Analysis

Are SOL, ADA and ETH worth buying on February 3, 2022?

Solana (SOL), Cardano (ADA), and Ethereum (ETH) are all blockchain networks that have smart contracts and tackle blockchain scaling. Each project aims to solve scaling issues and aims to heighten its dApp ecosystem. All of these tokens have the potential for growth. Solana (SOL), Cardano (ADA), and Ethereum (ETH) are all solid blockchain projects which are competing against each other in terms of functionality. We will be going over if each token is worth buying on February 3, 2022. Should you buy Solana (SOL)? On February 3, 2022, Solana (SOL) had a value of $94.89. The all-time high value of the Solana (SOL) token was on November 6, 2021, when the token reached a value of $259.96. This means that at its ATH value, the SOL token was $165.07 higher in value or by 173%. In terms of the perf...

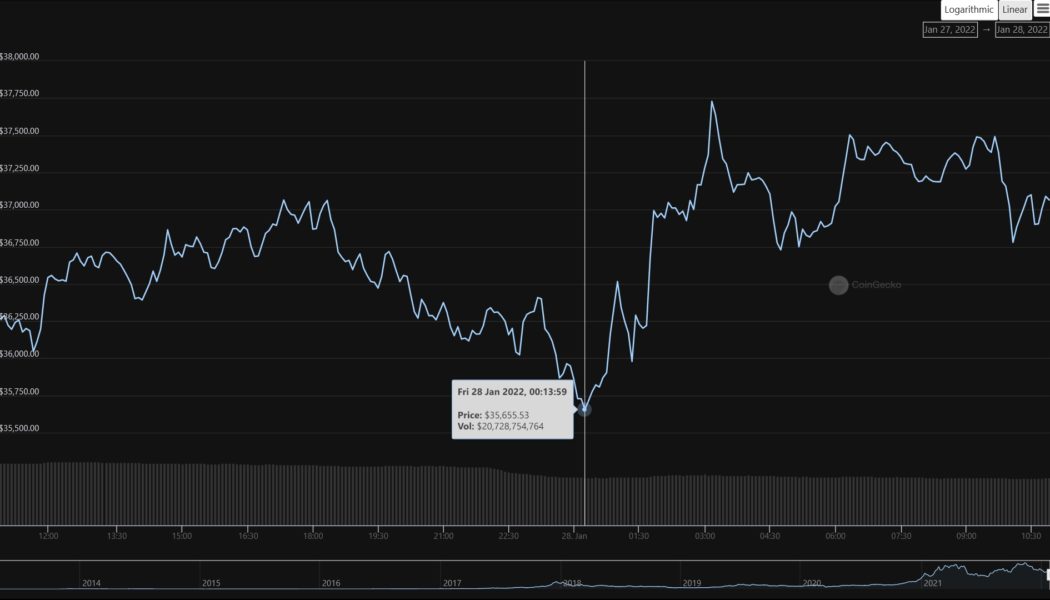

The US Federal Reserve is making some analysts bullish on Bitcoin again

Signs of a steady Bitcoin (BTC) price recovery emerged earlier this week as investors shifted away from the U.S. dollar on weaker-than-expected economic data. In detail, Bitcoin’s drop last week to below $33,000 met with a healthy buying sentiment that pushed its per token rate to as high as $39,300 on Feb. 1. As of Thursday, BTC’s price dipped below $37,000 but was still up 13% from its local bottom. Meanwhile, the U.S. dollar index (DXY), which measures the greenback’s strength against a basket of top foreign currencies, rose to 97.441 last Friday, logging its best level since July 2020. However, the index corrected by nearly 1.50% to over 96.00 by Feb. 3. DXY vs. BTC/USD daily price chart. Source: TradingView Some market analysts saw the dollar’s renewed weakness...

Analysts argue sell-off isn’t over even as crypto and stocks recover into the new month

Bitcoin and other top cryptocurrencies have posted modest gains since yesterday Market experts, however, believe January’s equities market slump could be an indication of a looming larger correction The crypto market is seeing a sense of stability on the first day of February after charting a recovery curve yesterday. Bitcoin (BTC), Binance Coin (BNB) and Cardano (ADA) are all up by roughly 4% on the day, while Ethereum (ETH), Solana (SOL), Polkadot (DOT) and Terra (LUNA) have double-digit gains in the last 24 hours. Solana’s native coin is up by over 20%, while Terra’s coin LUNA has seen a price upswing of almost 19% in the same period. Notwithstanding the green arrows in the market, industry experts maintain that the tide is not yet out as many market factors still hang...

Interesting centralized exchange tokens worth your attention at the start of February, 2022

BNB saw an increase in trading volume by 15% in the last 24 hours. CRO saw an increase in its value by 4% in the last 24 hours. FTX saw an increase in its trading volume by 152% in the last 24 hours. Binance Coin (BNB), Crypto.com Coin (CRO), and FTX Token (FTT) are all cryptocurrency tokens that are utilized by cryptocurrency exchanges. They provide numerous benefits on the exchanges they are based on to the holders of the tokens, such as discounts, access to features, or staking opportunities. Each token has a high level of utility associated with it and, as such, can increase in value throughout the following months. Should you buy Binance Coin (BNB)? On February 1, 2022, Binance Coin (BNB) had a value of $383. The all-time high value of Binance Coin (BNB) was on May 10, 2021, when the ...

Cardano has established a bearish trend, crypto analyst forewarns

A popular crypto analyst has projected that BTC would drop below $30k before it eventually bounces above $40k. He also tips off that Cardano’s ADA has carved a clear bearish path and could fall towards the support at either $0.80 or $0.65. Capo, a pseudonymous crypto analyst on Twitter, has told 240,000-large following that crypto assets are yet to come out of the bearish run. Change of tune on the leading cryptocurrency The analyst was initially bullish on Bitcoin, predicting that it would first rally beyond 40k before potentially seeing a bearish outturn. However, he has now changed his view and instead sees the flagship cryptocurrency directly plunging. “Whales are adding supply and removing bids below the current price. It seems that it will go just straight down without to...

Santiment analysis indicates XRP and Uniswap are entering an opportunity zone

On-chain data shows several altcoins could be set for an upturn as they approach historical opportunity zones Uniswap has recently hit an all-time negative low in MVRV, and XRP is on an eight-month low in this metric Blockchain analytics firm Santiment today reviewed the top altcoins that investors should look to after the sour January they have experienced with the markets. Over the course of the month, the markets have neither spared short-term nor mid-term investors, with the majority seeing trading losses at differing degrees. Advising traders to jump on the opportunity to buy low while others sulk, Santiment reviewed MVRVs of crypto assets and came up with a list of 150 assets that are prime for investment. The analytics firm justified the selection, noting that the tokens show “...

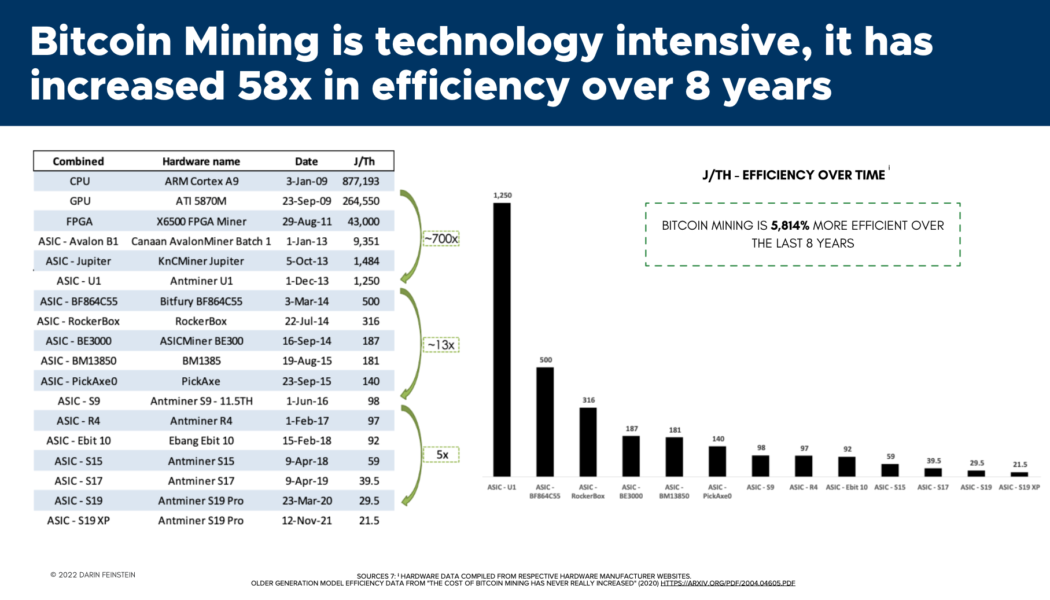

Bitcoin miners believe global hash rate to grow ‘aggressively’

Bitcoin (BTC) seems to be on everyone’s mind lately as the world recently witnessed the price of BTC take a rather unexpected bearish turn this month. On January 21, 2022, Bitcoin reached six-month lows, sinking below $40,000 for the first time in months. While some panicked, other industry experts pointed out that the Bitcoin network has become verifiably stronger than ever before. The growth of the Bitcoin network has become apparent, as hash rate figures for BTC continue to set new highs this month. For example, on Jan. 22, the BTC network recorded an all-time high of 26.643 trillion with an average hash rate of 190.71 exahash per second (EH/s). The hash rate will continue to grow, which is a good thing Samir Tabar, chief strategy officer at Bit Digital — a publicly listed Bitcoin...

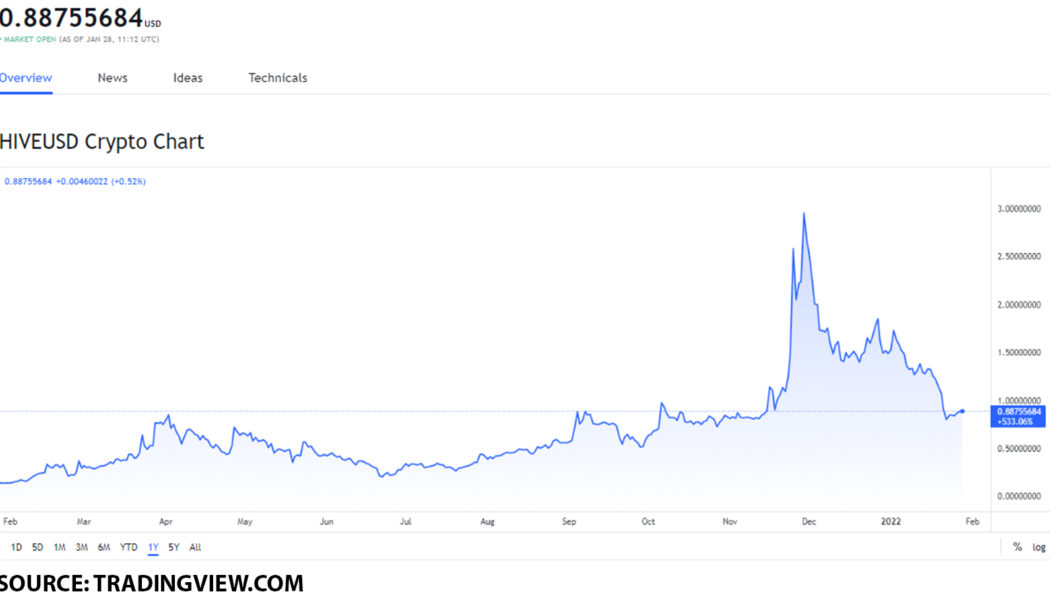

Discover why HIVE, THETA and STEEM are the best media tokens you can buy on January 28, 2022

HIVE, THETA and STEEM are the best media tokens you can buy on January 28, 2022. Each token has its own utility within its ecosystem Every one of these tokens has the potential to increase in value by the end of February 2022. Hive is a decentralized information-sharing network that is built on the Delegated Proof of Stake (DPoS) protocol. Theta is a blockchain-powered network specifically built for video streaming launched in March of 2019. Steem is a community-faced blockchain designed to provide earning opportunities for customers based on their value to the network, where they can post curated content online and get paid in crypto. Should you buy Hive (HIVE)? On January 28, 2022, Hive (HIVE) had a value of $0.88. To get a better perspective as to what kind of value point this is for th...

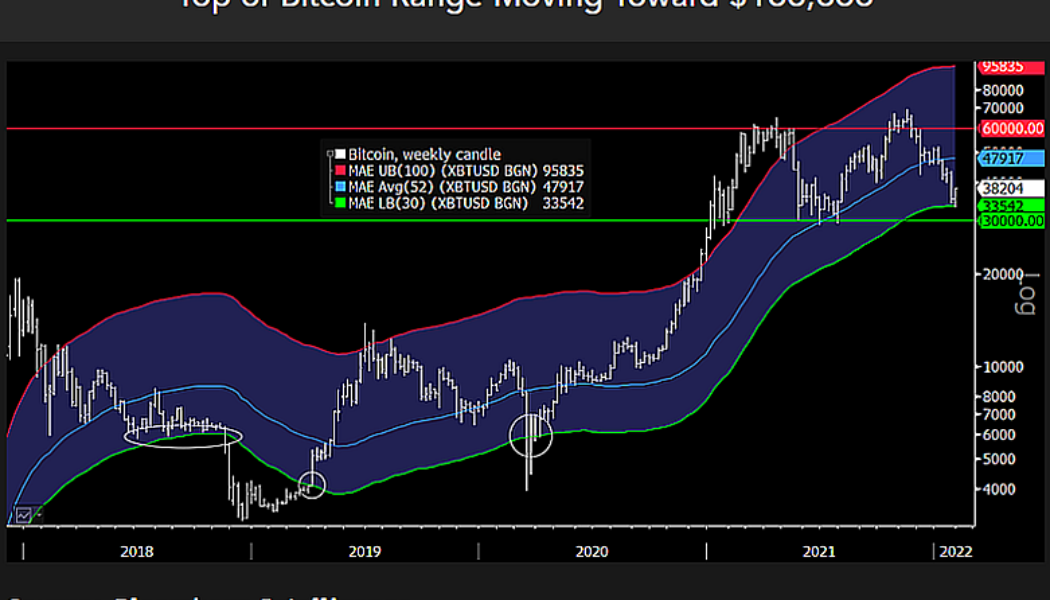

Macro trends expert Lyn Alden doesn’t see Bitcoin sinking below $20k

Alden is optimistic the flagship will stay above $20,000 even if the slump intensifies Bitcoin is trading on the green today and has cleared $37,000 Macroeconomics strategist Lyn Alden has shared her view on Bitcoin which, like other crypto assets, has suffered considerable losses in the recent market slump. In a mid-week interview with Kitco News’ David Lin, Alden noted that it is unlikely for the price of the leading cryptocurrency to sink below $20,000. Alden, who manages an eponymous equity research and investment research firm, backed his forecast, noting that the market is maturing and, as such, Bitcoin won’t see massive price fluctuations. “I’d be somewhat surprised to see a sub 20,000 print. I don’t rule it out as an option though […] Bitcoin ha...

Bloomberg strategist Mike McGlone predicts a bullish run once the correction ends

McGlone based his projection on the law of demand and supply He also posited that Bitcoin could be carving a bottom at $30k The two leading cryptocurrencies, Bitcoin and Ethereum, are poised to surge if they escape the persistent range-bound trading, according to Bloomberg’s Mike McGlone. McGlone argues that the former will get out of the current market slump on ‘bullish fundamentals.’ In a tweet shared today, he forecasted that the value of the two crypto assets will potentially rocket, citing the law of demand and supply. “What Ends #Bitcoin, #Ethereum Range Trade? Bullish Fundamentals – By the rules of economics, a market with rising demand and declining supply will go up over time, suggesting that Bitcoin may be forming a bottom again around $30,0...

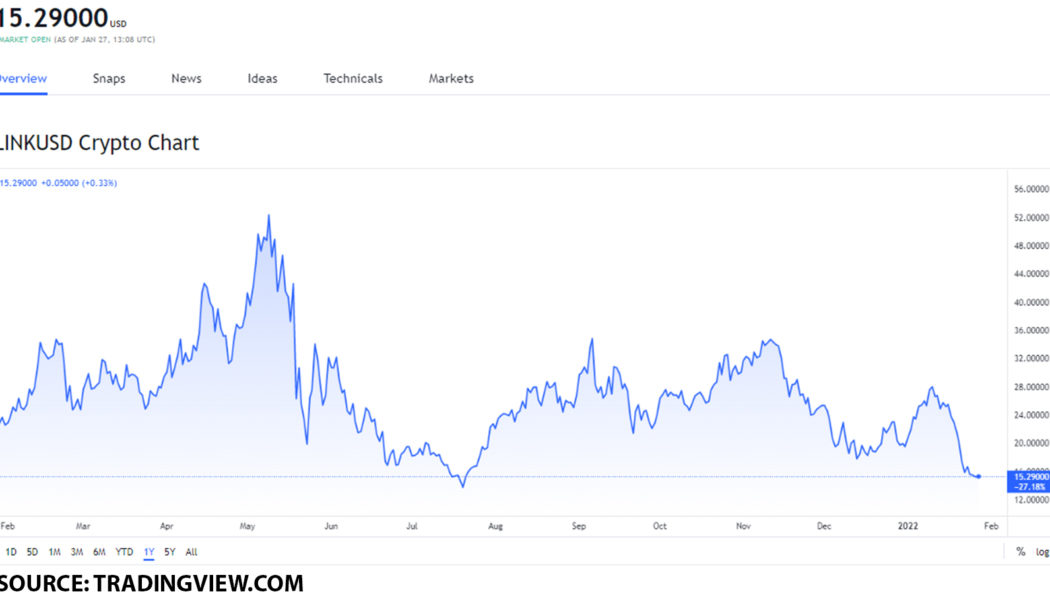

LINK, GRT and WAVES are the best Solana Ecosystem tokens you can buy on January 27, 2022

LINK, GRT, and WAVES are all connected to the Solana ecosystem. These tokens have seen an increase in their trading volume throughout the last 24 hours. All of these tokens have the potential to increase in value by the end of February 2022. Chainlink (LINK), The Graph (GRT), and Waves (WAVES) are all tokens that connect in some way with the Solana Ecosystem. Given its high transactions per second (TPS) throughout, Solana has been an attractive choice for a lot of decentralized application (dApp) developers. As such, these three tokens are the top picks you can make as of January 27, 2022. Should you buy Chainlink (LINK)? On January 27, 2022, Chainlink (LINK) had a value of $15.29. The all-time high value of Chainlink (LINK) was on May 10, 2021, when it reached a value of $52.70. This mean...

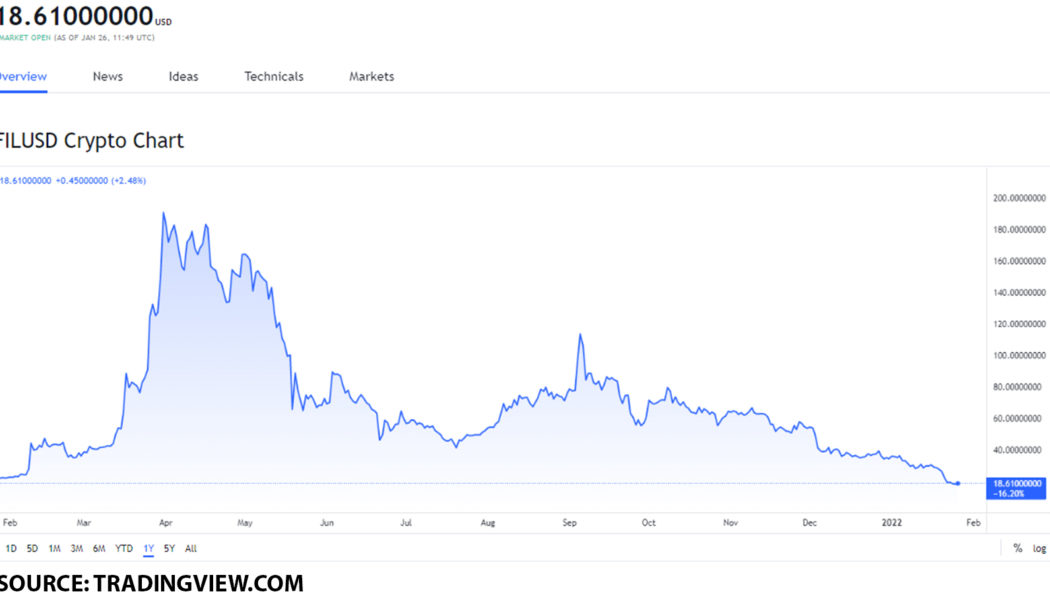

The top 4 storage tokens you can buy on January 26, 2022: FIL, AR, HOT and STORJ

Storage tokens have found a major place within the crypto space. FIL, AR, HOT, and STORJ are all from projects related to the storage category. Each of these tokens has the potential to increase in value. Filecoin (FIL), Arweave (AR), Holo (HOT) and Storj (STORJ) are all storage tokens. Each token has the potential to increase in value by the end of February 2022. We are going to go over each token and see exactly how far they can climb in value. Should you buy Filecoin (FIL)? On January 26, 2022, Filecoin (FIL) had a value of $18.61. Filecoin (FIL)’s all-time high was on April 1, 2021, when the token reached a value of $236.84. This means that at its ATH, the token was $218.23 higher in value or by 1172%. In terms of December’s performance, on December 1, the token had its highest v...