digital asset

French investors sued Binance for over 2.4 million euros in losses

Binance France and its parent company Binance Holdings Limited are being sued by 15 investors in France over alleged misleading commercial practices and fraudulent concealment, according to local media reports. In a complaint filed on Dec. 14, the plaintiffs claimed that Binance violated French laws by advertising and distributing crypto services before receiving registration from the country’s authorities. As reported by Cointelegraph, France’s financial market regulator, the Autorité des marchés financiers, has granted Binance a license as a digital asset provider in May 2022. The license allowed the crypto exchange to offer services such as assets custody and crypto trading. The complaint reportedly contains screenshots showing Binance’s social media activity pri...

Central Banks to set standards on banks’ crypto exposure – BIS

A global standard for banks’ exposure to crypto assets has been endorsed by the Group of Central Bank Governors and Heads of Supervision (GHOS) of the Bank for International Settlements (BIS). The standard, which sets a limit of 2% on crypto reserves among banks, must be implemented on January 1, 2025, according to an official announcement on Dec. 16. The report, dubbed “Prudential treatment of cryptoasset exposures”, introduces the final standard structure for banks regarding exposure to digital assets, including tonenized traditional assets, stablecoins and unbacked cryptocurrencies, as well as feedback from stakeholders collected in a consultation launched in June. The Basel Committee on Banking Supervision noted the report will soon be incorporated as a new chap...

Yuga Labs, Moonpay faces lawsuit over celebrities NFT promotion

Yuga Labs, creators of Bored Ape Yacht Club (BAYC) and crypto fintech Moonpay are facing a class-action lawsuit for allegedly using celebrities to misleadingly promote and sell nonfungible tokens (NFTs). Over 40 people and companies are named as defendants in the lawsuit, including Paris Hilton, Snoop Dog, Jimmy Fallon, Justin Bieber, Madonna, Serena Williams, Post Malone, and Diplo. The class-action was filed on Dec. 8 by John T. Jasnoch of Scott+Scott Attorneys at Law LLP in the Central District of California and claims the crypto companies used its Hollywood network to promote the digital assets without complying with disclosure requirements. The document states: “This case epitomizes these concerns as it involves a vast scheme between a blockchain start-up company, Yuga Lab...

Decentralization index from Cardano builder, U of Edinburgh will help users understand assets

The University of Edinburgh and Input Output Global (IOG), the builder of the Cardano network, have teamed up to create a blockchain decentralization index, IOG announced on its blog. The new service is the first of its kind and will use a “research-based” methodology developed at the university. The Edinburgh Decentralization Index (EDI) has been in development for several months and was introduced in Edinburgh on Nov. 18, but it is not yet operational, according to IOG: “The first step for the tracker is the creation of research papers detailing decentralization metrics and a considered methodology for compiling them into an index, created by researchers at the University of Edinburgh. It will then operate in the same way as other industry indexes.” When launched, the EDI will...

Prometheum partners with Anchorage Digital on SEC-registered alternative trading system

Prometheum Ember ATS announced the launch of its alternative trading system (ATS) on Oct. 26. The new ATS is registered by the United States Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority. Prometheum Ember ATS will offer digital asset securities trading, clearing, settlement and custody. The new ATS has partnered with Anchorage Digital Bank to help it provide its service, which is meant to “seamlessly integrate with legacy securities trading systems.” Prometheum stated that its ATS “enables institutions to trade digital asset securities under Federal Securities Laws.” It will initially support digital assets Flow, Filecoin, The Graph, Compound and Celo. Prometheum founder and co-CEO Aaron Kaplan said in a statement: “Prometheum sets ...

Wealthy crypto believer and incoming UK PM Rishi Sunak once commissioned a royal NFT

Rishi Sunak is set to become prime minister of the United Kingdom within days. Sunak was defeated for the top government post by Liz Truss on Sept. 5, but she resigned after 45 days in office. Indications so far are that his selection for the office is good news for the crypto industry. Sunak was chancellor of the exchequer, or head of the treasury, from early 2020 to July 5, when he resigned during a scandal that shook Boris Johnson’s government. During that time, Sunak repeatedly voiced his support for crypto. Speaking in April about proposed regulatory reform related to stablecoins, Sunak said: “It’s my ambition to make the U.K. a global hub for crypto-asset technology, and the measures we’ve outlined […] will help to ensure firms can invest, innovate and scale up in this country. This ...

South Africa declares crypto to be a financial product subject to financial services law

The Financial Sector Conduct Authority (FSCA), South Africa’s financial regulator, published a notice on Oct. 19 indicating that the country’s 2002 Financial Advisory and Financial Intermediary Services Act (FAIS) has been updated to include a definition of crypto assets. A decision of this type has been expected for several months, and it brings crypto assets under regulation in South Africa for the first time. The FSCA notice, which went into force on publication in the Green Gazette (the government gazette of record), states that a crypto asset is “a digital representation of value” that can be electronically traded, transferred and stored but is not issued by a central bank. Additionally, it “applies cryptographic techniques” and uses distributed ledger technology. The notice goes on t...

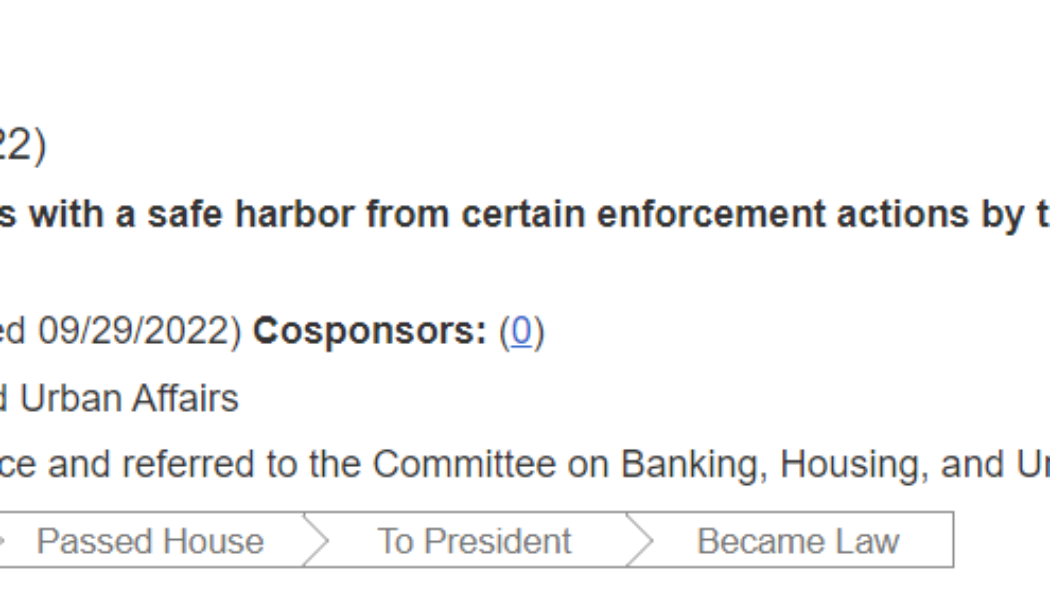

US senator bill seeks to cushion crypto exchanges from SEC enforcement actions

United States Senator Bill Hagerty, a member of the Senate Banking Committee, introduced legislation seeking a safe harbor for cryptocurrency exchanges from “certain” Securities and Exchange Commission (SEC) enforcement actions. The Digital Trading Clarity Act of 2022, introduced by Sen. Hagerty, aims to provide regulatory clarity around two primary concerns plaguing crypto exchange establishments — (i) the classification of digital assets and (ii) related liabilities under existing securities laws. A bill to provide digital asset intermediaries with a safe harbor from certain enforcement actions by the Securities and Exchange Commission, and for other purposes. Source: congress.gov Sen. Hagerty outlined an overview of the problems amid regulatory hurdles: “The current lack of regulatory c...

China accounts for 84% of all blockchain patent applications, but there’s a catch

China accounts for 84% of all blockchain applications filed worldwide, according to the latest data shared by the country’s government official. China has steered clear of the cryptocurrency market. However, the Beijing government has been supportive of the underlying blockchain technology. The country has actively promoted the use of blockchain tech over the years, and thus the high percentage of blockchain patents isn’t surprising. President Xi Jinping has also played a key role in promoting the nascent blockchain technology. In 2019, the President called upon citizens, tech companies and stakeholders of the ecosystem to actively participate and innovate with the nascent tech as it would play a key role in the future of the next industrial revolution. As Cointelegraph reported earlier, C...

Australian senator drafts bill aimed at stablecoin, digital yuan regulation

Australian Liberal Senator Andrew Bragg has released a new draft bill aimed at clamping down on digital asset exchanges, stablecoins, and China’s central bank digital currency, the e-Yuan. In a statement on Sept. 18, Senator Bragg stated that “Australia must keep pace with the global race for regulation on digital assets” as “it is essential that the parliament drives law reform” on the matter. The new draft bill, titled Digital Assets (Market Regulation) Bill 2022, calls for the introduction of licenses for digital asset exchanges, digital asset custody services, stablecoin issuers, as well as disclosure requirements for facilitators of the e-Yuan in Australia. Australia must keep pace in the digital assets race: a bill to protect consumers, promote investment & protect our inter...

US Treasury publishes laundry lists of crypto risks for consumers, national security

The United States Treasury Department released three publications related to digital assets Friday, in response to U.S. President Joe Biden’s Executive rder “Ensuring Responsible Development of Digital Assets.” One of them focuses specifically on crypto assets, and a shorter action plan looks at countering illicit finance risks. The discussion of crypto assets in “Crypto-Assets: Implications for Consumers, Investors, and Businesses” takes a cynical tone from the beginning, with the introductory paragraphs of the report stating: “The potential for blockchain technology to transform the provision of financial services, as espoused by developers and proponents, has yet to materialize.” About half of the report is a descriptive survey of crypto assets, after which the authors turn to the...

South Korean financial majors want to create virtual assets exchange in 2023: Report

Samsung Securities is among seven large South Korean securities companies that have applied for government approval to create a virtual assets exchange, according to a report in South Korean publication Newspim. The companies aim to create a corporation to open an exchange in the first half of next year. Newspim quoted an unidentified executive as saying that discussions on the project are now being finalized. According to the local coverage, Samsung Securities had been studying ways to develop and operate a securities token trading platform but was unable to recruit the necessary personnel to proceed last year. Mirae Asset Consulting, an affiliate of Mirae Asset Securities, South Korea’s largest investment banking and stock brokerage by market cap, is hiring personnel for cryptocurre...