USDT

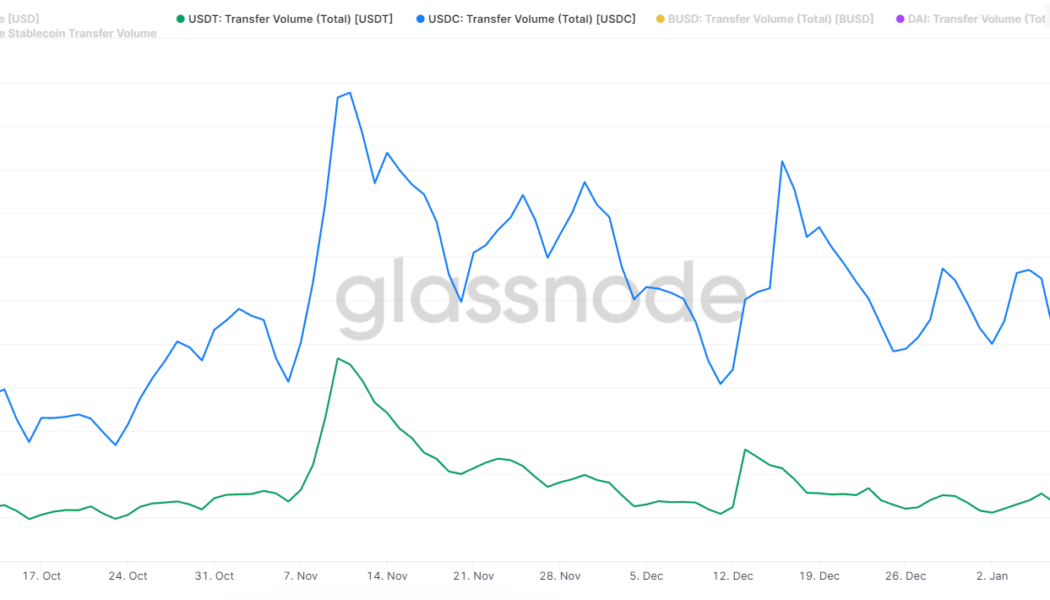

USDC transfer volume hit 5X USDT’s in fallout from FTX collapse

Stablecoin USD Coin (USDC) has grown in popularity since the collapse of FTX. It now frequently reaches daily transfer volumes four to five times that recorded by major competitor Tether (USDT) according to data from blockchain analytics firm Glassnode. That’s despite the market cap of USDT being $23 billion greater than USDC. As of Jan. 10, the difference was in USDC’s favor by a margin of four and a half times. Both stablecoins recorded surges in transfer volumes following an infamous tweet from Binance CEO Changpeng Zhao on Nov. 6 announcing Binance would liquidate its entire FTX Token (FTT) holdings. FTX went into bankruptcy soon after. Since then, USDC has been the preferred choice for crypto users, averaging over $12.5 billion more in transfer volume per day than USDT, according to G...

Tether commercial paper exposure now under $50M, says CTO

Stablecoin issuer Tether (USDT) has nearly completely slashed its commercial paper holdings, with less than $50 million worth of commercial paper units as of Sept. 30, 2022. Tether CTO Paolo Ardoino made the announcement in an Oct. 3 tweet, adding also that Tether’s United States Treasury bills increased to 58.1% of its total portfolio, up 25.1% from its Jun. 30 figure of 43.5%. #tether portfolio update. Tether as of 30 September 2022 holds ~58.1% of its assets in US t-bills. Up from 43.5% on June 30 2022.CP exposure is < 50M now.@Tether_to — Paolo Ardoino (@paoloardoino) October 3, 2022 Commercial papers are short-term debt instruments issued by companies, which are often used to finance various business operations, while treasury bills are claimed to be more stable than commercial pap...

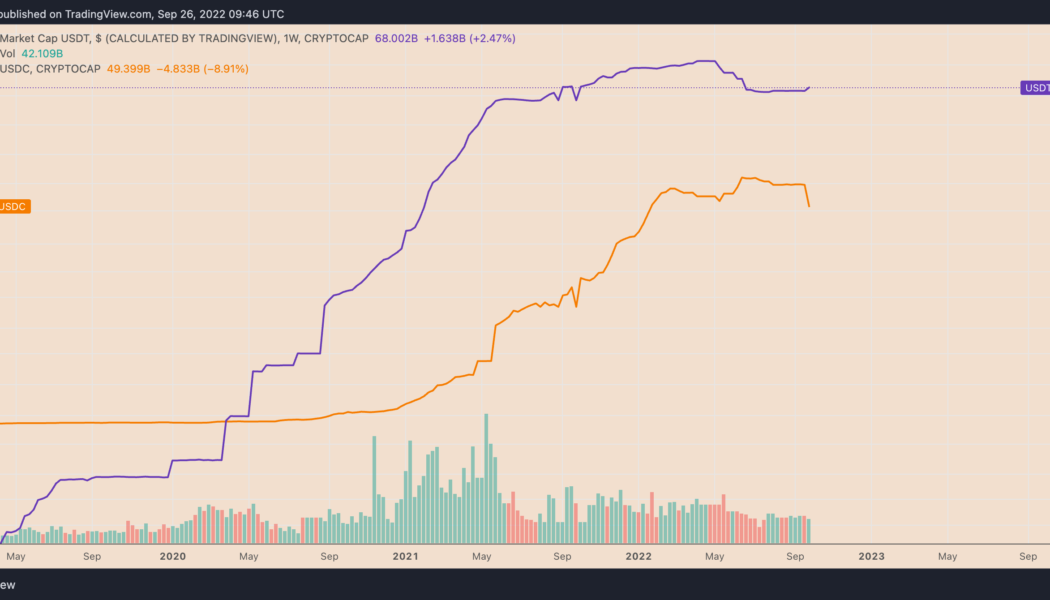

3 reasons why USDC stablecoin dropping below $50B market cap is Tether’s gain

The market capitalization of USD Coin (USDC), a stablecoin issued by U.S.-based payment tech firm Circle, has dropped below $50 billion for the first time since January 2022. On the weekly chart, USDC’s market cap, which reflects the number of U.S. dollar-backed tokens in circulation, fell to $49.39 billion on Sep. 26, down almost 12% from its record high of $55.88 billion, established merely three months ago. USDC versus USDT weekly market cap chart. Source: TradingView In contrast, the market cap of Tether (USDT), which risked losing its top stablecoin position to USDC in May, crossed above $68 billion on Sep. 26, albeit still down 17.4% from its record high of $82.33 billion in May 2022. The divergence between USDT and USDC shows investors’ renewed preference...

Circle co-founder says converged dollar books on Binance would be good for USDC

According to a new Twitter post, Jeremy Allaire, co-founder and CEO of USD Coin (USDC) stablecoin issuer Circle, said that the recent decision by Binance to merge stablecoin dollar books is “a good thing” for USDC. “This move would lead to a gradual net share shift from USDT to BUSD and USDC,” said Allaire. The day before, Binance announced it would cease trading support for USDC and auto-convert deposits after Sept. 29 to a consolidated Binance USD balance comprising other stablecoins pegged to the U.S. dollar. Users will be able to withdraw individual constituents from the consolidated balance at par value. Some users pointed out that it’s now possible to deposit and withdraw USDC seamlessly in Binance. Before the change, it was required to first conve...

Tether also confirms its throwing weight behind the post-Merge Ethereum

Hot on the heels of an official announcement from USD Coin (USDC) issuer Circle Pay, stablecoin giant Tether has now also officially confirmed its support behind Ethereum’s upcoming Merge upgrade and switch to a Proof-of-Stake (PoS) consensus mechanism-based blockchain. The announcement came on the same day as its stablecoin competitor, who pledged they will only support Ethereum’s highly anticipated upgrade. In an Aug. 9 statement, Tether labeled the Merge one of the “most significant moments in blockchain history” and outlined that it will work in accordance with Ethereum’s upgrade schedule, which is currently slated to go through on Sept. 19. “Tether believes that in order to avoid any disruption to the community, especially when using our tokens in DeFi projects and platforms, it’s imp...

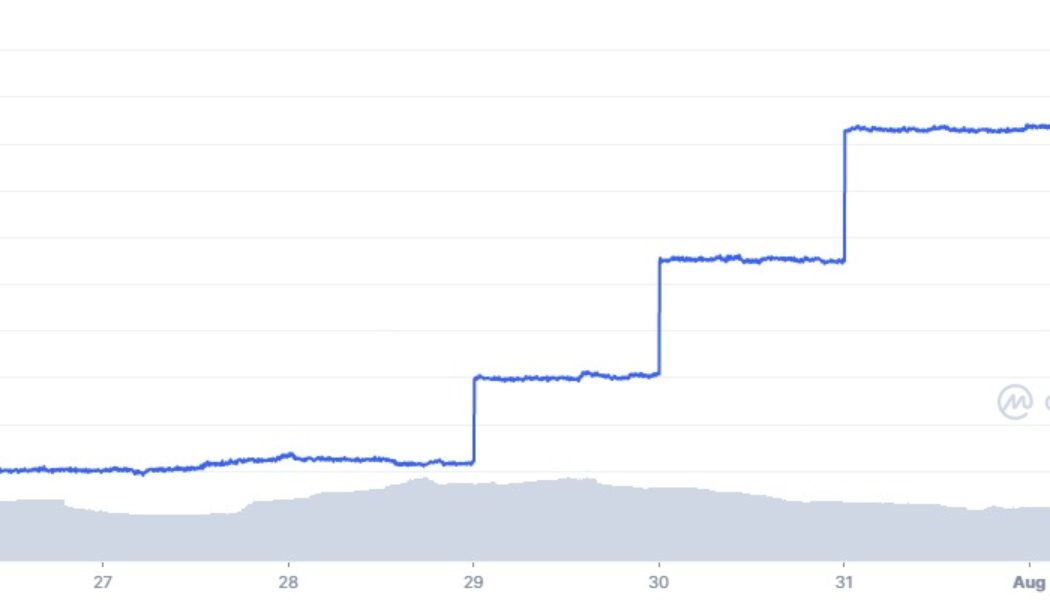

Tether supply starts to increase after three-month decline

The world’s largest stablecoin, Tether (USDT) has expanded its circulating supply following almost three months of reductions, in what could be a sign the crypto markets are slowly recovering. The first mint in almost three months occurred on July 29, and there have been three more, with the latest on August 2, according to CoinMarketCap. The USDT injections have been small, however, lifting Tether’s market cap by just 0.7% or just under $500 million. USDT market cap 7D – Coinmarketcap.com According to the Tether transparency report, there is now 66.3 billion USDT in circulation. This gives the stablecoin a total market share of around 43%. Tether supply reached an all-time high in early May when it topped 83 billion USDT. The collapse of the Terra ecosystem, resultant crypto c...

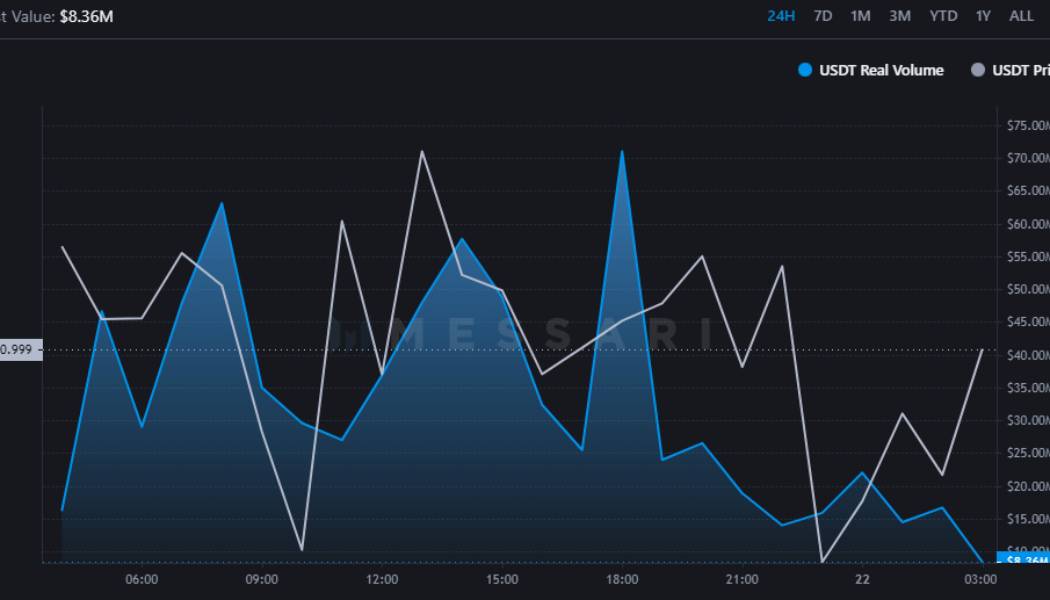

USDC’s ‘real volume’ flips Tether on Ethereum as total supply hits 55.9B

USD Coin is taking a run at the title of the top stablecoin in crypto after its daily ‘real volume’ on the Ethereum network doubled that of Tether’s USDT on Tuesday. According to crypto market data tool Messari, Circle’s USDC posted $1.1 billion in daily real volume on the Ethereum network on June 21, which was double USDT’s real volume of $579 million. Messari’s real volume metric is calculated by compiling data only from exchanges that it believes have “significant and legitimate crypto trading volumes” and thus differs to the more-commonly seen “total volume” metric. Exchanges included in Messari’s Real Volume metric include Binance, Bitfinex, Bitflyer, Bitstamp, Bittrex, Coinbase Pro, Gemini, itBit, Kraken, Poloniex, and those tracked on OnChainFX. 24 hr R...

Tether deploys new USDT token on the Tezos blockchain

Leading cryptocurrency stablecoin Tether has announced the launch of a new asset, Tether (USDT) tokens built on the Tezos blockchain, and with the ambition of expanding their digital footprint across the digital payments and decentralized finance (DeFi) sector. According to the press release, “USDT on Tezos will power revolutionary applications across payments, DeFi, and more.” In conversation with a Tether representative, greater context was provided as to the intended utility of Tether tokens: “Tether tokens are not an investment but a utility for engaging in internet commerce, combating volatility, and providing a safe haven for remittances. Tether tokens can be securely stored, sent, and received across the blockchain and are redeemable for the underlying asset, subjec...

These are the least ‘stable’ stablecoins not named TerraUSD

The recent collapse of the once third-largest stablecoin, TerraUSD (UST), has raised questions about other fiat-pegged tokens and their ability to maintain their pegs. Stablecoins’ stability in question Stablecoin firms claim that each of their issued tokens is backed by real-world and/or crypto assets, so they behave as a vital component in the crypto market, providing traders with an alternative in which to park their cash between placing bets on volatile coins. They include stablecoins that are supposedly 100% backed by cash or cash equivalents (bank deposits, Treasury bills, commercial paper, etc.), such as Tether (USDT) and Circle USD (USDC). At the other end of the spectrum are algorithmic stablecoins. They are not necessarily backed by real assets but depend on financial engin...

$1.9T wipeout in crypto risks spilling over to stocks, bonds — stablecoin Tether in focus

The cryptocurrency market has lost $1.9 trillion six months after it soared to a record high. Interestingly, these losses are bigger than those witnessed during the 2007’s subprime mortgage market crisis — around $1.3 trillion, which has prompted fears that creaking crypto market risk will spill over across traditional markets, hurting stocks and bonds alike. Crypto market capitalization weekly chart. Source: TradingView Stablecoins not very stable A massive move lower from $69,000 in November 2021 to around $24,300 in May 2022 in Bitcoin’s (BTC) price has caused a selloff frenzy across the crypto market. Unfortunately, the bearish sentiment has not even spared stablecoins, so-called crypto equivalents of the U.S. dollar, which have been unable to stay as “stable” a...

Bitcoin falls below $27K to December 2020 lows as Tether stablecoin peg slips under 99 cents

Bitcoin (BTC) fell out of its long-term trading range on May 12 as ongoing sell pressure reduced markets to 2020 levels. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Tether wobbles as UST stays under $0.60 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it exited the range in which it had traded since the start of 2021. At the time of writing, the pair circled $26,700 on Bitstamp, marking its lowest since Dec 28, 2020. The weakness came as fallout from the Terra stablecoin meltdown continued to ricochet around crypto and beyond, with rumors claiming that even professional funds were experiencing solvency issues due to losses on LUNA and UST. “People are still processing this but this is the Lehman moment for crypto” Hearing about a lo...

Tether slashes commercial paper by 21% in latest reserves attestation

USDT stablecoin issuer Tether cut its reserves allocation to commercial paper by more than one fifth between September and December last year, dropping from around $30.5 billion to $24.16 billion. Tether is legally required to disclose its reserves every quarter as part of an $18.5 million court settlement with the Office of the New York Attorney General from February 2021. The firm was alleged to have misrepresented the specific amount of fiat backing USDT in 2017 and 2018. The latest attestation was conducted by Cayman Islands-based Accountants MHA Cayman and provides a breakdown of Tether’s reserves as of 31 December 2021. The report states that Tether’s “consolidated assets exceed its consolidated liabilities,” however the difference is minimal with total assets tallied $78.67 billion ...

- 1

- 2