OKX

OKX cites intermittent outage amid Alibaba Cloud equipment anomaly

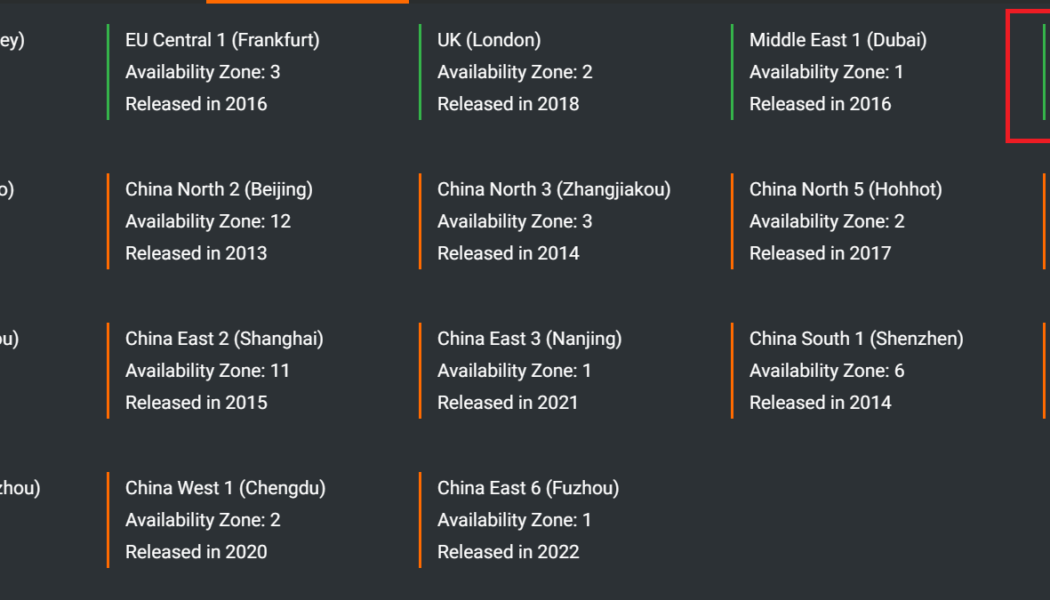

Crypto exchange OKX witnessed service disruptions after primary infrastructure services provider Alibaba Cloud announced a hardware failure in Alibaba Cloud’s Hong Kong data center. Alibaba Cloud Hong Kong IDC Zone C server went offline on Saturday at roughly 10 pm ET and failed to recover for over seven hours at the time of reporting. On-chain data further confirms that OKX processed no transactions during this timeline. Partial list of Alibaba Cloud’s global infrastructure. Source: Alibaba Cloud Alibaba Cloud’s website shows that the Hong Kong (China) server hosts three availability zones, which have been operational since 2014. The cloud provider confirmed the outage through an official announcement, as shown below. Alibaba Cloud’s official announcement about service disrupt...

OKX releases Proof of Reserves page, along with instructions on how to self-audit its reserves

Crypto exchange OKX has released a Proof of Reserves page that allows users to audit its reserves to make sure it is solvent. This comes at a time when crypto exchanges are coming under greater scrutiny after the collapse of FTX. OKX announced the new page in a tweet, as well as on its blog. Don’t trust, verify → OKX Proof of Reserves (PoR) is LIVE. To set a new standard of transparency, risk management and user protection, we’re launching our first PoR. You can now verify your assets are backed 1:1 on #OKX ⤵️ Details — OKX (@okx) November 23, 2022 The Proof of Reserves page offers two different options for users to audit the exchange’s reserves. The first allows users to get a brief summary of the exchange’s current reserves and liabilities for its top three cryptocurre...

Moonvember kicks off with sweeping staff layoffs across crypto

The crypto and tech industry has seen a slew of staff cuts this week against a backdrop of difficult market conditions, though on a positive note, some are bucking the trend. Crypto companies, including crypto exchanges, venture capital firms and blockchain developers, have been forced to reduce headcount in order to stay nimble amid the bear market. Some, however, have done the opposite, opening up offices in new locations and markets. It comes a few weeks after multiple high-level executives, such as OpenSea’s former chief financial officer, Kraken’s co-founder Jesse Powell and Ripple Labs’ engineering director, have all made headlines for either exiting or stepping down from their roles in the space. Stripe cuts around 1,000 staff Patrick Collison, CEO of payments processor Stripe...

Bitcoin fails to break the $21K support, but bears remain shy

Bitcoin (BTC) rallied on the back of the United States stock market’s 3.4% gains on Oct. 28, with the S&P 500 index rising to its highest level in 44 days. In addition, recently released data showed that inflation might be slowing down, which gave investors hope that the Federal Reserve might break its pattern of 75 basis-point rate hikes after its November meeting. In September, the U.S. core personal consumption expenditures price index rose 0.5% from the previous month. Although still an increase, it was in line with expectations. This data is the Federal Reserve’s primary inflation measure for interest rate modeling. Additional positive news came from tech giant Apple, which reported weak iPhone revenues on Oct. 27 but beat Wall Street estimates for quarterly earnings and margin. M...

3 major mistakes to avoid when trading cryptocurrency futures markets

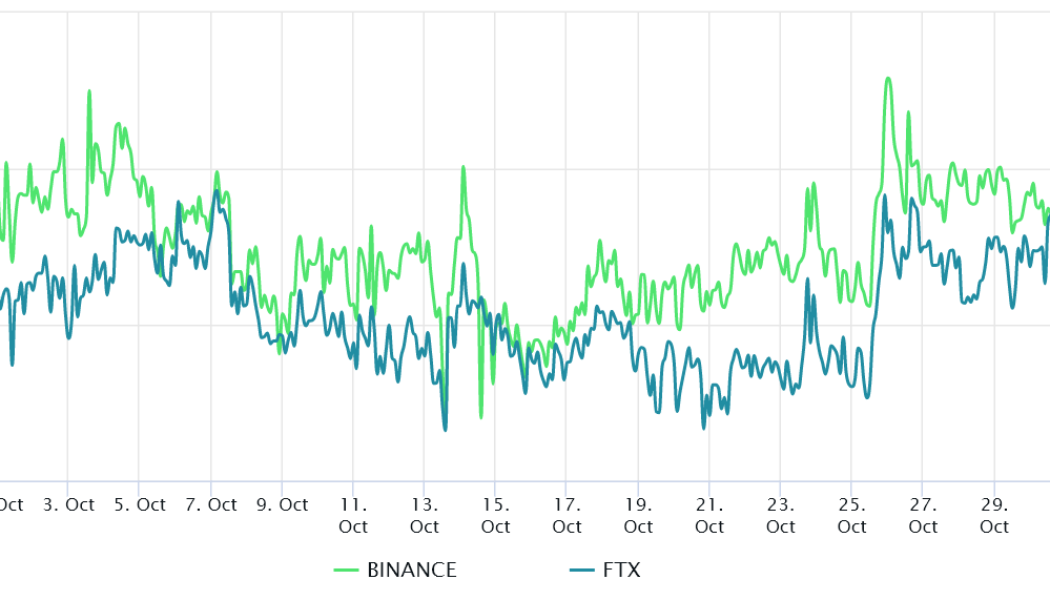

Many traders frequently express some relatively large misconceptions about trading cryptocurrency futures, especially on derivatives exchanges outside the realm of traditional finance. The most common mistakes involve futures markets’ price decoupling, fees and the impact of liquidations on the derivatives instrument. Let’s explore three simple mistakes and misconceptions that traders should avoid when trading crypto futures. Derivatives contracts differ from spot trading in pricing and trading Currently, the aggregate futures open interest in the crypto market surpasses $25 billion and retail traders and experienced fund managers use these instruments to leverage their crypto positons. Futures contracts and other derivatives are often used to reduce risk or increase exposure and are not r...

How Bitcoin’s strong correlation to stocks could trigger a drop to $8,000

The Bitcoin (BTC) price chart from the past couple of months reflects nothing more than a bearish outlook and it’s no secret that the cryptocurrency has consistently made lower lows since breaching $48,000 in late March. Bitcoin price in USD. Source: TradingView Curiously, the difference in support levels has been getting wider as the correction continues to drain investor confidence and risk appetite. For example, the latest $19,000 baseline is almost $10,000 away from the previous support. So if the same movement is bound to happen, the next logical price level would be $8,000. Traders are afraid of regulation and contagion On July 11, the Financial Stability Board (FSB), a global financial regulator including all G20 countries, announced that a framework of recommendations for the crypt...

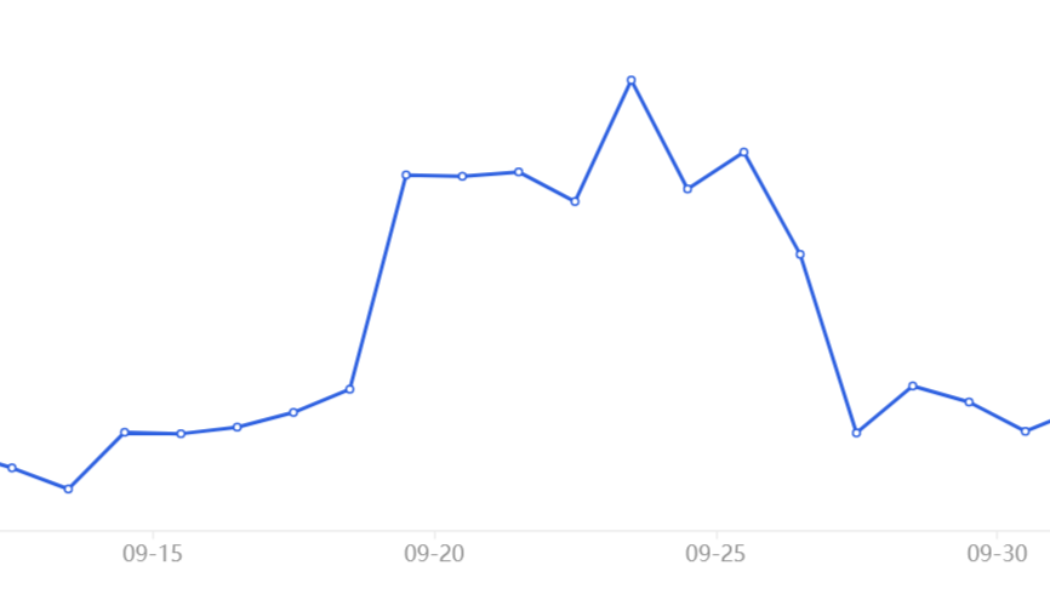

Total crypto market cap risks a dip below $1 trillion if these 3 metrics don’t improve

The total crypto market capitalization has ranged from $1.19 trillion to $1.36 trillion for the past 23 days, which is a relatively tight 13% range. During the same time, Bitcoin’s (BTC) 3.5% and Ether’s (ETH) 1.6% gains for the week are far from encouraging. To date, the total crypto market is down 43% in just two months, so investors are unlikely to celebrate even if the descending triangle formation breaks to the upside. Total crypto market cap, USD billion. Source: TradingView Regulation worries continue to weigh investor sentiment, a prime example being Japan’s swift decision to enforce new laws after the Terra USD (UST) — now known as TerraUSD Classic (USTC) — collapse. On June 3, Japan’s parliament passed a bill to limit stablecoin issuing to licensed banks, registered money t...

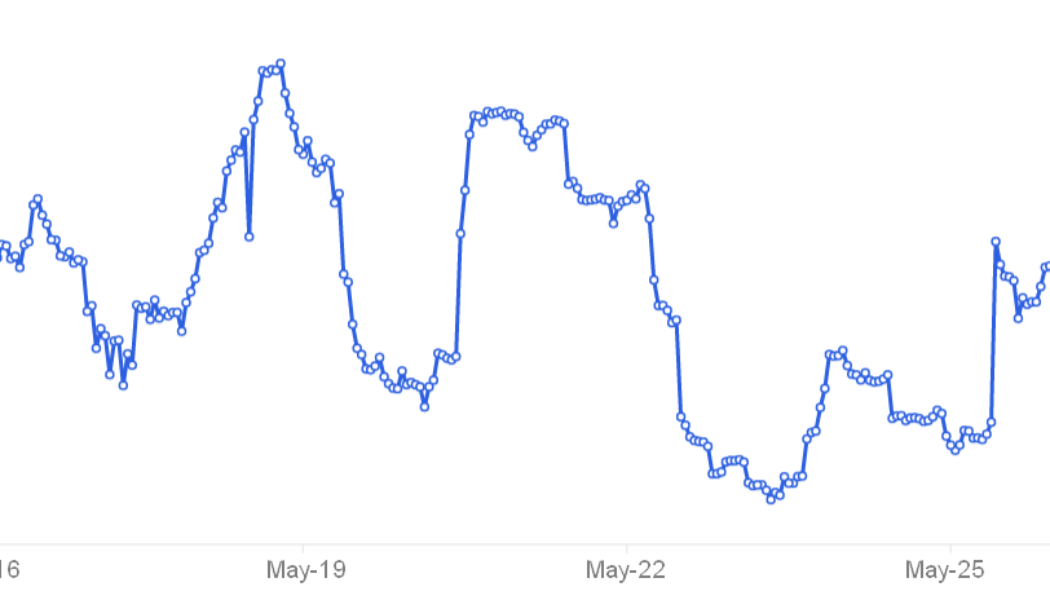

Any dip buyers left? Bulls are largely absent as the total crypto market cap drops to $1.65T

The total crypto market capitalization has been trading within a descending channel for 24 days and the $1.65 trillion support was retested on May 6. The drop to $1.65 trillion was followed by Bitcoin (BTC) reaching $35,550, its lowest price in 70 days. Total crypto market cap, USD billion. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptocurrencies dropped 6% over the past seven days, but this modest correction in the overall market does not represent some mid-capitalization altcoins, which managed to lose 19% or more in the same time frame. As expected, altcoins suffered the most In the last seven days, Bitcoin price dropped 6% and Ether (ETH) declined by 3.5%. Meanwhile, altcoins experienced what can only be described as a bloodbath. Below ar...

Bitcoin rally hopes diminish as pro traders flip bearish, retail interest at 12-month lows

Bitcoin (BTC) has been trapped in a symmetrical triangle for 56 days and the trend change could last until early May, according to price technicals. Currently, the support level stands at $38,000, while the triangle resistance for daily close stands at $43,600. Bitcoin mining up, retail interest down Bitcoin/USD price at FTX. Source: TradingView The week started with a positive achievement for the Bitcoin network as the Lightning Network capacity reached a record-high 3,500 BTC. This solution allows extremely cheap and instant transactions on a secondary layer, known as off-chain processing. After cryptocurrency mining activities were banned in China in 2021, publicly-listed companies in the United States and Canada attracted most of this processing power. As a result, Bitcoin’s hash...

Manchester soccer rivalries commence in field of Web3

Leading English soccer club Manchester City has announced an inaugural partnership with cryptocurrency exchange OKX across both its men’s and women’s teams, as well as the club’s emerging esports ventures. According to the club’s press release, the collaboration will focus on “exclusive experiences for OKX’s global customer base, in addition to an in-stadium presence across the Etihad Stadium and Academy Stadium.” OKX, which rebranded from OKEx earlier this year, is the second-largest spot exchange in the industry, reportedly having reportedly over 20 million customers and facilitating over $4.3 billion in normalized trading volume over the past 24 hours. This total places it ahead of Coinbase, which is in third at approximately $3.3 billion, but a ways behind Binance’s dominance...

- 1

- 2