Analysis

Bitcoin and Ethereum selloffs are coming to an end soon, says Mad Money’s Jim Cramer

Cramer suggested that Bitcoin could see a recovery like last year’s – a rally that pushed Bitcoin north to the November all-time high In a recent instalment of the Mad Money show, CNBC’s Jim Cramer analysed the markets, as predicted by Tom DeMark. Creator of the Symbolik financial markets analysis tool, Tom DeMark is not just any other head in market matters. With a long-running career in objective and mechanically-driven market indicators, he is credited with several past accurate predictions in the crypto market. Bitcoin and Ethereum set to embark on an uptrend Jim Cramer told viewers that the two leading crypto-assets, Bitcoin and Ethereum, could hit a trend exhaustion bottom this week. After days of massive selloffs that pushed markets to seek lower prices, Cramer pre...

Fundamentals and correlation models show that Bitcoin is undervalued

Chamber of Digital Commerce chief executive Perianne Boring told CNBC yesterday that correlation models suggest Bitcoin’s actual value is between $50k and $100k Founder and president of the Chamber of Digital Commerce, Perianne Boring, is the latest figure to assert that Bitcoin is currently undervalued, despite the volatility in crypto markets. During a CNBC Squawk Box Monday interview, Perianne advised investors to focus on Bitcoin’s underlying value rather than its price position. Several factors back her postulation Perianne said that the fundamentals of Bitcoin are showing real strength, and this is evidence that the asset is inaccurately valued. She pointed out that Bitcoin is currently growing at a higher rate than other technology elements – the internet during the late...

Top 5 NFT tokens in 2022 to watch out for

Non-fungible tokens (NFTs) have taken the crypto world by storm and have seen a tremendous level of growth throughout 2021. Due to this high level of success, a variety of different collection-based projects or limited-run projects arose, which essentially limited the collection of NFTs within their respective platform to a specific number. For example, there can only ever be 10,000 CryptoPunks that can ever exist, and this scarcity is what leads to their value. Many other NFT projects and NFTs, as a result, have found their way into Metaverse projects, which lead to their eventual increase in utility. Ultimately, all of this has contributed to the growth of both the industry as well as the tokens in question. As the NFT industry evolves, there will be a consistent stream of new projects a...

ETH, ADA and SOL are the top 3 smart contract tokens you can buy on January 24, 2022

Ethereum (ETH), Cardano (ADA), and Solana (SOL) are all projects that enable smart contracts. Each of them has potential for growth in the upcoming months. Each blockchain network and ecosystem provides many benefits to dApp developers. Ethereum (ETH), Cardano (ADA), and Solana (SOL) are all tokens that enable smart contract functionality. This enables decentralized application (dApp) developers to truly build scalable dApps and has contributed to the growth of the dApp ecosystem of each blockchain network. These are the top 3 tokens you can buy on January 24, 2022. Should you buy Ethereum (ETH)? On January 24, 2022, Ethereum (ETH) had a value of $2,190.81. In order for us to see what this value point means for the ETH token, we will go over its all-time high value as well as its performan...

Bearish chart pattern hints at $70 Solana (SOL) price before a possible oversold bounce

Solana (SOL) price may fall to $70 a token in the coming weeks as a head and shoulders setup emerged on the daily timeframe and possibly points toward a 45%+ decline. The chart below shows that SOL price rallied to nearly $217 in September 2021, dropped to a support level near $134 and then moved to establish a new record high of $260 in November 2021. Earlier this week, the price fell back to test the same $134-support level before breaking to a 2022 low at $87.73. SOL/USD weekly price chart featuring head and shoulders setup. Source: TradingView This phase of price action appears to have formed a head and shoulders setup, a bearish reversal pattern containing three consecutive peaks, with the middle one around $257 (called the “head”) coming out to be higher than the oth...

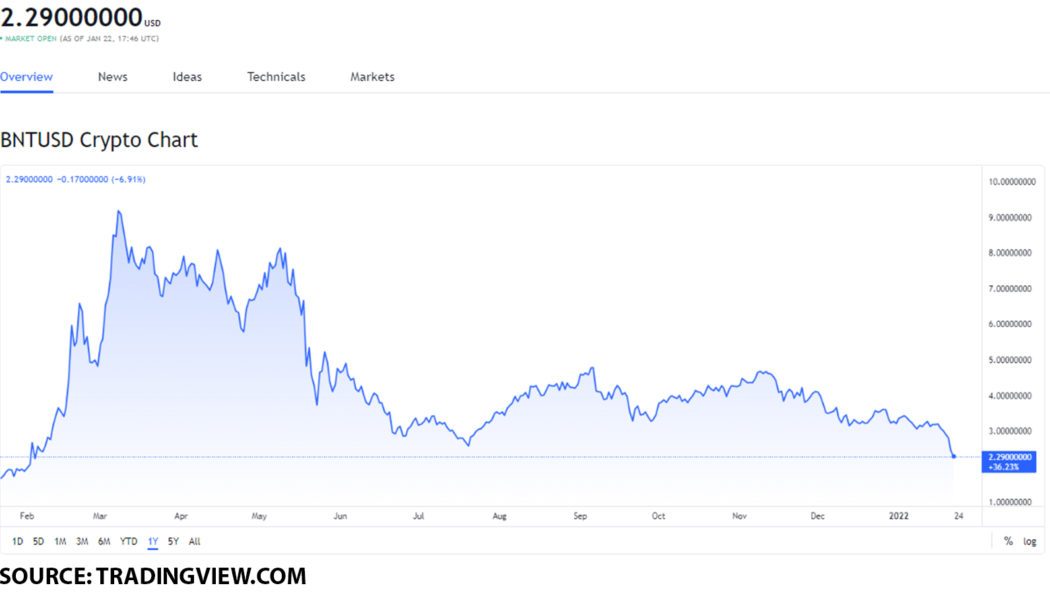

The best Ethereum ecosystem tokens worth your attention on January 22, 2022: BNT and BAT

Bancor Network Token (BNT)’s trading volume increased by 41% in the last 24 hours. Basic Attention Token (BAT)’s trading volume saw an increase of 50% in the last 24 hours. Both tokens have the potential to increase in value by the end of February 2022. Bancor is a blockchain protocol that lets users convert different virtual cryptocurrency tokens directly and instantly, powered by the BNT cryptocurrency token. Basic Attention Token is a blockchain-based system that tracks the media consumption time of users, as well as their attention on websites while using the Brave browser, powered by the BAT cryptocurrency token. Should you buy Bancor Network Token (BNT)? On January 22, 2022, Bancor Network Token (BNT) had a value of $2.29. In order for us to see what this value point means for the BN...

Best 5 Ways to Make Money in the Metaverse

Metaverse experiences such as Decentraland, The Sandbox and many others are evolving as venues for business, commerce, networking and marketing. While blockchain metaverses are quite new, tech-savvy entrepreneurs have started to run revenue-generating businesses in these virtual environments. Because these virtual environments allow users to own custody of their in-game assets via their crypto wallets, a vibrant economy of goods and services is emerging in the metaverse. This allows players to engage in activities that allow them to earn cryptocurrency, build brands, and trade with others—the possibilities are almost endless. Are you interested in making money in the metaverse? Read ahead for our guide that details several methods players use to earn cryptocurrency, start a business, and b...

3 of the best DeFi Tokens you can buy on January 21, 2022

Chainlink (LINK), Uniswap (UNI), and Terra (LUNA) are all DeFi tokens you can consider buying. Each token has its own stand-out feature. They are all at a solid price point currently. Decentralized Finance (DeFi) has truly evolved and plays a major role within the crypto world at the moment. Chainlink (LINK), Uniswap (UNI), and Terra (LUNA) are all tokens that are worth your attention, and all of them have the potential to increase in value by the end of January 2022. Should you buy Chainlink (LINK)? On January 21, 2022, Chainlink (LINK) had a value of $18.88. To get a better perspective as to what kind of value point this is for the LINK token, we will go over its ATH point of value alongside its performance last month. LINK’s ATH was on May 10, 2021, when it reached $52.70. It was ...

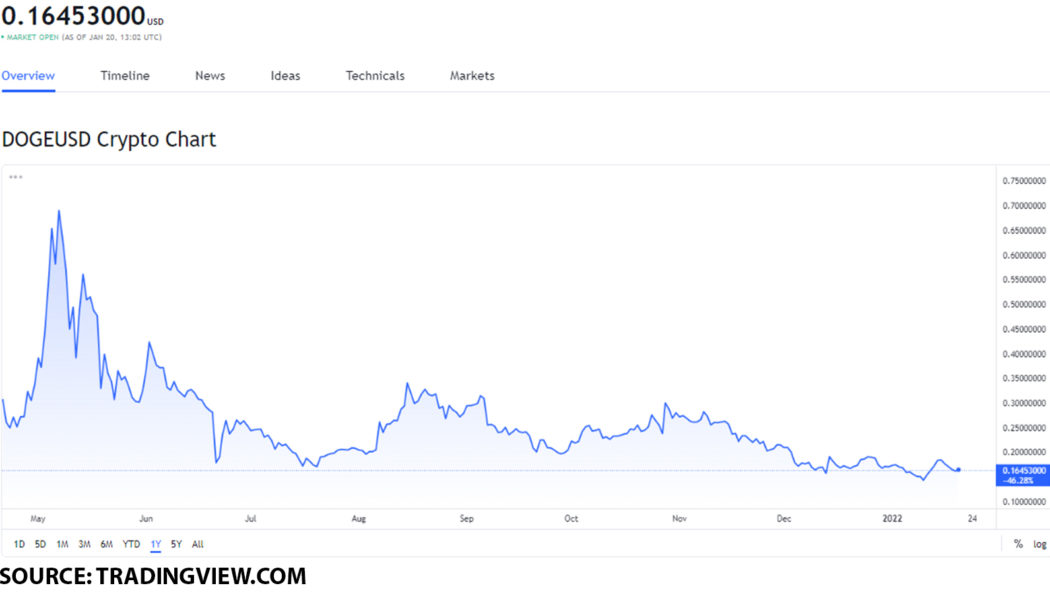

DOGE, SHIB and SPELL are the best meme tokens you can buy on January 20, 2022 and this is why!

Dogecoin (DOGE) is a token based on the popular “Doge” internet meme, which originally started as a joke, but is now one of the most commonly-used tokens to transfer value online. Shiba Inu (SHIB) is another meme token, dubbed as the “dogecoin killer,” which over time grew into its own ecosystem, introducing BONE, LEASH, and the ShibaSwap. Spell Token (SPELL) is essentially this reward token on the abracadabra.money lending platform that uses interest-bearing tokens as collateral to borrow a stablecoin known as Magic Internet Money (MIM). Should you buy Dogecoin (DOGE)? On January 20, Dogecoin (DOGE) had a value of $0.16453. DOGE had its all-time high value on May 8, 2021, at $0.731578. The token was 344% higher or by $0.567048. On December 2, the token had it...

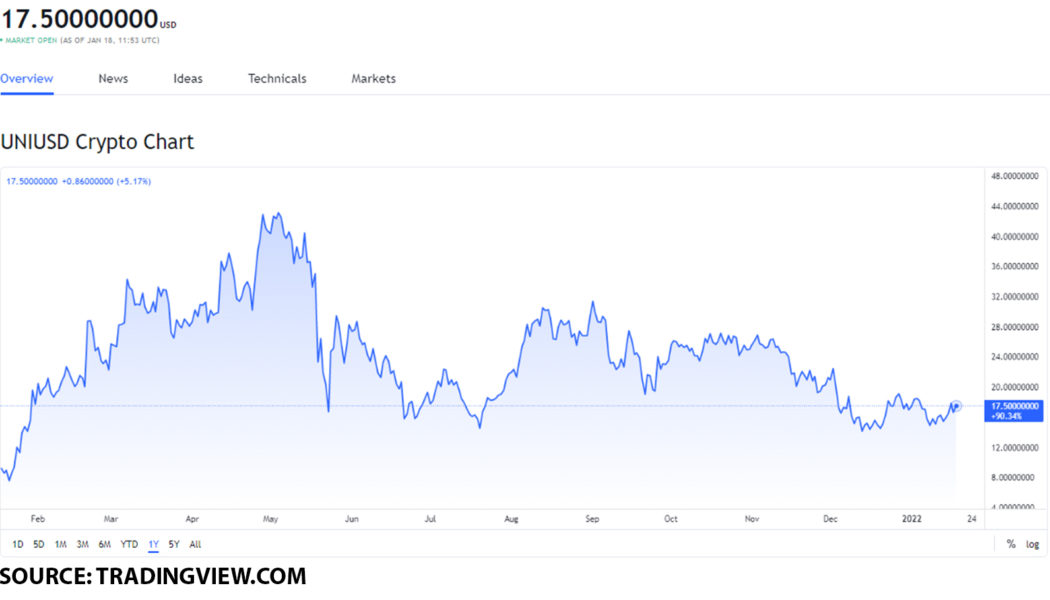

The 5 best yield farming tokens you can buy on January 18, 2022

Yield farming tokens have increased in popularity due to their utility. These tokens can be utilized as a means of adding an additional revenue stream to your portfolio. UNI, CAKE, AAVE, COMP, and CRV are the best tokens you can buy. Yield farming is an investment strategy typically utilized within decentralized finance (DeFi). It involves lending or staking cryptocurrency tokens as a means of gaining rewards from the transaction fees or interest which is generated. Should you buy Uniswap (UNI)? On January 18, Uniswap (UNI) had a value of $17.5. Uniswap had its all-time high on May 3, 2021, with a value of $44.92. This means that the token was $27.42 higher in value. On December 2, the token had its highest point of that month at $22.86. The token had its lowest point of value on December ...

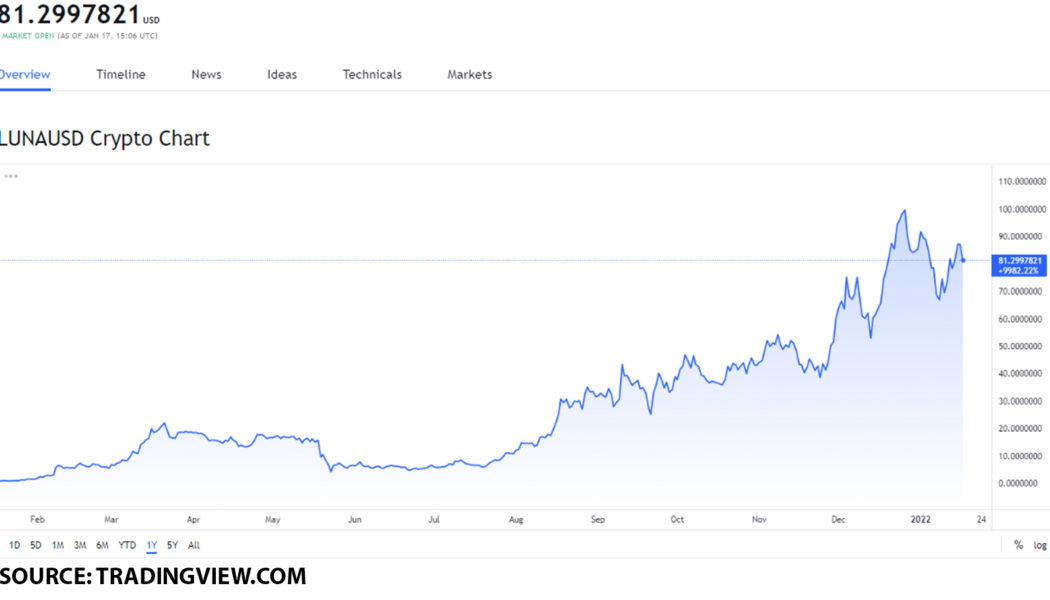

LUNA, LINK, UNI and AAVE the best DeFi tokens to buy on January 17, 2022 and this is why!

Terra (LUNA), Chainlink (LINK), Uniswap (UNI) and Aave (AAVE) are all tokens that have showcased solid growth. Each token fills a solid role within DeFi and has had great developments. These are the go-to tokens to buy on January 17, 2022. Decentralized finance (DeFi) has blown up in terms of both popularity as well as utility throughout the past few years. Many tokens have attempted to introduce new solutions, some of which have exceeded expectations. Terra (LUNA), Chainlink (LINK), Uniswap (UNI), and Aave (AAVE) are some of the best DeFi tokens you can buy on January 17, 2022. Should you buy Terra (LUNA)? On January 17, Terra (LUNA) had a value of $81.299. The all-time high value of the LUNA token was on December 27, 2021, when the token reached a value of $103.34. This made the token $2...

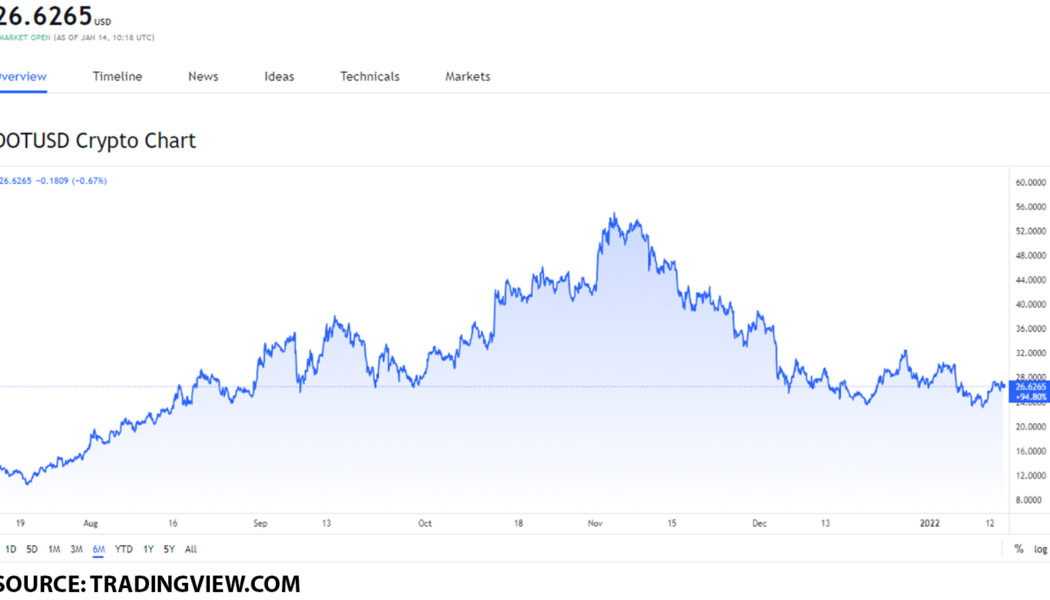

Invest in staking tokens through these 4 leading tokens

These tokens are Proof-of-Stake (PoS) tokens that allow you to stake them on the network they are based on. This can potentially give you another passive revenue stream. DOT, MATIC, SOL, and ADA are all tokens that are leaders in terms of market capitalization. Staking cryptocurrency tokens is seen by many investors as a means of putting the tokens to work for gaining additional yield. As such, Polkadot (DOT), Polygon (MATIC), Solana (SOL), and Cardano (ADA) are all solid options, and we are about to show you why. Should you invest in Polkadot (DOT)? On January 14, Polkadot (DOT) had a value of $26.62. To get a better perspective as to exactly what this value point means for the DOT token, we will go over the performance of the token last month and its all-time high value. The all-ti...