Lightning network

Nigerian innovator launches first active Bitcoin Lightning node in the country

The Lightning Network has struck the earth in one of the most challenging operating environments. Lagos, the capital of Nigeria — Africa’s most populous country — welcomed a new Bitcoin Lightning Network (LN) node this week, a vital step to better connect the continent to the layer-2 payments network that sits atop Bitcoin. The node runs on an old laptop powered by a diesel generator, as Lagos regularly experiences energy and electricity blackouts. Megasley’s diesel generator and laptop running the node. Source: Megasley In a discussion with Cointelegraph, Megasley, who operates the first Nigerian Lightning node of 2023 and the first active Lightning node in the country (other nodes are dormant), shared his vision for bringing instant, low-cost payments to Africa thanks to the LN. ”L...

Models and fundamentals: Where will Bitcoin price go in 2023?

Bitcoin (BTC) had a bumpy ride throughout 2022, along with the rest of the digital asset market. The cryptocurrency began the year exchanging hands around $46,700 and is currently trading over 64% down at $16,560 at the time of writing. Consequently, the coin’s market capitalization took a tumble from around $900 billion on Jan. 1, 2022 to end the year at around $320 billion. Bitcoin Price Trend in 2022 While Bitcoin’s drop in price could be attributed to the extraordinary circumstances that the entire cryptocurrency market has been through this year, it is important to reevaluate the 2022 price predictions made by various market entities. One of the most popular predictions was that of analyst PlanB’s Bitcoin Stock-to-Flow (S2F) model. The S2F model predicted BTC to be at nearly $11...

Not medical advice: Bitcoiner implants Lightning chip to make BTC payments by hand

The Lightning Network continues to shock the Bitcoin (BTC) community. A swiss IT Professional called F418 (not his real name) surgically implanted a Lightning-enabled chip into his right hand to make Lightning Network (LN) payments. An X-Ray image of the chip implanted into F418’s hand. Source: Youtube Speaking with Cointelegraph, F418 said he experimented with body modification and LN payments for fun. He does not recommend that Bitcoin enthusiasts take the layer-2 payments network, the LN, into their own hands as he did. “The use is just to show that it is possible and you can do stuff like that.” He added that most people carry cards, it’s just his hand has the wow factor: “It’s funny if you are doing a presentation as I sometimes do presentations about payments and talk to ...

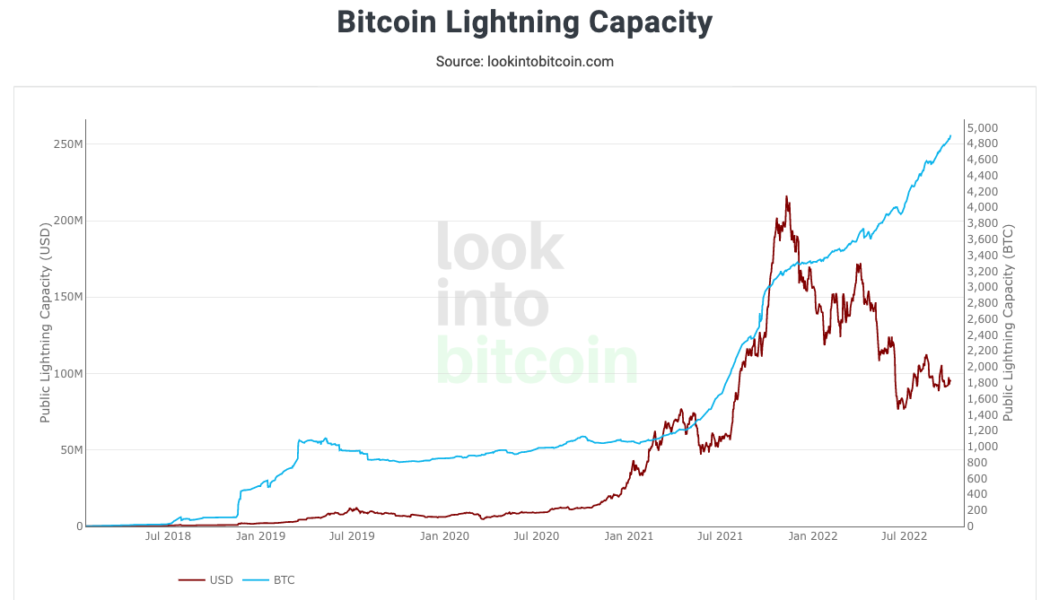

Bitcoin Lightning Network capacity strikes 5,000 BTC

Bear markets are for building out capacity on the layer-2 Lightning Network. Despite macroeconomic headwinds and sluggish price action, the Lightning Network, the layer-2 payments solution fo Bitcoin (BTC), continues to flourish. The Bitcoin Lightning Network reached a milestone capacity of 5,000 BTC ($96 million). In effect, more and more Bitcoin is being introduced to Lightning Network payment channels worldwide, as Bitcoiners continue to support the growth of the network. Bitcoin Lightning Network capacity. Source: Look into Bitcoin The Lightning Network allows users to send Bitcoin (or satoshis, the smallest amount of a Bitcoin) to send or receive money faster and with lower fees. The more capacity on the network, the more liquidity is on hand. As a result, users can experience faster ...

MicroStrategy takes its BTC maximalism to the next level with new engineer hire

MicroStrategy, the business intelligence and tech company that holds the world’s largest Bitcoin (BTC) reserve, is hiring a Bitcoin Lightning software engineer to create a Lightning Network-based software-as-a-service platform. The new engineer will be responsible for building a Lightning Network-based platform to address enterprise cybersecurity challenges and enable new e-commerce use cases, according to a job posting linked to the MicroStrategy website. Besides “an adversarial mindset,” the applicant should have certificates, knowledge of tools and programming languages, and experience with decentralized finance technologies. MicroStrategy is looking to hire a Bitcoin Lightning Software Engineer to build a Lightning Network-based SaaS platform. #bitcoin pic.twitter.com/XFYrkIaFA9 — Neil...

Why this tiny country is adopting the Bitcoin Lightning Network

Cointelegraph reporter Joe Hall visited the country of Gibraltar to explore Bitcoin (BTC) adoption on “The Rock,” as the peninsula is known locally, and how the adoption of Bitcoin for shopping in the territory is impacting business. The visit was also an opportunity to visit Xapo Bank, the world’s first private financial institution to combine traditional banking with Bitcoin. Coinbase acquired its custody business in 2019, making the American exchange the largest crypto custodian in the world. The British Overseas Territory of Gibraltar is known for its pioneering crypto regulations, support for blockchain development and Bitcoin adoption, with many retail businesses using the Lightning Network — a layer-two network that enables off-chain transactions — to accept Bitcoin as payment...

The Bitcoin bottom — Are we there yet? Analysts discuss the factors impacting BTC price

When Bitcoin was trading above $60,000, the smartest analysts and financial-minded folk told investors that BTC price would never fall below its previous all time high. These same individuals also said $50,000 was a buy the dip opportunity, and then they said $35,000 was a generational buy opportunity. Later on, they also suggested that BTC would never fall under $20,000. Of course, “now” is a great time to buy the dip, and one would think that buying BTC at or under $10,000 would also be the purchase of a lifetime. But by now, all the so-called “experts” have fallen quiet and are nowhere to be seen or heard. So, investors are left to their own devices and thoughts to contemplate whether or not the bottom is in. Should one be patient and wait for the forecast “drop to $10,000” ...

Bitcoin mining revenue jumps 68.6% from the lowest-earning day of 2022

The Bitcoin (BTC) mining industry endured immense financial stress throughout the year 2022 as a prolonged bear market directly impacted their earnings when translated to the U.S. dollar. However, miners resilient to the year’s lowest mining revenue day, June 13, witnessed a 68.63% increase in mining revenue within a month. Over the year, revenue from Bitcoin mining dropped due to a multitude of factors centered around investor sentiment — driven by tensions arising from market crashes, ecosystem collapses and loss-making investments. Cutting through the noise, the Bitcoin ecosystem recovered across numerous determinants, including miners’ revenue in dollars, network difficulty and hash rate. Total miners revenue over time. Source: blockchain.com Data from blockchain.com confirms that BTC ...

VC Roundup: Lightning Network payment rail, DeFi trading platform and blockchain security firm raise millions

Even with the onset of crypto winter, 2022 has been a watershed year for venture capital funding. Crypto and blockchain companies collectively raised $30.3 billion in venture capital in the first half of 2022, exceeding all of last year’s totals. While the number of deals has declined in recent months, startups at the intersection of blockchain payments, decentralized finance (DeFi) and cybersecurity are still attracting sizable interest from the VC community. The latest edition of VC Roundup highlights some of the most intriguing funding deals of the past month. Related: The risks and benefits of VCs for crypto communities ZEBEDEE closes $35M Series B ZEBEDEE, a Bitcoin (BTC)-powered payment processor for the gaming industry, has raised $35 million from several investors i...

Bitcoin network difficulty drops to 27.693T as hash rate eyes recovery

The difficulty in mining a block of Bitcoin (BTC) was reduced further by 5% to 27.693 trillion as network difficulty maintains its three-month-long downward streak ever since reaching an all-time high of 31.251 trillion back in May 2022. Network difficulty is a means devised by Bitcoin creator Satoshi Nakamoto to ensure the legitimacy of all transactions using raw computing power. The reduced difficulty allows Bitcoin miners to confirm transactions using lower resources, enabling smaller miners a fighting chance to earn the mining rewards. Despite the minor setback, zooming out on blockchain.com’s data reveals that Bitcoin continues to operate as the most resilient and immutable blockchain network. While the difficulty adjustment is directly proportional to the hashing power of miner...

- 1

- 2