USDC

Circle co-founder says converged dollar books on Binance would be good for USDC

According to a new Twitter post, Jeremy Allaire, co-founder and CEO of USD Coin (USDC) stablecoin issuer Circle, said that the recent decision by Binance to merge stablecoin dollar books is “a good thing” for USDC. “This move would lead to a gradual net share shift from USDT to BUSD and USDC,” said Allaire. The day before, Binance announced it would cease trading support for USDC and auto-convert deposits after Sept. 29 to a consolidated Binance USD balance comprising other stablecoins pegged to the U.S. dollar. Users will be able to withdraw individual constituents from the consolidated balance at par value. Some users pointed out that it’s now possible to deposit and withdraw USDC seamlessly in Binance. Before the change, it was required to first conve...

TORN price sinks 45% after U.S. Treasury sanctions Tornado Cash — Rebound ahead?

Tornado Cash (TORN) has lost almost half its market valuation two days after being slapped with sanctions by the U.S. Treasury Department. The department accused Tornado Cash, a crypto mixer platform, of laundering more than $7 billion in cryptocurrencies, including a stash of $455 million allegedly stolen by North Korea-based hackers. Immediate reactions were followed by U.S.-based crypto companies, including Circle and Coinbase. In a controversial move, the popular crypto firms blocked the movements of their jointly-issued stablecoin USDC tied to Tornado Cash’s blacklisted smart contracts. TORN price drops 45% The news prompted traders to limit their exposure to TORN, Tornado Cash’s native token. On the daily chart, TORN’s price has slipped by approximately 45...

Tether also confirms its throwing weight behind the post-Merge Ethereum

Hot on the heels of an official announcement from USD Coin (USDC) issuer Circle Pay, stablecoin giant Tether has now also officially confirmed its support behind Ethereum’s upcoming Merge upgrade and switch to a Proof-of-Stake (PoS) consensus mechanism-based blockchain. The announcement came on the same day as its stablecoin competitor, who pledged they will only support Ethereum’s highly anticipated upgrade. In an Aug. 9 statement, Tether labeled the Merge one of the “most significant moments in blockchain history” and outlined that it will work in accordance with Ethereum’s upgrade schedule, which is currently slated to go through on Sept. 19. “Tether believes that in order to avoid any disruption to the community, especially when using our tokens in DeFi projects and platforms, it’s imp...

Circle freezes blacklisted Tornado Cash smart contract addresses

Crypto data aggregator Dune Analytics said that, on Monday, Circle, the issuer of the USD Coin (USDC) stablecoin, froze over 75,000 USDC worth of funds linked to the 44 Tornado Cash addresses sanctioned by the U.S. Office of Foreign Assets Control’s Specially Designated Nationals and Blocked Persons (SDN) list. Tornado Cash is a decentralized application, or DApp, used to obfuscate the trail of previous cryptocurrency transactions on the Ethereum blockchain. All U.S. persons and entities are prohibited from interacting with the virtual currency mixer’s USDC and Ethereum smart contract addresses on the SDN list. Penalties for willful noncompliance can range from fines of $50,000 to $10,000,000 and 10 to 30 years imprisonment. An estimated $437 million worth of assets, cons...

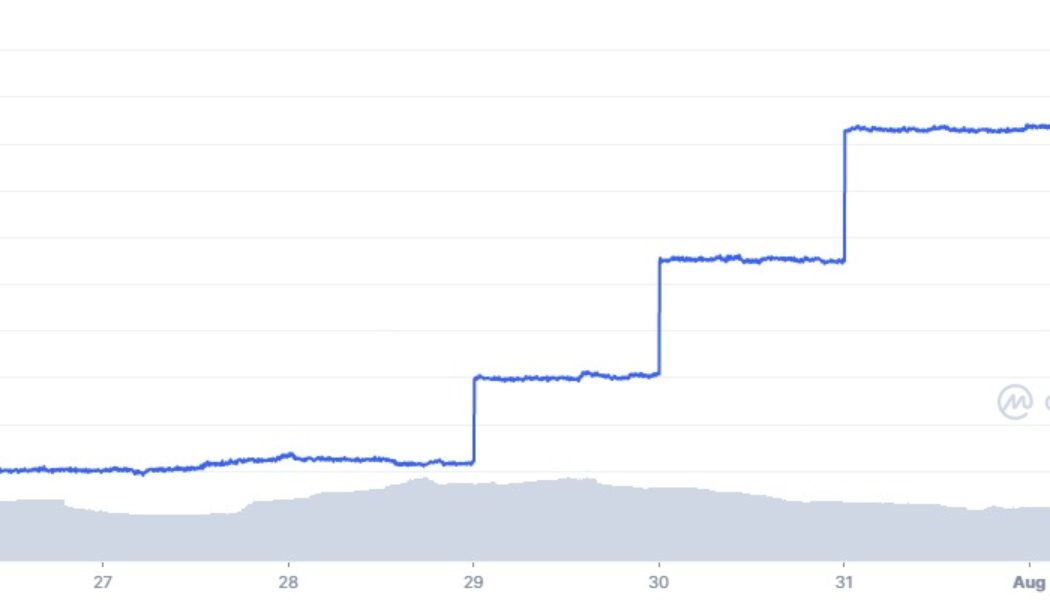

Tether supply starts to increase after three-month decline

The world’s largest stablecoin, Tether (USDT) has expanded its circulating supply following almost three months of reductions, in what could be a sign the crypto markets are slowly recovering. The first mint in almost three months occurred on July 29, and there have been three more, with the latest on August 2, according to CoinMarketCap. The USDT injections have been small, however, lifting Tether’s market cap by just 0.7% or just under $500 million. USDT market cap 7D – Coinmarketcap.com According to the Tether transparency report, there is now 66.3 billion USDT in circulation. This gives the stablecoin a total market share of around 43%. Tether supply reached an all-time high in early May when it topped 83 billion USDT. The collapse of the Terra ecosystem, resultant crypto c...

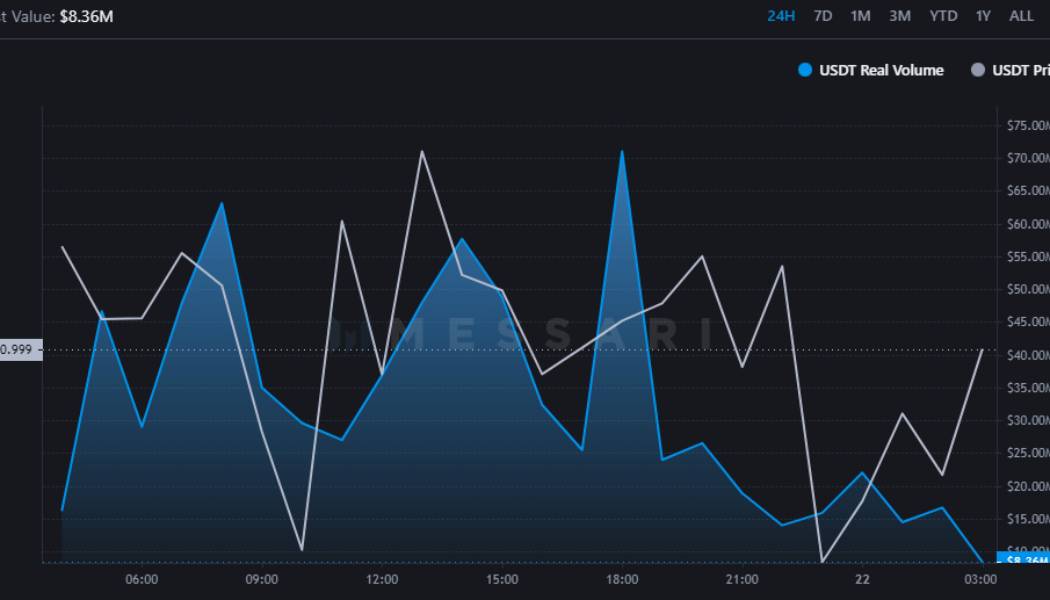

USDC’s ‘real volume’ flips Tether on Ethereum as total supply hits 55.9B

USD Coin is taking a run at the title of the top stablecoin in crypto after its daily ‘real volume’ on the Ethereum network doubled that of Tether’s USDT on Tuesday. According to crypto market data tool Messari, Circle’s USDC posted $1.1 billion in daily real volume on the Ethereum network on June 21, which was double USDT’s real volume of $579 million. Messari’s real volume metric is calculated by compiling data only from exchanges that it believes have “significant and legitimate crypto trading volumes” and thus differs to the more-commonly seen “total volume” metric. Exchanges included in Messari’s Real Volume metric include Binance, Bitfinex, Bitflyer, Bitstamp, Bittrex, Coinbase Pro, Gemini, itBit, Kraken, Poloniex, and those tracked on OnChainFX. 24 hr R...

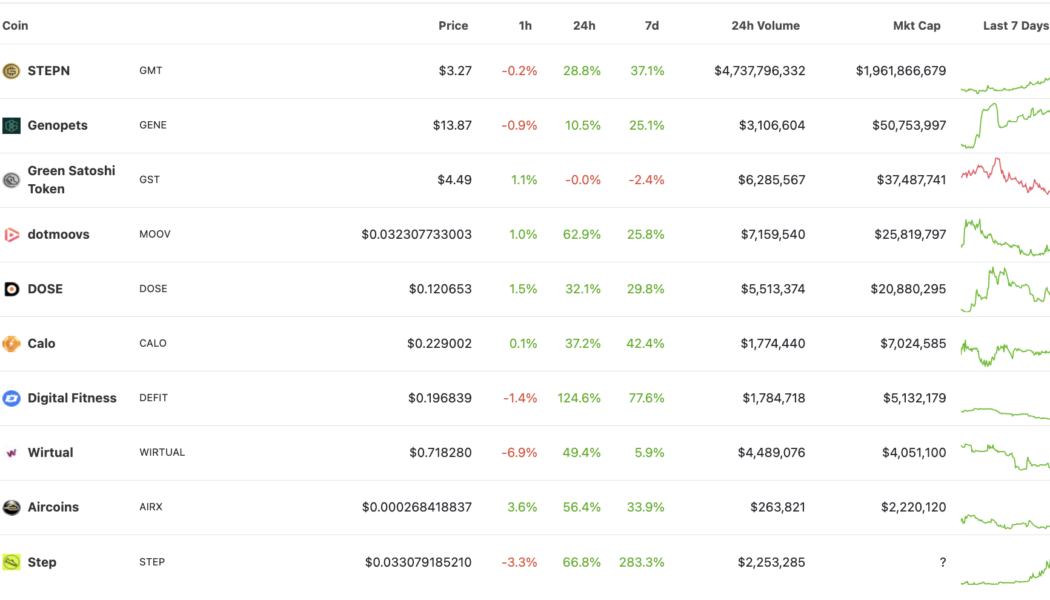

Solana’s STEPN hits record high as GMT price skyrockets 34,000% in over a month

STEPN (GMT), a so-called “move-to-earn” token using the Solana (SOL) blockchain, has soared incredibly since its market debut in March. GMT’s price jumped from $0.01 on March 9 to a record high of $3.45 on April 19 — a 34,000% upside move in just 41 days (data from Binance). Its massive uptrend appeared primarily due to the hype surrounding decentralized finance (DeFi) projects that reward users in tokens for staying active. For instance, the prices of GMT and its top rivals, including Genopets (GENE) and dotmoovs (MOOV), exploded massively on a 24-hour adjusted timeframe, data on CoinGecko shows. Nonetheless, STEPN remained the most valuable move-to-earn (M2E) project, with its market capitalization closing in on $2 billion. The performance of M2E tokens featu...

Neutrino Dollar breaks peg, falls to $0.82 amid WAVES price ‘manipulation’ accusations

Neutrino Dollar (USDN), a stablecoin issued through Waves-backed Neutrino protocol, lost its U.S. dollar-peg on April 4 amid speculations that it could become “insolvent” in the future. USDN plunges 15% despite WAVES backing USDN dropped to as low as $0.822 on Monday with its market capitalization also diving to $824.25 million, down 14% from its year-to-date high of $960.25 million. Interestingly, the stablecoin’s plunge occurred despite Neutrino’s claims of backing its $1-peg via what’s called “over collateral,” i.e., when the total value of Waves (WAVES) tokens locked inside its smart contract is higher than the total USDN minted, also called the “backing ratio.” Neutrino Dollar price performance in the last 24 hours. Source: Co...

Fireblocks completes First DAG acquisition to extend its payment offering

This is Fireblocks’ first-ever acquisition Fireblocks aims to enhance its payment offerings to acquirers and payment service providers Crypto infrastructure provider Fireblocks revealed yesterday that it had completed a deal to acquire Israeli crypto payments processor First Digital Assets Group (First DAG). The acquisition of the digital asset payments technology platform is the first-ever Fireblocks has completed. First DAG employees absorbed into the firm as part of the agreement Though specifics were not revealed at the time of the announcement, Fireblocks said that the deal was completed in cash and stocks. Two sources familiar with the matter have indicated that the price could be in the region of $100 million. Fireblocks plans to expand its current payment offering to enable p...

Tether daily active addresses down to a two-year low: Santiment

Tether whales account for almost 80% of the current USDT supply, as per data from Santiment Bitcoin mega whales have accumulated a significant chunk of the cryptocurrency since the last week of December Data from market behaviour analysis platform Santiment paints a picture of whale domination in the Tether and USD Coin stablecoin markets. It also shows that the number of Tether daily active addresses has crashed to lows last recorded over two years ago. Tether and USD Coin whale dominance Tether, the world’s largest stablecoin, currently has a market capital closing in on $78 billion (roughly 3.8% of the entire cryptocurrency market capital). Only Bitcoin and Ethereum have a higher market circulating value among crypto tokens and other digital assets. Tether addresses with a valuati...

Circle’s USDC stablecoin gobbles Tether’s market share with 50B milestone

The world’s second-largest stablecoin by market capitalization keeps on growing as it erodes the dominance of the current leader, Tether. The stablecoin landscape is a constantly-shifting dynamic but one trend has become clear over the past year or so — Tether’s dominance is diminishing. Its main rival, Circle, has just reached a milestone of 50 billion USDC in circulation according to CoinGecko and a Feb. 1 tweet by company co-founder and CEO, Jeremy Allaire. 50 BILLION USDC (w/ thread below) pic.twitter.com/5FEaPmXjup — Jeremy Allaire (@jerallaire) February 1, 2022 Allaire said that while this is a massive number, “it’s the massive growth and ecosystem around it that tells the broader story.” He added that USDC has seen 10,000% growth over the past two years. The total stablecoin s...

- 1

- 2