit

Bitcoin retraces intraday gains as bears aim to pin BTC price under $18K

On Dec. 14, Bitcoin (BTC) broke above $18,000 for the first time in 34 days, marking a 16.5% gain from the $15,500 low on Nov. 21. The move followed a 3% gain in the S&P 500 futures in three days, which reclaimed the critical 4,000 points support. Bitcoin/USD index (orange, left) vs. S&P 500 futures (right). Source: TradingView While BTC price started the day in favor of bulls, investors anxiously awaited the U.S. Federal Reserve decision on interest rates, along with Fed chair Jerome Powell’s remarks. The subsequent 50 basis point hike and Powell’s explanation of why the Fed would stay the course gave investors good reason to doubt that BTC price will hold its current gains leading into the $370 million options expiry on Dec. 16. Analysts and traders expect some form o...

This simple Bitcoin options strategy allows traders to go long with limited downside risk

Bitcoin (BTC) bulls were hopeful that the Nov. 21 dip to $15,500 would mark the cycle bottom, but BTC has not been able to produce a daily close above $17,600 for the past eighteen days. Traders are clearly uncomfortable with the current price action and the confirmation of BlockFi’s demise on Nov. 28 was not helpful for any potential Bitcoin price recovery. The cryptocurrency lending platform filed for Chapter 11 bankruptcy in the United States a couple of weeks after the firm halted withdrawals. In a statement sent to Cointelegraph, Ripple’s APAC policy lead Rahul Advani said he expects the FTX exchange bankruptcy to lead to greater scrutiny on crypto regulations.” Following the event, several global regulators pledged to focus on developing greater crypto regulat...

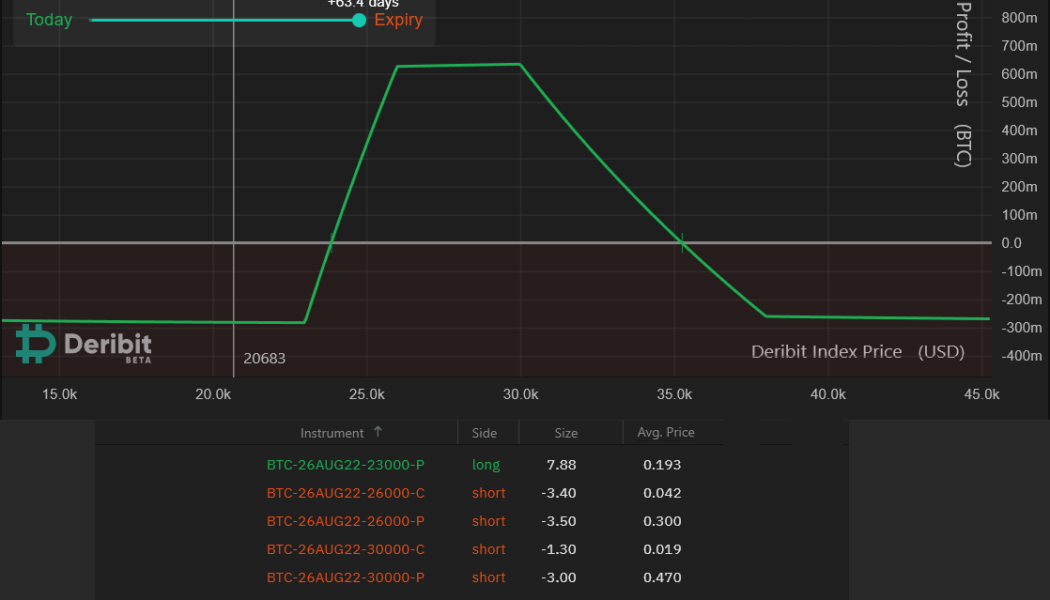

Here’s how Bitcoin pro traders plan to profit from BTC’s eventual pop above $20K

Bitcoin (BTC) entered an ascending channel in mid-September and has continued to trade sideways activity near $19,500. Due to the bullish nature of the technical formation and a drop in the sell pressure from troubled miners, analysts expect a price increase over the next couple of months. Bitcoin/USD price at FTX. Source: TradingView Independent analyst @el_crypto_prof noted that BTC’s price formed a “1-2-3 Reversal-Pattern” on a daily time frame, hinting that $20,000 could flip to support soon. $BTC #Bitcoin Yes, the price action of $BTC is really boring, isn’t it? But if you look closely, a textbook “1-2-3 Reversal-Pattern” has formed in the last few days, which should finally send Bitcoin above 20k soon. pic.twitter.com/29Wa64XKQa — ⓗ (@el_crypto_pro...

Here’s how pro traders could use Bitcoin options to buy the $20K BTC dip

Bitcoin hit a 2022 low at $17,580 on June 18 and many traders are hopeful that this was the bottom, but (BTC) has been unable to produce a daily close above $21,000 for the past six days. For this reason, traders are uncomfortable with the current price action and the threat of many CeFi and DeFi companies dealing with the loss of user funds and possible insolvency is weighing on sentiment. The blowback from venture capital Three Arrows Capital (3AC) failing to meet its financial obligations on June 14 and Asia-based lending platform Babel Finance citing liquidity pressure as a reason for pausing withdrawals are just two of the most recent examples. This news has caught the eyes of regulators, especially after Celsius, a crypto lending firm, suspended user withdrawals on June 12. On June 1...

Voyager Digital cuts withdrawal amount as 3AC contagion ripples through DeFi and CeFi

The Singapore-based crypto venture firm Three Arrows Capital (3AC) failed to meet its financial obligations on June 15 and this caused severe impairments among centralized lending providers like Babel Finance and staking providers like Celsius. On June 22, Voyager Digital, a New York-based digital assets lending and yield company listed on the Toronto Stock exchange, saw its shares drop nearly 60% after revealing a $655 million exposure to Three Arrows Capital. Voyager offers crypto trading and staking and had about $5.8 billion of assets on its platform in March, according to Bloomberg. Voyager’s website mentions that the firm offers a Mastercard debit card with cashback and allegedly pays up to 12% annualized rewards on crypto deposits with no lockups. More recently, on June 2...

Bitcoin futures enter backwardation for the first time in a year

Bitcoin’s (BTC) month-to-date chart is very bearish, and the sub-$18,000 level seen over the weekend was the lowest price seen since December 2020. Bulls’ current hope depends on turning $20,000 to support, but derivatives metrics tell a completely different story as professional traders are still extremely skeptical. BTC-USD 12-hour price at Kraken. Source: TradingView It’s important to remember that the S&P 500 index dropped 11% in June, and even multi-billion dollar companies like Netflix, PayPal and Caesars Entertainment have corrected with 71%, 61% and 57% losses, respectively. The U.S. Federal Open Market Committee raised its benchmark interest rate by 75 basis points on June 15, and Federal Reserve Chairman Jerome Powell hinted that more aggressive tightening could b...

Bitcoin price action decouples from stock markets, but not in a good way

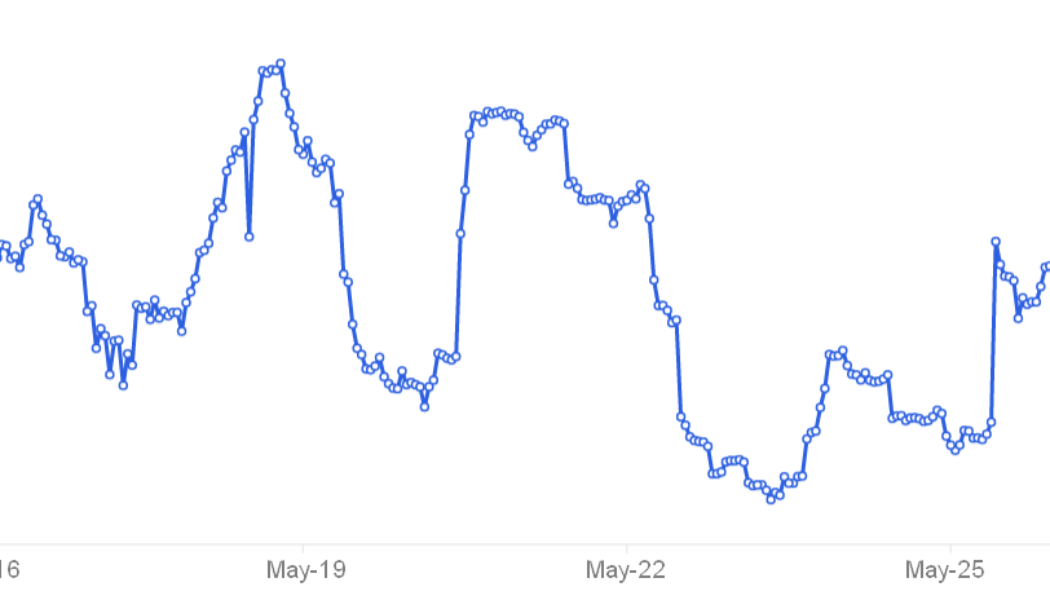

This week the stock markets began to flash a little green and Bitcoin (BTC) is decoupling from traditional markets but not in a good way. The cryptocurrency is down 3% while the Nasdaq Composite tech-heavy stock market index is up 3.1%. May 27 data from the United States Commerce Department shows that the personal savings rate fell to 4.4% in April to reach the lowest level since 2008 and crypto traders are worried that worsening global macroeconomic conditions could add to investors’ aversion to risky assets. For example, Invesco QQQ Trust, a $160 billion tech company-based U.S. exchange-traded fund, is down 23% year-to-date. Meanwhile the iShares MSCI China ETF, a $6.1 billion tracker of the Chinese shares, has declined 20% in 2022. To get a clearer picture of how crypto traders are posi...

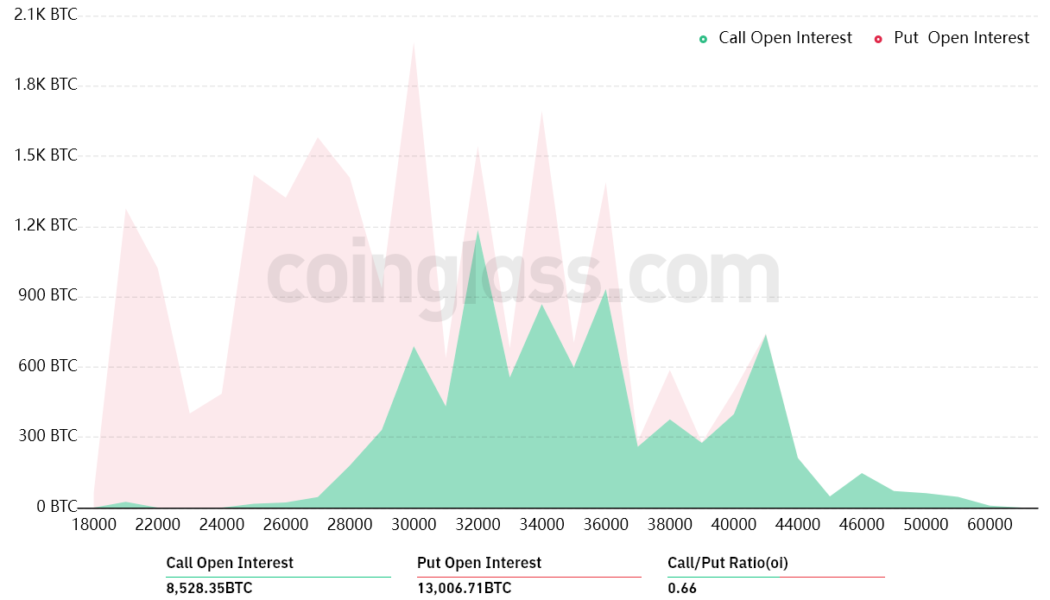

Here’s why bears aim to keep Bitcoin under $29K ahead of Friday’s $640M BTC options expiry

Over the past nine days, Bitcoin’s (BTC) daily closing price fluctuated in a tight range between $28,700 and $31,300. The May 12 collapse of TerraUSD (UST), previously the third-largest stablecoin by market cap, negatively impacted investor confidence and the path for Bitcoin’ price recovery seems clouded after the Nasdaq Composite Stock Market Index plunged 4.7% on May 18. Disappointing quarterly results from top United States retailers are amping up recession fears and on May 18, Target (TG) shares dropped 25%, while Walmart (WMT) stock plunged 17% in two days. The prospect of an economic slowdown brought the S&P 500 Index to the edge of bear market territory, a 20% contraction from its all-time high. Moreover, the recent crypto price drop was costly to leverage buyers (l...

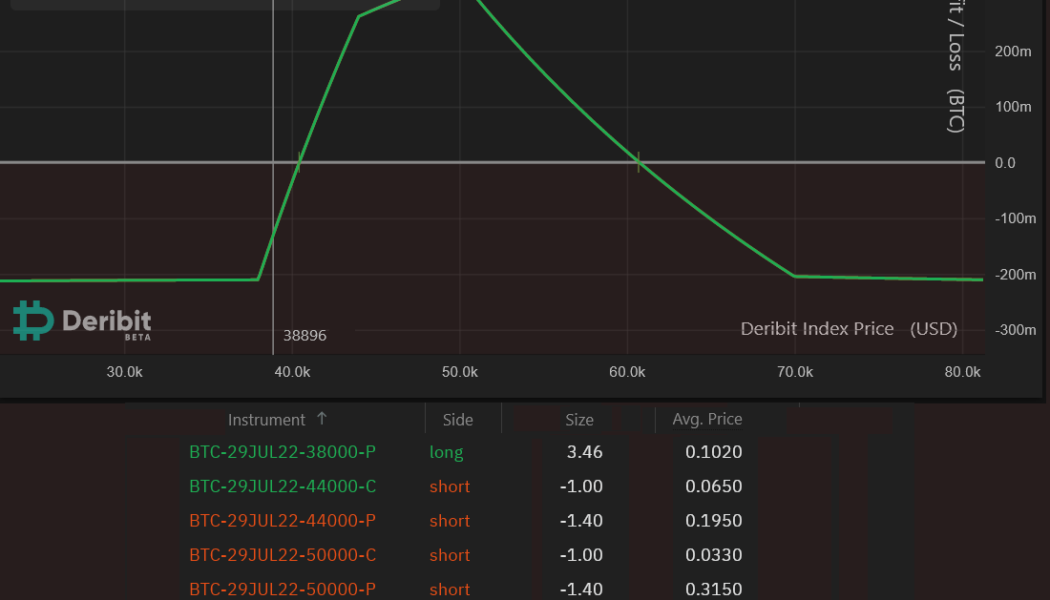

Afraid to buy the dip? Bitcoin options provide a safer way to ‘go long’ from $38K

The last time Bitcoin (BTC) traded above $50,000 was Dec. 27, 2021. Since then, four months have passed, but traders seem somewhat optimistic that inflation has hit the necessary threshold to trigger cryptocurrency adoption. In theory, the 8.5% inflation in the United States means that every five years, the prices increase by 50%. This essentially turns $100 into $66 by slashing 33% of the dollar’s purchasing power. The U.S. Federal Reserve FOMC meeting is expected to rule on the interest rates on May 4, but more importantly, the FED is expected to announce a program to offload part of its $9 trillion balance sheet. Thus, instead of supporting debt and mortgage markets, the U.S. Central Bank will likely sell $95 billion worth of these assets every month. The consequences could be severe an...

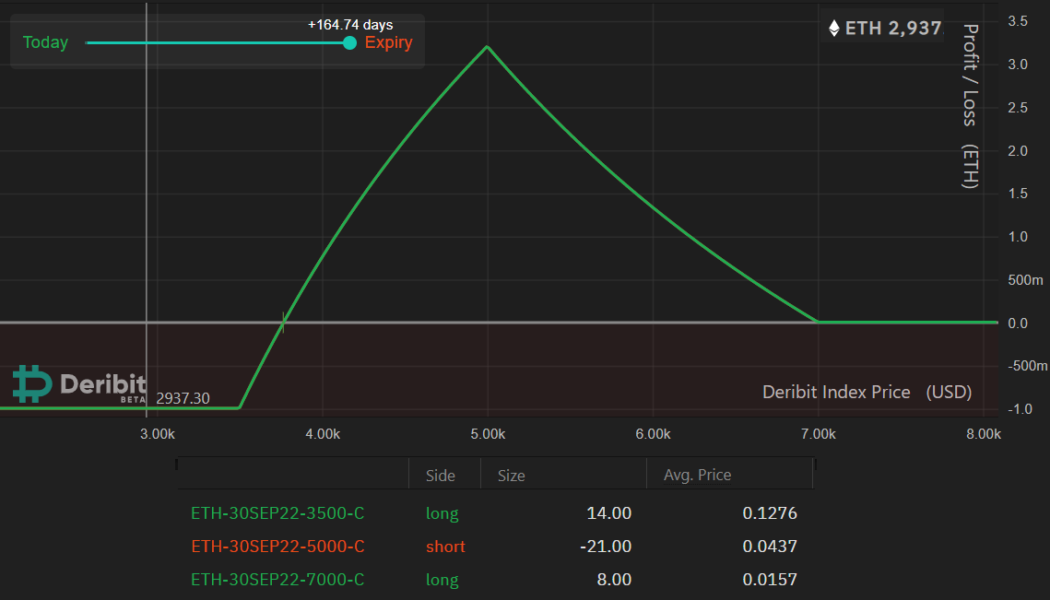

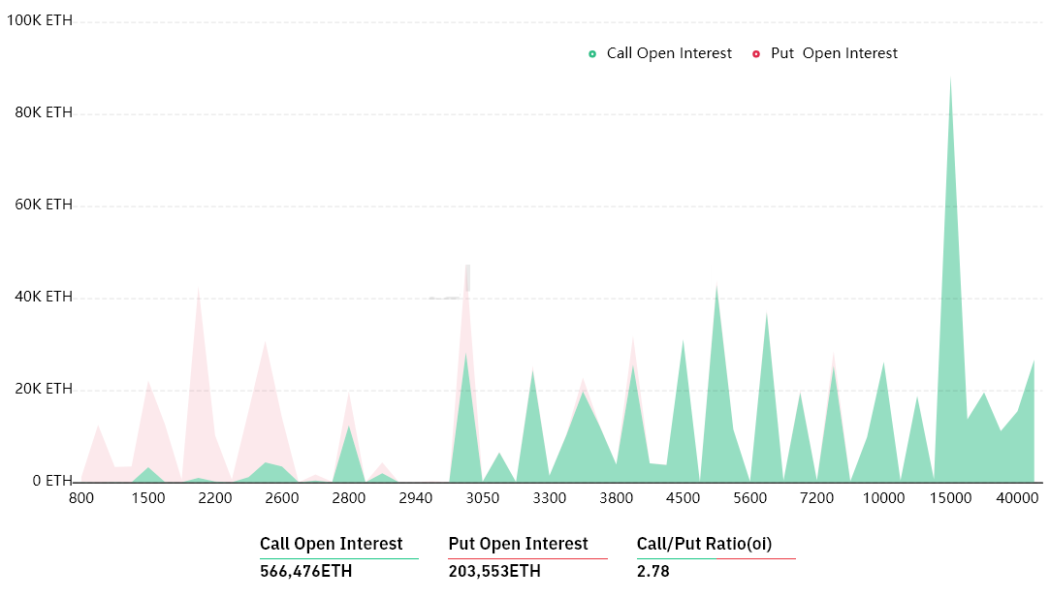

Here’s how Ether options traders could prepare for the proof-of-stake migration

Ethereum’s long-awaited transition away from proof-of-work (PoW) mining has recently suffered another delay and is expected to occur in the second half of 2022. Ethereum developer Tim Beiko stated on April 13 that “it won’t be June, but likely in the few months after. No firm date yet, but we’re definitely in the final chapter of PoW on Ethereum.” An automated increase in mining difficulty designed to make PoW mining less attractive is set to become active around May. Known as the “difficulty bomb,” it will eventually make blocks “unbearably slow,” forcing the upgrade to a proof-of-stake (PoS) network. Such news might have negatively impacted Ether’s (ETH) price, but it creates an immense opportunity for those betting on the ...

Terra’s Bitcoin purchase and BlackRock comments back ETH’s surge to $3.1K

Ether (ETH) bulls have a few good reasons to celebrate the 20% gain between March 14 and March 24. The price increase surprised many and led to the first daily close above $3,000 in 34 days. Even with this move, Marc’s $2.4 billion Ether options expiry is somewhat uncertain because bears can easily profit by pushing the price below $3,000. In a letter to shareholders, Larry Fink, the CEO of BlackRock, the world’s largest asset manager, noted that the global socio-political crisis and growing inflation could make way for a global digital payment network. Moreover, cryptocurrency investors turned bullish after Terra co-founder Do Kwon reconfirmed plans for the giant $10-billion BTC allocation. On March 24, the third tranche of Tether (USDT) left a wallet thought to hold fun...

Here’s why Bitcoin bulls will defend $42K ahead of Friday’s $3.3B BTC options expiry

Over the past two months, Bitcoin (BTC) has respected an ascending triangle formation, bouncing multiple times from its support and resistance lines. While this might sound like a positive, the price is still down 11% year-to-date. As a comparison, the Bloomberg Commodity Index (BCOM) gained 29% in the same period. Bitcoin/USD 1-day chart at FTX. Source: TradingView The broader commodity index benefited from price increases in crude oil, natural gas, corn, wheat and lean hogs. Meanwhile, the total cryptocurrency market capitalization was unable to break the $2 trillion resistance level and currently stands at $1.98 trillion. In addition to 40-year record high inflation in the United States, a $1.5 trillion spending bill was approved on March 15, enough to fund the government through Septem...

- 1

- 2