Markets Pro

3 reasons why Waves price gained 100%+ in the last week

Development never stops in the blockchain sector and projects that continuously evolve are the ones that stay at the forefront and survive over the long-term. One project attempting to stay on top of the innovation wave is Waves, a multi-purpose blockchain protocol designed to support a variety of use cases, including decentralized applications and smart contracts. Data from Cointelegraph Markets Pro and TradingView shows that the price of WAVES has rallied 120% since forming a double bottom at $8.28 on Feb. 22. WAVES/USDT 4-hour chart. Source: TradingView Three reasons for the price growth for WAVES are the recent announcement that the protocol will migrate to Waves 2.0, a partnership with Allbridge that will connect Waves with other popular blockchain networks and the upcoming laun...

Rune’s upcoming mainnet launch and Terra (LUNA) integration set off a 74% rally

2021 was a roller coaster of a year for THORChain (RUNE), which saw its price top out at $20.31 only to come crashing down below $4 as a series of hacks and declining interest in decentralized finance had the token limping into 2022. Data suggests that investors could be taking a closer look at Rune and a few potentially bullish factors could include the protocol’s recent integration with the Terra and Cosmos ecosystem, an upcoming mainnet launch and the attractive yields offered to liquidity providers. RUNE/USDT 4-hour chart. Source: TradingView Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $3.00 on Feb. 24, the price of RUNE has rallied 74.2% to a daily high at $5.23 on March 1 amid a 388% surge in its 24-hour trading volume. Rune integrates ...

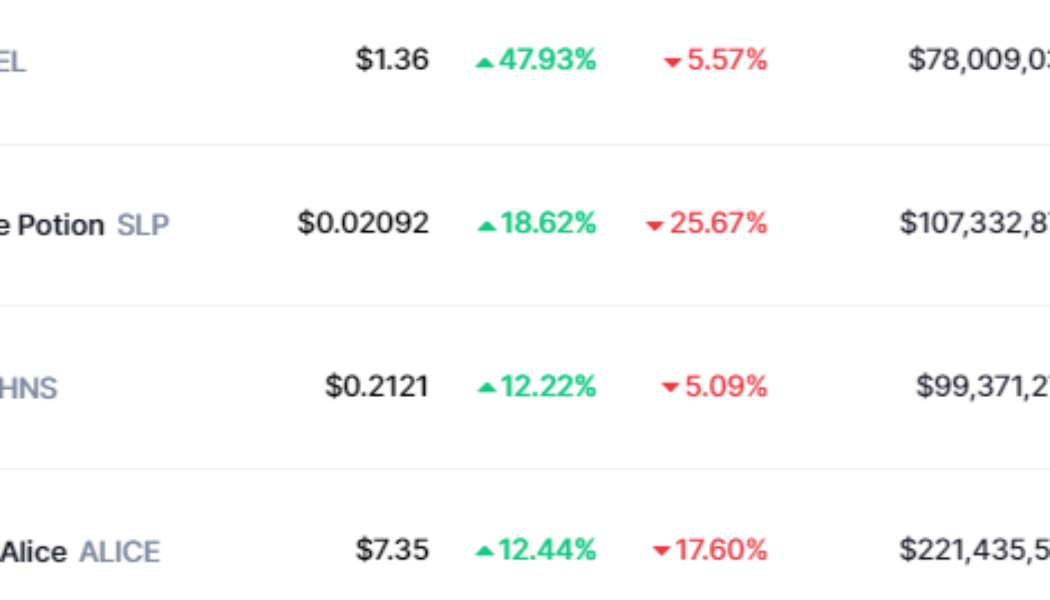

VOXEL, SLP and ALICE rally after protocol updates and a major exchange listing

Crypto markets are taking a beating but there are still a few standout performers even during this week’s volatility. One sector that has managed to rise above the noise are NFT-related altcoins and GameFi tokens. Top gainers in the collectible and NFT sector. Source: CoinMarketCap Data from Cointelegraph Markets Pro and CoinMarket Cap shows that three notable gainers over the past 48-hours were Voxies (VOXEL), Smooth Love Potion (SLP) and MyNeighborAlice (ALICE). Voxie Tactics launches its marketplace VOXEL is the native utility currency of Voxie Tactics, a free-to-play, 3-dimensional, role-playing game that combines the classic look of the popular tactical games of the 1990s and 2000s with modern game mechanics. Data from TradingView shows that after hitting a low of $0.90 on Feb. ...

Komodo (KMD) rallies 54% after major push to expand interoperability with AtomicDEX

Interoperability between separate blockchain networks has become a major theme in the cryptocurrency market over the past year, but several major exploits — such as the $321 million Wormhole exploit — have highlighted the difficulties in achieving cross-chain transfers in a secure manner. One protocol that has been gaining traction in February thanks to its alternative approach to achieving cross-chain interoperability is Komodo, an open, composable multichain platform that is home to the AtomicDEX wallet and non-custodial decentralized exchange. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $0.446 on Feb. 20, the price of the platform’s KMD token surged 54% to a daily high of $0.687 on Feb. 22. KMD/USDT 4-hour chart. Source: TradingView Three r...

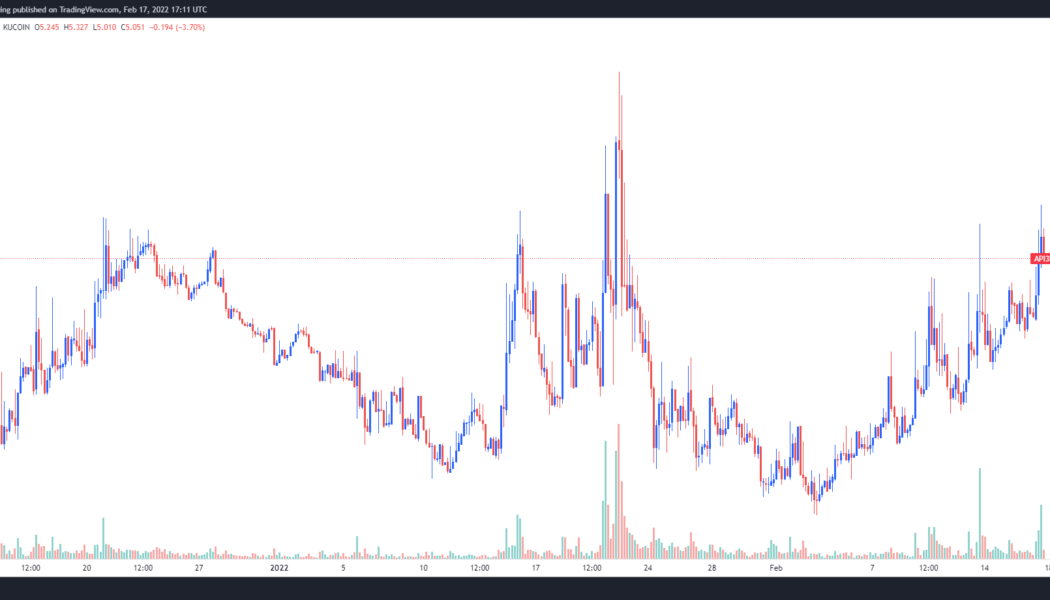

API3 price gains 55% after new partnerships and exchange listings attract investors

In the emerging Web3 world, data is the most valuable commodity, and oracle solutions provide a valuable role in facilitating the accurate and secure transmission of data between blockchains and data sources. One project that is taking a different approach to developing oracles is API3 (API3), a project which harnesses application programming interfaces (APIs) to create first-party oracles through the use of decentralized APIs capable of broadcasting data directly to blockchain networks. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $3.22 on Feb. 3 the price of API3 climbed 72% to reach a daily high of $5.55 on Feb. 17 as the wider cryptocurrency corrected after news of Russia escalating it’s incursion into Ukraine made waves in the news....

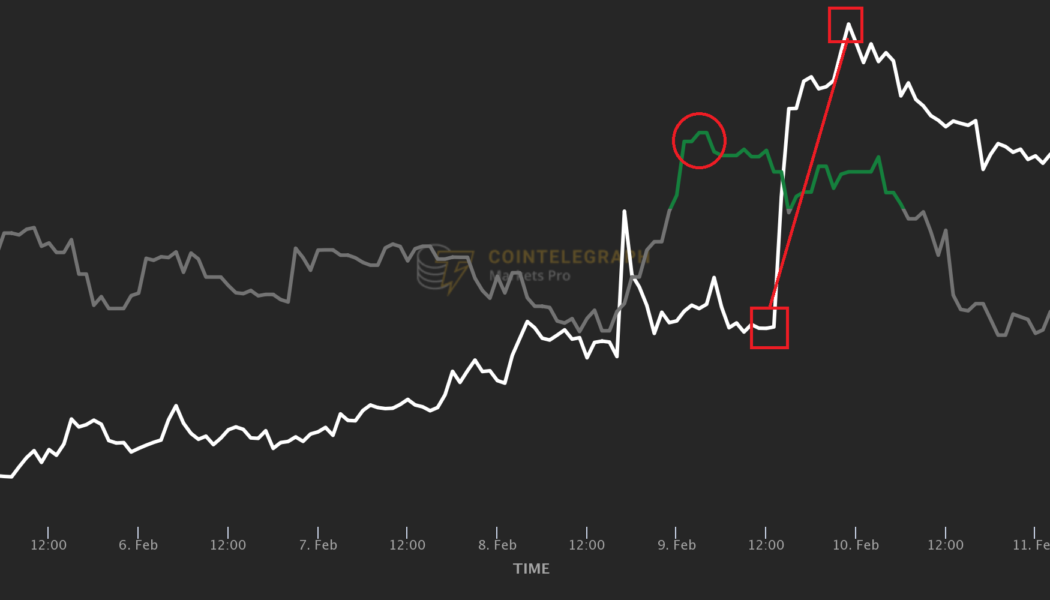

Here’s how traders got alerted to some of the biggest rallies of this week’s resurging market

This crypto winter wasn’t a very long one. Having briefly touched $34,000 in the second half of January, Bitcoin (BTC) is on its way up again, touching the $45,000 mark on Feb. 10. Many altcoins have been catching up as well and posting double-digit weekly returns. However, not all relief rallies were equally impressive. Is there a way for traders to pick the assets that are about to pull off the strongest rebounds? Luckily, bullish marketwide reversals tend to look similar in terms of both price movement and other variables that shape market activity: rising trading volumes, spikes of online attention to individual tokens, and the elevated sentiment of social media chatter around them. Furthermore, the conditions that underlie individual assets’ rallies in a resurging crypto market often ...

Injective Protocol (INJ) rallies 100%+ after launching cross-chain support for Cosmos

Trading perpetual futures contracts in decentralized apps is a crypto sub-sector ripe for growth, especially as discussions of regulation, taxation and mandatory KYC at centralized exchanges continue to take place. One DEX platform that has begun to gain traction is Injective (INJ), an interoperable layer-one protocol designed to facilitate the creation of cross-chain Web3 decentralized finance (DeFi) applications. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $3.91 on Feb. 3, the price of INJ has rallied 157.8% to a daily high of $10.08 on Feb. 11 amidst a 1,756% spike in its 24-hour trading volume to $306 million. INJ/USDT 1-day chart. Source: TradingView Three reasons for the spike in demand for INJ include the addition of support for new assets i...

Renewed interest in the Metaverse sends Decentraland (MANA) price 75% higher

The influence of blockchain technology on the ongoing digital revolution cannot be overstated as the rise of the Metaverse and the integration of virtual reality is transforming the way humans interact on a global scale. One project that is beginning to gain traction in its effort to bridge the old world with the new is Decentraland (MANA), a virtual reality (VR) ecosystem built on the Ethereum network that allows users to create, engage with and monetize digital content through a variety of interactive experiences. Data from Cointelegraph Markets Pro and TradingView shows that over the past two weeks, the price of MANA has climbed 70% from a low of $1.70 on Jan. 22 to a daily high of $2.90 on Feb. 1 as the wider crypto market struggled under bearish pressure. MANA/USDT 1-day chart. ...

Kyber Network (KNC) bucks the market-wide downtrend with a 57% gain in January

In the crypto market volatility continues to reign supreme, and fear, uncertainty and doubt (FUD) run rampant. This makes it challenging for any project to rise above the noise and post positive price gains but there are a few projects that are showing strength during the current downturn. Kyber Network (KNC) is a multi-chain decentralized exchange (DEX) and aggregation platform designed to provide decentralized finance (DeFi) applications and their users with access to liquidity pools that provide the best rates. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a bottom of $1.18 on Jan. 6, the price of KNC has rallied 57% to a daily high at $1.87 on Jan. 27 despite the wider weakness in the crypto market. KNC/USD 4-hour chart. Source: TradingView Three re...

3 reasons why Harmony (ONE) rallied back to its all-time high this week

Bitcoin price is still a ways from its $69,000 all-time high but this isn’t stopping altcoins from moving toward new highs. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.13 on Dec. 4, the price of Harmony (ONE) has risen 163% to establish a new all-time high of $0.38 on Jan. 14 ONE/USDT 1-day chart. Source: TradingView Three reasons for the growing strength of Harmony include an expanding ecosystem, the launch of multiple cross-chain bridges and developers interest in finding Ethereum network alternatives. ONE benefits from Harmony’s $300 million ecosystem development fund One of the biggest boosts to the overall health of the Harmony ecosystem began back in September when the project launched a $300 million developer incentive p...

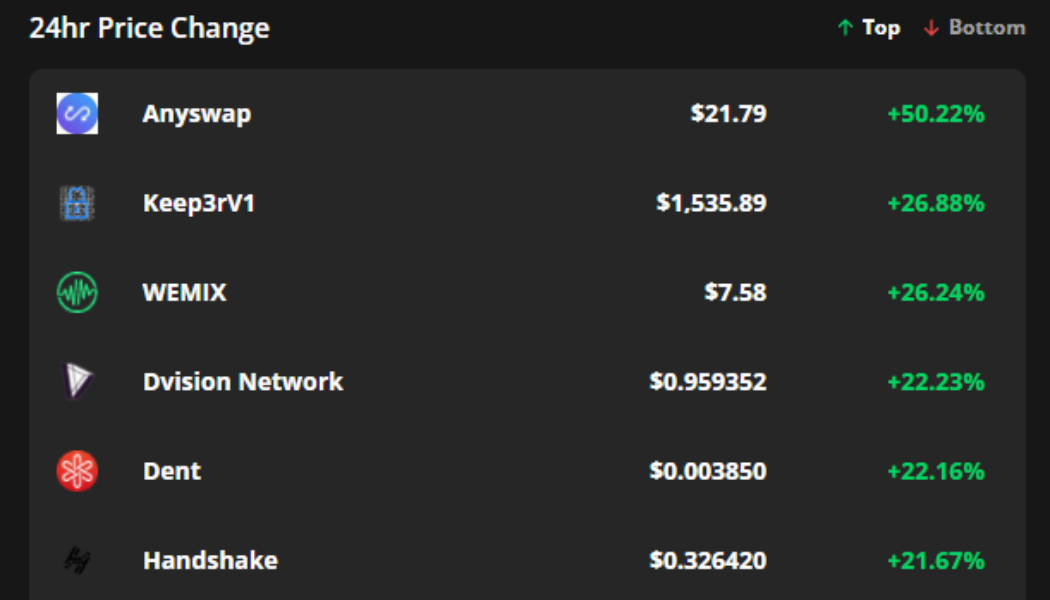

Anyswap, Keep3rV1, WEMIX follow Bitcoin’s move to $44K with double-digit rallies

The cryptocurrency community is back in high spirits on Jan. 12 after a majority of tokens in the top 200 flashed green following Bitcoin’s (BTC) spike to $44,000. The return of bullish momentum has come as a boon to several altcoin projects, with multiple tokens seeing gains in excess of 20%. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Anyswap (ANY), Keep3rV1 (KP3R) and WEMIX (WEMIX). Anyswap expands its list of supported networks Gains in the altcoin market were led by Anyswap, a decentralized exchange that specializes in allowing users to transfer and swap tokens between 25 distinct networks. Data from Cointelegraph Markets Pr...

Even after the pullback, this crypto trading algo’s $100 bag is now worth $20,673

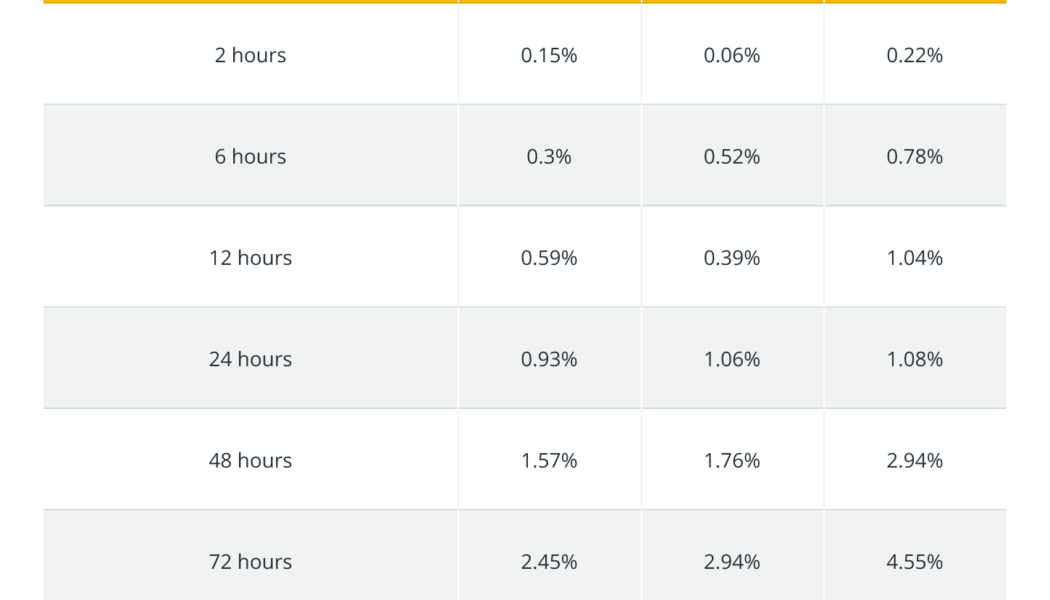

Exactly one year ago, on Jan. 9, 2021, Cointelegraph launched its subscription-based data intelligence service, Markets Pro. On that day, Bitcoin (BTC) was trading at around $40,200, and today’s price of $41,800 marks a year-to-year increase of 4%. An automated testing strategy based on Markets Pro’s key indicator, the VORTECS™ Score, yielded a 20,573% return on investment over the same period. Here is what it means for retail traders like you and me. How can I get my 20,000% a year? The short answer is – you can’t. Nor can any other human. But it doesn’t mean that crypto investors cannot massively enhance their altcoin trading game by using the same principles that underlie this eye-popping ROI. The figure in the headline comes from live testing of various VORTECS™-based tra...