Market Capitalization

Bitcoin scarcity rises as bad exchanges take 1.2M BTC out of circulation

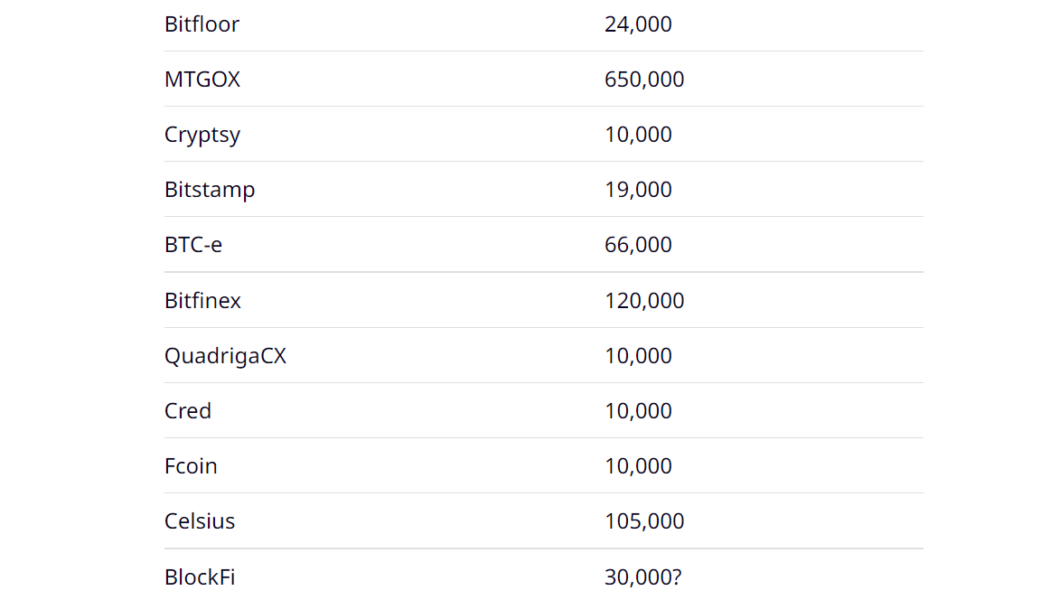

One of the biggest factors differentiating Bitcoin (BTC) from fiat currency and most cryptocurrencies is the hard limit of 21 million on its total circulating supply. However, the demise of numerous crypto exchanges over the last decade has permanently taken out at least 5.7% (1.2 million BTC) of the total issuable Bitcoin from circulation. The lack of clarity around a crypto exchange’s proof-of-reserves came out as the primary reason for their sudden collapses, as seen recently with FTX. Historical data around crypto crashes revealed that 14 crypto exchanges, together, were responsible for the loss of 1,195,000 BTC, which represents 6.3% of the 19.2 Bitcoin currently in circulation. Bitcoin lost due to defunct crypto exchanges. Source: Casa Blog An investigation conducted by Jameson ...

NFT ecosystem attempts a bounce back amid bearish market sentiment

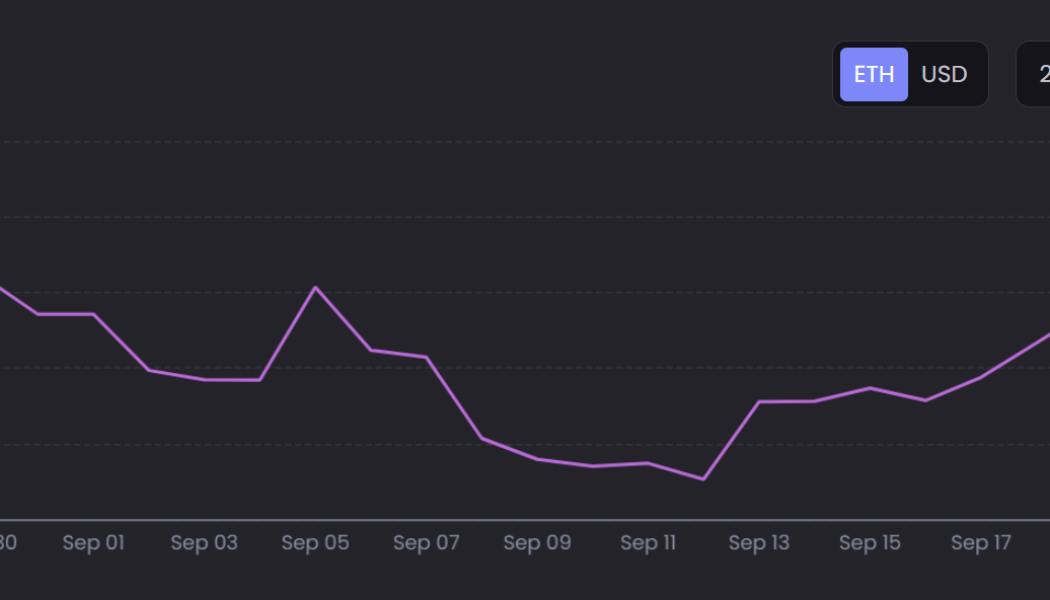

Over the past two years, nonfungible tokens (NFTs) gave the crypto ecosystem the boost it needed to grab mainstream attention — owing to the involvement of prominent artists and celebrities. However, despite the enormous losses suffered by NFT investors following the ongoing, 10-month-long bear market, the ecosystem showed sustainable signs of a comeback in the last two weeks. Since Sept. 12, the performance of blue-chip NFT collections witnessed a steady growth, inching back toward the 10,000 Ether (ETH) that was lost in mid-August 2022, according to data by NFTGo. The performance of blue-chip NFT collections. Source: NFTGo On Sept. 20, the market capitalization, which is derived from the floor price and the trading price of NFTs, spiked nearly 16.5% at roughly 11.25 million ETH. Mar...

NFT hype evidently dead as daily sales in June 2022 dip to one-year lows

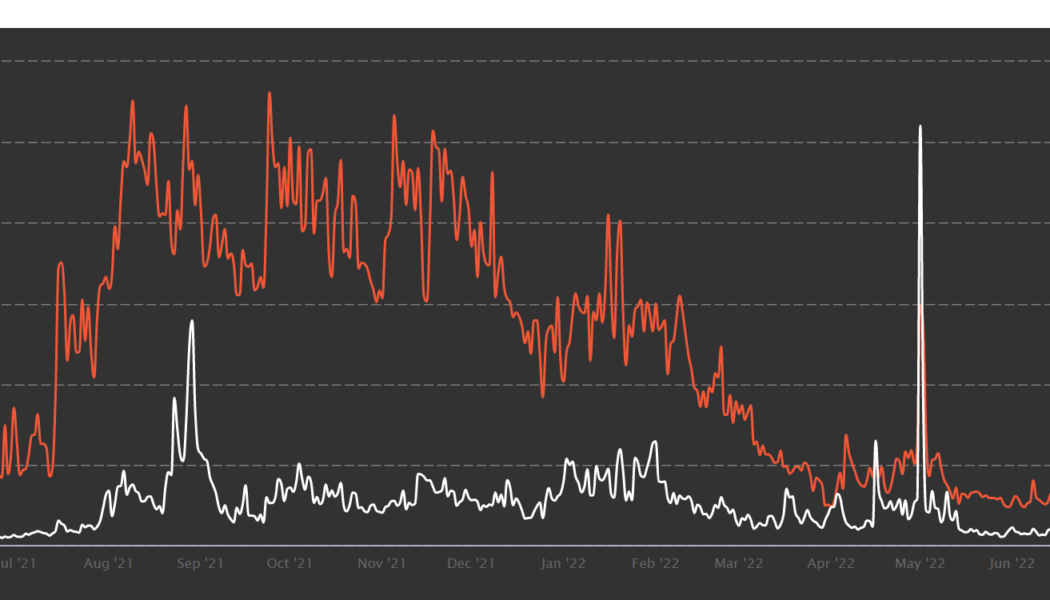

Nonfungible tokens (NFT) took center stage in the year 2021 as artists, influencers, A-list celebrities and the sports industry finally came across a fan engagement tool that empowered the general public to cash in on their success. However, the hype around NFT did not manage to stand its ground as sales plummeted to one-year lows amid the ruthless bear market of 2022. The NFT boom, which started in early 2021, upheld its glory until May 2022 — supported by a healthy and bullish crypto ecosystem and positive investor sentiment. However, Bitcoin’s (BTC) struggle to hold on to its all-time high prices had an adverse impact across the crypto ecosystem. Number of daily NFT sales between June 2021 – June 2022. Source: NonFungible The NFT ecosystem recorded its worst performance of th...

Tether’s USDT market cap dips below $70B for an 8-month low

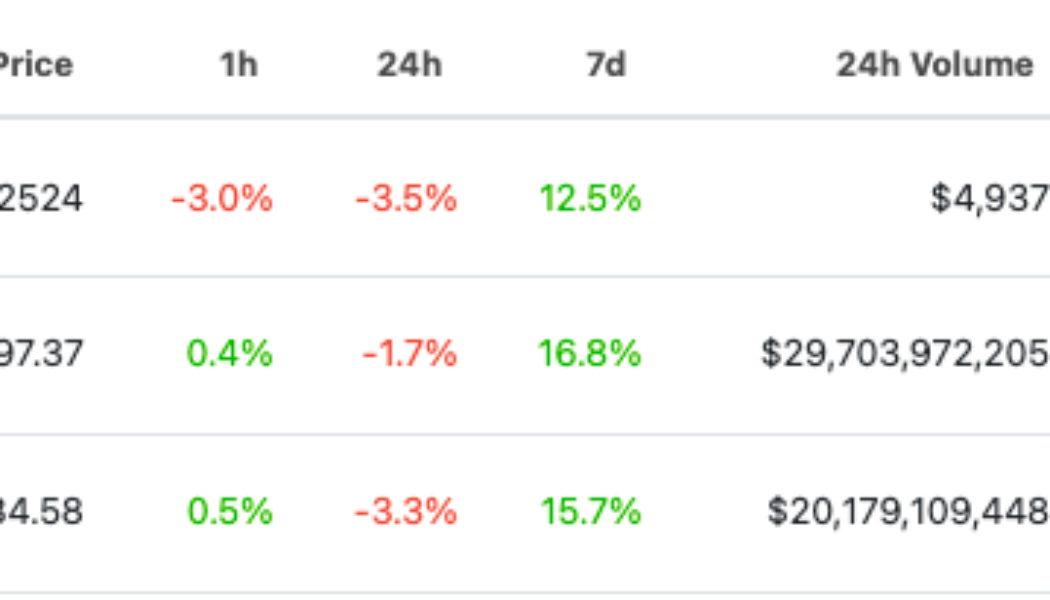

Tether (USDT), the biggest stablecoin and the third largest digital currency by market capitalization, continues losing its market value amid the current market downturn. On June 16, USDT’s market cap dropped below $70 billion for the first time since October 2021. The drop followed a cascade of repeated declines shortly after the USDT market value reached its all-time high above $80 billion in May. At the time of writing, Tether USDT’s market capitalization stands at $69.3 billion, up around $300 million from the multi-month low, according to data from CoinGecko. USDT 90-day market capitalization chart. Source: CoinGecko Tether’s biggest rival, USDC, is the second-largest U.S. dollar-pegged stablecoin backed by the peer-to-peer payments technology company Circle. The stablecoin reached $5...

Traders target $1,400 Ethereum price after ETH drops closer to a critical support level

On June 8 the Ethereum network successfully underwent the merge to become proof-of-stake on its Ropsten testnet, but the news had little impact on ETH price. With the Ropsten upgrade now looking more like a buy the rumor, sell the news type of event, most analysts have kept a short-term bearish outlook for Ether price. Let’s take a look. ETH/USDT 1-day chart. Source: TradingView Can Ether escape the head and shoulders pattern? Twitter analyst, “Cactus”pointed out a bearish head and shoulders pattern and questioned whether Ether price would be able to follow the sharp downside that typically follows the completion of the pattern. ETH/USD 1-week chart. Source: Twitter Cactus said, “This is what we are getting excited about? Hard to be bullish any t...

Bitcoin price recovers $31.5K, but traders say ‘scam’ price action will bring more downside

Bitcoin’s (BTC) short-term price action has been dominated by whipsaws that trigger around the $31,000 to $32,000 level and the June 6 reversal at this point triggered a quick sell-off that pushed the price down to $29,200. Surprisingly, on June 7, the price rapidly reversed course as Bitcoin rallied back to $31,500, but given the current rejection at this level, traders are likely to proceed cautiously, rather than expect a quick surge to $35,000. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about the short-term outlook for BTC and what support levels to keep an eye on moving forward. A clear redistribution range The range-bound trading currently impacting Bitcoin was addressed by crypto analyst and pseudonymous Twitter user il Capo of Crypto, wh...

Bitcoin briefly dethroned by unknown altcoin due to CoinGecko glitch

CoinGecko, one of the largest cryptocurrency tracking websites in the world, suffered a major glitch on Friday morning, with Bitcoin (BTC) mistakenly losing its position as the largest digital currency by market capitalization to a lesser-known altcoin. The list of top-valued cryptocurrencies on CoinGecko briefly went somewhat irrelevant, with BTC’s market cap temporarily falling behind a token known as Relevant (REL). As of 7:20 am UTC, REL was mistakenly placed at the top of the most-valued cryptocurrencies on CoinGecko, with its market cap going insane at $6.5 septillion, or way more than all other assets in the world combined. Source: CoinGecko The glitch also affected the total crypto market capitalization on CoinGecko, with the market cap temporarily growing as big as $7 septillion. ...

Apple overtakes Saudi Aramco as world’s most valuable public company

Apple’s stock hit a record high on Friday after reporting blockbuster quarterly results, helping the iPhone maker briefly overtake Saudi Aramco to become the world’s most valuable publicly listed company. Apple’s stock surged to as high as $412.22 a share, putting its market capitalization at $1.762 trillion, according to the share count provided by Apple in a regulatory filing on Friday. Saudi Aramco, which has been the most valuable publicly listed company since going public last year, had a market capitalization of $1.760 trillion as of its last close, according to Refinitiv data. Last up 6.2% at $408.78 in midday trading, Apple’s market capitalization stood at $1.748 trillion. After Apple bought back $16 billion worth of shares in the June quarter, it had 4,275,634,000 outstanding shar...